Does Leveraged DCA in Bitcoin Really Outperform?

Five-Year Backtest: 3x Leverage Delivers Little Value

Key takeaway:

Across a five-year backtest, using 3x leverage for BTC dollar-cost averaging (DCA) produced only 3.5% more return than 2x leverage—while exposing you to a near-wipeout level of risk.

When weighing risk, return, and practical execution, spot DCA stands out as the most effective long-term approach. 2x is the practical ceiling; 3x simply isn’t worth it.

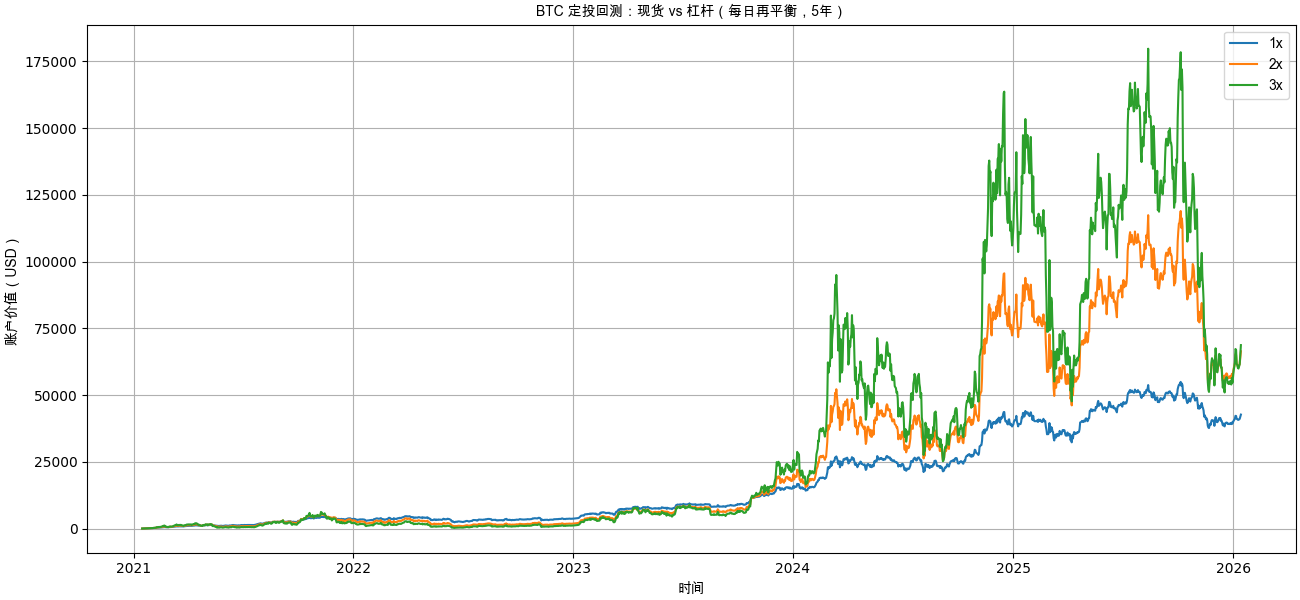

I. Five-Year DCA Net Value Curve: 3x Fails to “Pull Ahead”

The net value curves reveal:

- Spot (1x): Smooth, consistent upward trend with manageable drawdowns

- 2x leverage: Substantially amplifies returns in bull markets

- 3x leverage: Frequently “scrapes the bottom,” steadily eroded by volatility

While 3x ultimately edged out 2x during the 2025–2026 rebound,

for most of the period, 3x underperformed 2x in terms of net value.

Note: This backtest used daily rebalancing for leveraged positions, resulting in volatility decay.

Implication:

3x’s final outperformance depends almost entirely on “the last market surge.”

II. Final Return Comparison: Marginal Gains from Leverage Plummet

The real question isn’t “who made the most,” but how much extra was earned:

- 1x → 2x: ≈ $23,700 additional profit

- 2x → 3x: just ≈ $2,300 more

Returns barely increase, but risk rises exponentially.

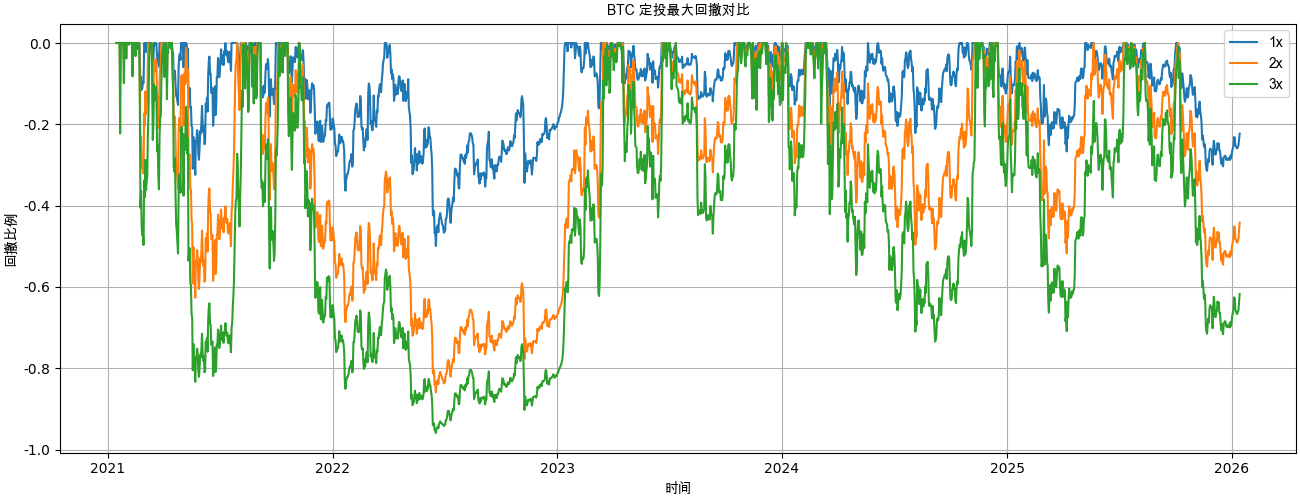

III. Maximum Drawdown: 3x Approaches “Structural Failure”

This exposes a critical reality:

- -50%: Psychologically manageable

- -86%: Requires +614% just to break even

- -96%: Requires +2,400% to recover

In the 2022 bear market, 3x leverage was effectively “mathematically bankrupt.”

Any subsequent gains were almost entirely due to new capital added after the market bottom.

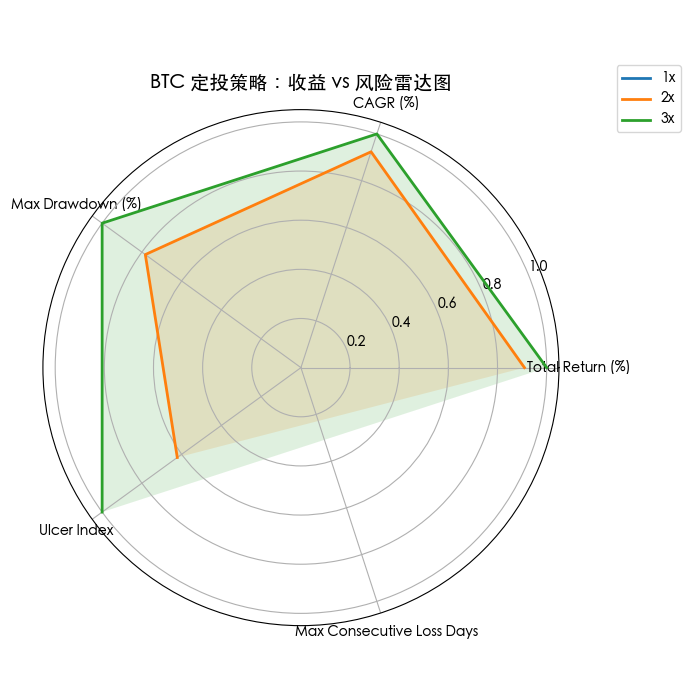

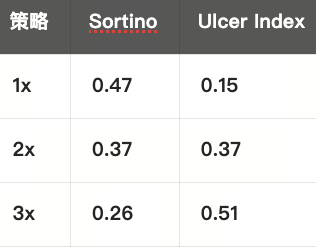

IV. Risk-Adjusted Returns: Spot Is the Optimal Choice

These results highlight three key points:

- Spot delivers the highest risk-adjusted return per unit

- Higher leverage means a much worse risk-reward profile on the downside

- 3x stays in deep drawdown territory long-term, causing significant psychological pressure

What does an Ulcer Index of 0.51 indicate?

Your portfolio stays “underwater” for long periods, providing almost no positive feedback.

Why Does 3x Leverage Underperform So Severely Over Time?

The answer is straightforward:

Daily rebalancing plus high volatility equals ongoing capital decay.

In a sideways market:

- Rising → Add to position

- Falling → Reduce position

- No movement → Portfolio steadily shrinks

This is classic volatility drag.

The impact scales with the square of the leverage multiple.

For a high-volatility asset like BTC,

3x leverage means suffering a 9x volatility penalty.

Final Verdict: BTC Is Already a “High-Risk Asset”

This five-year backtest delivers a clear verdict:

- Spot DCA: Best risk-reward profile, suitable for long-term implementation

- 2x leverage: Maximum aggressiveness, appropriate only for the very few

- 3x leverage: Extremely poor long-term value, not suitable for DCA

If you believe in BTC’s long-term value,

the most rational move isn’t to “add more leverage,”

but to let time work for you—not against you.

Disclaimer:

- This article is republished from [PANews]. Copyright remains with the original author [CryptoPunk]. For any concerns regarding this republication, please contact the Gate Learn team, which will process your request according to established procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize these translations without attribution to Gate.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

BTC and Projects in The BRC-20 Ecosystem

What Is a Cold Wallet?

Blockchain Profitability & Issuance - Does It Matter?

What is the Altcoin Season Index?