Bitcoin’s Expanding Role in Corporate Balance Sheets

Corporate Bitcoin Holdings Hit Record High

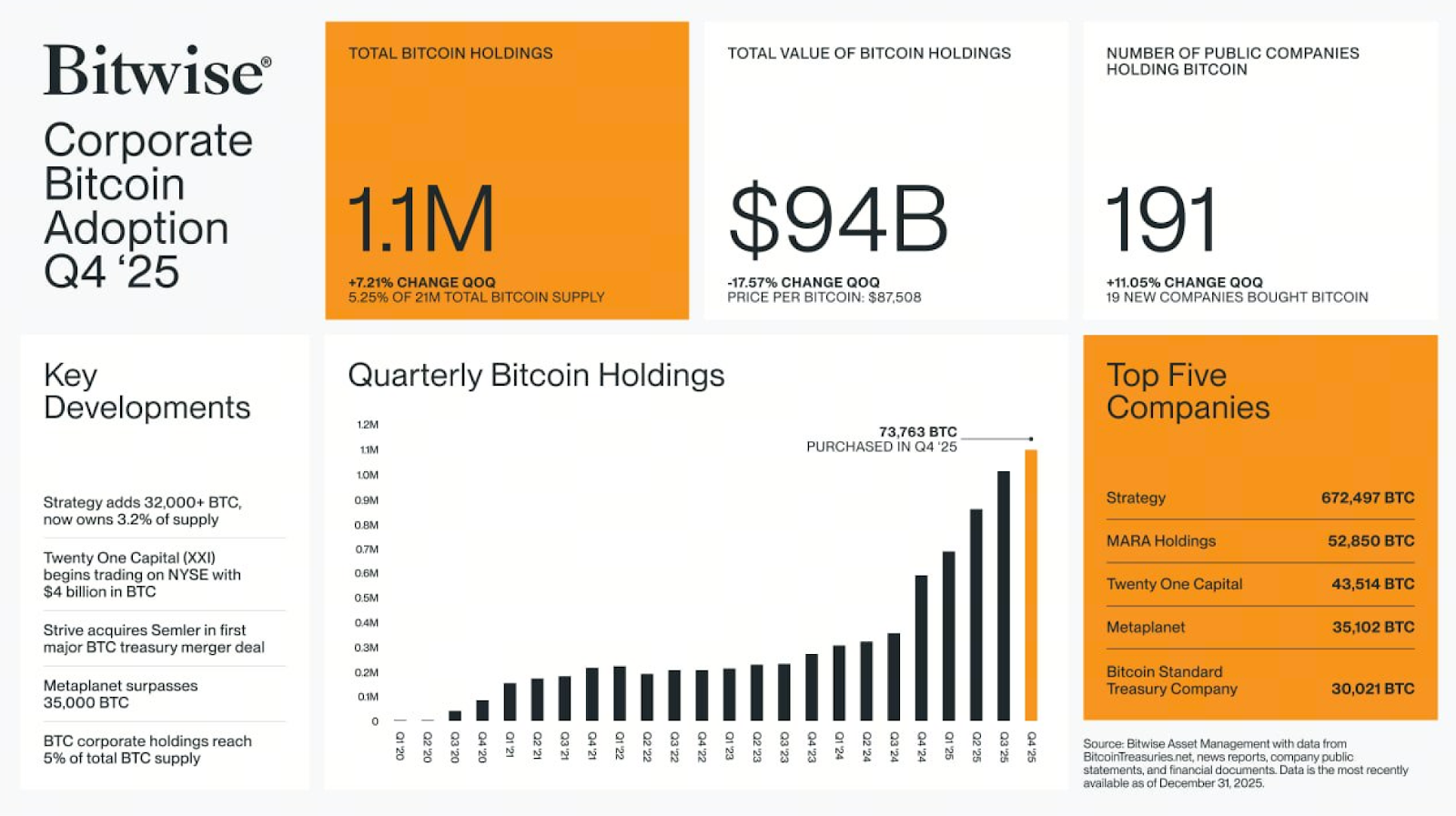

Bitwise’s latest corporate Bitcoin adoption report reveals that by Q4 2025, publicly traded companies worldwide collectively held about 1.1 million Bitcoin (BTC). At the quarter’s average price, these assets were valued at approximately $94 billion, accounting for roughly 5.25% of Bitcoin’s total supply.

(Source: Cointelegraph)

Quarter-over-quarter, corporate Bitcoin holdings increased 7.21%, demonstrating that companies continue to allocate to Bitcoin despite market volatility.

Public Company Participation Continues to Rise

The report notes that 191 listed companies now hold Bitcoin, up 19 from the previous quarter—a quarterly increase of 11.05%. This marks Bitcoin’s evolution from a niche choice for a few aggressive firms to a widely accepted asset class among public companies.

Holding Concentration and Major Players

Corporate Bitcoin ownership remains highly concentrated among a handful of leading entities:

- Strategy: 672,497 BTC

- MARA Holdings: 52,850 BTC

- Twenty One Capital: 43,514 BTC

- Metaplanet: 35,102 BTC

- Bitcoin Standard Treasury Company: 30,021 BTC

Strategy alone holds 3.2% of the total Bitcoin supply, making it a highly influential player in corporate ownership.

Quarterly Highlights

Q4 2025 saw several key developments driving further expansion of corporate Bitcoin portfolios:

- Strategy added more than 32,000 BTC in a single quarter

- Twenty One Capital debuted trading on the NYSE, anchored by Bitcoin assets

- Metaplanet’s holdings surpassed 35,000 BTC

- Corporate Bitcoin holdings climbed to about 5% of total supply

Trends Signal Corporate Strategy Shift

Bitwise data indicates that corporate Bitcoin holdings are shifting from short-term bets to a core component of long-term asset allocation and capital strategy. As both the number of participating firms and their holdings grow, companies are undergoing a structural change in how they perceive Bitcoin’s role.

For more in-depth Web3 insights, click to register: https://www.gate.com/

Summary

In summary, Q4 2025 data shows that corporations are moving from tentative Bitcoin exposure to well-defined asset allocation strategies. Increases in holding volume, participant numbers, and concentration all point to a substantive shift in Bitcoin’s place on corporate balance sheets. With more public companies treating it as a long-term capital management tool, continued corporate adoption may become a major force shaping the Bitcoin market’s structure.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks