From Price Holding to Yield Holding: How GTBTC Is Changing the Way BTC Is Used

Image: https://www.gate.com/staking/BTC

BTC Usage Is Evolving

Historically, BTC’s primary function was “buy and hold,” with investors relying on price appreciation for returns. This strategy proved effective during rapid bull markets, but when the market shifted to periods of volatility or correction, assets often remained idle.

As the market matures, more investors are asking:

Can you earn ongoing returns while holding BTC?

This is one of the reasons GTBTC was created.

GTBTC: Generating Value from BTC During Holding

GTBTC is a BTC yield asset launched by Gate. Users participate in on-chain earning or staking plans through the platform, transforming BTC into an asset that accumulates returns.

Returns are not dependent on short-term trading. Instead, they are continuously accumulated through platform strategies and yield mechanisms, gradually reflected in the asset’s net value.

For long-term BTC holders, this means assets can generate returns even while waiting for market appreciation.

Why Yield Support Matters in Volatile Markets

In fast-rising markets, price gains often mask asset efficiency concerns. However, when the market enters a period of volatility, stagnant funds become an issue.

Many investors feel anxious during sideways markets, as their assets neither rise significantly nor generate returns.

With GTBTC, users can continuously accumulate returns before the market takes off, making the holding experience more stable.

Earning Returns Without Frequent Trading

Frequent trading isn’t suitable for every investor. Many prefer assets to operate automatically, without daily monitoring of market changes.

GTBTC’s yield model emphasizes long-term accumulation, allowing users to earn returns without frequent actions. This approach is ideal for long-term investors or those seeking to reduce operational stress.

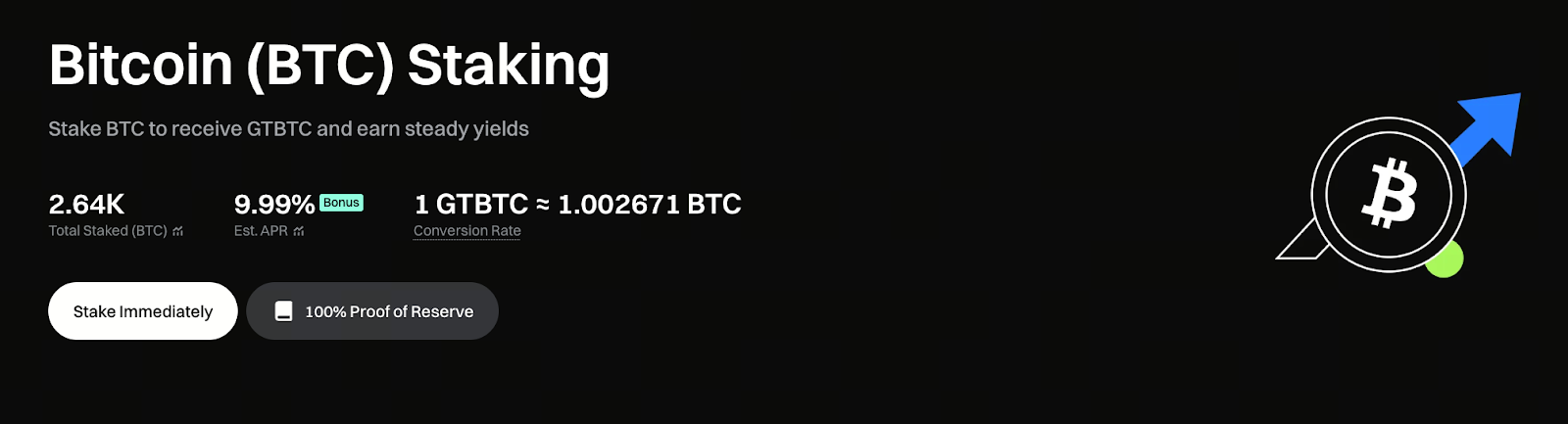

The Value of the Current 9.99% Annualized Yield

The current comprehensive annualized yield for BTC staking is about 9.99% (actual data is subject to the platform’s real-time page). This yield is not a short-term arbitrage, but is achieved through long-term strategic operations.

For investors already planning to hold BTC long-term, earning returns without additional complexity often aligns better with long-term objectives than frequent trading.

GTBTC’s Role in Asset Allocation

GTBTC doesn’t need to replace all BTC holdings. A more balanced approach is to convert part of your assets into yield-generating assets, while maintaining some liquidity positions.

This allocation preserves liquidity and improves the overall time efficiency of assets, creating a more balanced portfolio.

BTC: From Store-of-Value to Yield Asset

With market evolution, BTC is no longer just a store of value. It is gradually becoming an asset that can generate yields.

The introduction of GTBTC reflects an upgrade in BTC usage:

From simply holding, to continuously generating value during the holding period.

Summary

As the market enters a period of volatility, asset efficiency becomes increasingly important. GTBTC’s yield accumulation mechanism enables BTC to operate continuously during holding, providing long-term investors with a more efficient asset management solution.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks