Gate Precious Metals Perpetual Contracts: Redefining Gold and Silver Trading in Volatile Markets

Hedging: From Passive Waiting to Real-Time Response

Traditionally, gold and silver have served a straightforward role in investment portfolios—offering a temporary safe haven during market turbulence. But as information moves faster and the impact window for events shortens, the old logic of holding and waiting no longer meets traders’ demands for efficiency and agility.

Investors are increasingly rethinking how to use precious metals. Are they limited to passively absorbing risk, or can they form part of an active, real-time strategy? This shift in perspective is paving the way for precious metals’ entry into the crypto derivatives market.

When Precious Metals Meet the 24/7 Crypto Market

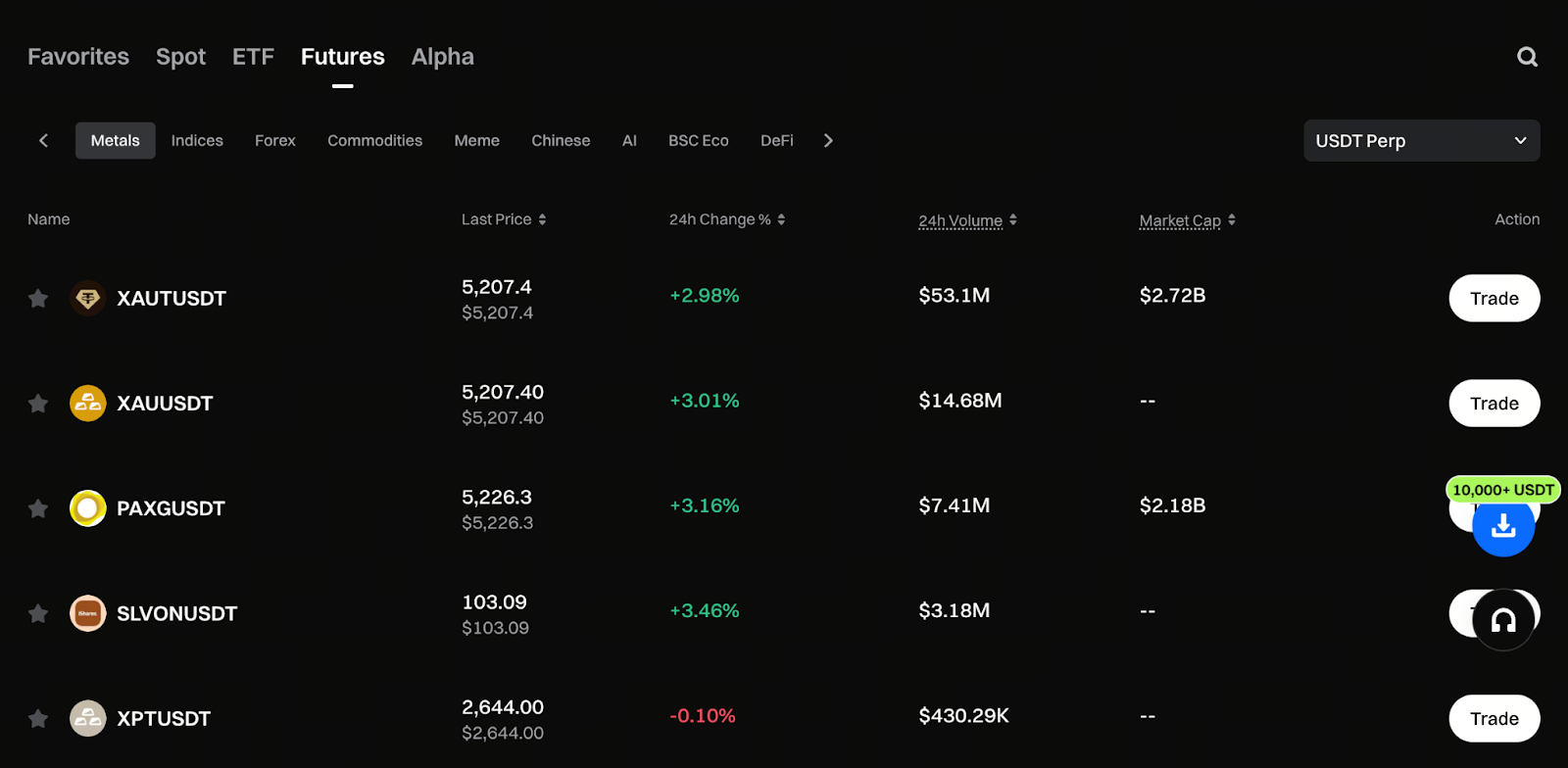

Gate’s Precious Metals Perpetual Contracts are designed to bring these classic hedging assets into the fast-paced world of crypto trading. With USDT-margined perpetual contracts, gold (XAU) and silver (XAG) are no longer bound by traditional market hours—they’re available for trading around the clock, seven days a week.

When interest rate decisions, geopolitical events, or macroeconomic data drive volatility, traders don’t have to wait for the next session. They can adjust positions instantly, turning precious metals from static defense into dynamic risk management tools.

Start trading now in Gate’s Precious Metals section: https://www.gate.com/price/futures/category-metals/usdt

A Seamless Interface Across Markets

Gate hasn’t built a separate system for precious metals. XAU and XAG perpetual contracts are fully integrated into the existing trading infrastructure. Whether on the website or app, users place orders, set leverage, and manage risk just as they always have. This seamless design eliminates the need to relearn processes or manage multiple accounts, making cross-market trading a natural extension of familiar habits and reducing friction when switching strategies.

Hedging Demand Rises, Price Volatility Returns

As market uncertainty grows heading into 2026, capital is once again focusing on safe-haven assets, putting precious metals back in the spotlight:

- Gold is up about 7% this year, repeatedly testing all-time highs.

- Silver, with its dual industrial and financial roles, has seen even more pronounced volatility—up roughly 23% year-to-date.

In this context, precious metals perpetual contracts offer a new way to participate. Traders can go beyond simple asset allocation to actively engage with price movements more frequently.

Index Pricing Mechanism: Supporting Long-Term Stability

To prevent price distortion from single-source feeds, Gate’s precious metals perpetual contracts use a multi-source index pricing model. By aggregating quotes from multiple markets, the contracts maintain fair pricing during high volatility and enhance transparency and verifiability. For users employing leverage, hedging, or complex strategies, stable pricing is a cornerstone of sound risk management.

A Strategic Bridge Between TradFi and Crypto

From an allocation perspective, precious metals perpetual contracts occupy a unique position:

- For traditional market participants, gold and silver are familiar and easy to evaluate.

- For crypto-native traders, these contracts introduce assets with different volatility profiles, helping diversify and reduce concentration risk.

Whether used for macro hedging, swing trading, or as a cross-market hedge, precious metals contracts create a practical link between traditional finance and crypto markets.

The Next Step in Multi-Asset Contract Expansion

The launch of precious metals perpetual contracts is more than a single feature update—it’s part of Gate’s ongoing effort to expand traditional assets within its derivatives ecosystem. Leveraging robust liquidity and risk control, Gate may continue to add more traditional market instruments, further broadening the range of assets available for contract trading.

Conclusion

With gold and silver now part of the crypto perpetual contract market, they’re no longer just defensive assets—they’re dynamic tools for real-time market participation. Gate’s precious metals perpetual contracts deliver greater flexibility for hedging and open new avenues for multi-market strategies. As the lines between traditional finance and crypto blur, these products are becoming essential pieces in advanced traders’ strategic playbooks.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About