Gate Ventures Weekly Crypto Recap (January 12, 2026)

TL;DR

- The December U.S. nonfarm payrolls report showed weaker job growth and downward revisions, slightly weighing on expectations for interest rate cuts.

- This week’s incoming data includes the ADP employment report, CPI and PPI, as well as retail sales and home sales data.

- BTC and ETH were largely flat, down 0.69% and 0.8%, respectively. ETF flows remained negative (–$681.0M for BTC, –$68.6M for ETH), while sentiment stayed cautious, with the Fear & Greed Index at 27.

- On-chain meme activity picked up after X rolled out Smart Cashtags under Head of Product Nikita Bier, with BONK surging as much as 175% following a screenshot mention.

- Top-30 assets were broadly flat (–0.85% on average). Monero (XMR) led gains with a +38.3% jump amid turmoil among Zcash developers, while Solana rose 4.4% on speculation it could be prioritized for future trading integrations on X.

- Andreessen Horowitz raises $15B, reinforcing its conviction in AI and crypto architectures.

- Ethereum staking sees institutional return as validator exit queue collapses.

- BNY launches tokenized bank deposits for institutional clients.

Macro Overview

The December U.S. nonfarm payrolls report showed weaker job growth and downward revisions, slightly weighing on expectations for interest rate cuts.

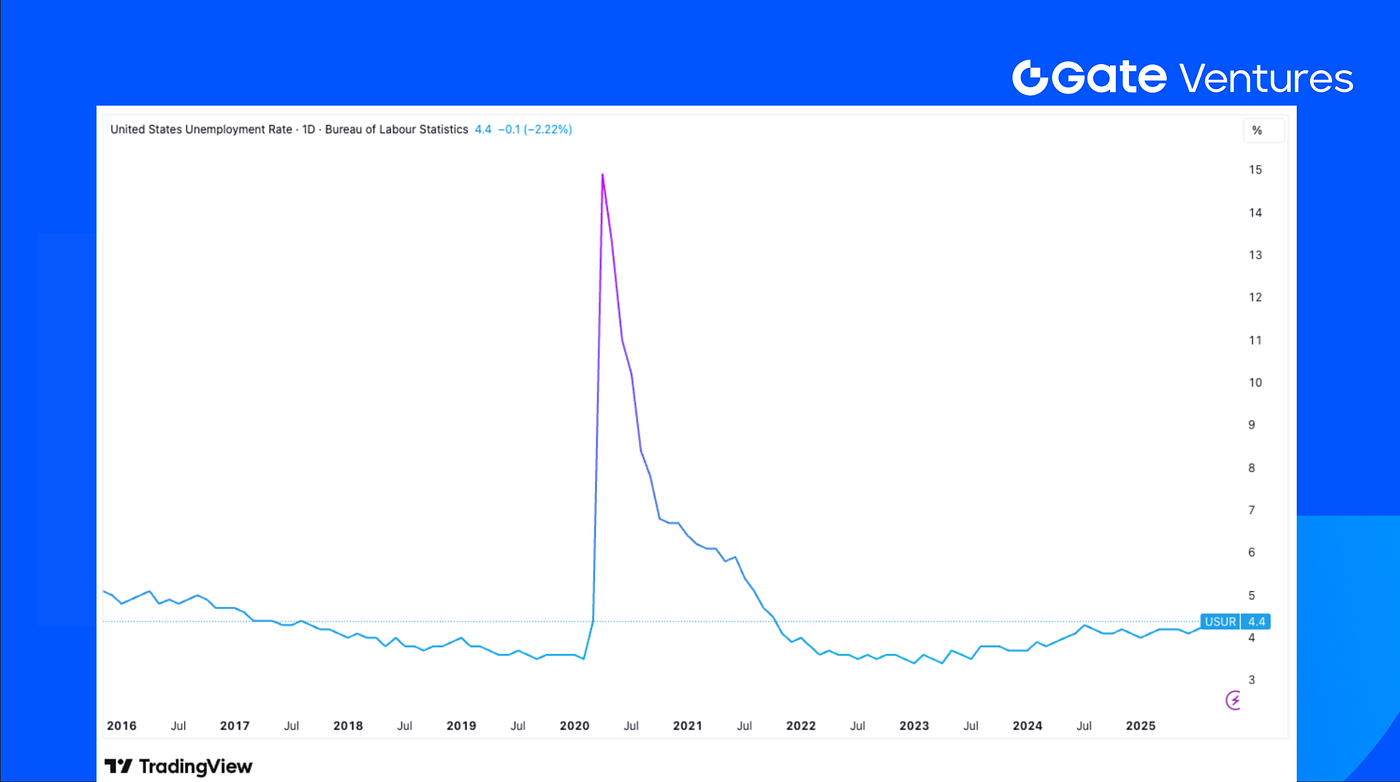

In December, the U.S. added 50,000 nonfarm payroll jobs, below Bloomberg’s consensus estimate of 70,000, with cumulative downward revisions for October and November totaling 76,000. The unemployment rate unexpectedly fell by 0.1 percentage points from November to 4.4%, while the labor force participation rate declined by 0.1 pp to 62.4%. Hourly wages grew 0.3% month-over-month, in line with expectations, and rose 0.1pp year-over-year to 3.8%, exceeding expectations. Average weekly working hours dropped by 0.1 hours to 34.2, below forecasts. Despite the decline in the unemployment rate, the significant downward revisions for the prior months brought the three-month average of private sector nonfarm job gains down to a low of 29,000.

In December, employment in the service sector marginally accelerated, concentrated in healthcare and leisure/hospitality, while the goods-producing sector contracted and government employment improved slightly. The service sector added 58,000 jobs, primarily driven by gains in healthcare and leisure/hospitality, while retail dragged on growth. Revisions for October and November in the retail sector accounted for over half of the total nonfarm downward revisions. Other service industries saw little to no net job gains. In the goods-producing sector, previously strong construction employment weakened, likely due to weather-related factors, while manufacturing and mining experienced slight contractions. Government employment increased marginally, up 7,000 to 13,000 in December.

This week’s incoming data includes ADP Employment Report, CPI & PPI, retail sales and home sales data, along with NY State and Philadelphia Fed Manufacturing Indexes. As the government shutdown earlier affected the data collection, the drop in headline inflation to 2.7% in November, down from 3.0% in September, and the drop in core inflation to 2.6% (its lowest since March 2021), was treated by markets with caution. The incoming December CPI data will therefore provide more insights into the inflation situation and policymaking. Updates to US retail sales, industrial production and producer prices will also be released through the week. (1, 2)

US unemployment rate, Tradingview

DXY

The US dollar had a four-day rally last week, but was ended by this Monday’s investigation on Federal Reserve Chair Jerome Powell, which put the central bank’s independence into question. (3)

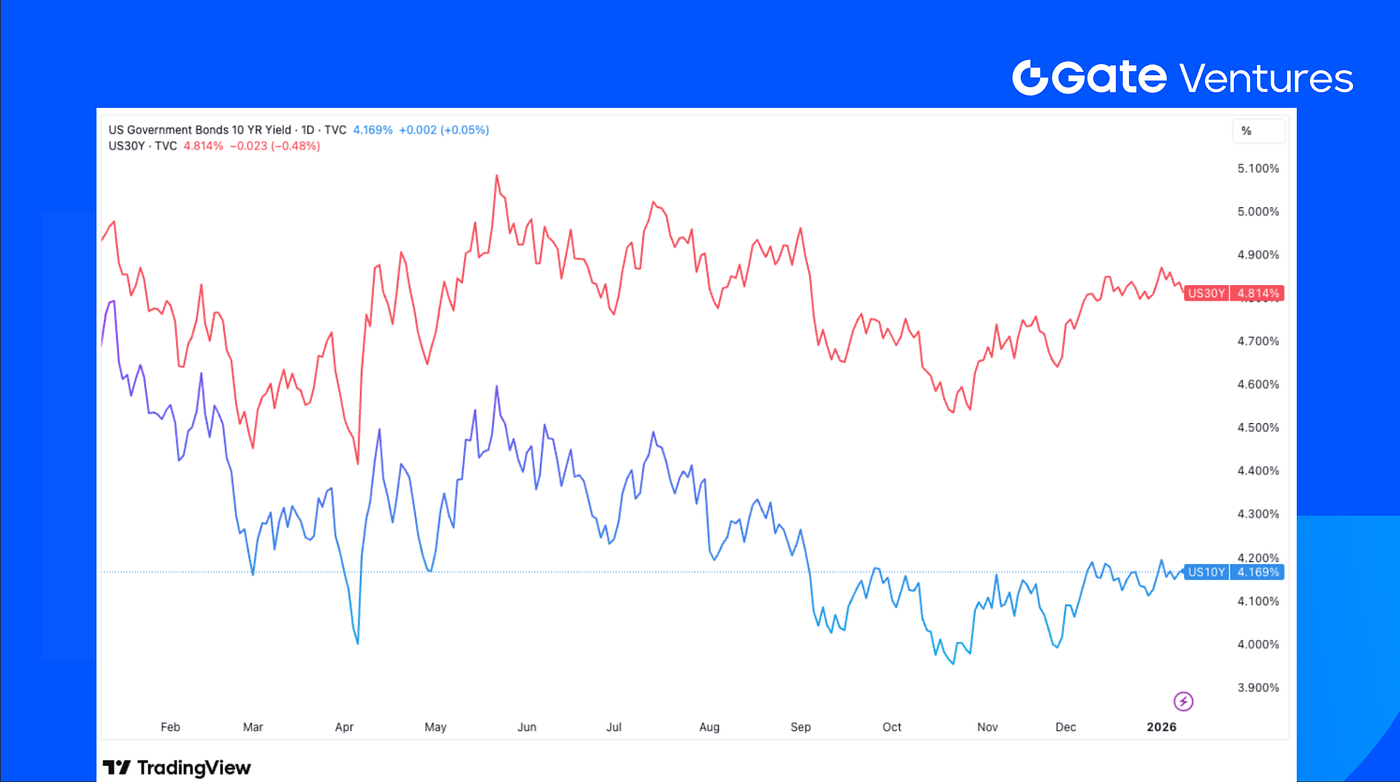

US 10-Year and 30-Year Bond Yields

The US Treasury yields have been on an upward trend, with the 10 year treasury yield approaching the highest level since September last year. (4)

Gold

Last week the gold price rose and was set for a weekly gain, as investors weighed weaker-than-expected US payroll data with broader policy and geopolitical uncertainty. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

BTC was mostly flat last week, dipping 0.69%. ETH moved in line, down 0.8%, pointing to limited movement across major assets.

ETF flows were negative, with $681.01M of net outflows from BTC ETFs and $68.57M from ETH ETFs. The ETH/BTC ratio edged down 0.09% to 0.0342.(6)

Market sentiment remained cautious, with the Fear & Greed Index staying in the Fear zone at 27. (7)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap was mostly flat, down 0.6%. Excluding BTC and ETH, the market dipped 0.28%. Altcoins lagged behind, with the market cap excluding the top 10 falling 1.47%, showing weaker performance in smaller-cap tokens.

Looking further out, a longer-term catalyst came from X, where Head of Product Nikita Bier introduced Smart Cashtags. The feature allows stock tickers and token symbols to display real-time prices and asset information, with a direct link to a trading page on click.

The rollout quickly lifted on-chain meme activity. BONK stood out, rallying as much as 175% after being referenced in a shared screenshot.

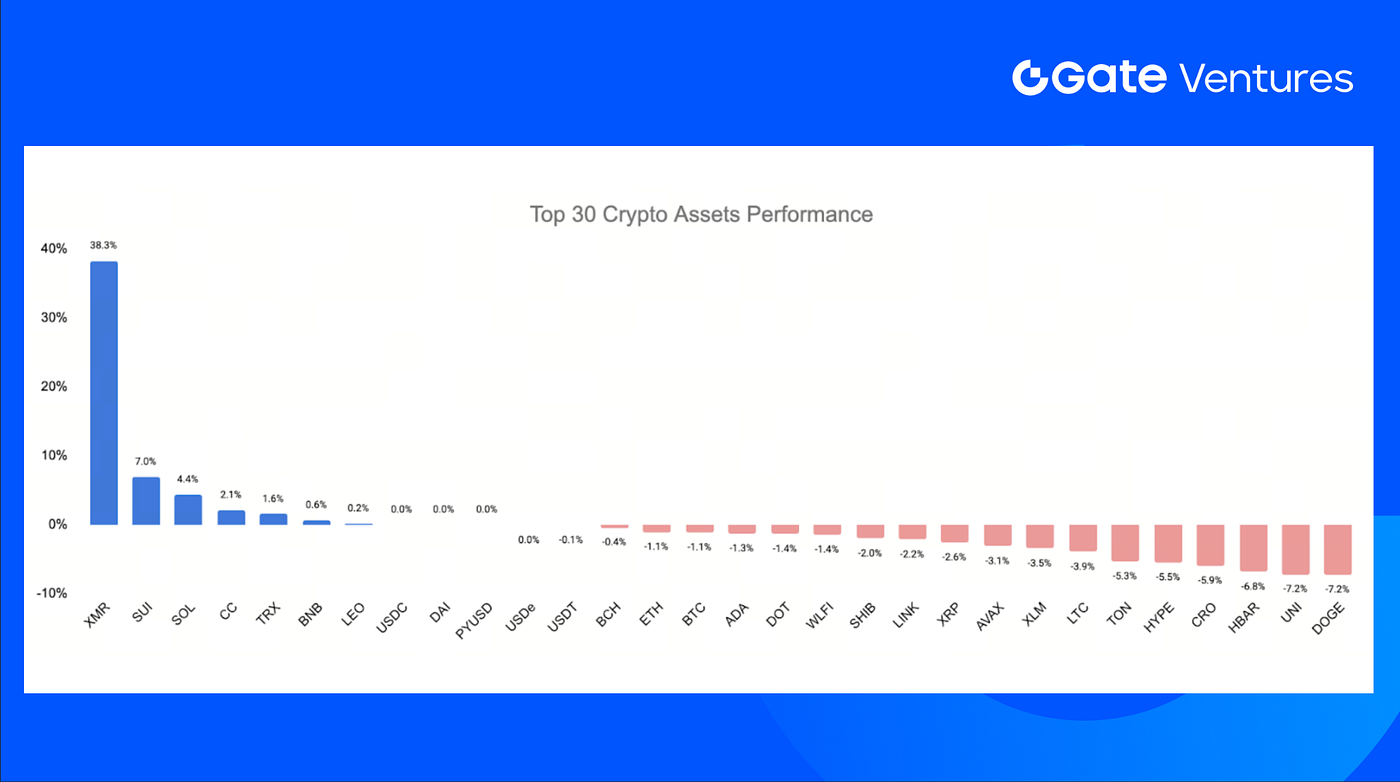

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Jan, 12nd 2026

The top-30 crypto assets were broadly flat, with the average price down just 0.85%. XMR clearly outperformed the group, leading gains, followed by SUI and SOL.

XMR jumped 38.3%. The move was mainly due to the entire Electric Coin Company team (the developer behind Zcash) resigning after a dispute with its nonprofit board. ECC CEO said the exit amounted to constructive discharge, with developers planning to form a new company. This appeared to push capital toward XMR, the other major privacy token. (8)

SOL rose 4.4%, supported by increased interest after the Smart Cashtags feature mentioned by Nikita Bier, Head of Product at X, who is also a Solana adviser. The market is increasingly speculating that Solana could be a priority partner for potential trading-related integrations on X. (9)

The Key Crypto Highlights

1. a16z raises $15B reinforces conviction in AI and crypto architectures

Andreessen Horowitz raised over $15B across multiple funds, framing crypto and AI as core architectures for securing America’s technological and economic leadership over the next century. While the dedicated crypto fund did not receive new capital, a16z said crypto investments will continue via its Growth fund, which spans sectors and portfolios. The allocation reflects sustained conviction in crypto’s strategic relevance amid intensifying global competition, alongside calls for closer public–private alignment to maintain U.S. innovation leadership. (10)

2. Ethereum staking sees institutional return as validator exit queue collapses

Ethereum’s validator exit queue has dropped to zero, down 99.9% from its September peak, signaling that near-term selling pressure from staking has largely cleared. At the same time, the entry queue climbed to 1.3M ETH as institutional players increased allocations, including BitMine’s $2.1B staked position and the first staking distributions from a U.S. spot Ethereum ETF. With 35.67M ETH now staked across nearly one million validators, institutional participation is reshaping Ethereum’s staking dynamics toward longer-term capital commitment. (11)

3. BNY launches tokenized bank deposits for institutional clients

BNY launched tokenized bank deposits for institutional clients, issuing on-chain depositor claims through an in-house permissioned blockchain. The tokenized deposits will initially support collateral and margin workflows, addressing demand for faster settlement, improved liquidity efficiency, and greater transparency in an always-on market environment. The move reflects a broader push by traditional financial institutions to modernize legacy infrastructure using blockchain technology, positioning tokenized cash as a foundational layer for future institutional trading, settlement, and risk management systems. (12)

Key Ventures Deals

1. Babylon raises $15M Strategic token round from a16z Crypto to expand BTC lending

Babylon raised a $15M Strategic round from a16z Crypto through the purchase of BABY tokens to advance its Bitcoin-native staking and lending infrastructure. The protocol enables BTC to be used as on-chain collateral without wrappers or custodians, including an upcoming Aave V4 integration. As large amounts of Bitcoin remain idle due to limited programmability, the investment reflects demand to unlock BTC as productive collateral while preserving native security and user control. (13)

2. ZenChain raises $8.5M pre-TGE round to bridge Bitcoin and EVM ecosystems

ZenChain closed an $8.5M pre-TGE funding round led by Watermelon Capital, DWF Labs and Genesis Capital, with additional angel commitments ahead of its token launch. The capital funds development of a secure interoperability layer connecting Bitcoin-native capital with EVM-compatible applications. As demand grows to make BTC productive without compromising security, the round reflects interest in infrastructure that unifies Bitcoin and programmable ecosystems for long-term cross-chain adoption. (14)

3. Rain raises $250M Series C at $1.95B to scale enterprise stablecoin payments

Rain raised a $250M Series C led by ICONIQ with Sapphire Ventures, Dragonfly and other investors, valuing the company at $1.95B and bringing total funding above $338M. The capital expands Rain’s compliant, full-stack stablecoin payments platform across global markets. As enterprises shift from pilots to production on tokenized money, the round reflects demand for infrastructure that makes stablecoin payments mainstream while preserving familiar card and app experiences at scale. (15)

Ventures Market Metrics

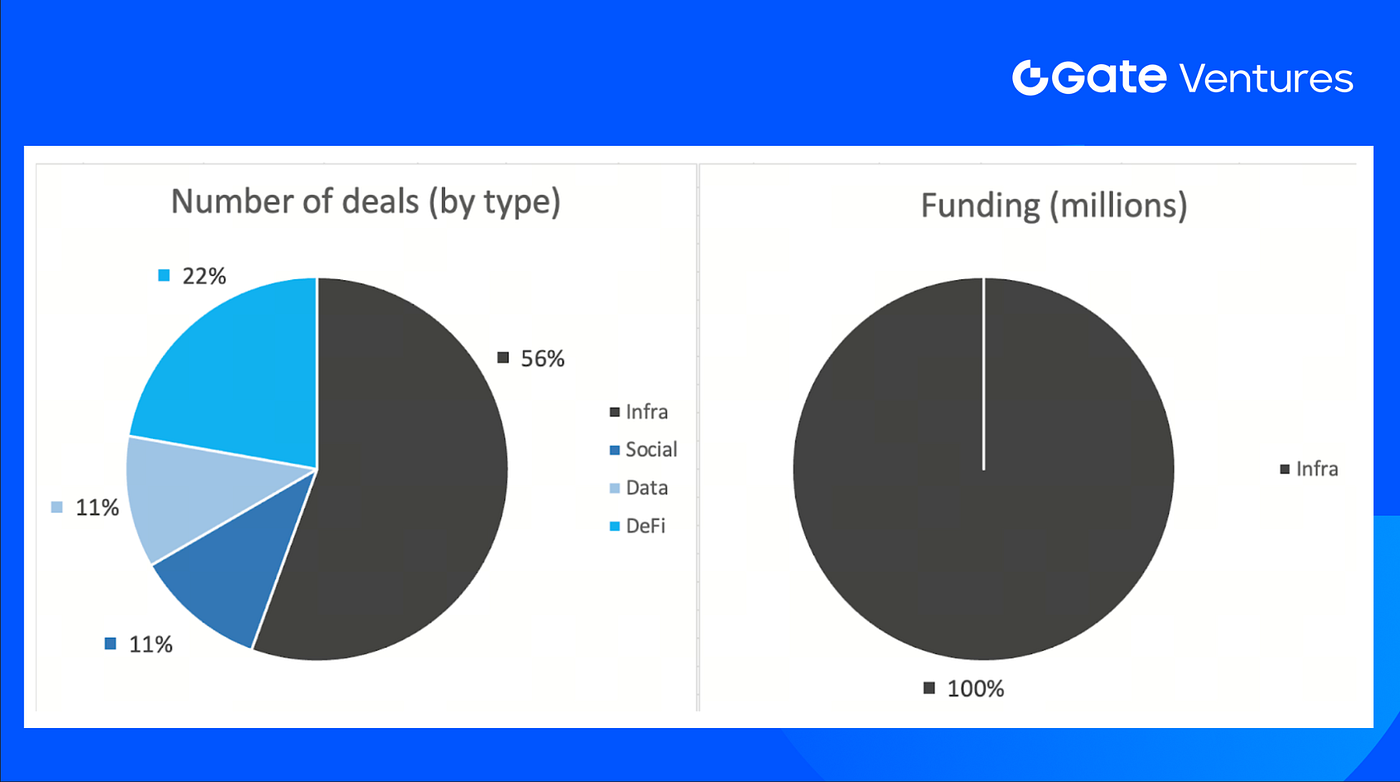

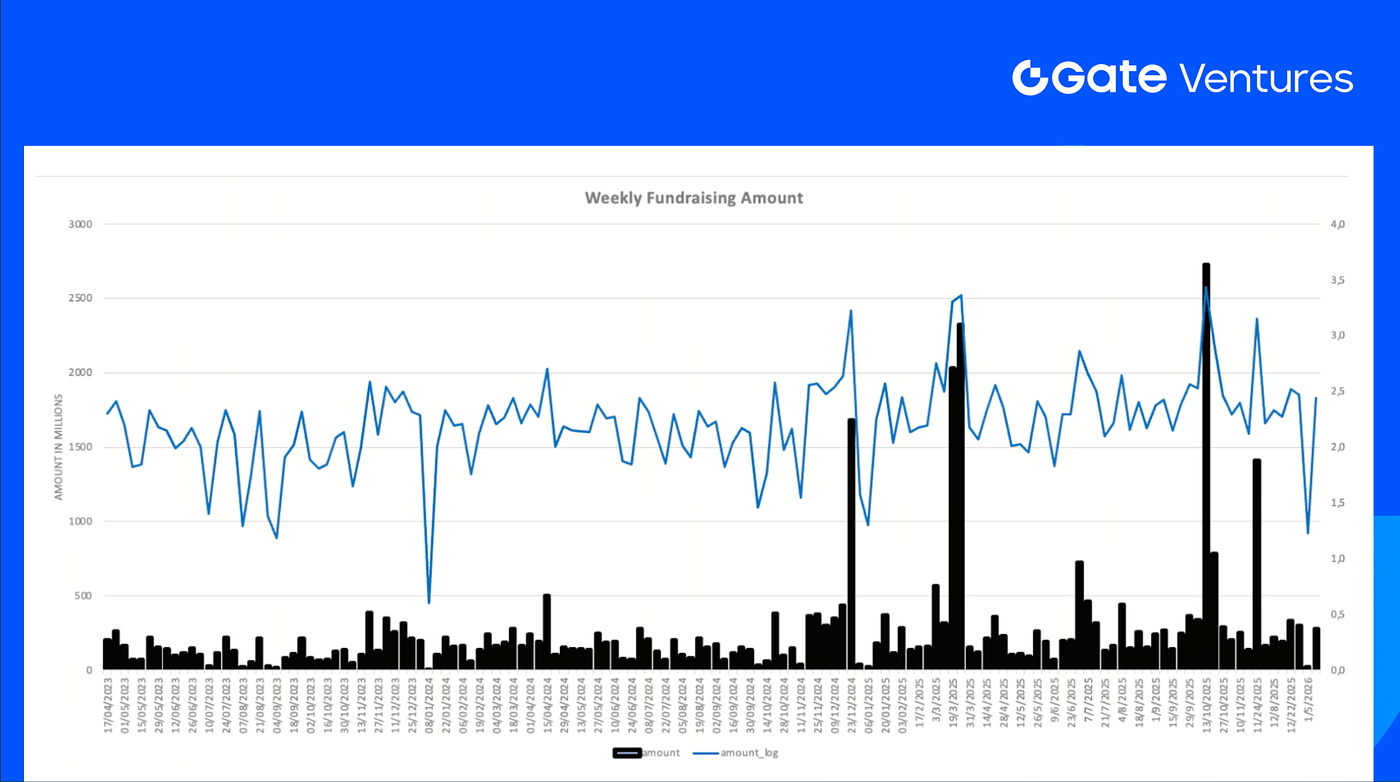

A total of 9 deals were closed in the previous week. Infrastructure led activity with 5 deals, accounting for 56% of total deal count. Social recorded 1 deal (11%), Data saw 1 deal (11%), and DeFi accounted for 2 deals (22%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 12th Jan 2026

The total amount of disclosed funding raised in the previous week was $275M, 6/9 deals in the previous week didn’t announce the raised amount. The top funding came from the Infra sector with $275M. Most funded deals: Rain ($250M), Babylon ($15M).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 12th Jan 2026

Total weekly fundraising rose to $275M for the 2nd week of Jan-2026, an increase of 1510% compared to the week prior. Weekly fundraising in the previous week was down 34% year over year.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Week Ahead Economic Preview, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-12-january-2026.html

- US unemployment rate, Tradingview, https://www.tradingview.com/chart/QOz7i3JC/?symbol=ECONOMICS%3AUSUR

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- ECC Team Dispute, https://coinmarketcap.com/academy/article/monero-reclaims-top-privacy-coin-spot-as-zcash-faces-developer-crisis

- Smart Cashtags Announcement, https://x.com/nikitabier/status/2010277345651990564?s=20

- a16z raises $15B, reinforces conviction in AI and crypto architectures,https://a16z.com/why-did-we-raise-15b/

- Ethereum staking exits vanish as institutional capital returns,https://www.theblock.co/post/384429/ethereum-validator-exit-queue

- BNY launches tokenized bank deposits for institutional clients,https://cointelegraph.com/news/bny-tokenized-deposits-bank-rush-blockchain-crypto

- Babylon raises $15M Strategic token round from a16z Crypto to expand BTC lending,https://a16zcrypto.com/posts/article/investing-in-babylon/

- ZenChain raises $8.5M pre-TGE round to bridge Bitcoin and EVM ecosystems,@Zen_Chain/zenchain-closes-8-5m-funding-round-ec752f3e6185?postPublishedType=initial"">https://medium.com/@Zen_Chain/zenchain-closes-8-5m-funding-round-ec752f3e6185?postPublishedType=initial

- Rain raises $250M Series C at $1.95B to scale enterprise stablecoin payments,https://x.com/raincards/status/2009589894234939576?s=20

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)