Gate Leveraged ETFs: A Smarter Way to Amplify Market Trends

The Rise of Leveraged ETFs

Exchange-Traded Funds (ETFs) were designed to diversify risk by holding a basket of assets, enabling investors to buy and sell fund shares as easily as stocks. Their straightforward structure, efficiency, and high liquidity have made them a staple in traditional financial markets.

As investor demands have grown more sophisticated, simple index tracking no longer meets all needs. The market now seeks more strategic products that can directly amplify market trends. Leveraged ETFs emerged to address this demand. Investors can magnify the gains and losses of underlying assets by a set multiple—without accessing the derivatives market—unlocking greater profit potential.

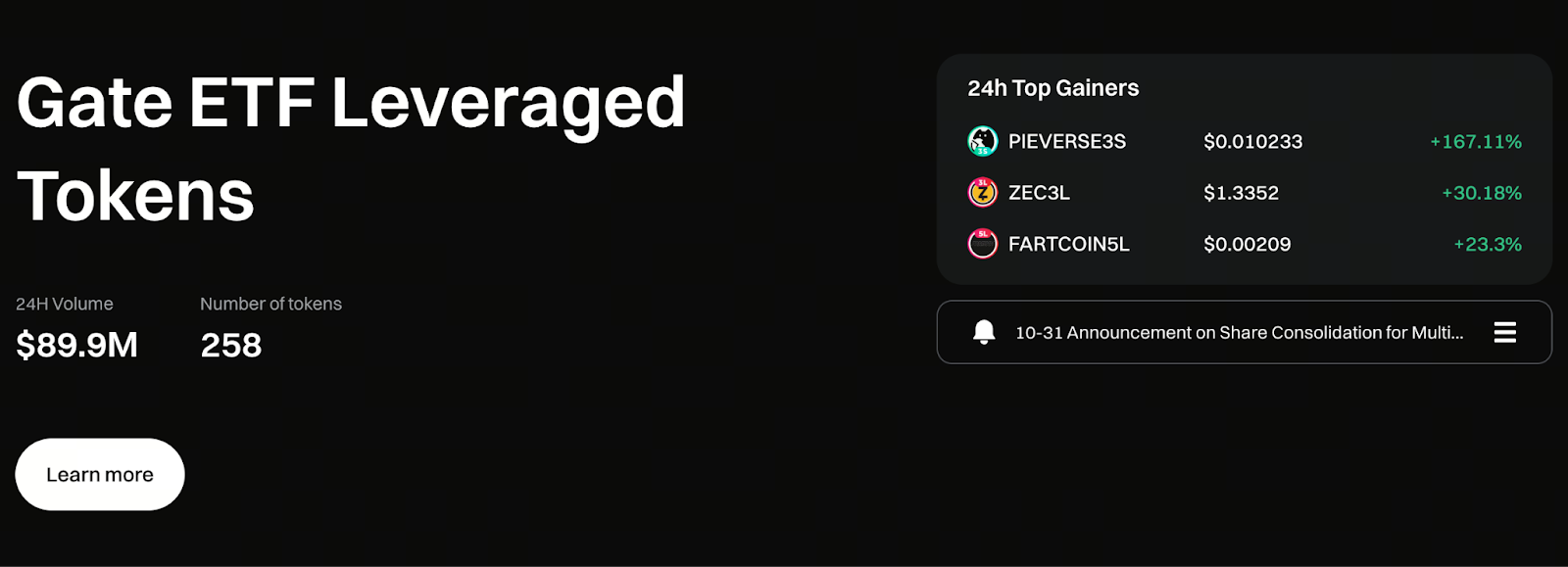

What Are Gate Leveraged ETF Tokens?

Gate’s leveraged ETFs are tokenized products that maintain a fixed leverage ratio—such as 3x or 5x—through perpetual contract positions. Users can access these effects simply by trading on the spot market, with no need for borrowing or margin management.

The standout feature is that the system fully manages the underlying contract positions, eliminating the risk of forced liquidation. For those unfamiliar with derivatives but seeking to capture amplified market moves, leveraged ETF tokens offer a safer and more accessible alternative.

Start trading Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

How Gate Leveraged ETFs Operate

To ensure stable leverage ratios, the platform employs multiple risk and position management mechanisms:

- Leverage Maintained via Perpetual Contracts

Each leveraged token is backed by a corresponding futures position, keeping the leverage ratio steady despite market volatility.

- Automatic Rebalancing Based on Market Movements

The system adjusts positions according to price changes, ensuring the token’s leverage stays within a preset range.

- Leverage Configuration Through Spot Trading

All strategies are executed on the spot market, so users never need to interact with derivatives platforms to access leverage.

- Daily 0.1% Management Fee

This fee covers rebalancing, hedging, contract costs, and keeps the product structure operating smoothly.

Key Advantages of Leveraged ETFs

- Multiplying Profits in Trending Markets

When market direction is clear, leveraged ETFs can amplify returns by a fixed multiple, significantly enhancing capital efficiency.

- No Forced Liquidation from Margin Calls

The system automatically maintains positions, so users avoid the typical liquidation risks found in derivatives trading.

- Rebalancing Drives Compounding Gains

During sustained uptrends, rebalancing naturally increases profits, creating a compounding effect on returns.

- Zero Learning Curve

Trading is as simple as buying and selling. The process mirrors spot trading, making it ideal for beginners and short-term traders alike.

Risks to Consider Before Trading

While easy to use, leveraged ETFs are inherently more volatile. Please keep the following in mind:

- Gains and Losses Are Both Magnified

Leverage increases the impact of both upward and downward price movements.

- Rebalancing Drag in Sideways Markets

In choppy or range-bound markets, rebalancing may erode long-term returns.

- Actual Performance May Deviate from the Stated Multiple

Due to rebalancing, costs, and volatility, price movements do not always follow a perfectly linear multiplier effect.

- Accumulated Management Fees Affect Long-Term Returns

The daily management fee is reflected over time in the token price, making leveraged ETFs unsuitable for long-term passive investing.

In summary, leveraged ETFs are best suited for short-term strategies, swing trading, or strong trending markets.

How Management Fees Are Used

The platform’s daily 0.1% management fee covers:

- Opening and closing contract positions

- Funding rates

- Hedging and slippage during leverage adjustments

- System rebalancing operations

Compared to similar leveraged products, this fee is moderate to low, with the platform absorbing some costs directly.

Conclusion

Leveraged ETFs provide investors with a straightforward way to use leverage, removing the complexities of derivatives trading and avoiding liquidation risk. However, higher leverage isn’t always better. The real key is recognizing market trends, understanding the effects of rebalancing, and having a disciplined approach to risk and timing. When you know the product rules and can read the market, leveraged ETFs can genuinely boost your returns. Otherwise, lingering in sideways markets can quickly erode your capital.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B