Gate GTETH: Transforming ETH into a High-Liquidity Yield Asset

The Market Moves Into High Gear: Asset Allocation Logic Is Evolving

As the crypto market transitions into a phase of high-frequency volatility and rapid sector rotation, asset management is shifting from long-term holding to real-time allocation. For most ETH investors, staking—once considered a reliable source of stable returns—is now revealing its misalignment with the market’s accelerated tempo.

In this environment of increasingly swift market movements, the ability to reallocate capital at any moment often outweighs the importance of annualized returns alone. When ETH is locked in staking contracts and cannot be quickly converted to liquid assets, these liquidity constraints become a hidden cost.

Structural Bottlenecks in Traditional Staking Models

After engaging in ETH staking, many users come to recognize several practical limitations:

- Staked positions cannot be reallocated instantly, even when market trends are clear

- ETH cannot participate in other investment strategies simultaneously

- Yield performance is difficult to incorporate into overall asset efficiency assessments

Mechanisms originally intended to boost returns end up restricting capital flexibility in highly volatile markets.

GTETH: Redefining ETH’s Asset Structure

GTETH doesn’t just add features to the traditional staking process—it transforms how ETH is represented as an asset. By converting ETH to GTETH, staking becomes an embedded property of the asset itself, rather than a separate operational step.

Instead of holding ETH that’s waiting to be unlocked, users now hold a yield-accruing mirrored asset. This shift turns staking from a process into an inherent attribute of the asset.

Built-In Yield: Holding Means Earning

GTETH employs a built-in yield model, with its price reflecting actual returns over time from two main sources:

- Base staking rewards from Ethereum PoS

- Additional GT incentives provided by Gate

There’s no need for users to manually claim rewards or perform extra operations. Simply holding GTETH allows returns to accrue automatically and transparently, with all data verifiable on-chain.

No Need to Sacrifice Liquidity to Earn Staking Rewards

The key difference from traditional staking is that GTETH doesn’t require locking your assets. Holders can:

- Redeem for ETH at any time

- Trade directly on the market

- Adjust as part of their asset allocation strategy

This structure allows yield and liquidity to coexist in a single asset, so ETH no longer has to choose between stable returns and capital flexibility.

From Passive Storage to Strategic ETH Units

With GTETH, ETH is no longer just a passively stored yield asset—it becomes a strategic unit that can be dynamically adjusted based on market conditions. Whether you’re reducing risk exposure or quickly reallocating when opportunities arise, GTETH maintains staking yield potential while preserving capital flexibility.

Transparent Yield Sources—Long-Term Efficiency Is Easily Measured

GTETH’s yield structure is straightforward:

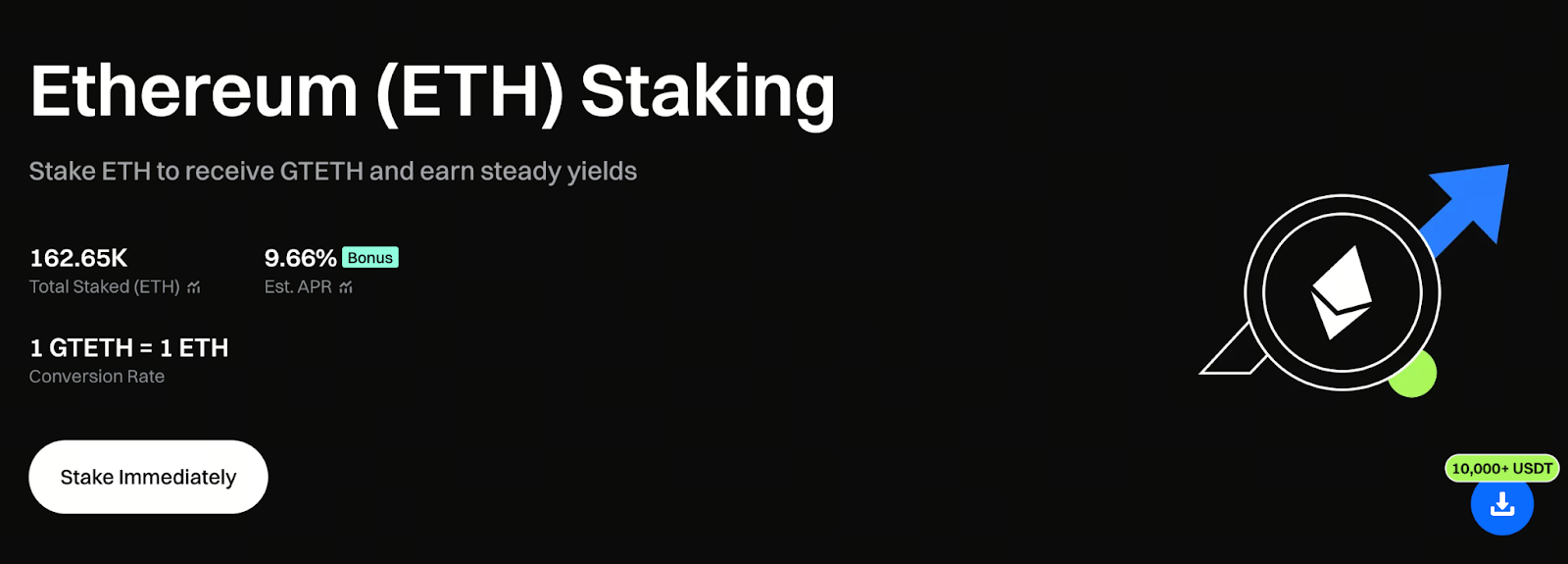

- ETH PoS staking rewards: approximately 2.66% annualized

- GT incentives from Gate: approximately 7% annualized

All returns are reflected in a single transaction when redeeming for ETH, making it easy to calculate, compare, and evaluate overall yield.

Start your on-chain yield journey with Gate ETH staking now: https://www.gate.com/staking/ETH?ch=ann46659

VIP Level: The Key Factor for Compounding Returns

GTETH’s fee rates adjust according to your Gate VIP level:

- VIP 5–7: 20% fee discount

- VIP 8–11: 40% fee discount

- VIP 12–14: 60% fee discount

Short-term differences may be minor, but over time, compounding makes the fee structure a decisive factor in your final returns.

Beyond Liquid Staking: A True Asset Management Solution

While most LSTs are still built around locked asset mirroring, GTETH functions as an ETH asset management tool. Its value grows naturally with yield and allows unrestricted market entry and exit. In this structure, staking is no longer a passive commitment but a capital deployment method that can be adjusted in sync with market strategies.

Summary

GTETH doesn’t make ETH staking more complex—it redefines ETH’s role in asset allocation. By embedding yield directly into the asset and removing lock-up restrictions, GTETH provides both yield and liquidity, truly fitting the pace of high-frequency markets. As capital efficiency becomes a core competitive edge, ETH staking is no longer just a long-term holding option, but an instantly deployable strategic tool.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks