Gate Precious Metals Perpetuals: Turning Gold and Silver into Active Trading Instruments

Safe-Haven Assets: Moving Beyond Passive Risk Management

Gold and silver have long served as defensive assets during market turmoil, typically held passively while waiting for risks to be reflected in prices. As market cycles shorten and price reactions accelerate, the traditional approach of waiting for signals from the market has become less effective. This shift has led to a new question: If safe-haven assets can be traded instantly, can they evolve from defensive allocations to active elements in strategic portfolio management?

Precious Metals Enter Round-the-Clock Trading

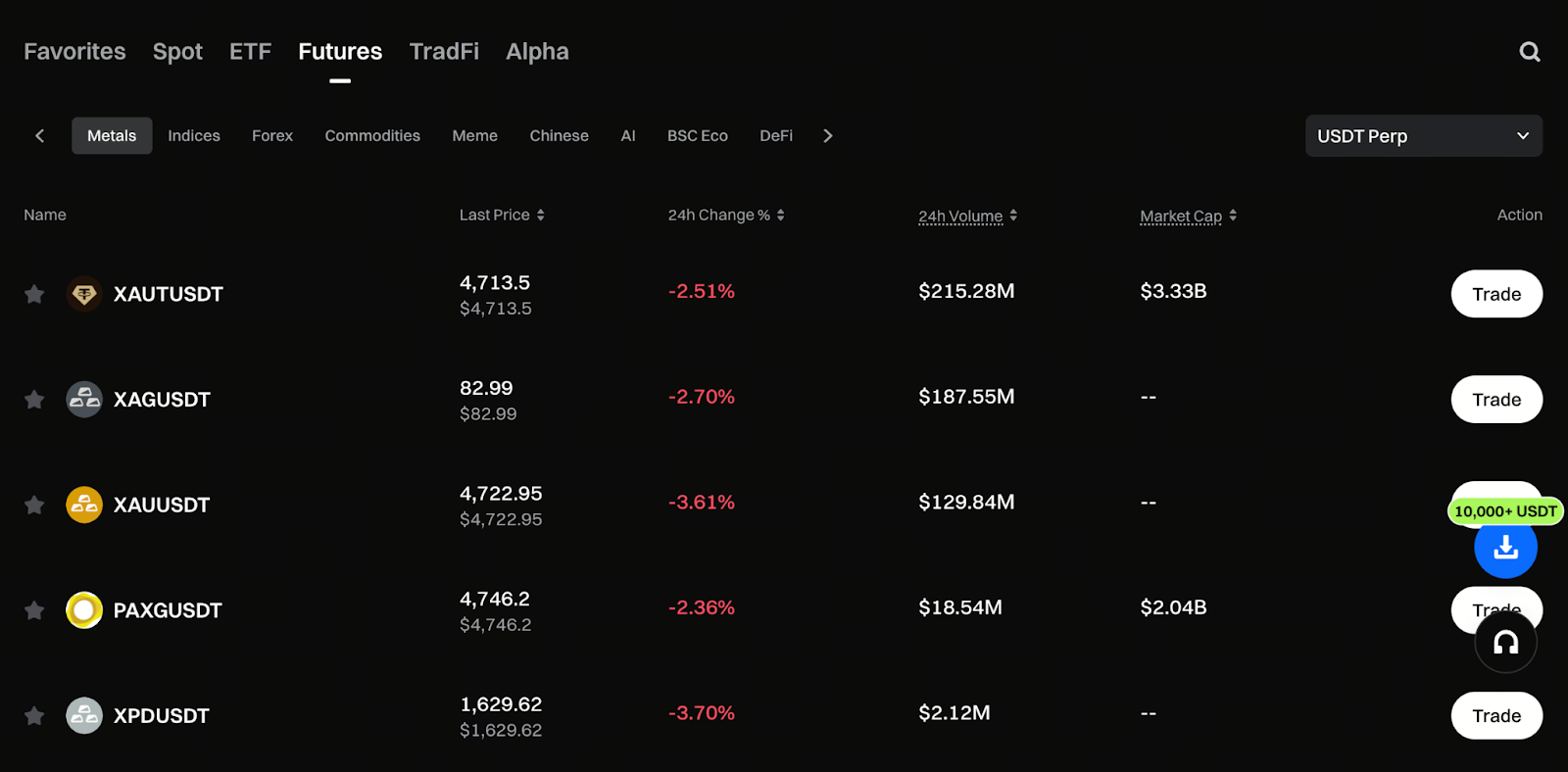

Gate has introduced perpetual contracts for precious metals in response to this evolving environment. Through USDT-settled perpetual contracts, gold (XAU) and silver (XAG) now trade in a continuous 24/7 market, no longer limited by traditional market hours. When interest rate policies change, geopolitical events unfold, or key macroeconomic data is released, traders can adjust their positions immediately—transforming risk management from a reactive to a real-time process.

Start trading now in Gate’s Precious Metals section: https://www.gate.com/price/futures/category-metals/usdt

Building on Existing Trading Logic, Not Reinventing the System

Gate has seamlessly integrated precious metal contracts into its existing trading infrastructure, rather than creating a separate module. XAU and XAG perpetual contracts utilize familiar order placement, leverage settings, and risk management tools. For active contract traders, this means entering the precious metals market requires no relearning or fragmented account management. Existing strategies can be naturally extended to new asset classes, reducing both the learning curve and execution costs for cross-market trading.

Safe-Haven Assets Back at the Forefront of Price Volatility

With market uncertainty intensifying ahead of 2026, capital is once again flowing into safe-haven assets, resulting in pronounced price swings for precious metals:

- Gold is up about 7% year-to-date, repeatedly approaching record highs

- Silver, which has both industrial and financial uses, has seen greater volatility and a year-to-date gain of about 23%

In this environment, perpetual contracts for precious metals have become more than just long-term allocation tools—they now offer traders a key gateway to participate in short- and medium-term price movements, enabling swing trading and hedging strategies.

Multi-Source Index Pricing: Stability Amid Volatility

To reduce bias from single-market pricing, Gate’s precious metals perpetual contracts utilize a multi-source index pricing mechanism, aggregating prices from multiple markets as the contract benchmark. During periods of high volatility, this approach helps ensure price rationality and transparency. For traders using leverage, executing hedging strategies, or engaging in short-term trades, this is a critical foundation for effective risk management.

Where TradFi Meets Crypto

From a portfolio strategy perspective, precious metals perpetual contracts occupy a unique intersection:

- Traditional market traders see gold and silver as familiar assets with relatively low analysis barriers

- Crypto-native traders gain access to assets with distinct volatility characteristics, enhancing portfolio diversification

Whether for hedging against macro events, executing swing trades, or serving as cross-market hedging tools, precious metals contracts provide a practical strategic interface between TradFi and Crypto.

Expanding the Multi-Asset Derivatives Landscape

The introduction of precious metals perpetual contracts is part of Gate’s ongoing effort to complete the traditional asset mosaic in the derivatives market. By leveraging existing liquidity and risk management frameworks, the coverage of assets in the futures market remains highly adaptable for continued expansion.

Conclusion

With gold and silver now available in crypto perpetual contracts, they have moved beyond passive risk defense to become strategic tools for real-time market engagement. Gate’s precious metals perpetual contracts enhance operational flexibility for safe-haven assets and offer practical solutions for cross-market and multi-asset allocation. As the lines between TradFi and Crypto continue to blur, these products are becoming indispensable components of advanced trading portfolios.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About