Gate Private Wealth Management Monthly Report—January 2026

2026-02-11 03:13:56

Download the Full Report (PDF)

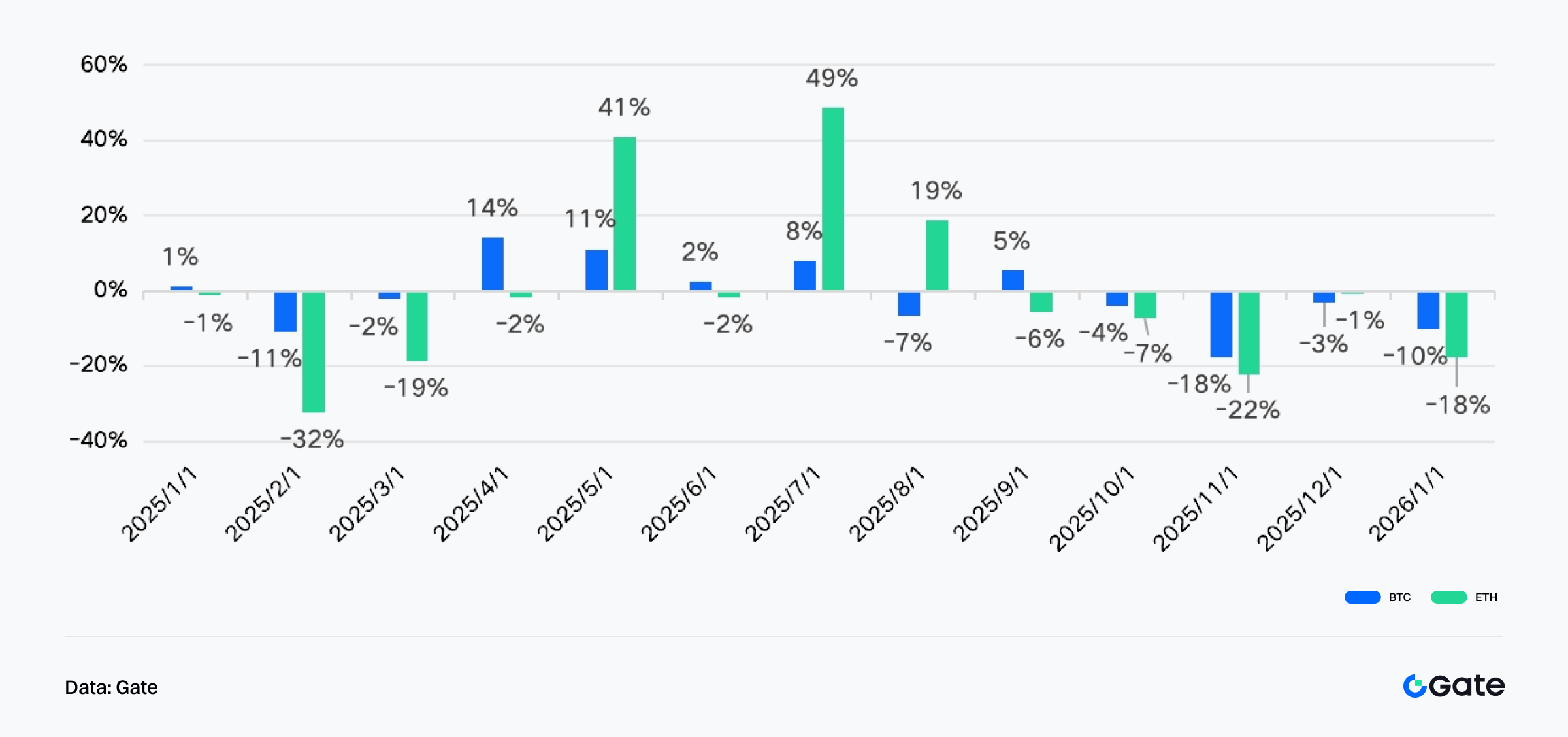

- Market Review: A hawkish-leaning Fed chair nomination triggered a repricing of the monetary policy path, putting pressure on risk assets. Precious metals reversed sharply after hitting record highs, posting their largest monthly decline on record. Crypto markets also faced concentrated selling toward month-end, with BTC and ETH breaking key support levels and falling 10% and 18% in January. ETF flows failed to provide effective support, while market fear and risk aversion rose rapidly.

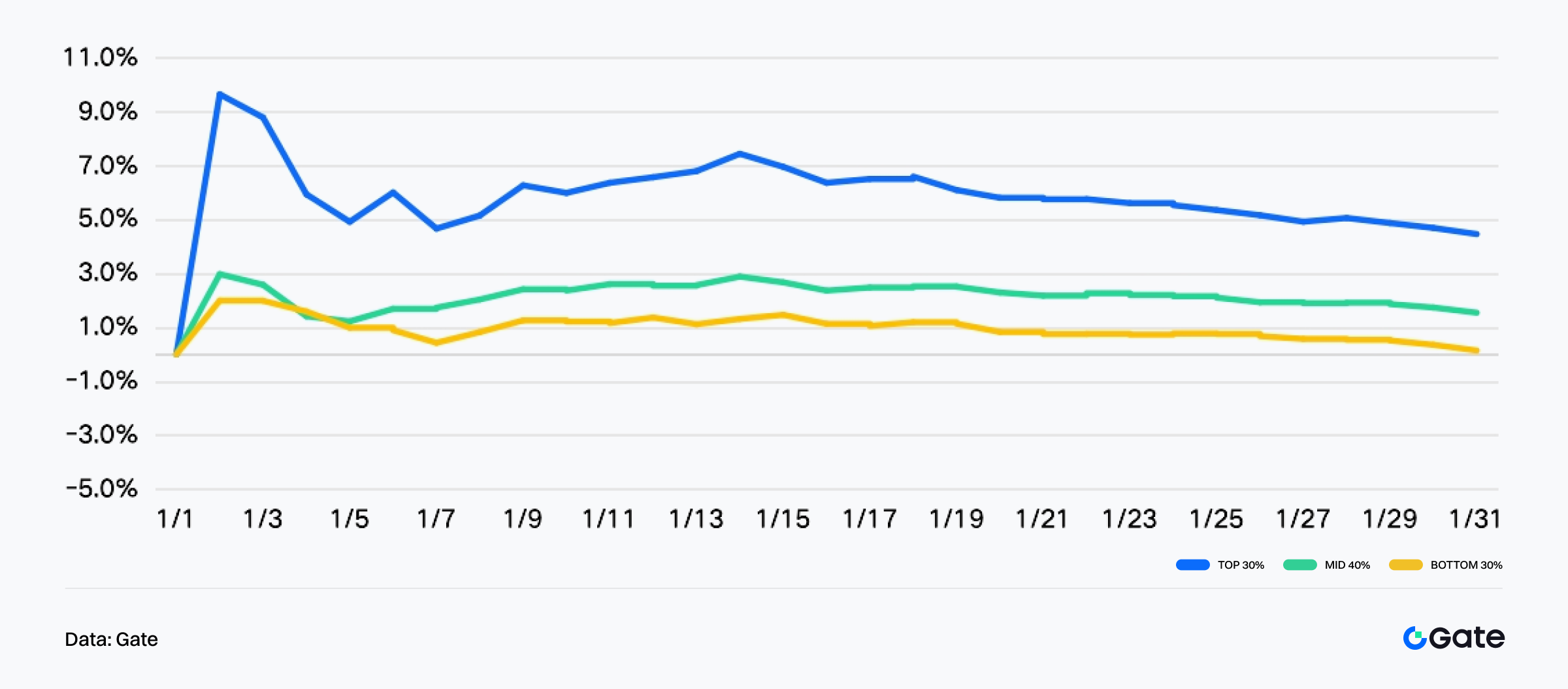

- Gate Private Wealth Product Performance: In January, the USDT strategy generated a 2.5% annualized return and 6.7% over the past year. The Interstellar Hedge (USDT) strategy led with a 5.0% monthly annualized return. Quantum Leap (USDT), Interstellar Hedge (USDT), and Gravity Hedge (USDT) have all maintained a 100% monthly win rate since inception. The Top 30% portfolio posted a 4.5% annualized return in January, clearly outperforming Bitcoin and treasury yields.

- Outlook: On-chain drawdown data show that past expansion cycles often experienced multiple pullbacks exceeding 35%, yet the medium- to long-term uptrend ultimately remained intact. Current conditions appear to reflect a phase of sentiment and selling-pressure digestion, potentially laying the groundwork for price stabilization. Meanwhile, Walsh’s appointment does not signal a full turn toward tightening, and market consensus continues to expect two rate cuts later this year.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Author: Akane

Reviewer(s): Puffy, Shirley, Kieran

Disclaimer

* The information is not intended to be and does not constitute financial advice or any other recommendation of any sort offered or endorsed by Gate.

* This article may not be reproduced, transmitted or copied without referencing Gate. Contravention is an infringement of Copyright Act and may be subject to legal action.

Related Articles

Advanced

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

This report provides a comprehensive analysis of the past year's market performance and future development trends from four key perspectives: market overview, popular ecosystems, trending sectors, and future trend predictions. In 2024, the total cryptocurrency market capitalization reached an all-time high, with Bitcoin surpassing $100,000 for the first time. On-chain Real World Assets (RWA) and the artificial intelligence sector experienced rapid growth, becoming major drivers of market expansion. Additionally, the global regulatory landscape has gradually become clearer, laying a solid foundation for market development in 2025.

2025-01-24 08:09:57

Beginner

Perpetual Contract Funding Rate Arbitrage Strategy in 2025

Perpetual contract funding rate arbitrage refers to the simultaneous execution of two transactions in the spot and perpetual contract markets, with the same underlying asset, opposite directions, equal quantities, and offsetting profits and losses. The goal is to profit from the funding rates in perpetual contract trading. As of 2025, this strategy has evolved significantly, with average funding rates stabilizing at 0.015% per 8-hour period for popular trading pairs, representing a 50% increase from 2024 levels. Cross-platform opportunities have emerged as a new arbitrage vector, offering additional 3-5% annualized returns. Advanced AI algorithms now optimize entry and exit points, reducing slippage by approximately 40% compared to manual execution.

2025-05-23 06:47:35

Intermediate

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

This article offers a deep dive into the 2025 altcoin season. It examines a fundamental shift from traditional BTC dominance to a narrative-driven dynamic. It analyzes evolving capital flows, rapid sector rotations, and the growing impact of political narratives – hallmarks of what’s now called “Altcoin Season 2.0.” Drawing on the latest data and research, the piece reveals how stablecoins have overtaken BTC as the core liquidity layer, and how fragmented, fast-moving narratives are reshaping trading strategies. It also offers actionable frameworks for risk management and opportunity identification in this atypical bull cycle.

2025-04-14 07:05:46

Intermediate

The Impact of Token Unlocking on Prices

This article explores the impact of token unlocking on prices from a qualitative perspective through case studies. In the actual price movements of tokens, numerous other factors come into play, making it inadvisable to solely base trading decisions on token unlocking events.

2024-11-25 09:15:45

Beginner

Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"

It’s called the Financial Innovation and Technology for the 21st Century Act aka FIT21, and it could make regulating crypto in the U.S. much clearer for everyone working in the industry.

縮短标题:Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"

2024-06-07 06:25:00

Advanced

Gate Research: Web3 Industry Funding Report - November 2024

This report summarizes Web3 industry fundraising activities in November 2024. The industry completed 121 funding deals totaling $1.76 billion—a 28.45% decrease from the previous month. Fundraising approaches showed greater diversity, highlighted by MARA's convertible bond issuance and OG Labs' innovative combination of seed round financing and token purchase commitments. Blockchain services and public chain sectors attracted the most investment attention. The report explores key funding achievements from notable projects, including 0G Labs, StakeStone, KGeN, Noble, and Deblock.

2024-12-13 15:30:58