Bedrock: Next-Gen BTCFi Liquid Staking Protocol — Security Upgrade Sparks Major Attention

What Is Bedrock?

Source: https://www.bedrockdao.com/

Bedrock is a multi-asset liquid restaking protocol focused on BTCFi. It converts BTC, ETH, DePIN, and other leading assets into yield-bearing assets that can move freely across multi-chain DeFi ecosystems. The project’s core vision is to make staking more than just long-term lockup—transforming it into an asset management strategy that delivers yield, security, and liquidity.

Bedrock’s architecture features three main components:

- Restake Layer: Supports staking and restaking for multiple assets.

- Liquidity Layer: Enables cross-chain utility for liquidity tokens like uniBTC and uniETH.

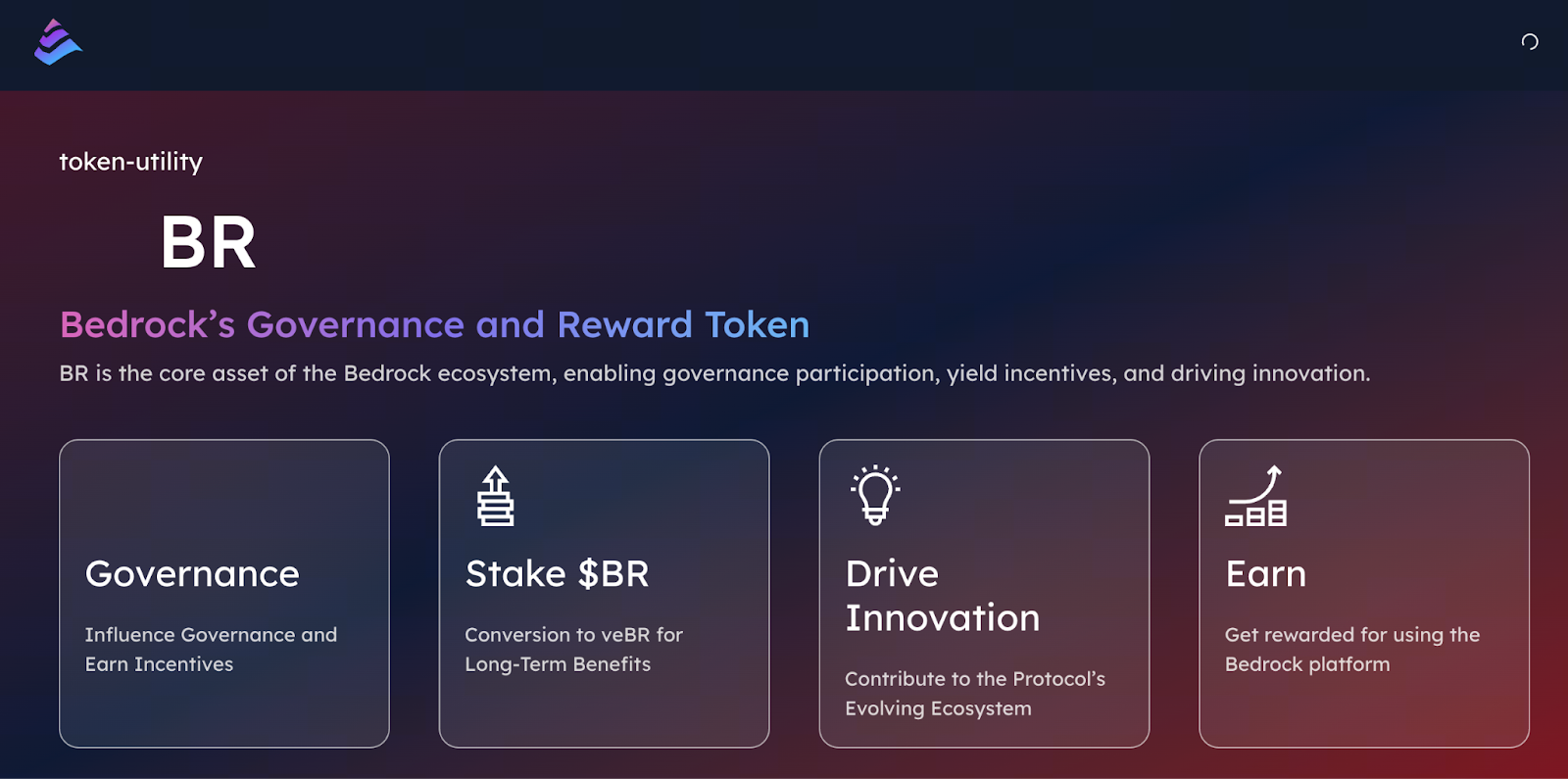

- Governance Layer: Utilizes a BR → veBR governance system to allocate rewards, set parameters, and manage on-chain strategies.

This structure naturally meets the liquidity needs of the multi-chain era.

Multi-Layer Security Enhancements: Chainlink + Secure Mint + CCIP

In 2025, Bedrock implemented a series of critical security upgrades, positioning itself among the few liquid staking protocols with institutional-grade security architecture.

Proof-of-Reserve (PoR)

Through Chainlink’s PoR, every uniBTC is backed by on-chain, verifiable BTC reserves.

- Prevents over-minting

- Eliminates the risks of centralized custody black boxes

- Boosts transparency and user trust

Secure Mint Mechanism

Secure Mint introduces multi-party verification and security thresholds to the minting and burning processes, ensuring:

- Over-minting is impossible

- Abnormal cross-chain activity is automatically blocked

- All operations are fully auditable and verifiable

CCIP + Chainlink Price Feeds

Chainlink’s Cross-Chain Interoperability Protocol enables uniBTC to move securely between chains, while price oracles ensure real-time price synchronization.

Collectively, Bedrock has established a multi-layer, modular security framework that greatly enhances scalability and institutional trust.

uniBTC and the Multi-Asset Restake Model

uniBTC is one of Bedrock’s core assets—essentially a “yield-bearing cross-chain BTC.”

Key advantages include:

- Robust cross-chain liquidity, usable across Ethereum, Layer 2s, modular chains, and more.

- Maintains BTC exposure while earning staking rewards—something WBTC and tBTC do not provide.

- Supports lending, liquidity provision, collateralization, and other DeFi applications.

- Redeemable for native BTC, eliminating the risk of pseudo-assets on-chain.

Beyond BTC, Bedrock also supports ETH, DePIN assets, and more, broadening choices across the entire Liquid Restaking Token (LRT) ecosystem.

Latest Bedrock Data and Price Performance

Source: https://www.gate.com/trade/BR_USDT

The latest BR Token price is about $0.055, with circulating supply representing roughly 23% of the total. The token unlock schedule is gradual, mitigating short-term sell pressure.

Large holders exited, causing a price drop for Bedrock. As security upgrades were implemented and cross-chain applications expanded, the price steadily recovered.

Current market consensus:

- If BTCFi continues to scale

- If uniBTC becomes the primary collateral among cross-chain assets

Then Bedrock’s protocol revenue and token value could rise together.

Institutional Adoption Trends and Market Sentiment

Several institutional players have incorporated Bedrock into their multi-chain yield strategies. For example:

- Multi-chain lending protocols now accept uniBTC as collateral

- Some institutions are exploring restaking part of their BTC holdings

- DePIN projects are leveraging Bedrock’s restake solutions to bolster node security

Compared to competitors that act solely as “cross-chain BTC bridges,” Bedrock’s “multi-asset infrastructure plus modular security” design is earning greater recognition from professional investors.

Implications for Users, LPs, and Developers

For users:

- Users can earn yields without giving up liquidity.

- Multi-chain use cases include collateral, liquidity provision, and lending.

- Security is significantly improved.

For liquidity providers (LPs):

- LPs can earn extra rewards across chains.

- There is increasing demand and deeper markets for LRT assets.

For developers:

- uniBTC offers stability and transparency, making it an ideal collateral base.

- Developers can quickly build cross-chain DeFi applications.

- Chainlink-powered security modules help reduce development costs.

Future Potential and Risk Considerations

Potential:

- The LRT market is expanding rapidly.

- Combined BTC and ETH yield strategies are becoming a significant trend.

- Technologies such as CCIP and ZK could unlock more cross-chain opportunities.

- Bedrock has significant room for capital efficiency gains.

Risks:

- Market volatility could trigger sharp short-term price swings.

- Fierce competition in restaking demands constant innovation.

- If ecosystem growth stalls, token value may be hard to sustain.

Overall, Bedrock is positioned at a pivotal intersection of technology, market momentum, and user demand, warranting ongoing observation and analysis.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About