Gate Precious Metals Perpetual Contracts: Trading Gold and Silver 24/7

Redefining the Role of Safe-Haven Assets

In a global landscape marked by persistent uncertainty, gold and silver have long served as stable anchors in the capital markets. As market reaction times accelerate, simply holding these assets over the long term no longer meets most traders’ needs. Investors are now focused not just on hedging risk, but on retaining the flexibility to adjust positions and move capital as risk intensifies.

This transition is shifting precious metals from static allocation tools to actively traded assets, creating the conditions for their integration into crypto derivatives markets.

Gate Precious Metals Section: Bringing Traditional Assets into Real-Time Trading

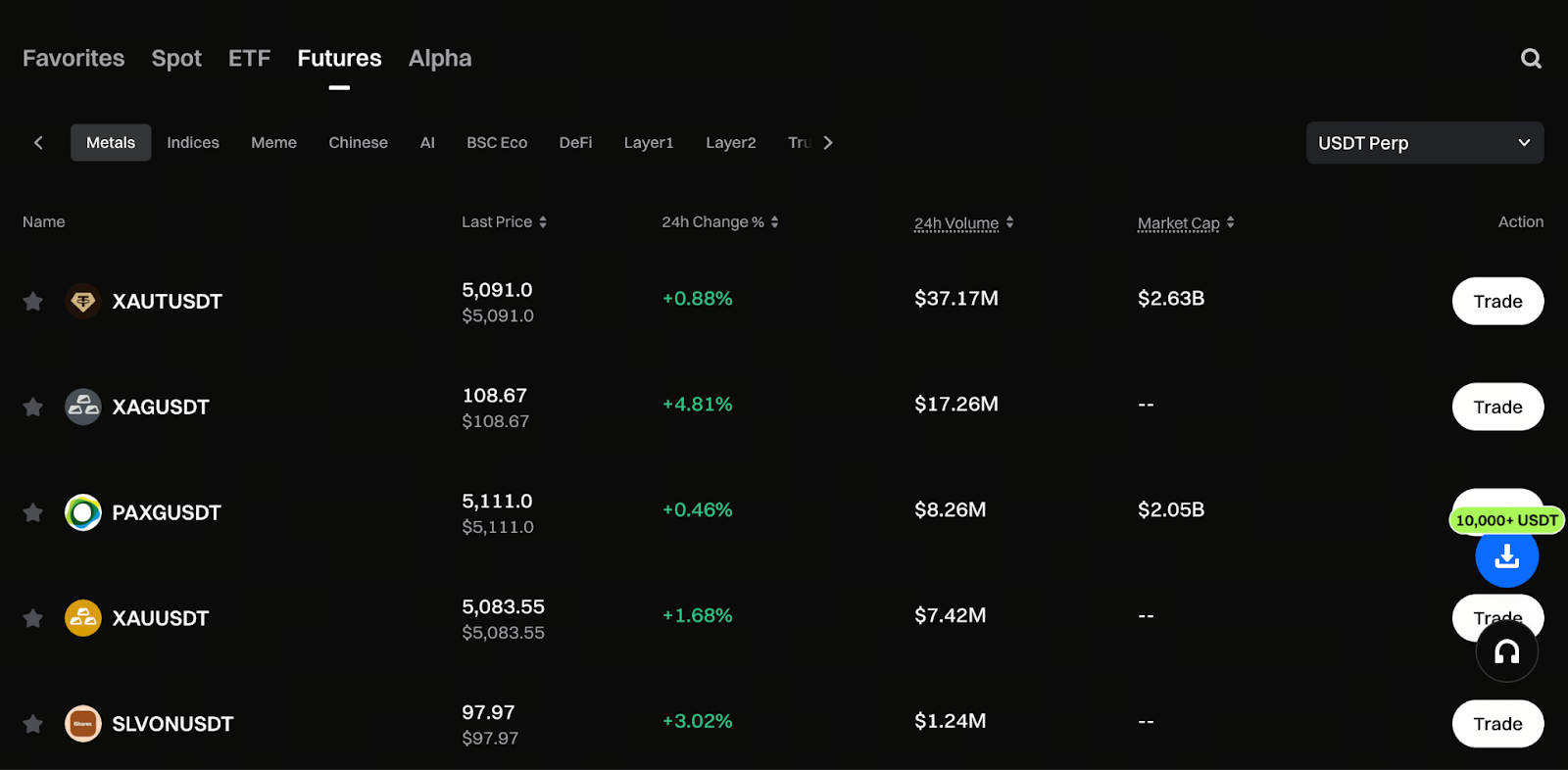

Gate has launched the Precious Metals Section, introducing USDT-margined perpetual contracts for gold (XAU) and silver (XAG) into its platform. This move frees precious metals from the time constraints of traditional exchanges, enabling continuous 24/7 trading and pricing.

During major economic events or rapid shifts in market sentiment, prices can react instantly—traders no longer need to wait for markets to open to adjust positions. This real-time flexibility is a core advantage of the crypto market’s pace.

Start trading now in the Gate Precious Metals Section: https://www.gate.com/price/futures/category-metals/usdt

Unified Cross-Market Trading Experience

Gate has integrated precious metals directly into its existing contract trading interface, without introducing a separate trading system. XAU and XAG perpetual contracts are accessible via the Gate website or app, with no need for additional registration or account switching. This unified design allows traders to engage with both crypto assets and precious metals using familiar order placement methods, risk management rules, and interfaces—significantly reducing the learning curve and transition costs for cross-market strategies.

Capital Returns: Precious Metals Regain Market Focus

After 2026, renewed demand for safe-haven assets has driven momentum in precious metals prices:

- Gold prices have risen nearly 7% year-to-date, at times surpassing the $4,600 level

- Silver, with greater volatility, has gained approximately 23% year-to-date, with especially strong short-term momentum

In this context, XAU and XAG USDT perpetual contracts serve as crucial channels connecting traditional safe-haven demand with the efficiency of crypto trading. This enables capital to participate more actively in price movements, rather than remaining in passive allocations.

Maintaining Price Stability and Transparency with Index Pricing

Gate’s precious metals perpetual contracts use an index mechanism derived from multiple market prices as their pricing foundation. This approach prevents any single source from exerting undue influence over contract prices, helping maintain fair pricing during periods of high volatility and enhancing transparency and verifiability.

For users employing leverage, managing risk, or executing strategic trades, a stable and reliable pricing mechanism is essential for the long-term viability of these contracts.

A Strategic Bridge Between TradFi and Crypto

From a strategic standpoint, precious metals perpetual contracts offer exceptional flexibility:

- For TradFi participants, gold and silver are familiar, straightforward assets to evaluate

- For crypto-native traders, these contracts introduce assets with different risk profiles, helping to reduce portfolio concentration

Whether for macro hedging, swing trading, or as cross-market hedging tools, precious metals contracts serve as practical intermediaries between traditional finance and the crypto sector.

Expanding Multi-Asset Contract Strategies

The launch of the Precious Metals Section represents more than just a new product—it marks Gate’s continued effort to strengthen traditional asset offerings within its derivatives ecosystem. Leveraging established liquidity management and risk control frameworks, Gate is actively evaluating additional contract-based offerings for traditional assets, with plans to expand into indices, commodities, and other sectors in the future.

Conclusion

With gold and silver now available in the 24/7 crypto contract market, the use of safe-haven assets is transforming. Gate’s precious metals perpetual contracts enable traditional assets to move beyond static defense, offering real-time responsiveness to global market shifts and greater flexibility for multi-market, multi-asset strategies. As crypto and traditional finance continue to converge, these products are becoming indispensable tools for strategic traders.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About