Gate Simple Earn: A Beginner-Friendly Guide to Growing Idle Assets

What Is Gate Simple Earn?

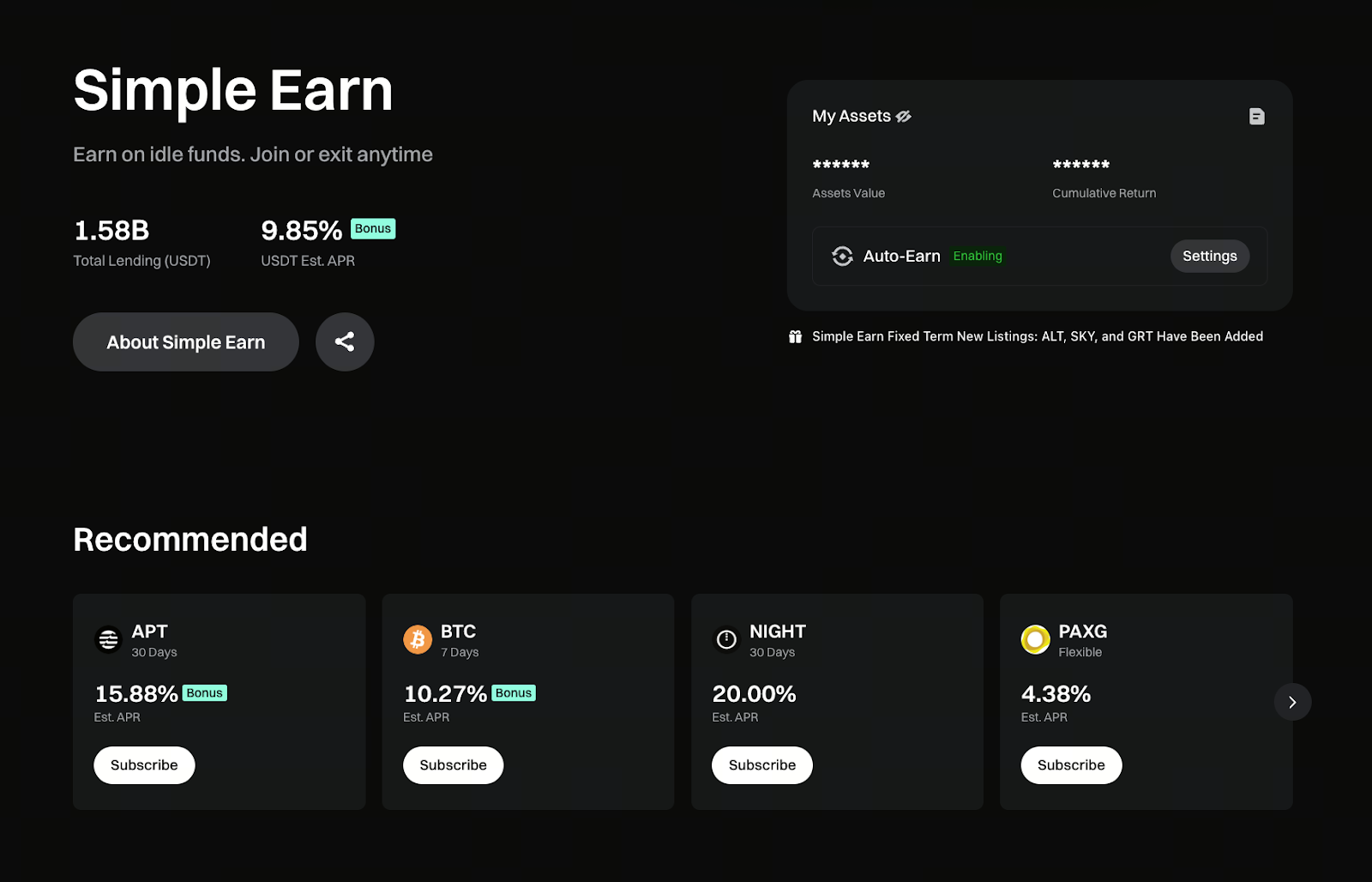

Image: https://www.gate.com/simple-earn

Gate Simple Earn is an idle asset management product offered by Gate. It enables users to lend or match borrowers with temporarily unused tokens (such as USDT, ETH, and others) to earn interest. The service includes both flexible-term products for liquidity and fixed-term products with higher yields that require short-term locking. Gate officially classifies Simple Earn as part of its financial product suite, positioning it as a low-barrier, user-friendly tool for managing idle funds.

Key Product Types (Flexible / Fixed-Term / Extra Reward Pools)

- Flexible (deposit and withdraw anytime): The primary advantage is flexibility. Users can subscribe and redeem at any time, making it ideal for short-term capital preservation and liquidity management.

- Fixed-term (short-term, e.g., 3/7/30 days): Requires funds to be locked for a specified period. These typically offer higher annualized yields and are suitable for users who do not need immediate access to their funds.

- Extra reward pools / activity pools: Gate periodically launches extra reward pools or special activities for specific tokens (such as USD1, APT, etc.). Subscribing during the event period provides additional annualized returns. These activities enhance short-term overall yields.

How Earnings Are Generated and Settled (Hourly Matching, Real-Time Annualized Rate)

Simple Earn’s returns primarily stem from lending market interest rates and extra reward pool subsidies provided by the platform. Gate typically uses an hourly matching mechanism to determine whether lending is successful for a given hour—meaning users deposit assets and set lending rates before the hour mark, and the system matches and distributes hourly interest at that time. If users redeem before the hour mark or set rates too high, resulting in unsuccessful lending, they will not receive interest for that hour. Annualized rates fluctuate based on market conditions and platform activities. Both official and media reports have documented historical increases in rates and changes in asset scale.

How to Subscribe and Redeem (Steps and Key Considerations)

- Log in to Gate (ensure all required account verification and security settings are completed).

- Navigate to “Finance” → “Simple Earn,” select your token and product type (Flexible / Fixed-Term / Activity Pool).

- Enter the subscription amount, review the current reference annualized rate and redemption rules, then confirm your submission.

- Flexible products can be redeemed at any time, but pay attention to hourly matching and interest settlement rules. Early redemption of fixed-term products may affect interest or impose additional restrictions.

- Monitor platform announcements and activity pages. Some extra rewards require subscription during the event period to be effective.

Applicable Scenarios and Common Uses

- Idle fund yield: Deposit short-term unused funds in flexible products to earn higher interest than in trading accounts.

- Supporting trading strategies: Use Simple Earn as a unified liquidity source for spot, contract, or leveraged margin (subject to platform rules).

- Extended returns from project activities: Occasionally, after new listings or subscriptions, Simple Earn offers extra reward paths, creating a continuous yield chain of “subscription → Simple Earn → compounding.”

Risk Warnings and Security Recommendations

- Market interest rate fluctuation risk: Lending market rates change with supply and demand. Returns are not fixed.

- Liquidity risk: In extreme market conditions, reduced borrowing demand or redemption surges may impact instant redemption experiences.

- Counterparty / platform risk: While Gate claims to have reserves and audits, users should assess exchange operational and compliance risks.

- Personal operational risk: Early redemption of fixed-term products may result in loss of interest. Setting excessively high lending rates may lead to prolonged inability to lend.

Recommendation: Diversify allocation, prioritize liquidity needs with flexible products, and review event rules and interest calculation details before participating in high-yield activities.

Frequently Asked Questions (FAQ)

- Q: When does flexible begin accruing interest?

A: Typically determined hourly. After successful lending, interest is settled hourly or daily, depending on platform rules. - Q: Can I receive interest if I redeem fixed-term early?

A: Most fixed-term products reduce or eliminate interest upon early redemption, sometimes returning only the principal. Refer to specific product terms. - Q: Are returns guaranteed?

A: Returns from financial products are influenced by market conditions and platform activities and cannot be guaranteed to remain unchanged. Note that event rewards are time-limited.

Conclusion (Three Tips for Beginners)

- Start with a small amount in flexible products to become familiar with hourly matching and interest settlement logic.

- For funds not needed in the short term, consider short-term fixed-term products for higher yields, but avoid locking up all liquidity.

- Follow official announcements and activity pages. Use extra reward pools to boost short-term returns, but understand the event periods and rules clearly.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks