Gate Precious Metals Perpetual Contracts: Trade Gold and Silver with Flexible Leverage

Market Dynamics Are Changing—Traditional Asset Strategies Must Evolve

Uncertainty in the global markets is no longer confined to specific windows. Policy signals, geopolitical risks, and macroeconomic data can trigger price swings at any moment, compressing market reaction times to hours or even minutes.

In this environment, waiting to adjust positions until after risks emerge means missing out on critical opportunities. The market has come to recognize a key principle: if safe-haven assets can’t be traded in real time, they become an outdated allocation method.

Precious Metals Break Free from Traditional Trading Hours

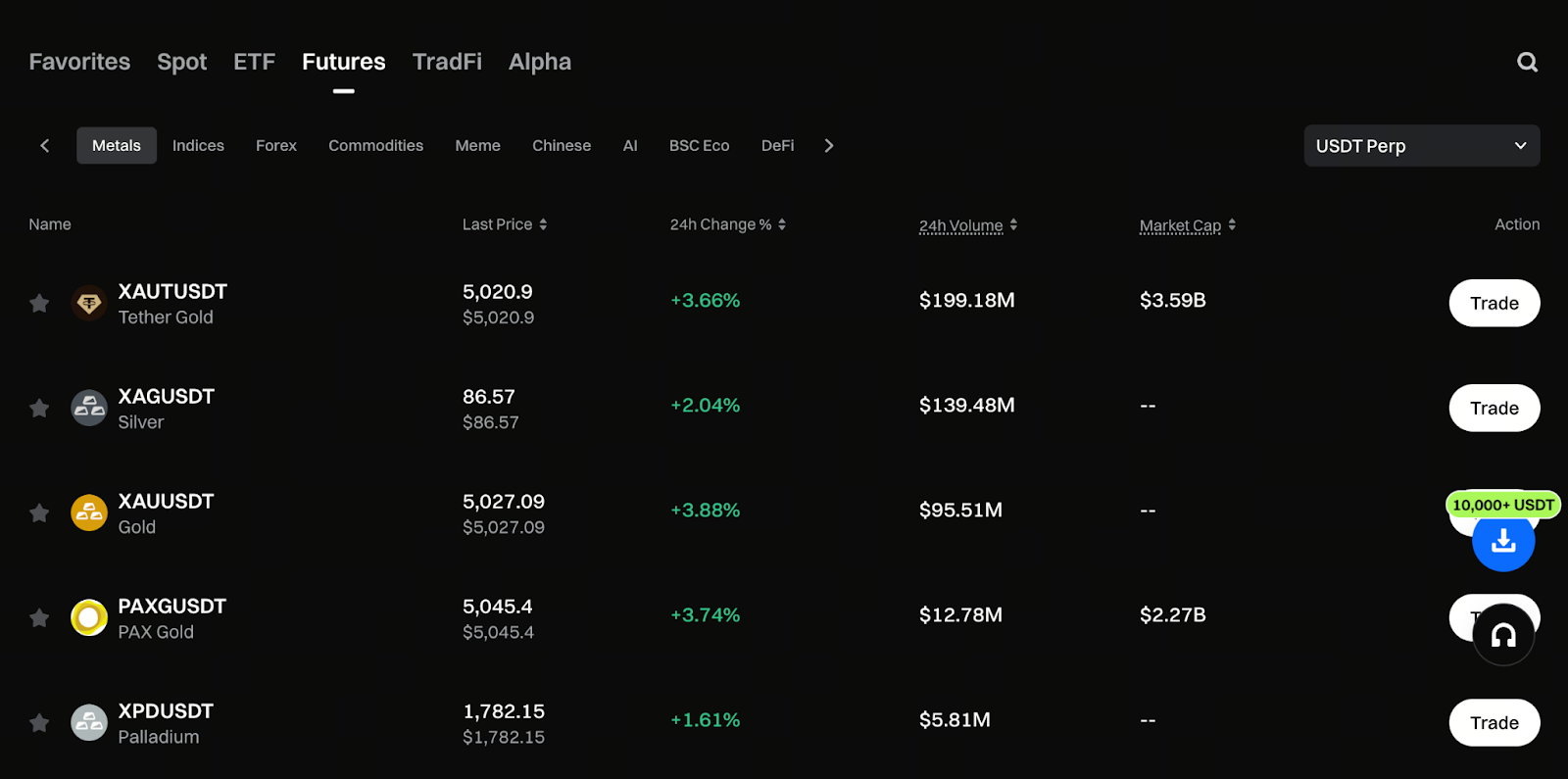

Gate’s gold (XAU) and silver (XAG) USDT-margined perpetual contracts directly address this market shift. With perpetual contracts, precious metals are now fully integrated into a 24/7 trading environment—no longer restricted by the opening and closing of traditional financial markets.

When major events occur, traders don’t have to wait for the next trading day. They can immediately adjust their risk exposure, transforming hedging from a delayed reaction to a real-time decision.

Trade now in Gate’s precious metals section: https://www.gate.com/price/futures/category-metals/usdt

A Seamless Trading Experience—No Need to Relearn

Gate’s product design does not isolate precious metals contracts into a standalone system. XAU and XAG perpetual contracts are integrated directly into the existing contract trading framework, maintaining familiar order flows, leverage controls, and risk management tools. For experienced contract traders, precious metals are no longer a new market to master—they fit naturally into established trading logic. Strategies don’t need to be rewritten; traders simply gain an additional asset class with a distinct volatility profile.

Volatility Returns—Precious Metals Regain Center Stage

Recently, capital has shifted back toward safe-haven assets, amplifying volatility in precious metals markets:

- Gold is up about 7% year-to-date, repeatedly testing historical highs

- Silver, with both financial and industrial attributes, has shown even greater price elasticity, rising about 23% year-to-date

This pricing environment means precious metals are no longer just static holdings—they are vital tools for swing trading, risk hedging, and portfolio balancing.

Multi-Source Indexing—A Stable Benchmark for Volatile Markets

In leveraged trading, price stability is essential for effective risk management. Gate’s precious metals perpetual contracts use a multi-source index, aggregating prices from multiple markets as a reference benchmark. This reduces the risk of single-source price distortion. In fast-moving conditions, this approach helps maintain fair pricing, ensuring stop-losses, hedges, and strategic execution remain reliable—especially for short-term and risk-focused traders.

TradFi and Crypto—Where Practice Meets

From an asset allocation perspective, precious metals perpetual contracts are positioned at the intersection of traditional finance and crypto markets:

- For traditional traders, gold and silver are familiar assets with relatively low barriers to entry

- For crypto market participants, these metals provide exposure to assets with different volatility profiles, reducing portfolio concentration

Whether hedging macro events or executing cross-asset strategies in volatile markets, precious metals contracts offer practical, actionable interfaces for trading strategies.

A Key Element in Multi-Asset Derivatives Strategy

The launch of precious metals perpetual contracts is not a one-off update—it’s part of Gate’s ongoing expansion in the derivatives market. By leveraging existing liquidity, risk controls, and trading infrastructure, the contract market remains flexible and ready to accommodate more traditional assets in the future.

Conclusion

As gold and silver enter the 24/7 perpetual contract market, the role of safe-haven assets is evolving. They are no longer static allocations, but strategic tools that can respond instantly to market rhythms. With precious metals perpetual contracts, Gate delivers greater flexibility for multi-asset allocation and further blurs the lines between TradFi and crypto at the practical trading level.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks