Gate introduces TradFi contract-for-difference (CFD) trading, offering an innovative trading experience that merges cryptocurrency with traditional financial markets.

Gate Accelerates TradFi Expansion, Broadens Multi-Asset Trading Horizons

As global financial markets move toward greater diversity and digitalization, crypto asset trading platforms are continually exploring new product models. Recently, Gate, a leading global crypto asset trading platform, introduced TradFi contract for difference (CFD) trading, formally expanding its trading offerings from crypto assets to traditional financial asset pricing.

With Gate TradFi, users can trade CFDs for traditional financial assets—including gold, forex, global indices, commodities, and select popular stocks—all on a single platform. This initiative marks Gate’s development of a multi-asset trading system that spans both crypto and traditional financial markets, delivering users a more comprehensive set of trading options.

USDx Pricing Model Lowers TradFi Trading Barriers

Gate TradFi uses USDx as its margin and account display unit. USDx is not a fiat currency or on-chain asset; rather, it’s an internal pricing unit for TradFi scenarios at Gate, anchored 1:1 to USDT.

Users simply transfer USDT from their main account to their TradFi account, and the system automatically displays the balance in USDx—no extra conversion steps, fees, or custody costs required. All TradFi trading assets remain fully backed by USDT, enabling users to participate in traditional financial market price movements within the familiar crypto asset ecosystem.

CFD Mechanism Aligned with Traditional Market Rules

Unlike crypto perpetual contracts, Gate TradFi contracts strictly follow the logic of traditional financial markets. These contracts feature clearly defined trading hours and market closures, with overnight fees incurred during non-trading periods. The overall structure mirrors mainstream CFD market practices.

TradFi contracts employ a fixed leverage model, with no option for users to manually adjust the leverage multiplier. The margin system is cross-margin, allowing long and short positions in the same trading pair to be hedged by lot calculation. This design reduces risk misjudgment from complex operations, enabling users to manage risk more clearly when trading traditional financial assets.

High Leverage and Low Fees Optimize Trading Costs

Gate TradFi offers up to 500x leverage for major assets such as forex and indices, while stock CFDs support up to 5x leverage—consistent with traditional financial market standards for different asset risk levels.

Gate TradFi also maintains a competitive fee structure, with transaction fees as low as $0.018 per trade, providing users with transparent and manageable trading costs. This fee advantage makes TradFi contracts particularly appealing for high-frequency and short-term trading strategies.

MT5 System Integration Enhances Risk Management and Trading Stability

Gate TradFi is powered by the MT5 (MetaTrader 5) trading system. Users can trade via the Gate App or MT5 client, with account data, positions, and trading history synchronized across all interfaces.

For risk management, Gate TradFi implements a forced liquidation mechanism based on margin ratio. When the account margin ratio falls to 50% or below, the system initiates a step-by-step forced liquidation process according to established rules, preventing further risk escalation. This approach is fully aligned with standard practices in traditional CFD markets.

Experience Campaign Supports First-Time TradFi Trading

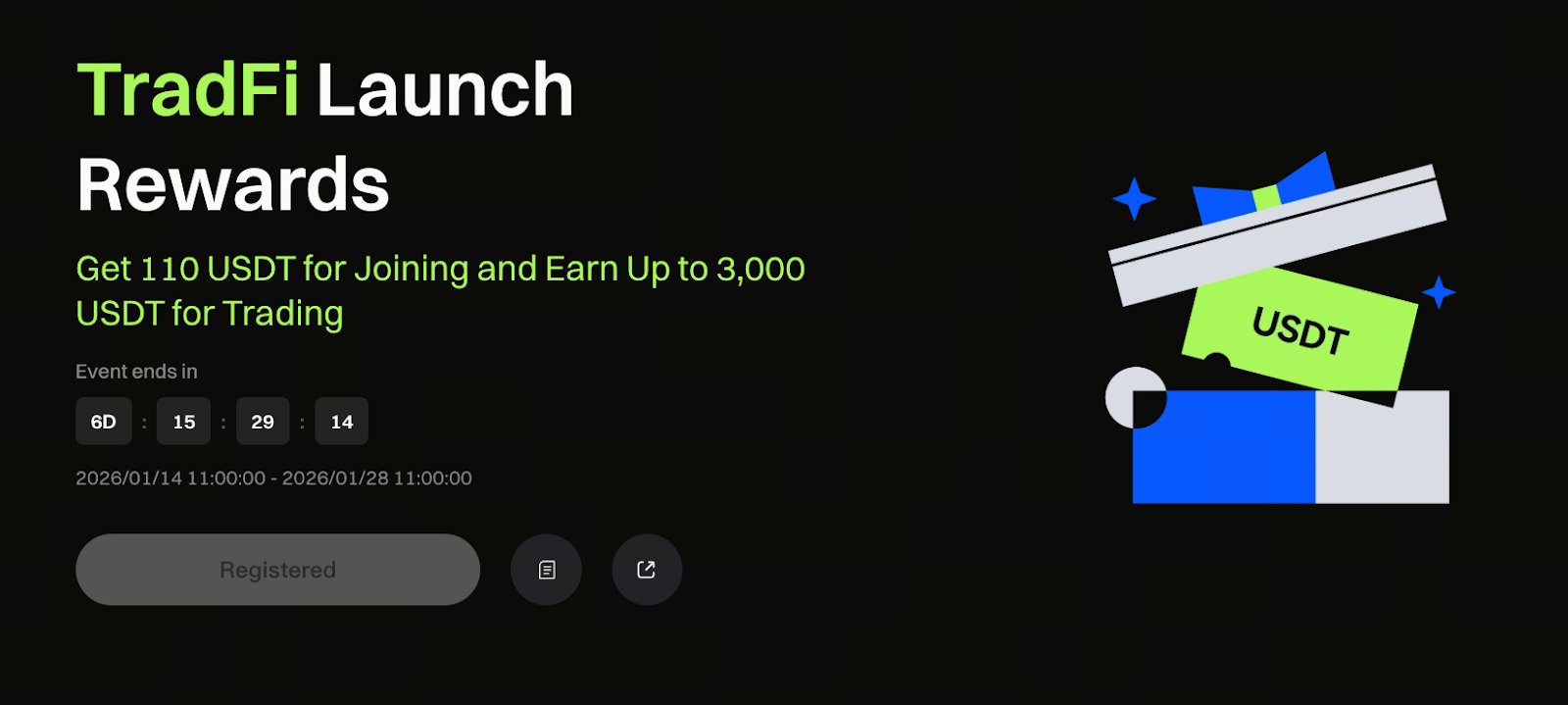

Image: https://www.gate.com/campaigns/3817

To make TradFi trading more accessible, Gate has launched an experience campaign. Eligible users who register can earn up to $110 in experience rewards, and by completing designated trading tasks, unlock additional phased incentives up to $3,000 to support their first TradFi trading experience.

This campaign offers crypto users a low-cost, practical entry point to explore traditional financial asset trading mechanisms.

A Key Step Toward Multi-Asset Integration

The launch of Gate TradFi extends the platform’s trading system beyond crypto assets to encompass a broad range of traditional financial asset price trading. Users can conduct multi-market price analysis, risk hedging, and strategy combinations all on one platform, streamlining the complexity of cross-platform operations.

As the boundaries between crypto and traditional financial markets continue to blur, Gate’s ongoing development in the TradFi space may prove to be a pivotal step in building integrated trading infrastructure, providing the industry with new reference models for merging diverse asset classes within a compliant framework.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About