Gate Research: AI Narrative Drives Capital Back to High-Activity Chains as Solana Meme Issuance Rebounds|Web3 On-Chain Data Insights for January 2026

On-Chain Insights Overview

Overview of On-Chain Activity and Capital Flows

To accurately assess the real usage conditions of blockchain ecosystems, this section examines multiple key on-chain activity indicators, including daily transaction count, gas fees, active addresses, and cross-chain bridge net flows. These dimensions collectively reflect user behavior, network utilization intensity, and asset liquidity. Compared with merely observing capital inflows and outflows, such native on-chain data provides a more comprehensive view of fundamental shifts across public blockchains. This helps determine whether capital rotation is accompanied by genuine usage demand and user growth, thereby identifying networks with sustainable development potential.

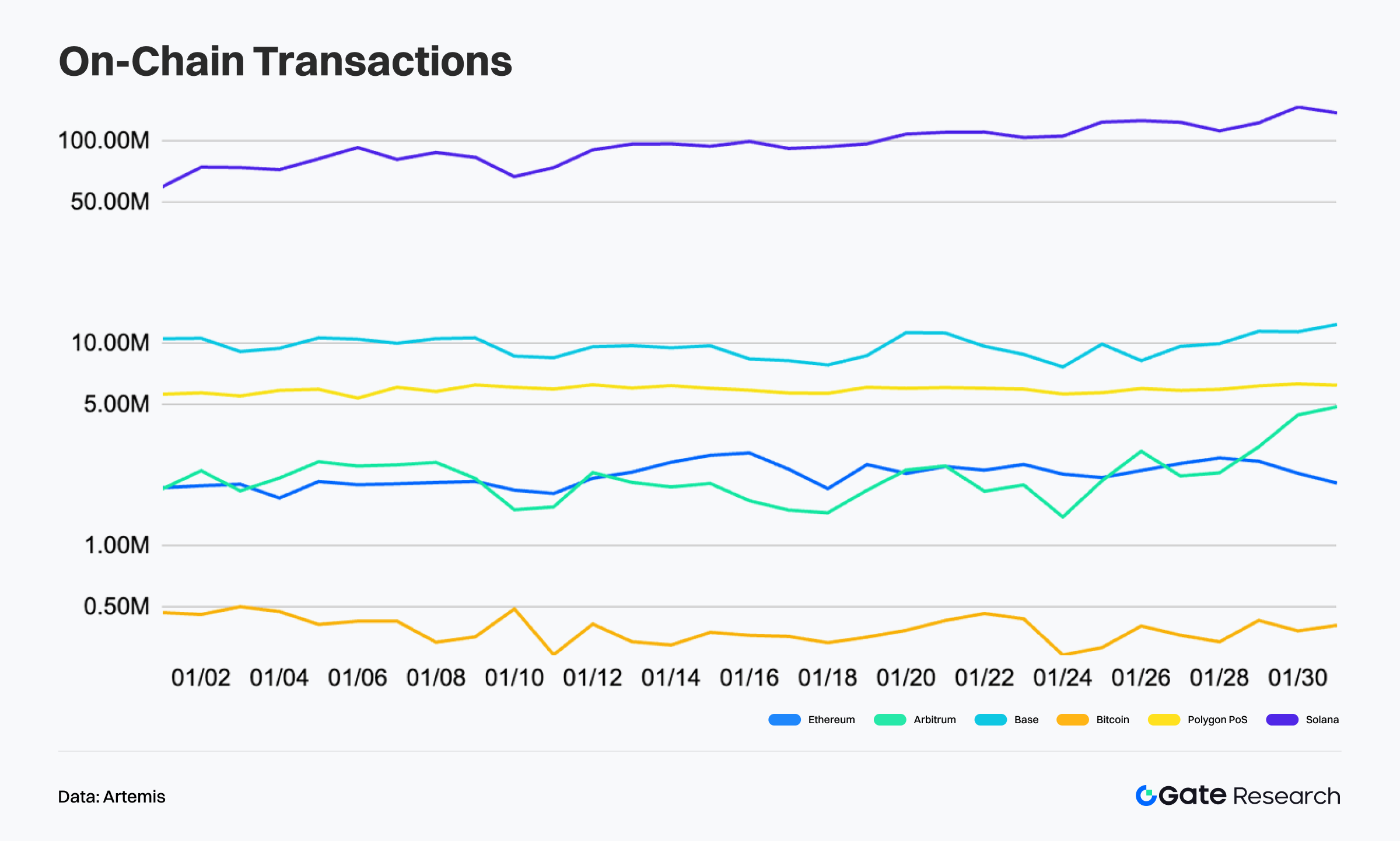

Transaction Count Analysis: Solana Maintains Absolute Dominance, Base Expands, L2 Divergence Intensifies

According to data from Artemis, overall on-chain transaction activity across major public blockchains remained elevated in January, without cooling in tandem with market volatility, indicating structurally supported interaction demand. Solana continued to lead by a wide margin, with average daily transactions ranging between 80 million and 100 million. Despite minor fluctuations, the overall trend remained stable to mildly upward, reflecting sustained high-frequency usage driven by native trading ecosystems and application activity.【1】

Base demonstrated a gradual upward trajectory. Transaction counts hovered around 9 million at the beginning of the month and climbed steadily to over 11 million by month-end, suggesting continued incremental demand from social and lightweight interaction applications. In contrast, Arbitrum exhibited greater volatility. After falling to a temporary low mid-month, activity rebounded but remained within a broad range-bound structure without establishing sustained growth.

Ethereum mainnet maintained a relatively stable base transaction volume of approximately 1.0–1.3 million per day, consistent with its role as a high-value settlement layer. Polygon PoS also remained stable with limited fluctuations. Bitcoin’s on-chain transactions continued at relatively low frequency, primarily reflecting settlement and value transfer functions rather than high-frequency interaction use cases.

Overall, the transaction structure currently reflects a pattern of “Solana’s absolute high-frequency dominance + Base’s moderate expansion + traditional L2 divergence.” Even amid shifting market risk appetite, real on-chain usage intensity has not contracted synchronously, and functional differentiation among networks remains clear.

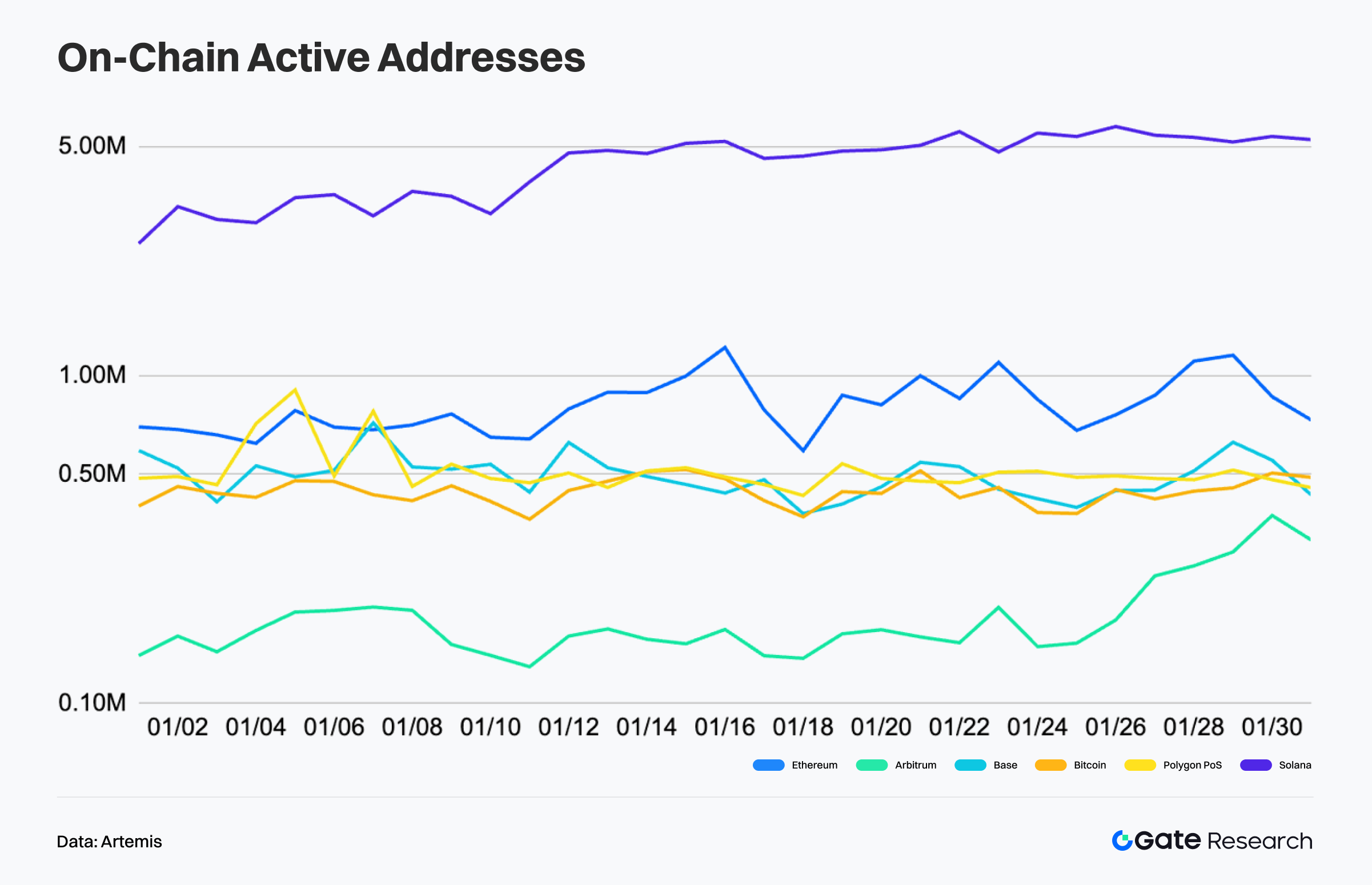

Active Address Analysis: Solana and Ethereum Recover, Some L2 Ecosystems Cool

According to Artemis, January saw a noticeable redistribution of active address activity. High-performance blockchains and core mainnets recovered, while certain L2 and sidechain ecosystems cooled.【2】

Solana’s daily active addresses continued to rise, reaching a monthly average of approximately 4.46 million in January, up roughly 51% from December. This suggests that high-frequency trading, meme activity, and application ecosystems continue to attract users and capital inflows. Ethereum also showed a significant recovery, with average daily active addresses increasing to approximately 819,000, up about 48% month-over-month. This indicates that amid heightened volatility, asset rebalancing and settlement activity partially returned to the mainnet, reinforcing its foundational clearing and value-carrying role.

Mid-tier networks showed overall cooling and divergence. Although Base’s daily curve remained relatively stable, its monthly average active addresses declined approximately 12% month-over-month, suggesting some pullback in social and lightweight interaction-driven activity. Polygon PoS saw a sharper decline, with daily active addresses dropping about 57% month-over-month, moving from prior highs to mid-to-low ranges. Arbitrum remained in low-level oscillation with slight declines and no clear recovery signal. Bitcoin’s active addresses also edged lower but with limited volatility, consistent with its settlement-focused characteristics.

Overall, on-chain user activity appears to be undergoing structural rotation rather than synchronized contraction. Capital and users are reallocating from expansion-phase ecosystems back toward Solana and Ethereum as core networks.

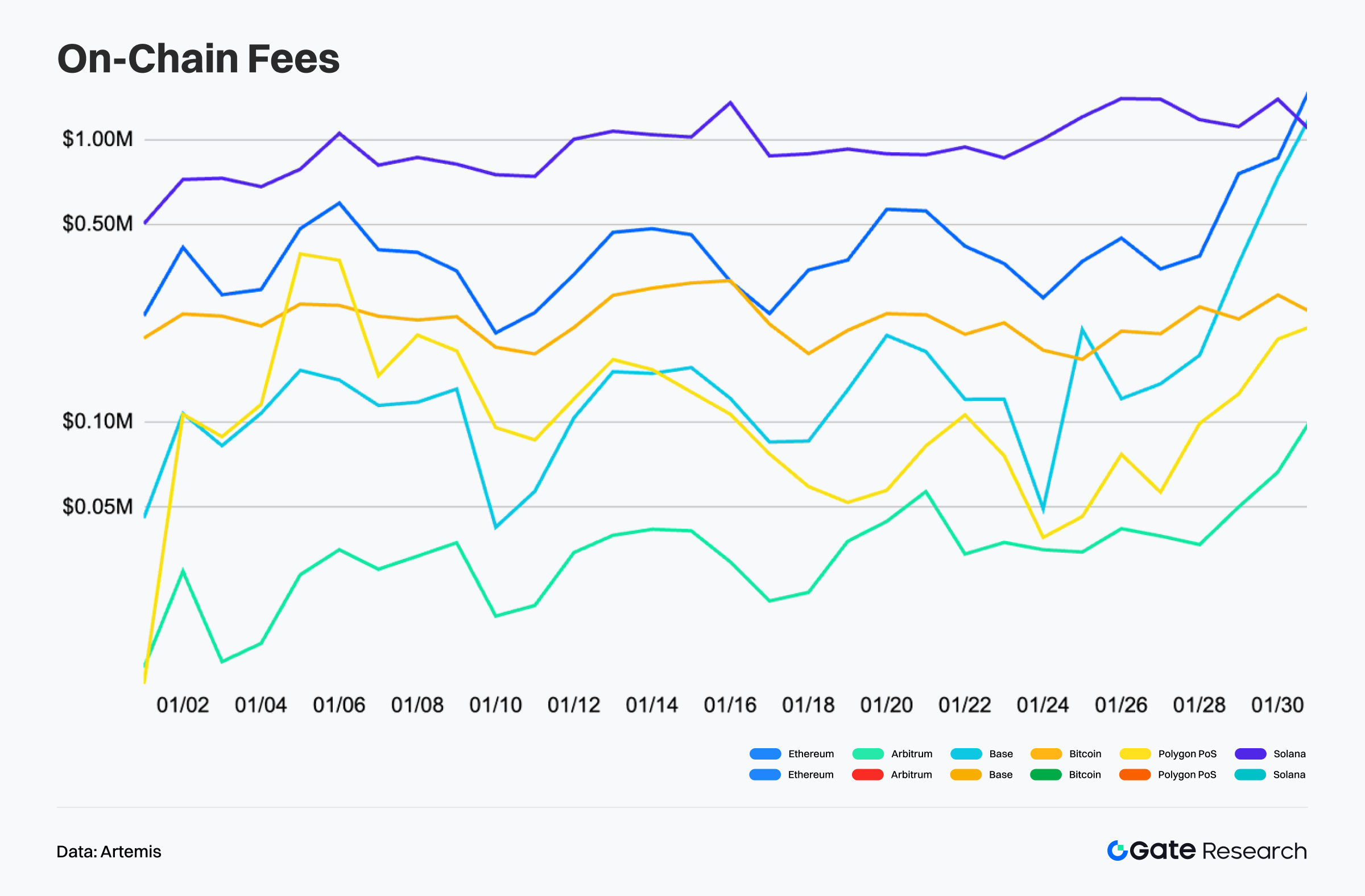

On-Chain Fee Revenue Analysis: Solana and Ethereum Lead, Base Surges Late in the Month

According to Artemis, January’s on-chain fee revenue structure became more stratified. Solana and Ethereum remained at elevated levels, while Base exhibited amplified volatility.【3】

Solana’s fee revenue consistently ranked in the top tier, generally fluctuating between $800,000 and $1.2 million, with another spike toward month-end. This reflects continued value capture from high-frequency trading, meme activity, and application interactions. Ethereum displayed more pronounced volatility. After dipping multiple times mid-month to the $200,000–$400,000 range, fees rebounded and briefly exceeded $1 million near month-end. This suggests that during periods of heightened volatility, DeFi interactions, asset rebalancing, and high-value contract operations increased significantly, resulting in stronger fee elasticity.

Among mid-tier networks, divergence intensified. Base fees fluctuated near the zero axis early and mid-month but surged sharply near month-end to nearly $1 million, indicating concentrated activity tied to specific hotspots or high-frequency asset issuance and trading bursts. Bitcoin’s fees remained relatively stable, primarily influenced by transfer demand and occasional congestion. Polygon PoS and Arbitrum stayed in low-level oscillation with sporadic spikes but lacked sustained value capture trends.

Overall, fee revenue is increasingly concentrated among high-activity, high-density networks. Inter-chain divergence is widening, with capital and user behavior clustering around ecosystems capable of consistently generating transaction demand.

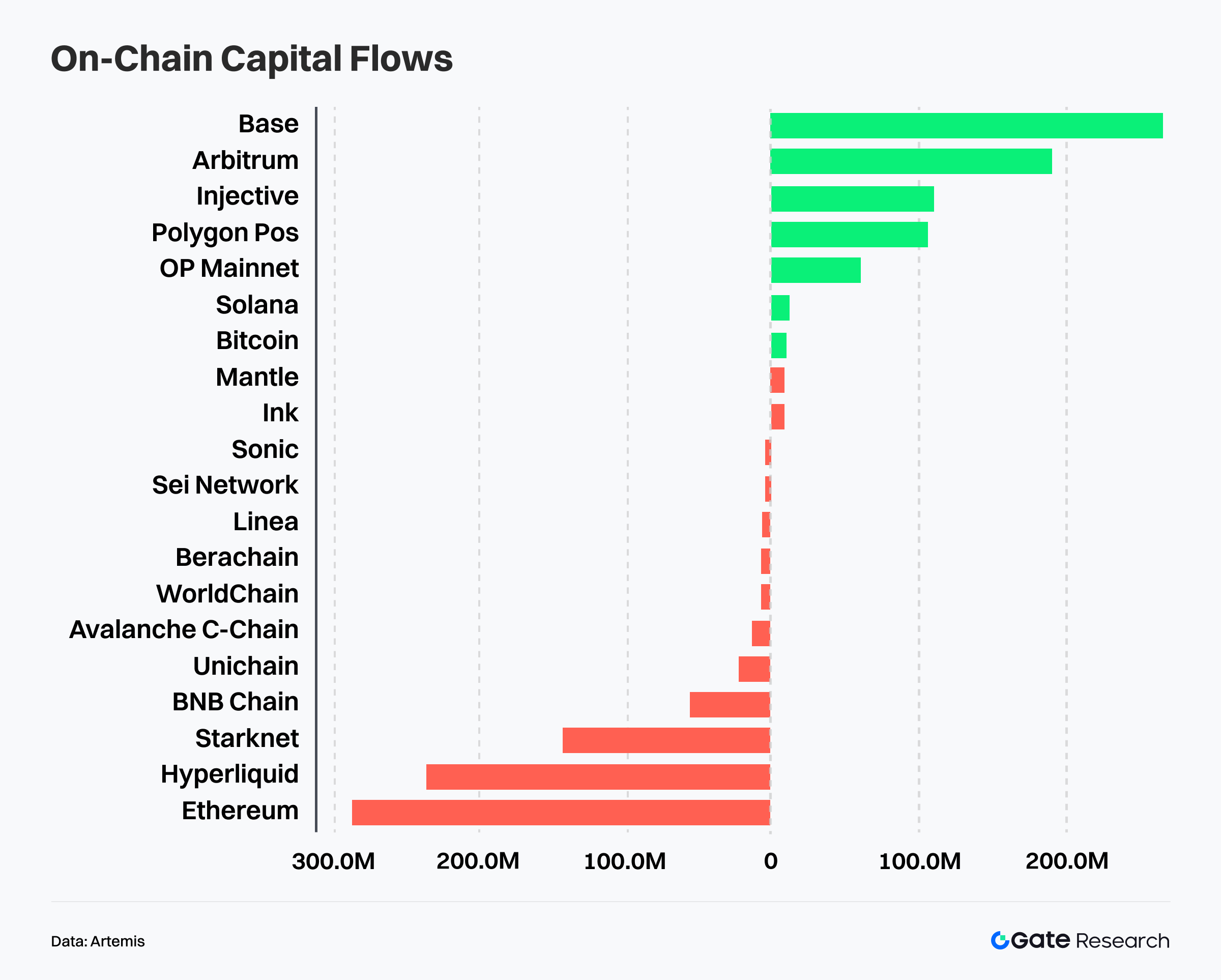

Public Chain Capital Flow Divergence: Capital Rotates Toward High-Efficiency Networks

According to Artemis, public chain capital flows over the past month show clear structural divergence. Rather than broad-based risk expansion, capital has concentrated in networks offering stronger capital efficiency and trading attributes, while some traditional Layer 1 and Layer 2 ecosystems face sustained net outflows.【4】

Base recorded the largest net inflows, becoming a central destination for capital and attention. This is closely tied to the recent AI agent social narrative. Around agent-native social scenarios such as Moltbook, narrative momentum rapidly translated into on-chain issuance and trading demand. Through Base-native infrastructure like Clanker, asset deployment and liquidity absorption formed a feedback loop of “content – attention – token issuance – trading,” attracting speculative and early-stage pricing capital.

Meanwhile, Polygon PoS, Injective, and OP Mainnet also recorded notable net inflows, reflecting continued capital preference for low-cost, high-interaction, and efficient networks. Persistent inflows into Hyperliquid indicate that trading-oriented capital remains active in high-efficiency matching environments.

On the outflow side, Ethereum, Starknet, and Arbitrum experienced the largest net withdrawals. Ethereum’s net outflow suggests partial capital rotation from high-valuation, settlement-focused environments toward more trade-elastic execution layers. Arbitrum and Starknet outflows reflect internal filtering within the Layer 2 sector.

Overall, current capital flows reflect dual characteristics: “narrative-driven attention migration + capital efficiency prioritization.” The market has entered a structural rotation phase, shifting from single-ecosystem narratives toward refined selection based on actual usage scenarios and capital turnover efficiency.

Bitcoin Key Metrics Analysis

Over the past month, both BTC and ETH have shown weakening trends. On the 4-hour timeframe, structure shifted from range-bound to bearish dominance. BTC broke below multiple moving averages and staged only weak rebounds, remaining suppressed under the MA system. ETH performed even weaker, accelerating downward before entering low-level consolidation, with moving averages diverging bearishly. Volume-price structure shows expanded volume during declines and contraction during rebounds, reflecting cautious dip-buying and insufficient momentum for trend repair.

Against this backdrop, on-chain data from cost distribution, profit realization intensity, and holder structure present consistent signals. BTC’s short-term holder (STH) cost basis has cooled significantly, with price oscillating around breakeven levels, indicating digestion of prior profit-taking supply. Profit realization momentum has dropped sharply, shifting the market from an active distribution phase to a wait-and-see repair phase. The proportion of profitable supply has declined, short-term unrealized losses have increased but remain contained, and selling pressure continues to come mainly from short-term holders, while long-term holders remain relatively stable. The market has transitioned from unilateral upside expansion to consolidation and rebalancing.

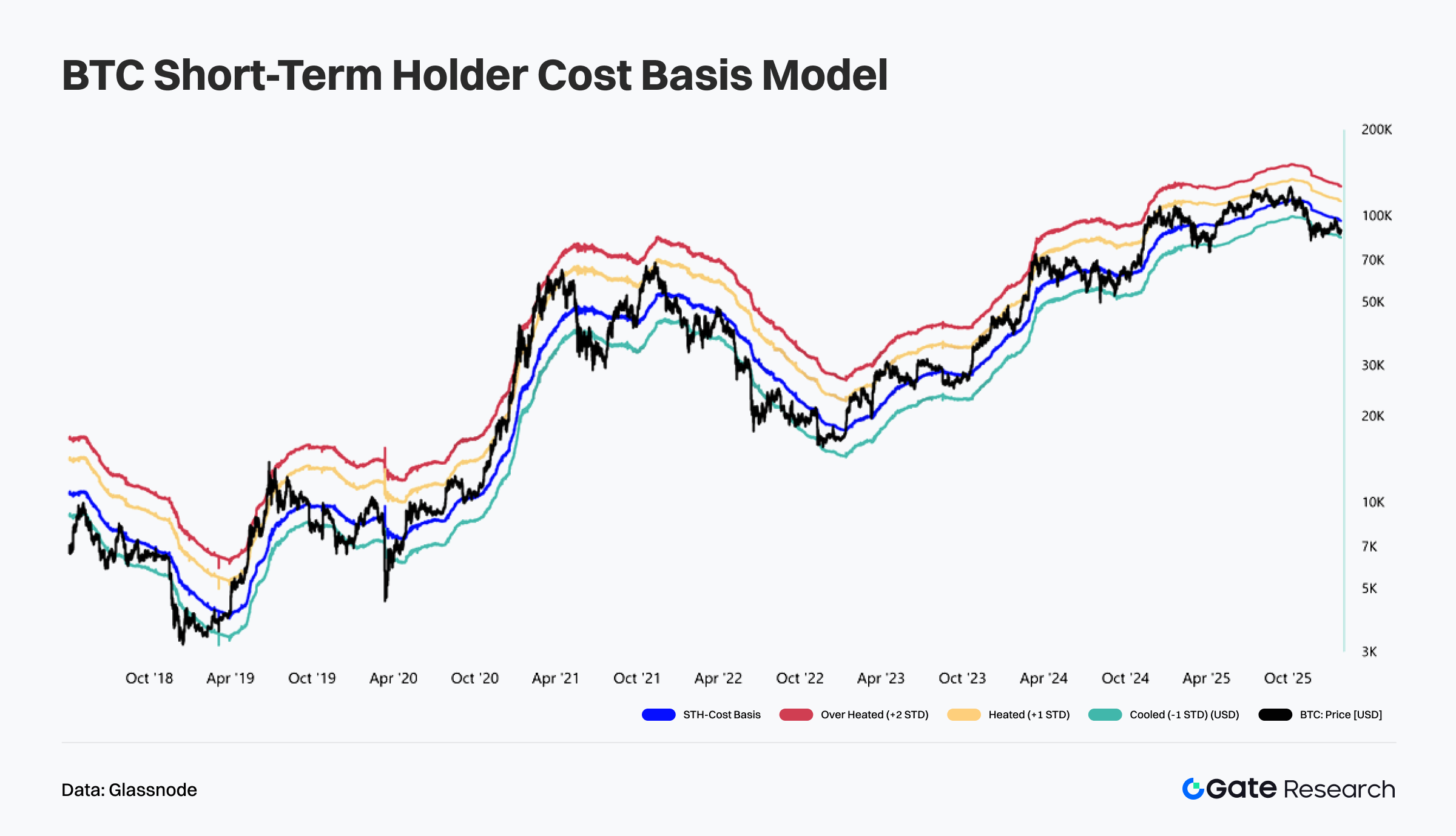

BTC Short-Term Holder Cost Basis Cools, Price Consolidates Around Breakeven

According to Glassnode data, the Short-Term Holder (STH) cost model shows that after retreating from overheated levels, BTC price has gradually approached and hovered above the STH cost band. Previously elevated short-term supply has entered a phase of profit compression, but there are no signs of systemic breakdown below cost basis levels. Price is currently positioned between the +1 standard deviation band and the cost line, suggesting sentiment has shifted from exuberant to relatively neutral and cautious, with short-term capital transitioning from momentum chasing to observation and structural repositioning.【5】

Structurally, the STH cost band continues to slope upward, indicating that the average entry price of newly participating capital remains rising and the broader trend framework is intact. Price has not fallen into the -1 standard deviation cooling zone, implying that short-term holders remain broadly in profit or mild compression without triggering panic liquidation. Historical cycle comparisons suggest that as long as price holds above the cost line, the market is more likely to enter a high-level redistribution and time-based consolidation phase rather than transition directly into a bear market structure.

Overall, BTC is currently in a “post-overheating cost band rebalancing phase.” Upside overheating risk has largely been released, while the key breakeven zone below remains intact. The market is more likely to oscillate around the cost band to facilitate supply turnover. As long as the short-term holder profit structure is not materially damaged, the medium-term bullish framework remains valid. The current phase resembles a healthy mid-cycle cooling process rather than a confirmed trend reversal.

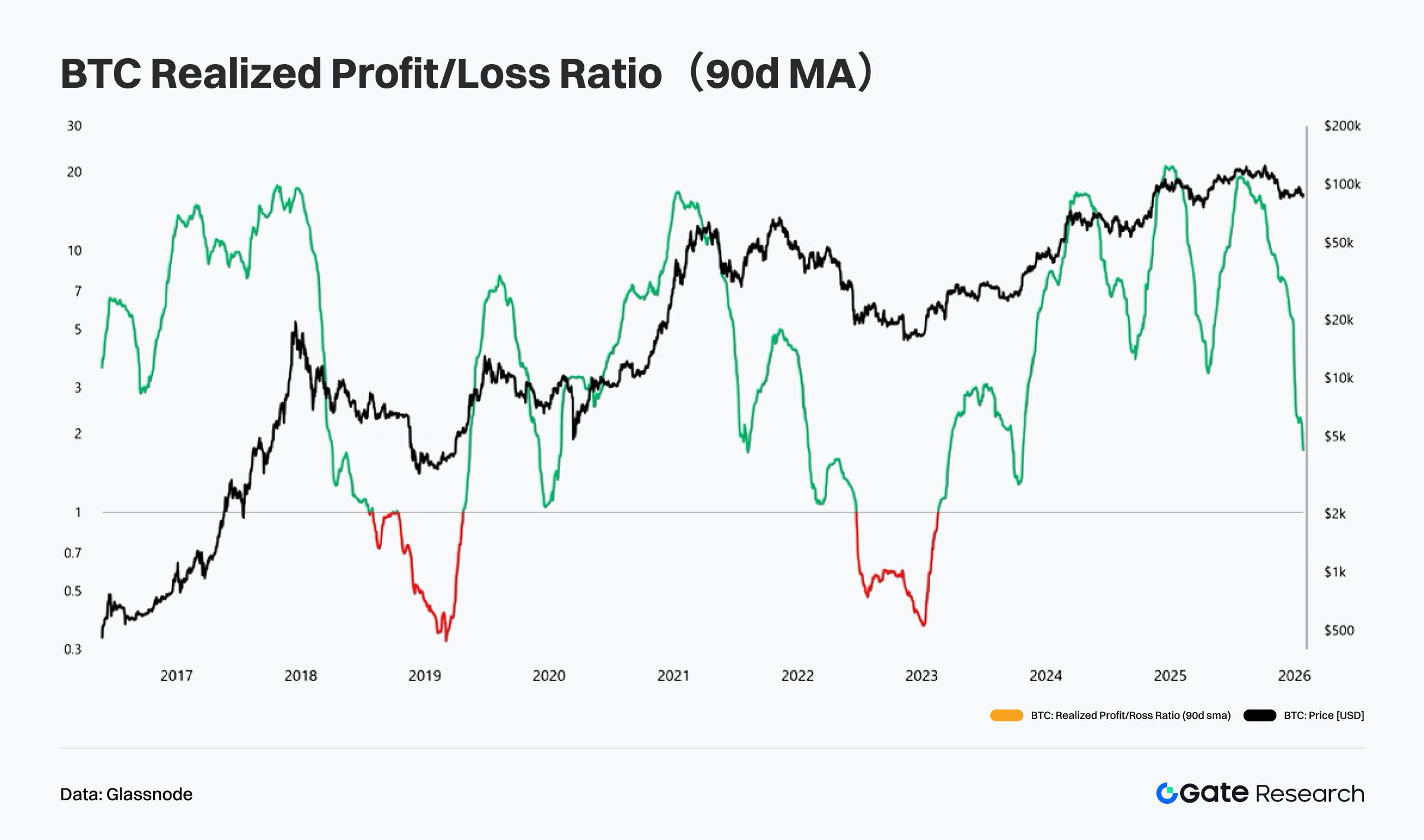

BTC Profit-Taking Momentum Cools Rapidly, Market Shifts from Heavy Realization to Consolidation

According to data from Glassnode, the Realized Profit/Loss Ratio (90-day moving average) has declined sharply from elevated levels, indicating that the scale of realized on-chain profits is contracting quickly. The market has transitioned from a phase of large-scale profit realization to a more restrained trading environment. Previously, the ratio remained well above 1 for an extended period, signaling widespread profit-taking at higher price levels. The recent rapid decline suggests that active selling pressure has significantly weakened, with short-term distribution momentum cooling after prior release.【6】

From a cyclical perspective, although the ratio has fallen, it has not entered a prolonged loss-dominant regime (sustained below 1). This suggests the market is not experiencing panic-driven capitulation but rather a typical “profit digestion phase” often seen in the mid-to-late stages of a bull cycle. Historically, similar conditions have corresponded to high-level consolidation periods, where upward slope moderates and volatility increases, yet the broader trend remains structurally bullish. As long as the ratio stays above breakeven, the market remains in aggregate profit, with selling pressure driven primarily by voluntary realization rather than forced liquidation.

Overall, BTC currently reflects a rebalancing phase characterized by cooling profit realization and gradually diminishing sell pressure. While short-term upside is constrained by prior profit overhang, the broader medium-term structure remains intact so long as loss-driven sentiment does not dominate. The market is more likely to digest accumulated profits through time and volatility rather than transition directly into a systemic downtrend.

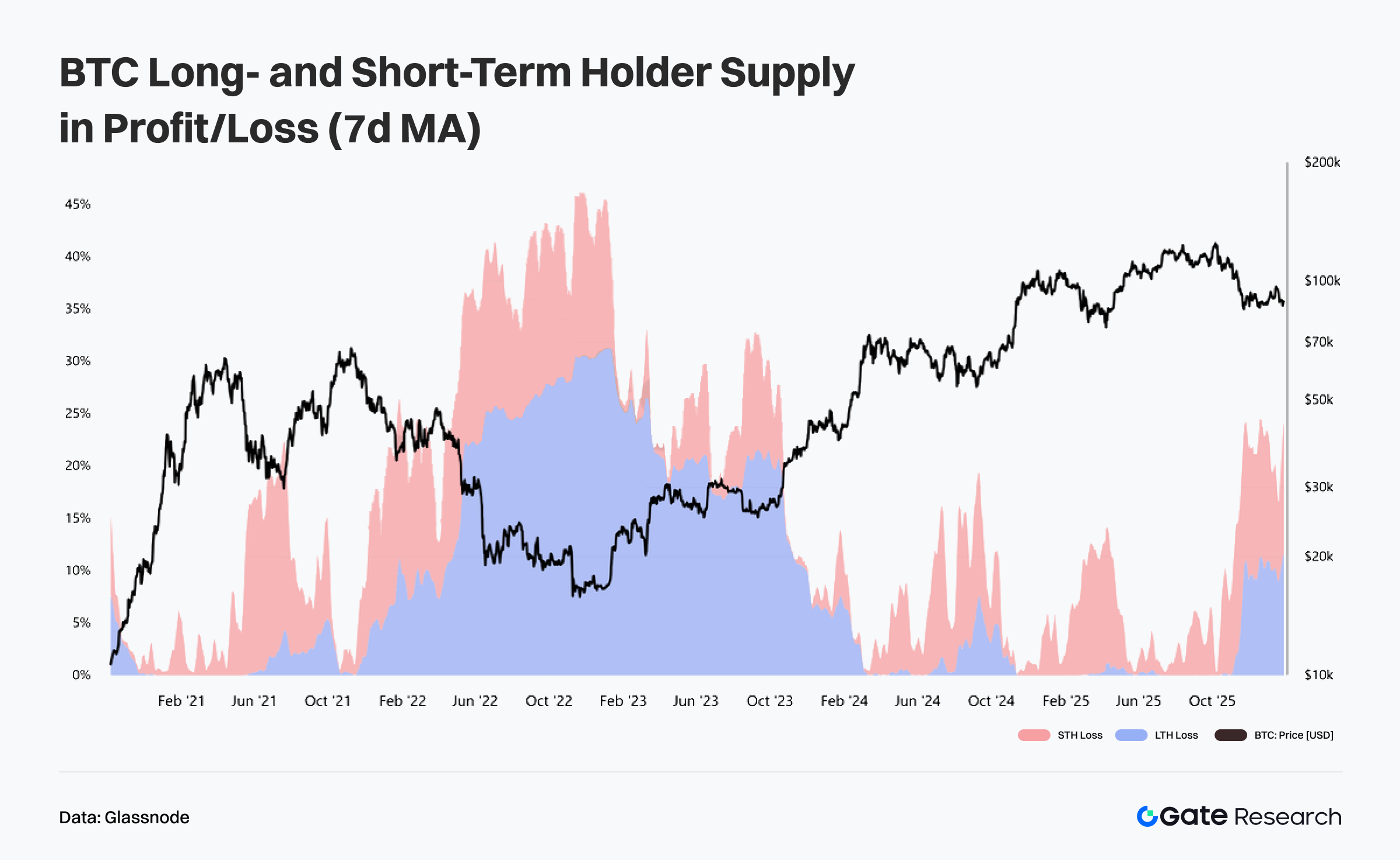

BTC Profitable Supply Declines, Short-Term Losses Rise but Remain Contained

According to Glassnode, the Long-Term Holder (LTH) and Short-Term Holder (STH) supply in profit/loss (7-day average) shows that the proportion of STH supply in loss has risen meaningfully, while LTH loss supply remains at relatively low levels. This indicates that the recent price pullback has primarily compressed short-term profit margins, concentrating pressure on recently acquired positions at higher levels, while the long-term holder structure remains resilient. Current losses reflect marginal unrealized drawdown expansion rather than systemic entrapment across the broader market.【7】

Historically, when STH loss supply increases while LTH supply remains largely profitable, markets are often in the mid or mid-to-late stages of a bull cycle consolidation. Short-term capital is passively flushed out during volatility, and supply gradually rotates toward lower-cost, longer-horizon holders, strengthening the foundation of the medium-term trend. There is no sign of large-scale LTH capitulation, implying the market has not entered the “broad panic” phase typically required for structural trend reversal.

Overall, BTC is undergoing a rebalancing process marked by short-term unrealized loss expansion while long-term structure remains stable. Short-term volatility may persist at elevated levels, but price action is more consistent with rotational consolidation rather than unilateral acceleration to the downside. As long as loss pressure remains largely confined to STH and does not materially spread to LTH, the medium-term bull structure retains resilience. The current phase resembles internal risk release and supply redistribution rather than trend breakdown.

Trending Project & Token Activity

On-chain data suggests that capital and users are gradually concentrating in ecosystems with stronger interaction foundations and application depth. Projects combining narrative appeal and technical innovation are emerging as focal points for capital allocation. The following section highlights notable projects and tokens that have recently demonstrated strong performance.

Overview of Trending Project

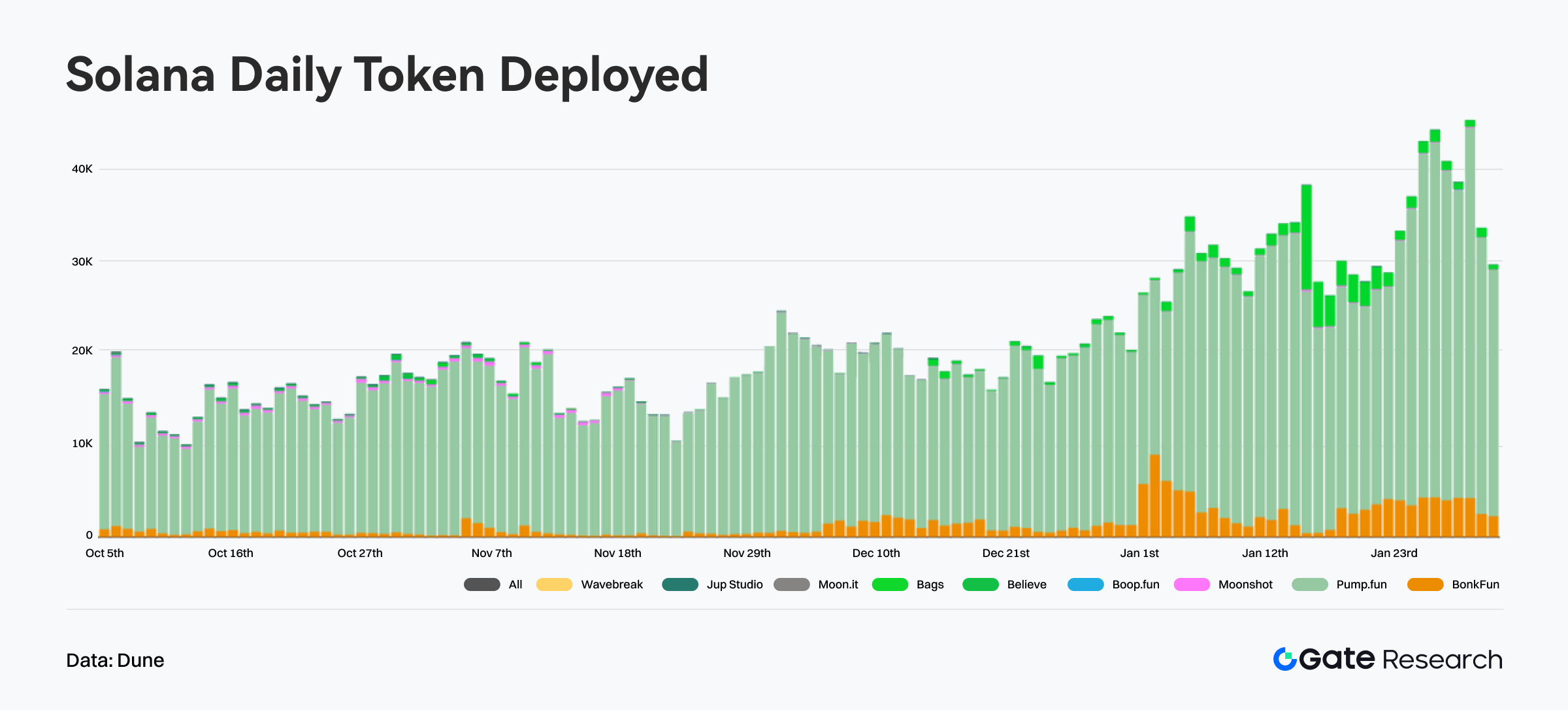

Solana Meme Launchpad Ecosystem

As meme issuance activity on Solana rebounds, launchpad ecosystems have regained momentum. Over the past week, daily new token creation has returned above 30,000 tokens, with January 16 exceeding 38,000 new tokens in a single day. During this surge, Pump.fun remains dominant, while Bags App has rapidly entered the second tier through differentiated mechanisms, recording over 11,000 tokens created in one day and capturing nearly 30% market share at peak. The competitive landscape reflects parallel validation of “scaled incumbents + innovative mechanism challengers,” rather than immediate displacement.【8】

From a mechanism design standpoint, Bags App introduces a “donation-driven incentive” model. Token creators designate beneficiaries (such as X users, celebrities, or KOLs), with a portion of trading fees automatically allocated to them. This creates a viral distribution loop in which communities issue tokens first and “pressure” beneficiaries to acknowledge participation. In sentiment-driven meme cycles, such a structure possesses strong viral propagation potential and has amplified wealth effects and social endorsement in early cases. The platform also enhances fee allocation transparency, community engagement, and partial anti-rug safeguards, aligning well with “community + celebrity narrative” meme operations.

However, the participation structure remains controversial. Some Web2 founders and brands strongly oppose being designated passive beneficiaries, citing reputational and brand appropriation concerns. Despite fee-sharing mechanisms reducing traditional developer rug risk, the ecosystem still relies heavily on user due diligence and anti-scam tools. Historically, most tokens exhibit short life cycles and rapid price collapse, with wealth effects concentrated among a small number of breakout projects and early participants. The broader market remains characterized by high attrition and intense speculation.

In summary, Solana’s meme resurgence has triggered a new phase of mechanism competition among launchpads. Pump.fun remains the scale leader, while Bags App represents an innovative exploration of socially embedded issuance. The current landscape reflects multi-model experimentation during sector expansion rather than competitive finality. Future sustainability will depend on user growth, breakout continuity, and the ability to balance compliance boundaries with community trust.

Overview of Trending Token

$CC

Canton Network is a blockchain network designed for institutional financial scenarios, focused on connecting traditional financial infrastructure with on-chain asset environments. It emphasizes compliance, privacy protection, and high-performance interoperability. Its architecture supports multi-party financial collaboration, including asset tokenization, cross-institution settlement, and synchronized financial data on-chain, aiming to preserve enterprise-grade privacy and permissioning while enhancing composability and settlement efficiency.

According to CoinGecko, $CC has risen approximately 20% over the past month. The move reflects structural recovery after a prolonged deep drawdown rather than abrupt fundamental catalysts.【9】

Structurally, prior price appreciation was moderate with a relatively clear channel, positioning $CC as a candidate for both trend-following and swing capital during broader market weakness. Social media attention has lagged price performance, with discussion focused on trend continuation rather than explosive narrative hype. Technically, short-term structure remains within an ascending channel, with $0.195–$0.200 forming a dense resistance zone and $0.175–$0.178 serving as key support. A breakdown below support would materially weaken short-term structure. Overall, $CC remains trend-intact but has entered a higher-level consolidation and tactical trading phase, favoring range-based positioning rather than aggressive breakout chasing.

Conclusion

In January 2026, comprehensive on-chain indicators suggest the market has not experienced broad usage contraction but rather entered a structural reallocation phase. Transaction counts, active addresses, and fee revenue all indicate accelerating concentration of activity in high-frequency, high-efficiency networks. Solana maintains strong activity and transaction density, Ethereum reinforces its high-value settlement and asset coordination role, and Base has experienced periodic expansion driven by narrative catalysts. Meanwhile, certain traditional L2 and sidechains show weakening activity and value capture capacity, deepening ecosystem divergence. Capital flows corroborate usage data. Allocation logic is shifting from macro narrative-driven positioning toward network-level efficiency and transaction throughput considerations. AI and meme narratives primarily function as traffic funnels, but sustained capital retention depends on ecosystems capable of generating durable on-chain demand and robust infrastructure. Competition among public chains is evolving from scale expansion to efficiency and authentic usage intensity.

At the Bitcoin level, short-term structure remains weak with insufficient rebound volume, yet on-chain indicators align more with “high-level cooling” than trend reversal. Price oscillates around the short-term holder cost band, reflecting digestion of prior high-level supply. Profit realization momentum has declined sharply, with selling pressure transitioning from concentrated distribution to gradual attenuation. Supply structure shows declining profitable supply and rising short-term losses, but pressure remains largely confined to short-term holders while long-term holders remain structurally stable. The current phase more closely resembles oscillatory rebalancing than structural deterioration.

At the project level, Solana’s meme rebound has revitalized launchpad ecosystems. Pump.fun maintains dominance, while Bags App’s donation-driven issuance model rapidly scales, forming a parallel validation structure between established leaders and innovative challengers. Although the model enhances social propagation and celebrity narrative leverage, it carries reputational controversy and high attrition risk, leaving the sector in an exploratory and highly speculative stage.

On the token side, $CC, as an institutional-grade financial infrastructure project, has exhibited structural recovery following extended drawdown. In an environment where major assets are weakening, its relatively clear price channel and measured sentiment acceleration reflect joint participation by trend and swing capital. However, having entered a higher consolidation range, continuation now depends on follow-through volume and broader market risk appetite alignment.

References:

- Artemis, https://app.artemisanalytics.com/chains

- Artemis, https://app.artemisanalytics.com/chains

- Artemis, https://app.artemisanalytics.com/chains

- Artemis, https://app.artemisanalytics.com/flows

- Glassnode, https://studio.glassnode.com/charts/sth-cost-basis-model?s=1514979790&u=1769601600&zoom=

- Glassnode, https://studio.glassnode.com/charts/indicators.RealizedProfitLossRatio?a=BTC&mAvg=90&s=1464393600&u=1769558400&zoom=

- Glassnode, https://studio.glassnode.com/charts/supply.LthSthProfitLossRelative?a=BTC&mAvg=7&s=1602115200&u=1769558400&zoom=

- Dune, https://dune.com/adam_tehc/memecoin-wars

- CoinGecko, https://www.coingecko.com/en/coins/canton

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?