Gate ETF Leveraged Tokens: The Lowest-Barrier Trend Amplifier — Why They Are Gaining Popularity in 2026

Image: https://www.gate.com/leveraged-etf

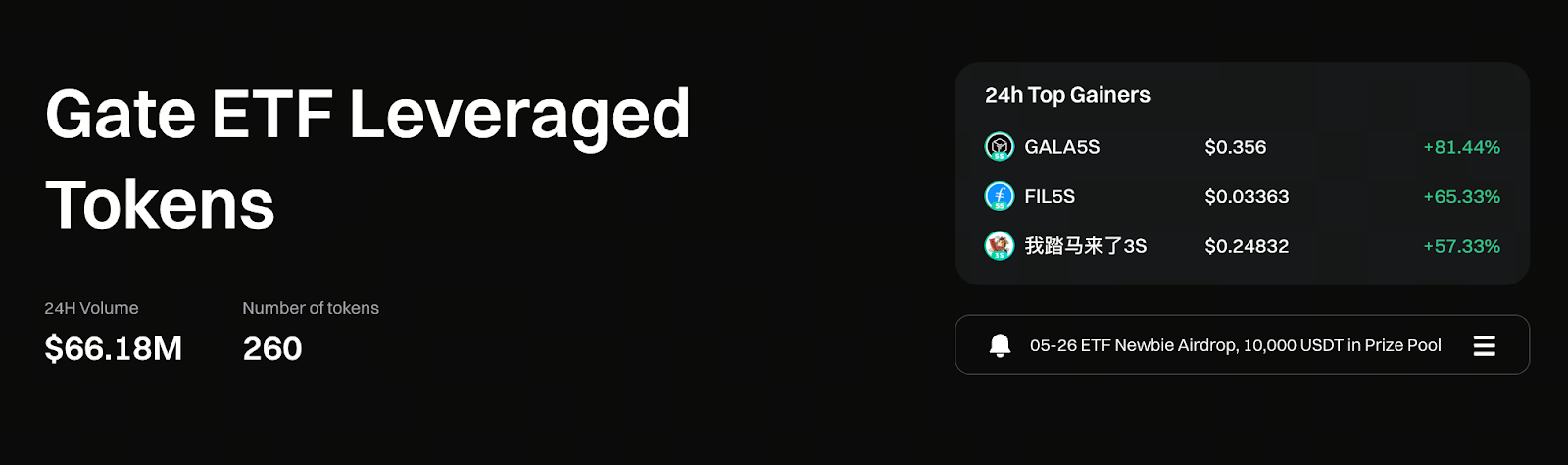

Since 2026, the crypto market has continued to deliver strong signals. From the approval of new crypto ETFs in the US and Asian markets to the steady rise in BTC and ETH prices, the industry is seeing a new wave of capital inflows. Against this backdrop, ETF leveraged tokens have become a go-to tool for both new and professional traders. Gate’s leveraged token products, known for high liquidity and broad market coverage, have seen surging popularity in recent months.

When the market enters a clear trend, ETF leveraged tokens stand out for their straightforward structure, amplified returns, and the absence of forced liquidation risk.

I. Why Did ETF Leveraged Token Trading Volume Surge on Gate in 2026?

1. Global Crypto ETFs Accelerate User Education

From spot BTC and ETH ETFs to more specialized thematic ETFs, users worldwide have become familiar with the ETF product structure.

This educational momentum is benefiting leveraged ETF tokens on crypto exchanges as well—especially on Gate, where clear product introductions and well-structured tutorials make it easier for users to grasp how they work.

2. Clear Market Trends and Growing Demand for Amplified Returns

In bullish markets, many users want higher returns than spot trading but prefer to avoid the high risks of derivatives. ETF leveraged tokens provide a middle ground:

- Amplified volatility

- No need to set leverage manually

- No forced liquidation risk

- Buy and sell as easily as spot

This makes it easier for users to capture opportunities during bull runs.

3. Gate Offers the Most Comprehensive Leveraged Token Ecosystem

Gate covers nearly all major and trending assets, including:

- BTC3L, BTC5L, ETH3L, SOL3L, TON3L, DOGE3L

- Multiple leveraged options for trending sectors

- Rapid listings during market surges for optimal relevance

This wide selection gives traders the freedom to follow trends or chase hot narratives as they see fit.

II. Gate ETF Leveraged Token Mechanism Advantages

1. Automatic Rebalancing Delivers Compounding in Trends

ETF leveraged tokens automatically rebalance daily based on market volatility, maintaining a stable leverage ratio. When prices rise steadily, this mechanism increases the effective position, creating a compounding effect that further amplifies returns in trending markets.

2. No Forced Liquidation Risk, Lower Stress

The biggest challenge in derivatives trading is forced liquidation, but ETF leveraged tokens eliminate this risk—investors are only exposed to the token’s price movement.

This makes them ideal for:

- Beginner traders who lack risk management skills

- Those seeking higher profits without using derivatives

- Traders aiming to maximize trend returns

3. Spot-like Trading Experience, Minimal Learning Curve

The buy/sell process is just like spot trading—simply choose your preferred leverage. For example:

- BTC3L: 3x long Bitcoin

- ETH5L: 5x long Ethereum

- BTC3S: 3x short Bitcoin

Users can get started quickly without learning complicated leverage management.

III. What Market Conditions Are Best for Using Gate Leveraged Tokens?

Clear Uptrends

For example, when BTC breaks key price levels and continues to rally, BTC3L typically delivers a higher beta effect.

Short-Term Volatility Driven by Bullish Events

Examples include:

- ETF approval news

- Institutional accumulation

- Positive macro data

- On-chain sector surges

In these scenarios, leveraged tokens can quickly amplify short-term gains from volatility.

Strong Major Coin Trends

Leveraged tokens for BTC, ETH, SOL, and TON typically offer strong liquidity and more reliable price tracking.

IV. Key Risks to Watch When Using Gate ETF Leveraged Tokens

While they’re easy to use, it’s essential to understand the product’s characteristics:

1. “Price Decay” Risk in Sideways Markets

Automatic rebalancing benefits trends, but can erode returns during choppy, range-bound periods.

2. Not Designed for Long-Term Holding

Leveraged tokens are short-term trend tools, not long-term investment vehicles.

3. Avoid Heavy Positions in Highly Volatile, Directionless Markets

When market direction is unclear, add positions cautiously to avoid compounding losses.

V. Why Are Gate ETF Leveraged Tokens Especially Suitable for Beginners?

- No need to set leverage ratios or worry about forced liquidation

- Identical trading process to spot markets

- Extensive educational articles, product guides, and case studies from Gate

- Broad coverage, high liquidity, and low entry barriers

Compared to derivatives, ETF leveraged tokens are the easiest leveraged products for beginners to understand and use safely.

VI. Conclusion: In 2026, ETF Leveraged Tokens Remain the Top Choice for Trend Trading

As global crypto ETFs drive market maturity and both trading volume and institutional capital climb, trends are becoming increasingly clear. In this environment, Gate’s ETF leveraged tokens are an ideal tool for everyday traders to maximize efficiency and returns.

Advantages include:

- Simple operation

- No forced liquidation risk

- Strong compounding in trend markets

- Wide asset coverage

- Beginner-friendly design

For traders aiming to maximize profits in bull markets and quickly position in trending sectors, Gate ETF leveraged tokens remain one of the most valuable trading tools in 2026.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B