Gate Stock Token Zone Explained: How to Properly Understand Tokenized Stock Price Trading

Image: https://www.gate.com/tokenized-stocks

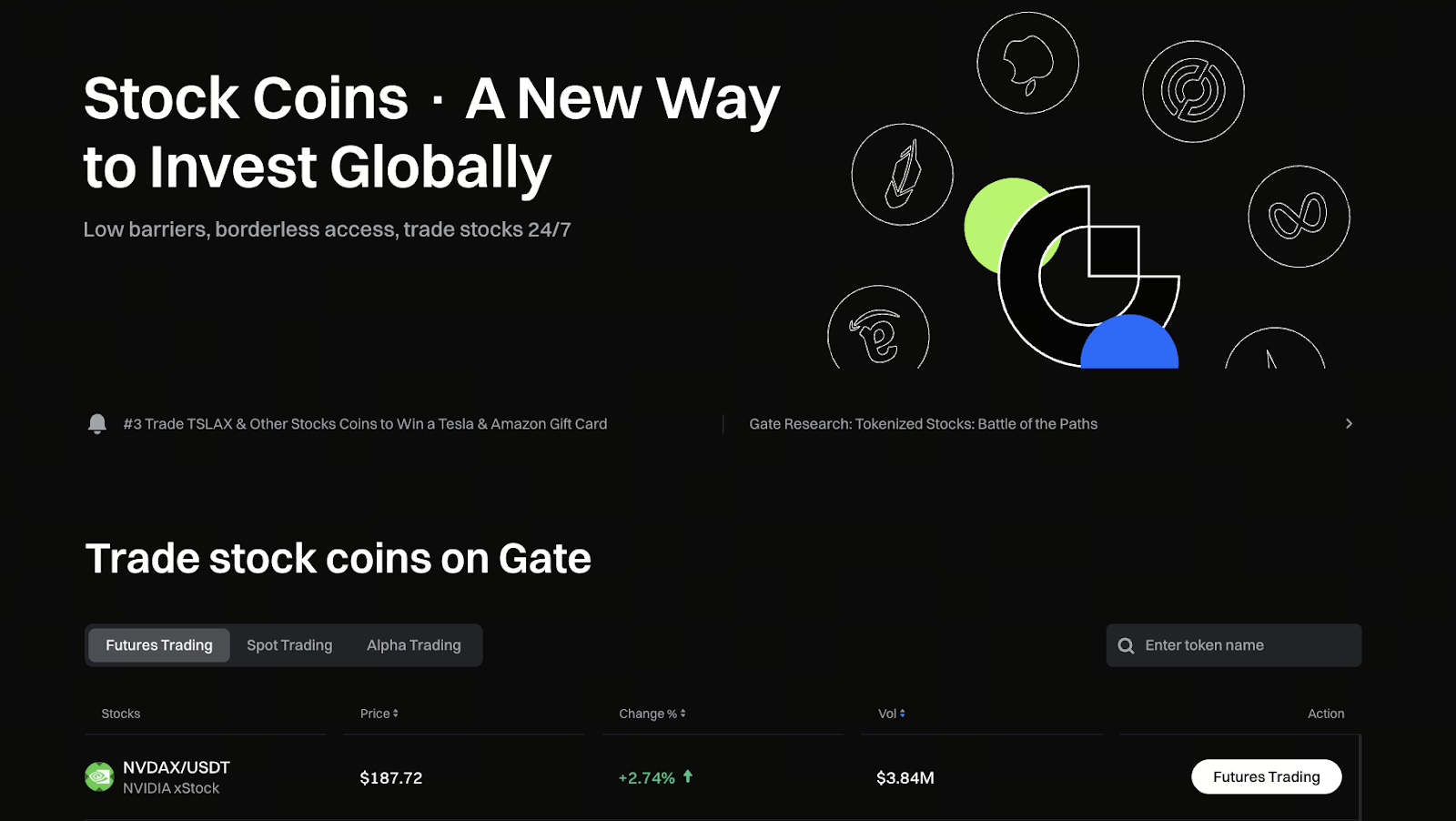

1. Essential Concepts Before Accessing the Gate Tokenized Stocks Section

The Gate Tokenized Stocks section is a dedicated module on the Gate platform designed for products linked to stock prices. Its primary function is to tokenize traditional stock price movements, enabling their representation and trading within a crypto market environment. Before entering this section, users must understand a fundamental concept: what is displayed and traded here is the performance of stock prices, not the underlying stock assets.

This distinction is critical for grasping how the section operates. Tokenized stocks do not represent equity in listed companies and do not establish any securities holding relationship. By presenting tokenized stocks in a separate section, Gate differentiates them from other digital assets, helping users clearly identify product attributes and participation boundaries before trading.

2. How Tokenized Stocks Function in Trading

Within the Gate Tokenized Stocks section, tokenized stocks are classified as digital assets. Their prices are typically adjusted based on the corresponding stock’s price fluctuations in traditional financial markets. When the underlying stock price changes, the tokenized stock price shifts accordingly, mirroring stock market dynamics in the crypto trading landscape.

Because trading takes place in the digital asset market, tokenized stocks may be influenced in the short term by factors such as trading depth, market activity, and sentiment volatility. While tokenized stock prices correlate with their underlying stocks, actual price movements may differ. Understanding these trading characteristics enables users to make more informed and rational decisions when participating.

3. Practical Expectations for Using Tokenized Stocks

From a practical standpoint, tokenized stocks are best suited as tools for price participation and market monitoring. They allow users to observe stock price changes in real time under varying macroeconomic conditions or market sentiment on a crypto platform, deepening their understanding of stock market mechanics.

Moreover, the Gate Tokenized Stocks section provides convenience for users seeking to track multiple asset markets. Observing both crypto assets and stock price trends on a single platform fosters a more comprehensive market perspective. This approach emphasizes flexible participation and short-term analysis, rather than long-term holding or value investing strategies.

4. Risk Awareness Required Before Engaging with Gate Tokenized Stocks

While tokenized stocks lower the barrier to entry, price volatility risk remains significant. Tokenized stock prices are affected not only by the performance of the underlying stocks but also by broader digital asset market fluctuations, which can lead to substantial price swings under certain market conditions.

Therefore, before trading in the Gate Tokenized Stocks section, users must recognize that tokenized stocks are not equivalent to stock assets, do not confer shareholder rights, and do not include dividends or governance privileges. Assessing personal risk tolerance and managing exposure is essential when engaging with price-based products. Gate also urges users to remain rational and exercise caution in any transaction involving price volatility.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About