Gate TradFi Launches Industry-First Adjustable Leverage Gold Trading

Industry-First Adjustable Gold Leverage Trading Mechanism

Gate TradFi has officially introduced the market’s first adjustable leverage mechanism for gold trading, making it the only platform currently offering multiple fixed leverage options for XAU (gold). The initial launch features XAUUSD20, XAUUSD100, and XAUUSD200—gold CFD contracts with 20x, 100x, and 200x leverage, respectively—giving users more flexible ways to trade gold.

This multi-leverage structure lets traders select leverage levels that match their risk tolerance and strategy, going beyond the limitations of single-leverage products and expanding the possibilities for precious metals trading.

Exclusive Multi-Leverage XAU Trading—Expanding Metal Market Applications

Gate TradFi’s core innovation is its exclusive support for multi-leverage gold trading. Users can trade gold CFDs with different leverage levels on the same platform, enabling strategies that range from moderate risk allocations to high-leverage approaches.

This adjustable leverage model transforms gold from a traditional long-term safe haven into a dynamic asset for short-term trading and strategic execution, deepening liquidity and activity for metals on the crypto platform.

Specifications of the Initial Gold Leverage Products

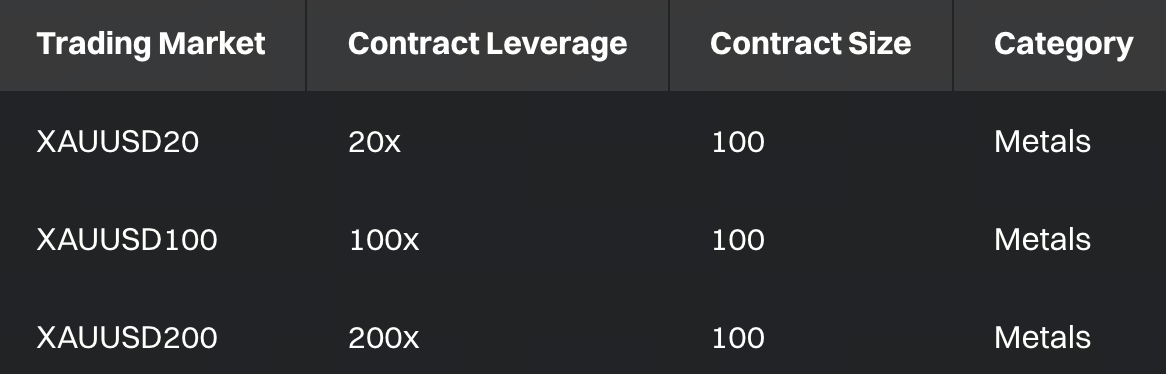

Gate TradFi now offers the following three gold leverage contracts:

Each product is a metal-based CFD, allowing users to choose gold trading strategies with distinct risk and reward profiles.

Full Dual-Platform Access—TradFi Covers Multiple Traditional Assets

Gate TradFi has enabled both App and Web trading, allowing users to switch seamlessly between devices for a complete TradFi experience. As of this release, the platform supports stocks, metals, forex, indices, and commodities, including major assets like gold, silver, Tesla, NVIDIA, and Apple.

Gate TradFi offers leverage up to 500x and a competitive fee structure, empowering professional traders to manage crypto and traditional financial assets on a single platform.

Click to access Gate TradFi: https://www.gate.com/tradfi

Accelerating the Integration of Crypto and Traditional Finance—Building the Next Generation TradFi Ecosystem

With the launch of the industry’s first adjustable gold leverage mechanism and a robust multi-platform TradFi architecture, Gate is driving deeper integration between crypto trading platforms and traditional financial markets. From product innovation to infrastructure upgrades, Gate TradFi is building a professional trading system that spans multiple assets, strategies, and markets.

As TradFi continues to add new asset classes and trading models, Gate will further strengthen its pivotal role in the global digital transformation of traditional finance, offering users a comprehensive, one-stop cross-market trading environment.

Summary

With the official launch of the industry’s first adjustable gold leverage trading mechanism, Gate TradFi has overcome the limitations of single-leverage gold trading and introduced greater flexibility to metal assets. Through multi-leverage XAU products and full dual-platform access, Gate is building a core bridge between crypto and traditional financial markets, enabling gold and other traditional assets to integrate more efficiently into digital trading and expanding the practical reach of TradFi.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Bitcoin's Future & TradFi (3,3)