Defi App: A Modular Gateway Lowering Barriers to Decentralized Finance

Preface

(Source: defiapp)

Over the past two years, Decentralized Finance (DeFi) has evolved from a technical concept into a mainstream application layer spanning multiple blockchain ecosystems. For many potential users, DeFi’s promise of financial freedom is balanced by its technical complexity. Core processes such as wallet management, private key handling, and cross-chain asset transfers remain significant barriers to entry. This gap in user experience has clearly slowed down the pace of mass adoption.

In response, Defi App aims to redefine accessible decentralized finance by placing user experience at the heart of system design. Through a modular architecture, gasless transaction mechanisms, and multi-chain integration interfaces, Defi App seeks to lower the entry threshold for DeFi to a level comparable with Web2 applications.

Fragmentation and Experience Gap

Despite ongoing innovation within the DeFi ecosystem, systemic gaps remain. Key challenges include:

- High operational barriers: New users must understand wallets, mnemonic phrases, and cross-chain protocols, which raises the cost of participation.

- Fragmented ecosystem: Asset management and switching across different chains complicate operations.

- Asymmetric risk: Loss of private keys or mistaken signatures can lead to irreversible losses.

- Persistent centralization: Many users still rely on exchanges for liquidity and asset access, which runs counter to the ethos of decentralization.

These issues create a persistent gap between DeFi’s ideals and its real-world implementation.

Integration Strategy: Abstraction and Modularization

Defi App’s core solution is to abstract away complexity, offering a unified interface where users can manage wallets, execute cross-chain transactions, and configure yield strategies within a single environment.

- Cross-chain compatibility: Supports multi-chain liquidity operations and leveraged farming, eliminating the need to switch between multiple platforms.

- Gasless mode: Utilizes the $HOME token as a gas abstraction layer, allowing transactions to proceed without native chain tokens.

- Unified asset management: Integrates wallet, trading, and governance functions into a single platform interface.

- User-centric design: Balances ease of use for newcomers with advanced operational flexibility for experienced users.

This integrated approach transforms DeFi from a tool reserved for professionals into an open financial gateway for mainstream users.

$HOME Token: The Core Engine for Incentives, Governance, and Liquidity

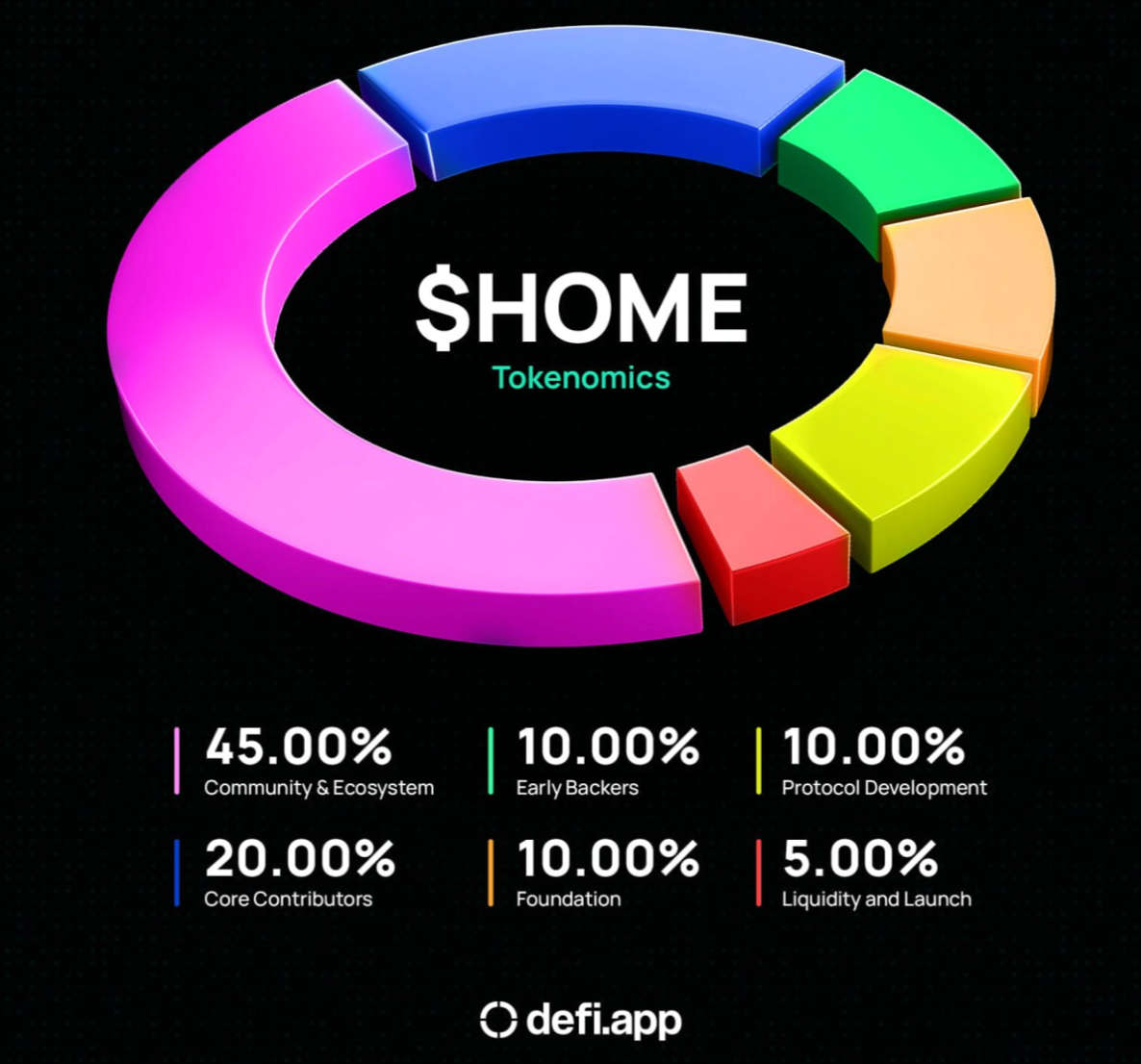

The Defi App ecosystem is powered by its native token, $HOME, which combines functional utility and governance capabilities. The total supply is 10 billion tokens, with the Token Generation Event (TGE) set for June 10, 2025. The distribution mechanism is designed to promote long-term incentives and ecosystem sustainability:

- Community and ecosystem development: 45%, released in stages to support activities and user incentives;

- Core contributors: 20%, gradually unlocked after a 12-month lock-up period;

- Early supporters, foundation, and protocol development: 10% each, allocated for governance and ongoing development;

- Liquidity provisioning: 5%, fully released at TGE to ensure trading depth.

(Source: defidotapp)

Practical Functional Scenarios Include:

- Gas abstraction layer: $HOME is used to pay multi-chain transaction fees, lowering barriers for users.

- Governance participation: Stakers can vote on platform parameters and upgrade proposals.

- Incentive multiplier: Staking $HOME increases XP reward rates, impacting airdrop and feedback distribution.

- Protocol integration mechanism: New protocols can accelerate onboarding and exposure by purchasing and staking $HOME.

This economic structure extends the token’s utility beyond a transaction medium, making it the collaborative and governance backbone of the entire platform.

DeFi’s Sustainability Initiatives

Defi App is not merely pursuing operational convenience—it aims to establish itself as a foundational infrastructure layer for decentralized finance. By delivering a gasless experience, abstracted operations, and cross-chain compatibility, previously fragmented DeFi modules can now operate collaboratively within a unified architecture.

With this design, Defi App becomes the gateway protocol for new users entering the Web3 economy, reducing the learning curve and providing a standardized interface for multi-chain financial activities. As the $HOME economic model matures and protocol integration deepens, Defi App is positioned to become the central node connecting users, capital, and protocols throughout the DeFi ecosystem.

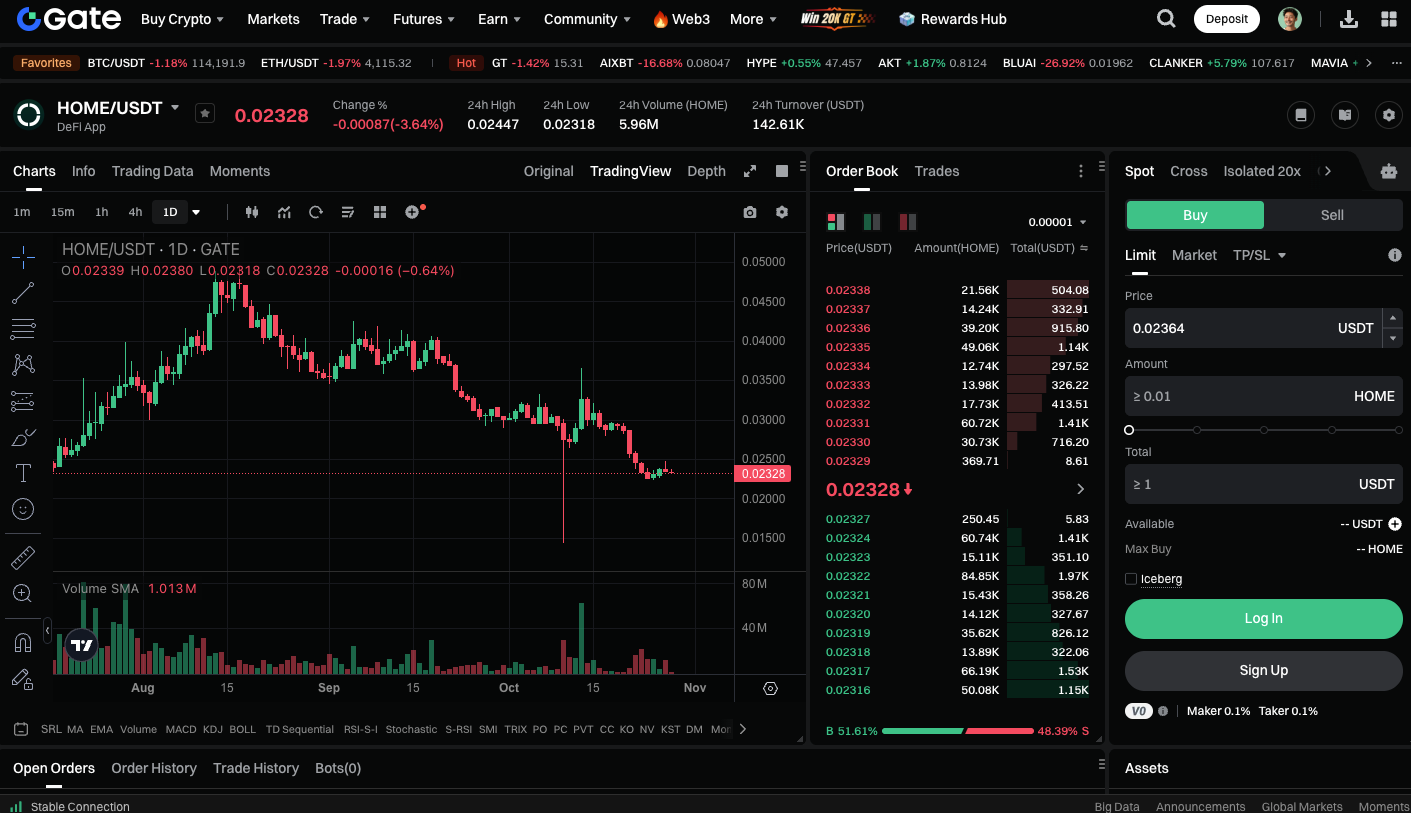

Start trading HOME spot now: https://www.gate.com/trade/HOME_USDT

Conclusion

The future of decentralized finance hinges not only on technological sophistication, but also on widespread adoption of user-centric experiences. Defi App represents a shift in direction, transforming DeFi from a high-barrier testing ground into an open market accessible to all. As cross-chain integration, abstraction, and user experience are redefined, DeFi will evolve from a niche playground for the few into an open economic revolution for everyone.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About