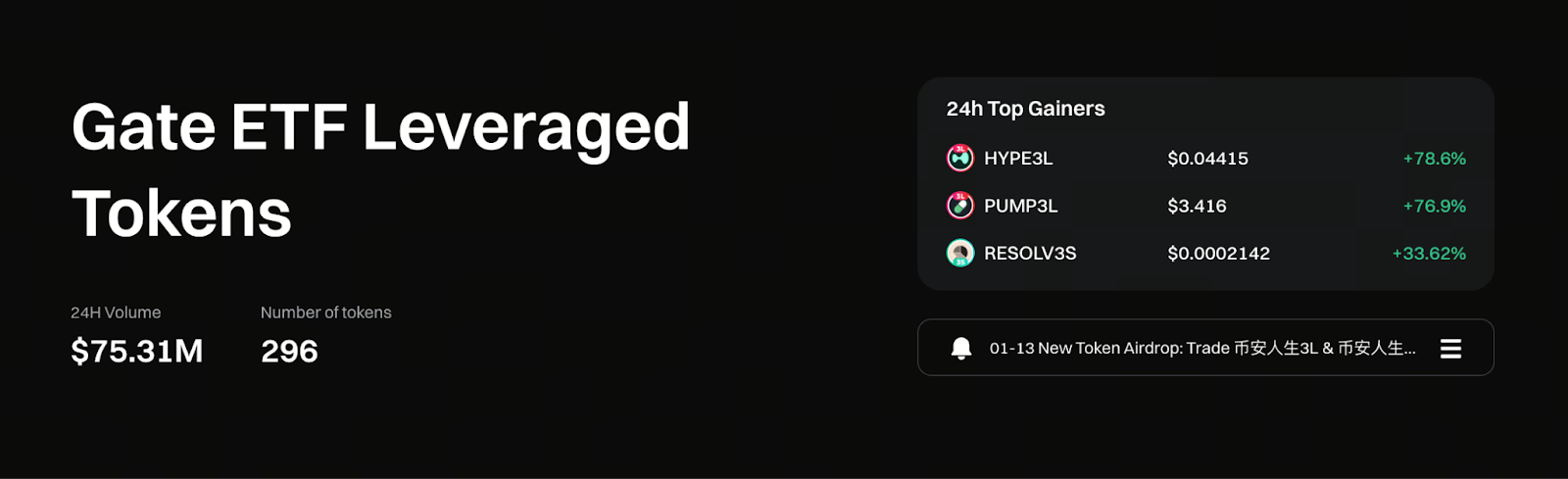

Gate ETF Leveraged Tokens: A Trend-Amplifying Tool Even Beginners Can Use — Why They’re Gaining Attention Again in 2026

Image source: https://www.gate.com/leveraged-etf

Crypto ETF Momentum Continues to Build, Fueling Demand for “Light Leverage Tools”

Since the start of 2026, capital has consistently flowed into crypto ETFs. Bitcoin ETFs, Ethereum ETFs, and emerging funds focused on Solana and Layer2 have steadily attracted attention from both institutions and individual investors. This surge in ETF adoption has sparked a new trend: more traders are seeking leverage tools that are easier to use and carry less risk than futures.

In this environment, Gate’s ETF Leverage Tokens have become highly popular once again.

The reason is clear—they’re easier to understand than futures, require no margin, and allow traders to amplify market returns.

What Are Gate ETF Leverage Tokens? Easier Than You Think

ETF Leverage Tokens are tokenized products that track the price movement of a specific asset (like BTC or ETH) at a fixed multiple. For example:

- BTC3L ≈ 3x long BTC

- BTC3S ≈ 3x short BTC

Traders can achieve leverage simply by buying and selling these tokens as they would with standard spot assets—no need to open contracts or navigate complex funding rates, borrowing procedures, or liquidation mechanics.

Gate’s official courses and help center highlight: ETF Leverage Tokens are essentially “light leverage products with no liquidation risk.”

ETF Leverage Tokens Deliver Amplified Returns in Trending Markets

When the market moves in a clear direction, compounding effects drive the returns of Gate ETF Leverage Tokens.

For example:

- BTC rallies for consecutive days

- BTC3L rises daily by the price gain multiplied by the leverage factor

- Daily rebalancing creates “compounding on gains,” further boosting returns

In other words, during strong uptrends, ETF Leverage Tokens often outperform futures with the same leverage.

Gate’s official articles consistently emphasize: the stronger the trend, the greater the advantage of ETF Leverage Tokens.

Gate ETF Leverage Token Risk Design: Rebalancing, No Borrowing, No Liquidation

Unlike traditional leverage or futures, Gate’s ETF Leverage Tokens incorporate three core safety features:

1. Automatic Rebalancing

To maintain a fixed leverage ratio, the system automatically adjusts positions during significant price swings. In strong trends, this mechanism generates “positive compounding,” enhancing returns.

2. No Borrowing or Margin Required

Purchasing the token is equivalent to opening a position—no need for:

- Borrowing

- Margin collateral

- Concerns about funding rates

The trading experience closely resembles spot trading.

3. No Liquidation Risk

One of the key advantages of ETF Leverage Tokens is that they “cannot be liquidated.” Prices may fluctuate, but forced liquidation—common in futures contracts—does not occur.

Three Types of Traders Who Benefit from Gate ETF Leverage Tokens

Bullish on Market Trends but Prefer Not to Trade Futures

Many users are unfamiliar with futures concepts like:

- Opening/closing positions

- Liquidation thresholds

- Margin management

ETF Leverage Tokens offer a streamlined way to “follow the trend.”

Want to Amplify Market Moves Without High Risk

Trading leverage tokens as spot assets keeps risk manageable and execution straightforward.

Short-Term and Medium-Term Position Holders

During strong trends, the compounding mechanism of ETF Leverage Tokens provides multi-day advantages, making them ideal for capturing medium-term moves.

Why Is 2026 an Especially Favorable Market for ETF Leverage Tokens?

Several factors in 2026 have made ETF Leverage Tokens a hot topic:

- Global expansion of crypto ETF approvals

- Mainstream crypto assets entering a new growth phase

- Significant increases in trading volume and improved liquidity

- Major exchanges driving more transparent, automated product structures

Gate’s ETF Leverage Tokens stand out in this cycle with extensive product coverage—from BTC and ETH to leading public chains, AI sectors, and Layer2 assets, each with dedicated leverage tokens.

As Gate Learn, its courses, and the help center continue to add ETF tutorials, users gain a clearer understanding of product structures, which drives ongoing adoption.

Conclusion: Gate ETF Leverage Tokens Are the “Lightweight Weapon” for Trend Trading

With crypto ETF interest surging and market trends accelerating, Gate’s ETF Leverage Tokens are back in the spotlight for the following reasons:

- No liquidation risk

- No margin required

- Automatic rebalancing

- Spot-style trading

- Compounding advantages in trending markets

For traders seeking to capitalize on market moves in 2026, ETF Leverage Tokens offer a risk-controlled, user-friendly, and return-amplifying solution.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B