Gate ETF Leveraged Tokens Explained: An Advanced Tool for Amplifying Returns in Crypto Trend Markets

What Are Gate ETF Leveraged Tokens

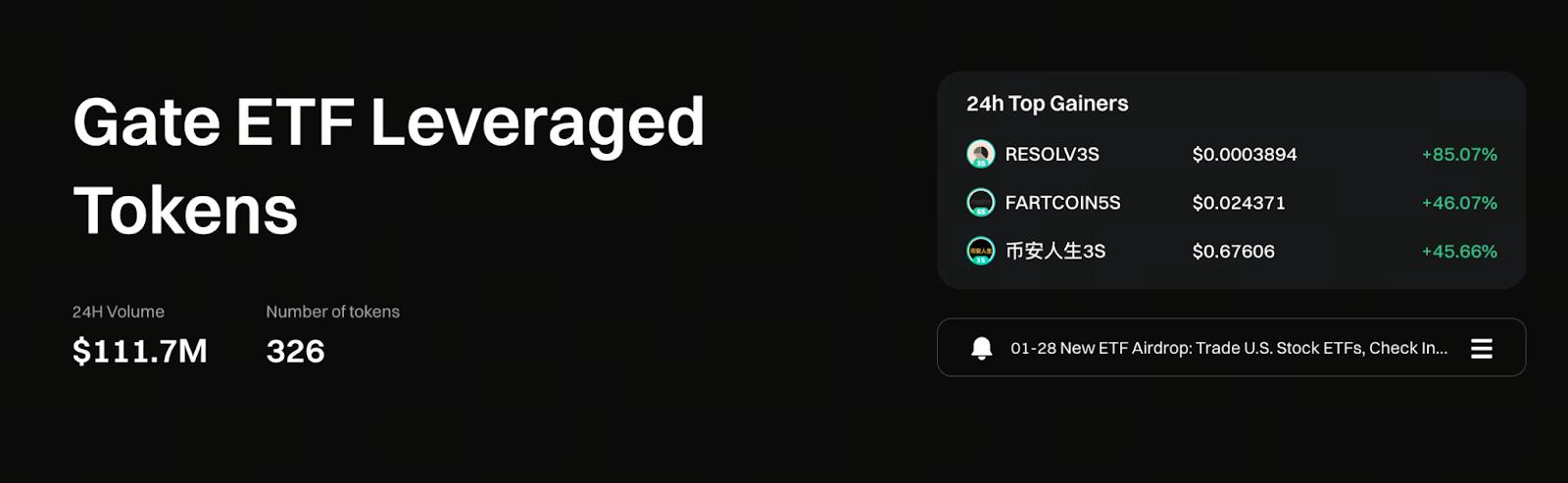

Image: https://www.gate.com/leveraged-etf

Gate ETF leveraged tokens are crypto derivatives that eliminate the need for margin and carry no risk of liquidation. They are designed to provide users with fixed-multiple price exposure, such as 3x long or 3x short positions on a particular crypto asset. Unlike traditional contracts, ETF leveraged tokens do not require margin calls or forced liquidation, making them ideal for investors who want to participate in trending markets without constantly managing their positions.

On Gate, ETF leveraged tokens trade as spot assets. Users can buy and sell them just like any other crypto asset, greatly lowering the barrier to leveraged trading.

Core Mechanisms of Gate ETF Leveraged Tokens

The defining feature of Gate ETF leveraged tokens is their automatic rebalancing mechanism. When the price of the underlying asset moves up or down, the system dynamically adjusts positions according to the preset leverage ratio to maintain the target leverage level.

In trending markets, this mechanism creates a significant compounding effect. If the market continues to move in one direction, long ETF leveraged tokens will amplify returns through ongoing rebalancing. Conversely, in a sustained downtrend, short products will deliver similar results.

It is important to recognize that rebalancing does not happen on a fixed daily schedule—it is triggered automatically whenever leverage deviates from the target range. This is a key reason why Gate ETF leveraged tokens can help smooth out volatility.

Why Trending Markets Are Better Suited for ETF Leveraged Tokens

ETF leveraged tokens are not optimal for every market environment. Their strengths are most apparent in clear trending markets.

During sustained uptrends or downtrends, the compounding mechanism consistently accumulates returns, resulting in a performance curve that outpaces standard spot holdings. In sideways or volatile markets, frequent price swings can gradually erode profits—a risk that many newcomers tend to overlook.

Gate ETF leveraged tokens are best suited for:

- Markets with clear directional breakouts

- Trends driven by macro or fundamental factors

- Medium- and short-term trend trading, rather than high-frequency trading

Recognizing this helps prevent “using the right tool in the wrong scenario.”

Advantages and Common Misconceptions of Gate ETF Leveraged Tokens

From a product design perspective, Gate ETF leveraged tokens offer several key advantages. First, they are easy to use, requiring no understanding of complex margin or liquidation rules. Second, risk is relatively controlled, with maximum loss limited to the amount invested. Third, they provide high transparency, allowing users to monitor net value changes and historical performance at any time.

However, some common misconceptions exist. Many investors mistakenly believe that ETF leveraged tokens are suitable for long-term passive holding. In reality, holding these tokens long-term in a volatile market may result in ongoing net value decline. Additionally, some users treat them as tools for frequent short-term trading, which can reduce overall returns due to rebalancing costs.

Risks to Note When Using Gate ETF Leveraged Tokens

While Gate ETF leveraged tokens simplify the complexities of traditional leveraged trading, they are not without risk.

Amplified price movements, greater principal volatility, and value erosion in choppy markets are all factors that demand careful attention.

A more prudent approach includes:

- Entering only after confirming a trend to avoid chasing at highs;

- Managing positions rather than going all-in;

- Regularly assessing whether market conditions still justify using ETF leveraged tokens.

With a thorough understanding of how the product works, ETF leveraged tokens can serve as effective tools to enhance trading efficiency—instead of becoming sources of increased risk.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B