Gate Ventures Weekly Crypto Recap (January 19, 2026)

TL;DR

- The U.S. initiated a new phase of financial repression in 2026, evidenced by MBS purchases, regulatory caps on credit card interest rates, proposed rate cuts from Stephen Miran, and investigations targeting Fed Chair Jerome Powell.

- This week’s incoming data includes the ADP employment report, the final reading of U.S. Q3 2025 GDP, November core PCE inflation, and the University of Michigan (UoM) consumer sentiment survey.

- BTC and ETH rose 3.04% and 5.29%, respectively, last week, supported by strong ETF inflows, with $1.42 billion into BTC ETFs and $479 million into ETH ETFs. Market sentiment improved from 27 to 44 but remained in the Fear zone.

- The total crypto market capitalization rose 2.24% last week, though gains were largely concentrated in BTC and ETH. Privacy-focused tokens (DASH, DUSK, SCRT) showed relative resilience, while World Cup–related tokens such as CHZ also outperformed on narrative-driven interest.

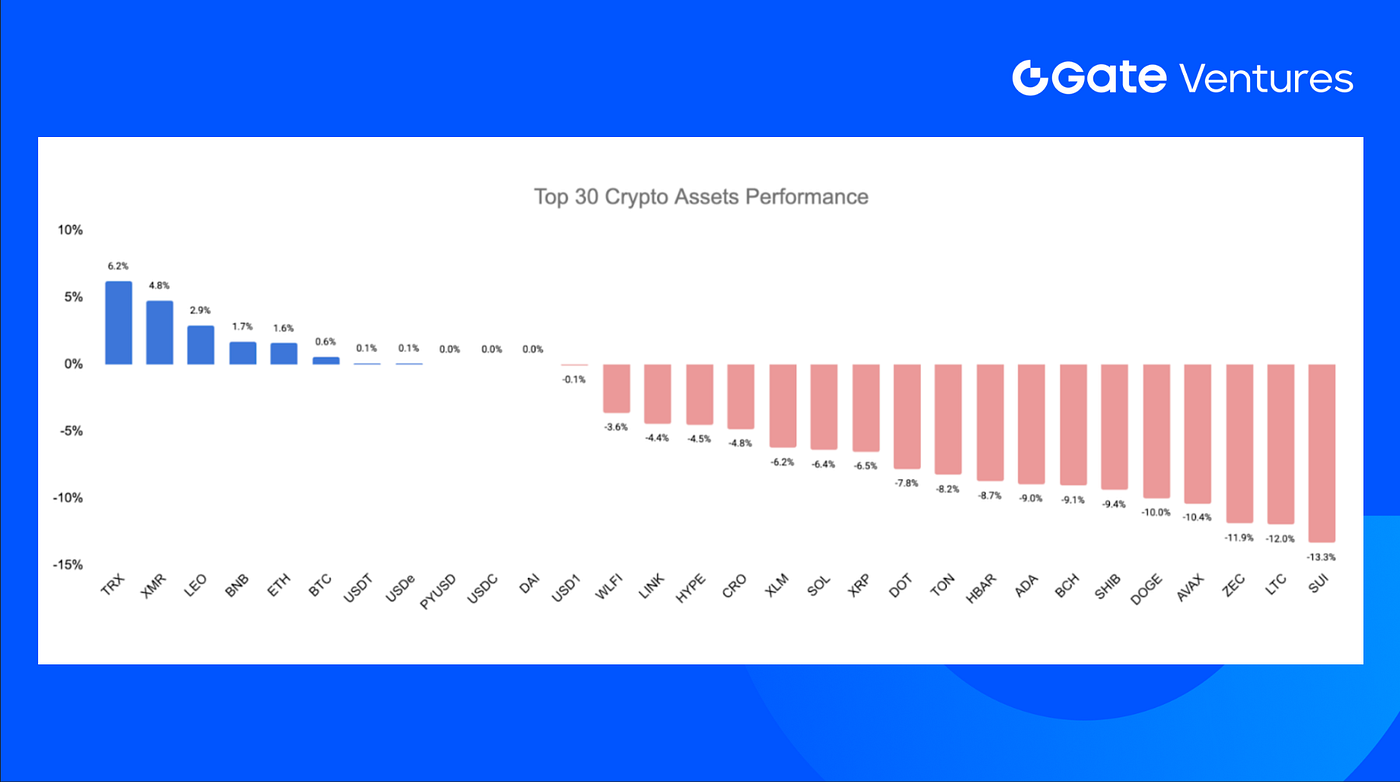

- Among the top 30 assets, prices fell 4.79% on average, with only TRX and XMR showing relatively better performance.

- WalletConnect Pay partnered with Ingenico to enable stablecoin payments at global point-of-sale checkouts, advancing real-world crypto payment adoption.

- Polygon acquired Coinme and Sequence to build a regulated, end-to-end on-chain payments stack.

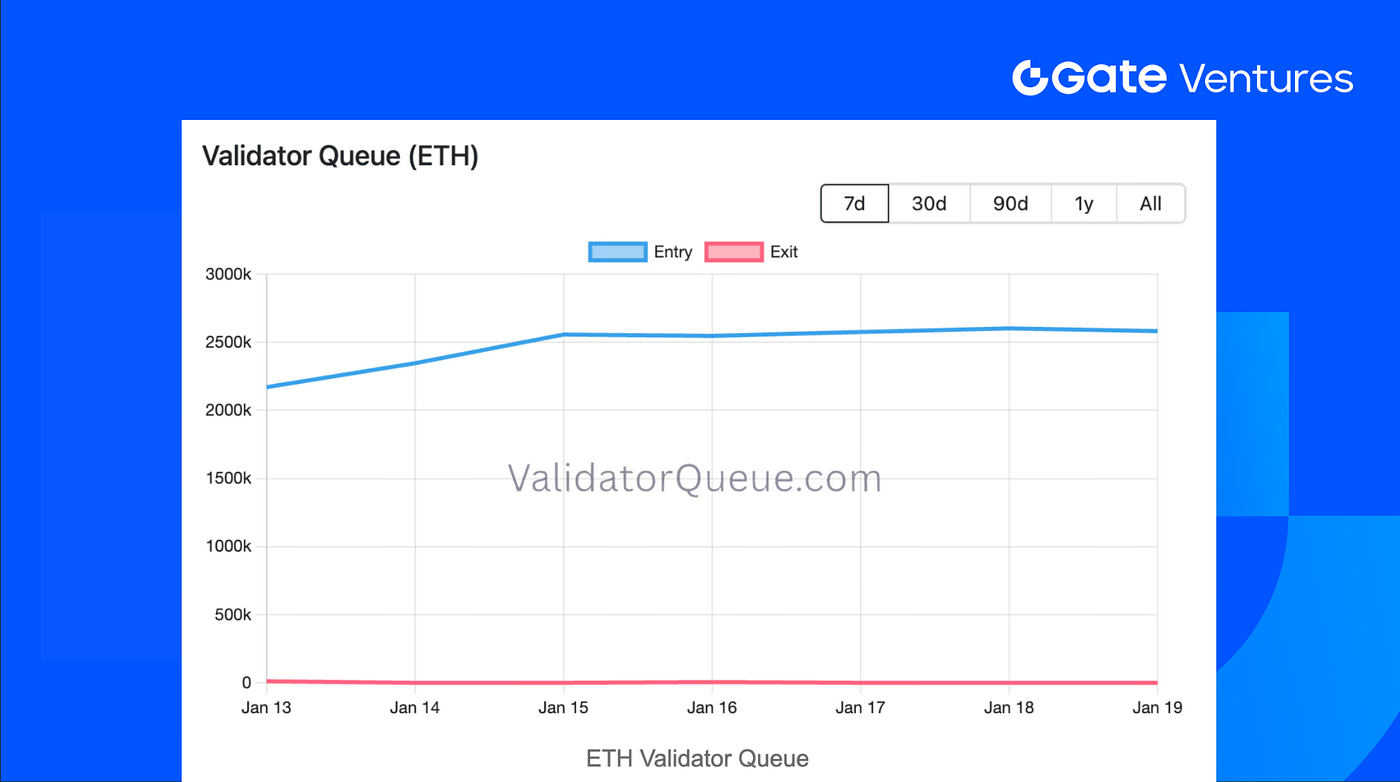

- A surge in staking activity by BitMine has led to the longest Ethereum validator entry queue since 2023, signaling renewed staking demand and network participation.

Macro Overview

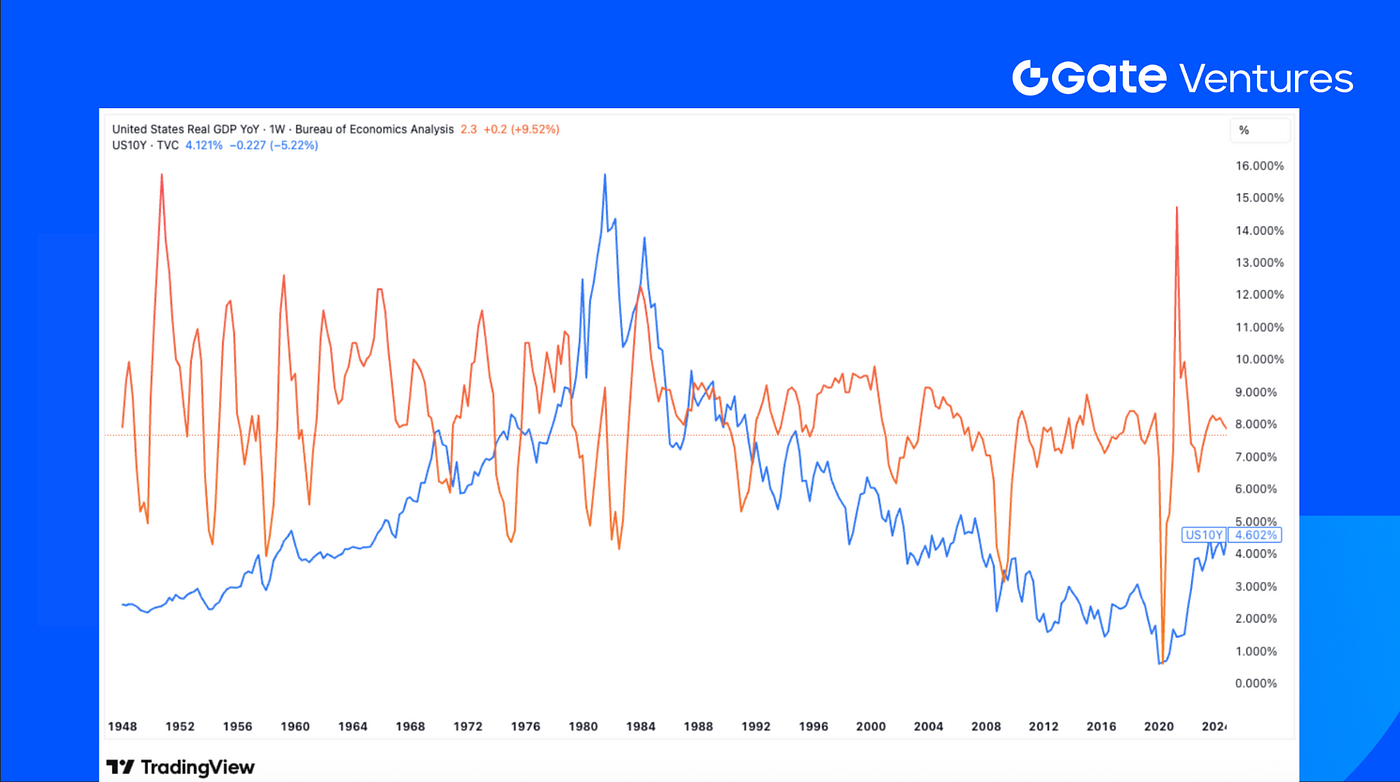

The U.S. entered a phase of financial repression in 2026, reflected in renewed mortgage-backed securities (MBS) purchases, caps on credit card interest rates, rate-cut proposals by Stephen Miran, and investigations involving Federal Reserve Chair Jerome Powell.

At the start of 2026, the United States’ process of financial repression accelerated rapidly. On January 8, the White House instructed Fannie Mae and Freddie Mac to purchase $200bn in mortgage-backed securities (MBS) to suppress housing costs, and later announced that a 10% cap on credit card interest rates would take effect for one year starting January 20. Stephen Miran, the temporary board member of the Fed nominated by Trump, proposed a 150 basis point rate cut in 2026. Meanwhile, the US Department of Justice has launched an investigation into Jerome Powell, further pressuring the Federal Reserve as a new chair nomination looms.

At the end of last year, the Federal Reserve already began regular balance sheet expansion. Since the beginning of this year, various actions have focused on interest rate control, with the possibility of evolving into yield curve control (YCC). Driven by the pressures of the midterm elections, the Trump team may introduce more policies to lower costs and stimulate the economy, including capping interest rates on consumer loans and small business loans, controlling the prices of key energy resources by increasing supply, and expanding the balance sheet further.

This week’s incoming data includes the ADP employment report, the final reading of U.S. Q3 2025 GDP, November core PCE inflation, the University of Michigan (UoM) consumer sentiment survey, personal income and spending data, and December pending home sales.

The final estimate of third-quarter GDP growth is likely to be overshadowed by the November PCE inflation release. Following the latest consumer price index (CPI) data, which showed inflation remaining subdued at 2.7% (with core inflation unchanged at 2.6%) despite the impact of tariffs, analysts will be closely watching the PCE figures for confirmation. The most recent available PCE inflation data (both headline and core), for September, stood at 2.8%. (1, 2)

US GDP Growth & 10-Year Treasury Yield, Tradingview

DXY

The US dollar index hit a six-week high last Thursday, after data showed that the number of Americans filing new applications for unemployment benefits unexpectedly fell last week. (3)

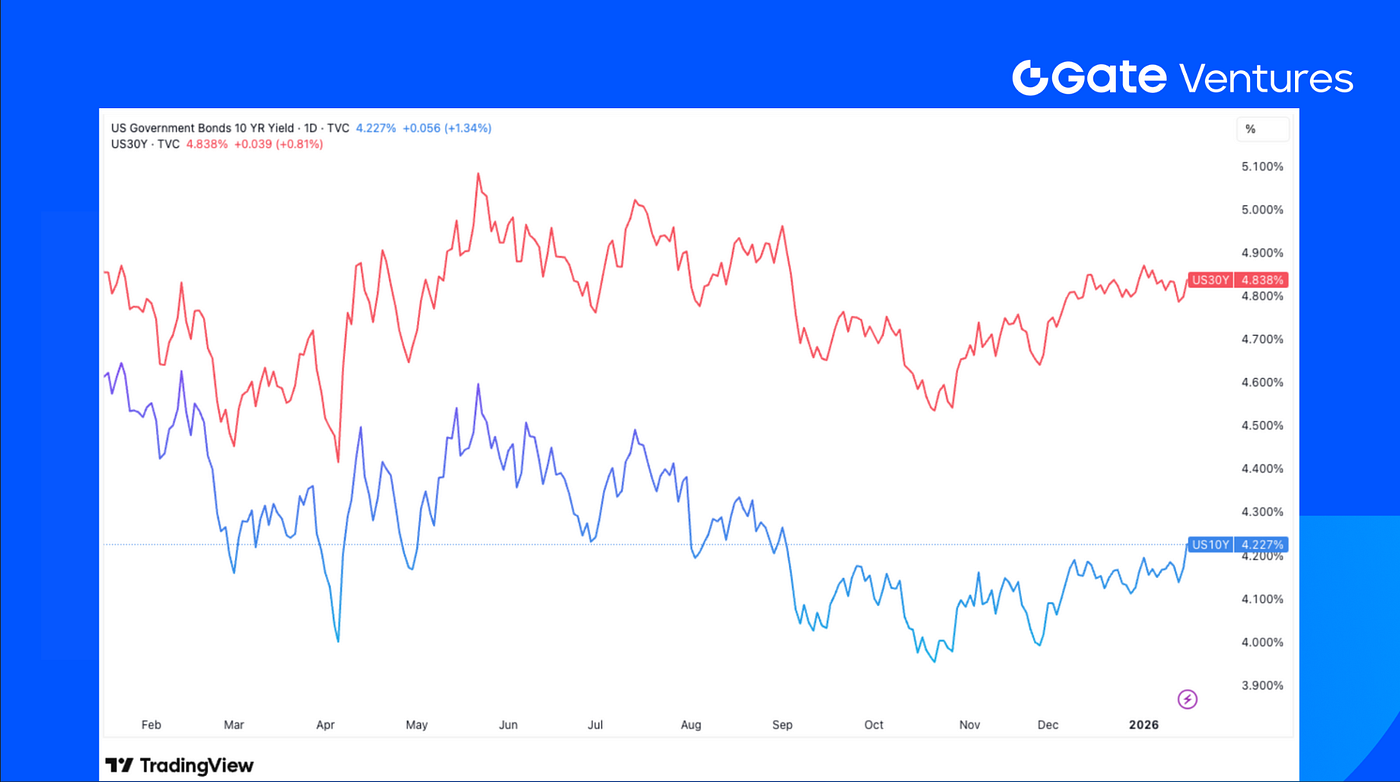

US 10-Year and 30-Year Bond Yields

The US Treasury yields rose last week, as investors were assessing the economic outlook and geopolitical tensions, while the economic data remained relatively quiet. (4)

Gold

Last week, the gold price pushed to new all-time highs, repeatedly reclaiming the $4,600 level and making a new record in midweek. The gold price pulled back last Friday as the chances on U.S. military intervention in Iran decreased. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH Validator Queue

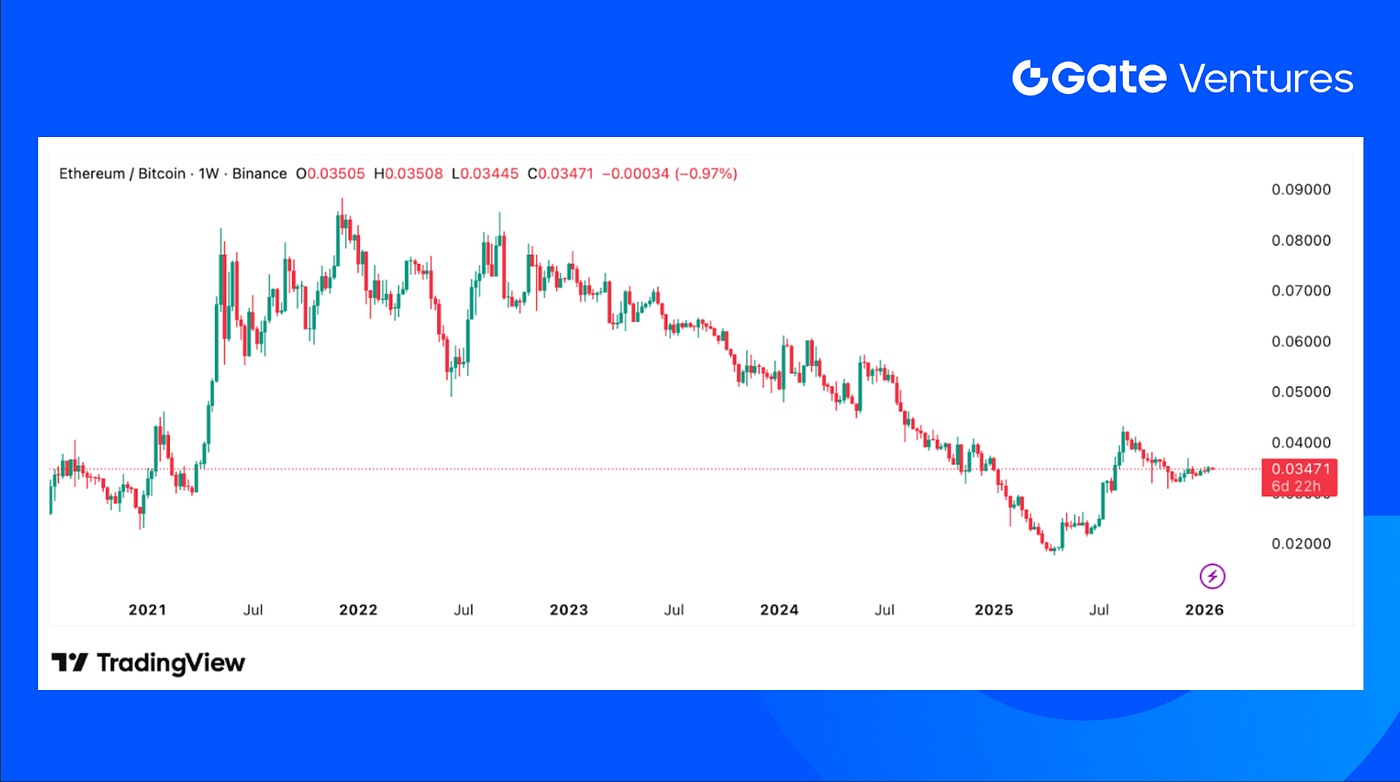

ETH/BTC Ratio

BTC rose 3.04% last week, while ETH gained 5.29%, outperforming BTC. ETF flows were strong, with $1.42B of net inflows into BTC ETFs and a record $479.04M into ETH ETFs. (6)

As of 19 Jan, the ETH validator exit queue fell to zero, while the entry queue continued to rise and remained around 2.6M, indicating strong staking demand alongside limited withdrawal pressure for ETH. (7)

The ETH/BTC ratio increased 2.13% to 0.0346, showing slightly stronger performance from ETH. Market sentiment also improved, moving from 27 to 44, though it is still in the Fear zone. (8)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap increased 2.24% last week, but gains were mainly driven by BTC and ETH. Excluding them, the market fell 0.75%, and the broader altcoin market excluding the top 10 dropped 2.32%, showing continued weakness across most alts.

The privacy coin narrative continued to show solid momentum, with names such as DASH, DUSK, and SCRT standing out as relative outperformers.

DASH benefited from concrete distribution catalysts, including Alchemy Pay’s fiat on-ramp support and a partnership with AEON Pay, enabling crypto payments at over 50 million merchants globally. (9)

DUSK’s gains were driven by execution rather than narrative, as its mainnet is live with core functionality already deployed, including DuskEVM, liquid staking, hyperstaking rewards, and an active developer environment. (10)

Hence, with the 2026 World Cup set to take place in June 2026, World Cup–related tokens such as CHZ also saw strong performance. CHZ staking is currently offering at least 18% APR, reflecting elevated market interest and hype around the narrative. (11)

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Jan, 19th 2026

Among the top 30 crypto assets by market cap, prices declined by an average of 4.79%, with only TRX and XMR showing relatively better performance.

The Key Crypto Highlights

1. WalletConnect Pay partners with Ingenico to bring stablecoin payments to global checkout

WalletConnect Pay is launching globally through a landmark partnership with Ingenico, one of the world’s most widely deployed payment terminal providers. The integration makes WalletConnect Pay available across Ingenico’s 40M+ point-of-sale terminals in 120+ countries, enabling stablecoin payments directly at everyday checkout locations. For merchants, WalletConnect Pay offers near-instant settlement, significantly lower fees than traditional card payments, 24/7 global payments, and a familiar QR-based checkout that fits existing PSP compliance frameworks. At scale, even small fee reductions can translate into millions or billions in savings, positioning stablecoins as a practical payment rail for both global enterprises and local businesses. (12)

2. Polygon acquires Coinme and Sequence to build a regulated on-chain payments stack

Polygon announced the acquisition of Coinme and Sequence, marking a strategic shift towarda vertically integrated, regulated payments infrastructure. The deals give Polygon U.S. money transmitter licenses across most states, tens of thousands of retail on/off-ramp locations, and direct control over wallets and user access. By owning the full stack, from bank accounts and compliance to wallets and on-chain settlement, Polygon is positioning itself as a core infrastructure provider for stablecoin payments, tokenized assets, and institutional-grade on-chain finance. (13)

3. BitMine staking surge createsa long Ethereum validator entry queue

A surge in staking by BitMine Immersion has pushed Ethereum’s validator entry queue to its longest since mid-2023, with 2.6M ETH waiting to be activated and an estimated ~44-day delay before rewards begin. BitMine has already staked over 1.25M ETH, with more still on its balance sheet, raising the risk of further congestion. The backlog underscores Ethereum’s validator caps for network stability and comes as institutional staking demand builds, including interest from ETF issuers like BlackRock and Grayscale, potentially delaying yield capture for large allocators entering the queue. (14)

Key Ventures Deals

1. Saturn raises $800K to build USDat, a Bitcoin-backed yield stablecoin

Saturn raised $800K from YZi Labs and Sora Ventures to build USDat, a yield-bearing stablecoin offering 11%+ returns. The protocol is built on Strategy’s STRC, using Bitcoin-backed digital credit combined with U.S. Treasury exposure to generate yield. Saturn aims to bring institutional credit on-chain, positioning USDat as a scalable DeFi stablecoin product with a long-term goal of reaching $10B+ in supply. (15)

2. Noise raises $7.1M Seed Round led by Paradigm to build attention markets

Noise completed a $7.1M seed funding round led by Paradigm, with participation from Figment Capital, Anagram, GSR, JPEG Trading, and others, to accelerate development of its “attention markets” product. Noise aims to let users trade on cultural relevance and trends, turning real-time social data into continuously priced markets. It is targeting a mainnet launch on Base in 2026, following a successful invite-only beta that showed strong early engagement. The financing will support building trading infrastructure and preparing for public launch. (16)

3. Alpaca raises $150M Series D to scale global brokerage infrastructure

Alpaca announced a $150 million Series D funding round led by Drive Capital, valuing the company at $1.15 billion and securing a $40 million credit line to strengthen its balance sheet. The raise attracted broad investor participation, including Citadel Securities, Kraken, and Opera Tech Ventures. Alpaca’s APIs and self-clearing custody enable partners to offer equities, options, crypto, and other assets, and the new capital will be used to expand global investment infrastructure, support regulatory licensing in key jurisdictions, and advance institutional-grade trading capabilities. (17)

Ventures Market Metrics

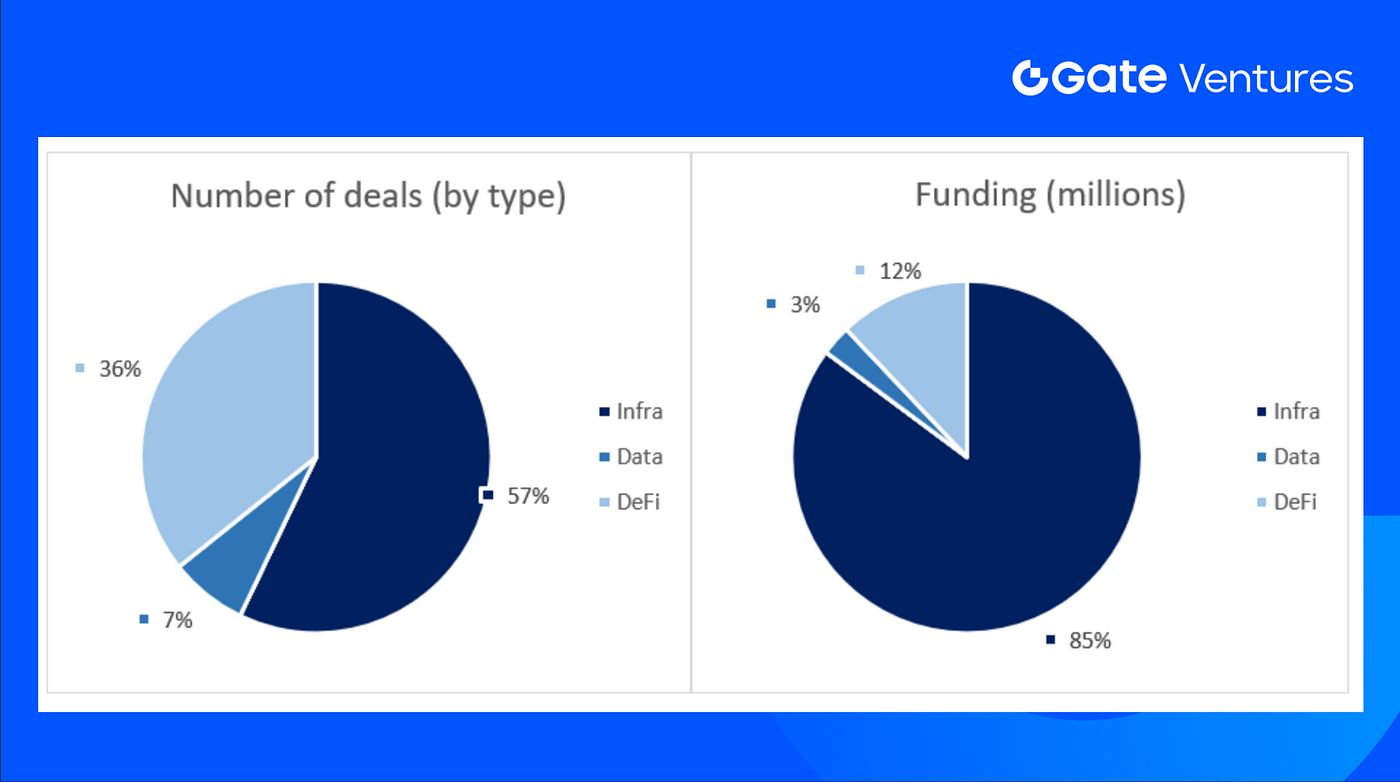

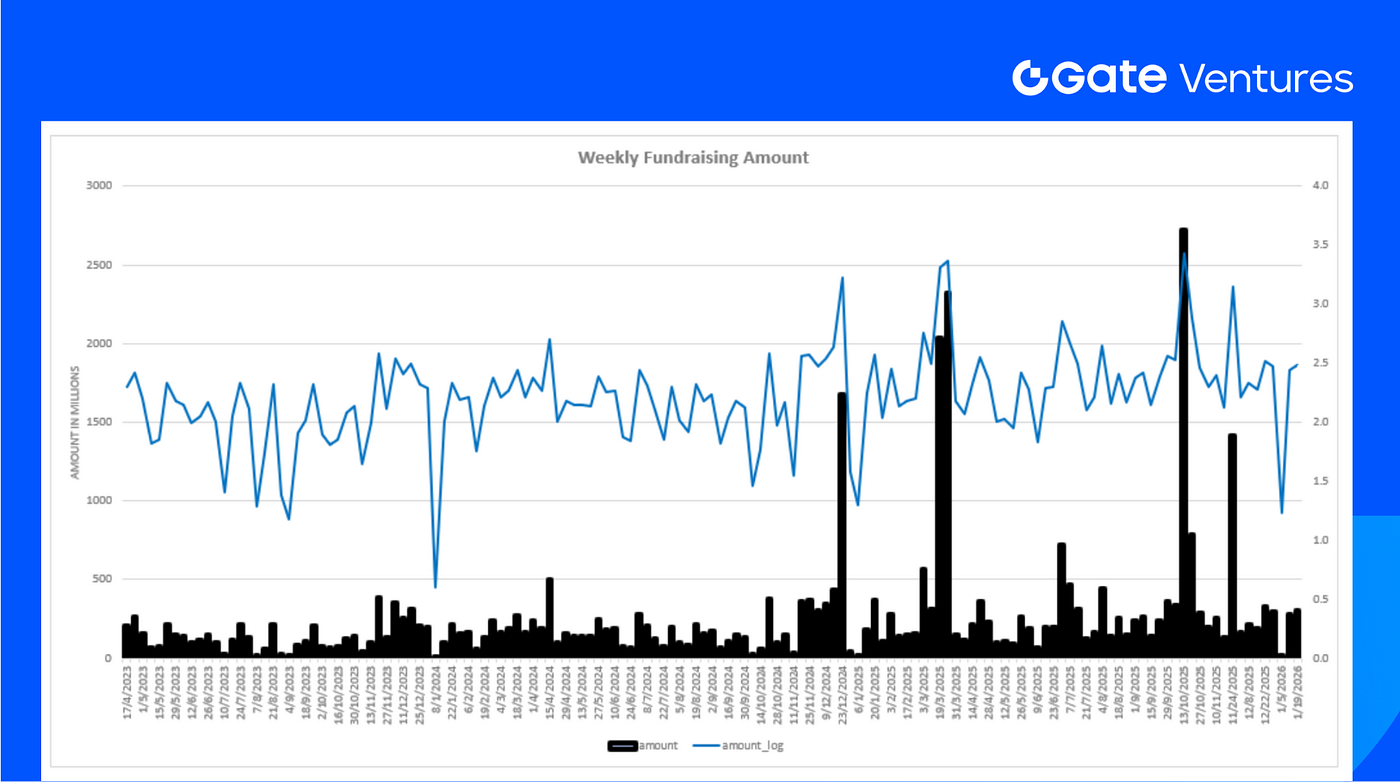

The number of deals closed in the previous week was 14, with Infra having 8 deals, representing 57% of the total number of deals. Meanwhile, DeFi had 5 deals (37%), and Data had 1 deal (7%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 19th Jan 2026

The total amount of disclosed funding raised in the previous week was $288.9M, 2 deals in the previous week didn’t announce the raised amount. The top funding came from the Infra sector with 246M. Most funded deals: LMAX Digital ($150M), Upexi ($36M).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 19th Jan 2026

Total weekly fundraising rose to $288.9M for the 3rd week of Jan-2026, an increase of 5% compared to the week prior.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Week Ahead Economic Preview, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-19-january-2026.html

- US GDP Growth & 10-Year Treasury Yield, Tradingview, https://www.tradingview.com/chart/QOz7i3JC/?symbol=ECONOMICS%3AUSGDPQQ

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Ethereum Validator Queue, https://www.validatorqueue.com/

- DASH Payment Integration, https://coinmarketcap.com/community/articles/696a6f402492a24f980612fe/

- DUSK Network Mainnet Live, https://coinmarketcap.com/community/articles/696b503fa167f654ea1b1f00/

- Chiliz Chain Staking, https://governance.chilizchain.com/staking

- WalletConnect Pay Partnership with Ingenico, https://x.com/Houlgrave/status/2012208491578950089

- Polygon Acquisition on Coinme and Sequence,https://polygon.technology/blog/polygon-labs-to-acquire-coinme-and-sequence-to-offer-regulated-stablecoin-payments-in-the-u-s

- BitMine staking surge creates long Ethereum validator entry queue,https://www.coindesk.com/tech/2026/01/16/tom-lee-s-bitmine-immersion-pushes-the-ethereum-staking-network-into-usd8-billion-backlog

- Saturn raises $800K to build USDat, a Bitcoin-backed yield stablecoin, https://bitcoinmagazine.com/press-releases/saturn-raises-800k-from-yzi-labs-and-sora-ventures-to-build-usdat-a-11-yield-bearing-stablecoin-protocol-backed-by-strategys-digital-credit

- Noise raises $7.1M seed round to build attention markets,https://www.noise.xyz/news/noise-raises-7-1m-seed

- Alpaca raises $150M Series D to scale global brokerage infrastructure,https://alpaca.markets/blog/alpaca-raises-150-million-at-a-1-15b-valuation-to-build-the-global-standard-for-brokerage-infrastructure/

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)