Gate Ventures Weekly Crypto Recap (January 26, 2026)

TL;DR

- The Bank of Japan maintains policy rate at 0.75% amid hawkish tone and raised economic outlook with the recovery of economies.

- This week’s incoming data includes Fed FOMC decision, December PPI, balance of trade, factory orders, housing data, etc.

- Crypto markets weakened notably last week, with BTC down 7.5% and ETH down 14.3%. ETF outflows accelerated, with $1.33B leaving BTC ETFs and $611M exiting ETH ETFs.

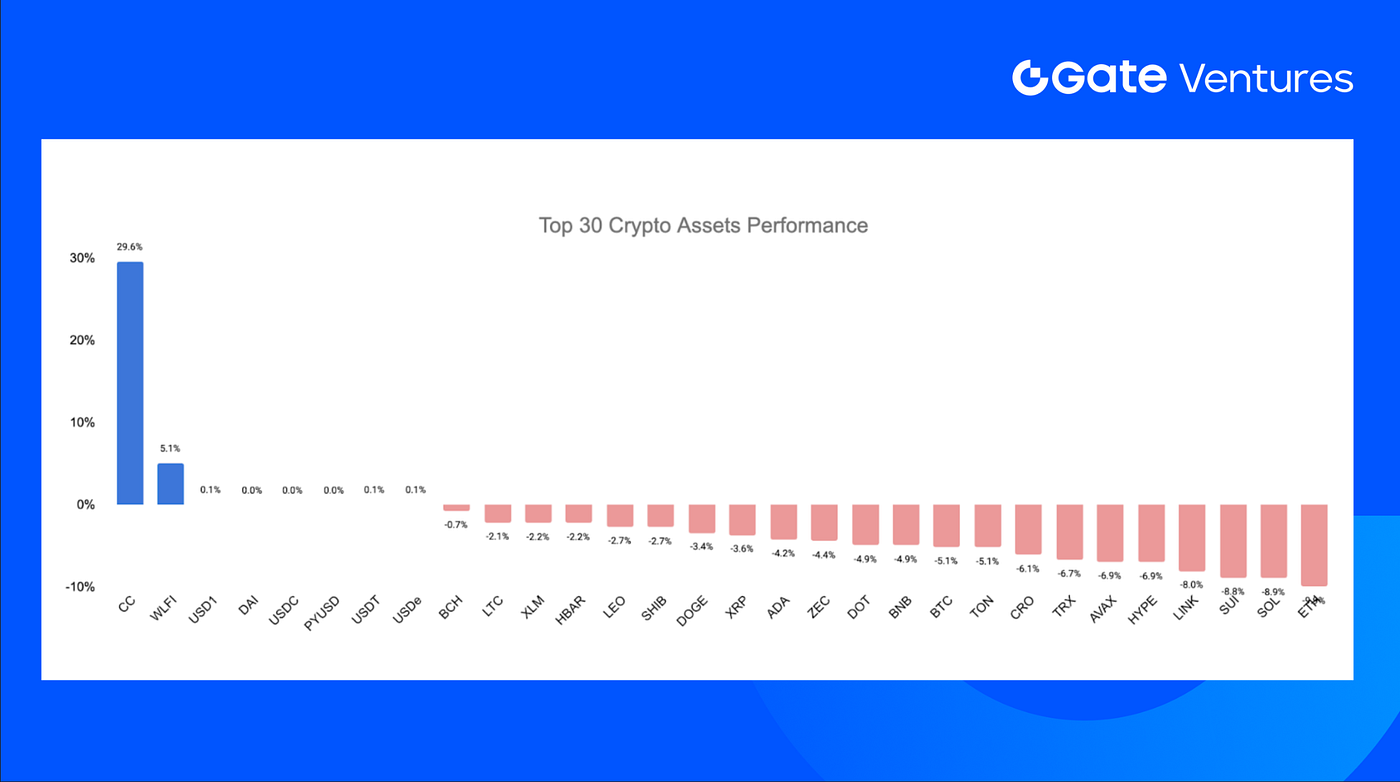

- Among the top 30 crypto assets, prices fell 3.23% on average, with only Canton Network (CC) and WLFI posting gains.

- CC surged 29.6% on renewed interest in the RWA-on-chain narrative and progress on its institutional roadmap, while WLFI rose 5.1% supported by SpaceCoin-related incentives and a Binance reward campaign.

- U.S. pauses CLARITY Act, reigniting DeFi governance and self-custody debate

- Superstate raises $82.5M Series B to expand on-chain equity issuance infrastructure

- Nasdaq has filed a rule change with the U.S. SEC to remove position limits on options tied to spot Bitcoin and Ether ETFs

Macro Overview

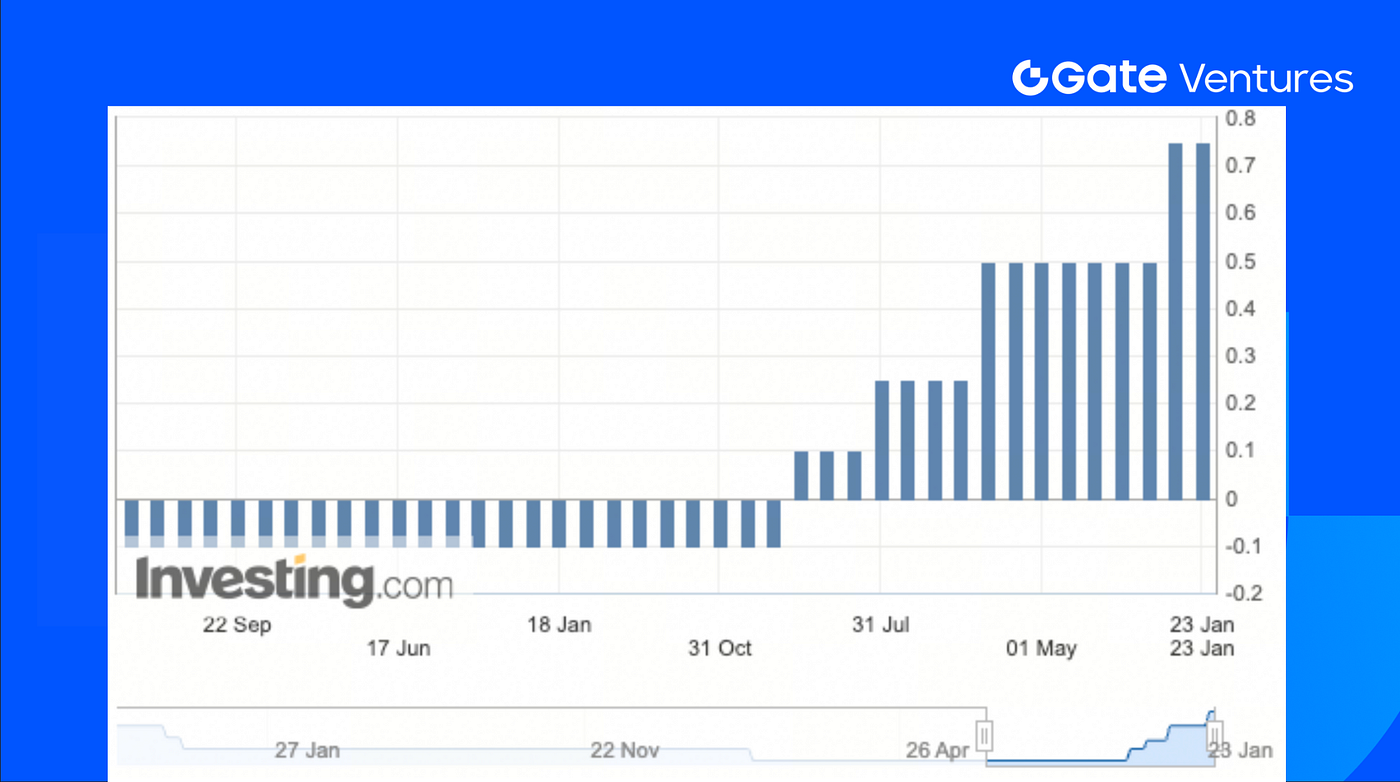

The Bank of Japan maintains policy rate at 0.75% amid hawkish tone and raised economic outlook with the recovery of economies.

On January 23, the Bank of Japan (BOJ) announced, as expected, that it would keep the policy rate unchanged at 0.75%. At the same time, it raised its economic growth and inflation forecasts for fiscal year 2026 and highlighted upside inflation risks. While the overall tone was hawkish, the BOJ did not provide a specific rate hike path. There were internal disagreements over the pace of rate hikes. Hawkish officials argued that Japan faces upside risks to inflation, and they supported a rate hike at this meeting. The BOJ’s statement continued to emphasize that the current real interest rate remains significantly negative and maintained its forward guidance that “further rate hikes will occur if economic data aligns with expectations.” Following the meeting, the Japanese Ministry of Finance may conduct a “rate check” on the yen, which led to a sharp appreciation of the currency.

With the recovery of overseas and domestic economies, the support of fiscal stimulus and accommodative financial conditions, the BOJ is optimistic about economic growth in 2026. The BOJ raised its 2026 GDP growth forecast by 0.3 pps to 1%, and it expects economic growth to accelerate by 0.1 pps compared to 2025. Japan’s real interest rate remains at low levels, indicating that the BOJ is still significantly lagging behind the yield curve. Recently, Japanese Prime Minister Sanae Takaichi announced the dissolution of the House of Representatives. To boost the chances of winning, Takaichi announced a potential two-year suspension of the food consumption tax, which would provide an additional 0.8% fiscal expansion to GDP. If this policy is implemented, it could increase Japan’s potential inflationary pressure and bring forward the BOJ’s timeline for rate hikes.

This week’s incoming data includes Fed FOMC decision, December PPI, balance of trade, factory orders, housing data, Chicago Fed National Activity Index, and Dallas and Richmond Fed Manufacturing Index. Although the FOMC decision is coming soon, no change is expected to set US interest rates. Having already cut three times late last year, there’s a widespread expectation that policymakers will hold rates steady at 3.5–3.75% as they assess the outlooks for growth, inflation and employment. US economic data on durable goods orders, factors orders, consumer sentiment, housing market and producer prices, as well as several regional manufacturing surveys, will provide insights into US economic trends.(1, 2)

Japan Interest Rate Decision, Investing.com

DXY

The US dollar index experienced its worst week in 8 months, as the spillover effect of the US government policies continues to strike foreign relations, tariff predictions and foreign investors’ confidence. (3)

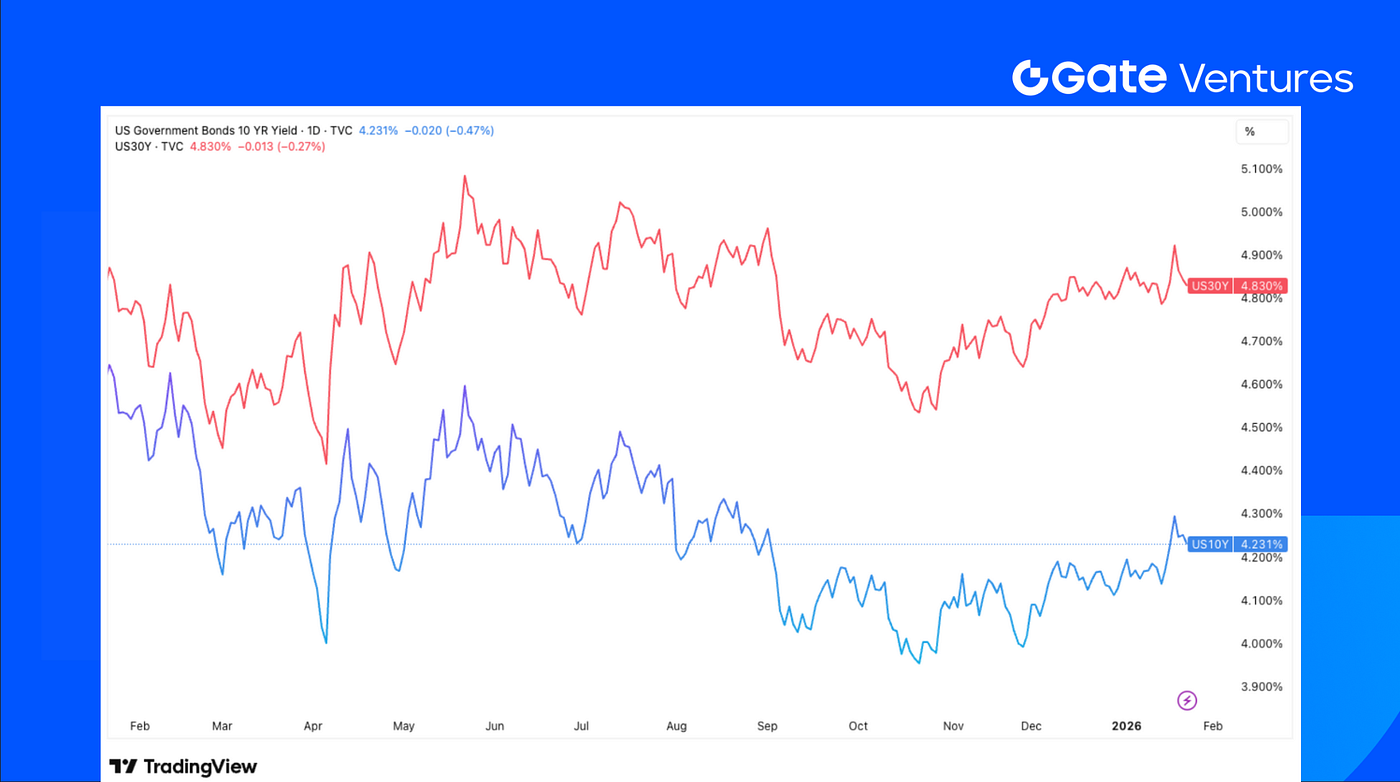

US 10-Year and 30-Year Bond Yields

The US Treasury yields spiked earlier last week as the US-Europe tension escalated on Greenland issues and tariff threats, and Danish pension operator AkademikerPension exiting US Treasuries sparked concerns over Europe investors’ confidence in the US assets. (4)

Gold

Last week the gold price pushed to new all-time highs, reaching the historical level of $5,000/oz. The retail investors and momentum driven buying added to the increasing demands for precious and industrial metal. (5)

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

Crypto markets had a rough week. BTC fell 7.48% and ETH dropped 14.28%, with ETH seeing much heavier selling. Selling pressure was reinforced by heavy ETF redemptions: BTC ETFs recorded a $1.33B net outflow, the second-largest weekly outflow in their history, while ETH ETFs saw a record $611.17M net outflow. (6)

Notably, the average cost basis of BTC ETF holders is around $84,099, a level that has historically acted as an important support zone. Overall, sentiment turned very bearish, with the Fear & Greed Index back in “extreme fear” at 20. (7) (8)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

The total crypto market cap fell about 8%, while the market excluding BTC and ETH declined 6.1%, showing broad-based weakness beyond the majors. Altcoins outside the top 10 were also hit hard, with their combined market cap down 6.62%.

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Jan, 26th 2026

Across the top 30 cryptocurrencies by market cap, prices fell 3.23% on average, with only WLFI and Canton Network (CC) posting gains.

CC surged 29.6%, driven by growing market interest and expectations around RWA moving on-chain, which sits at the core of its narrative. For Canton Network roadmap development, Temple Digital Group launched a private, institutional trading platform on Canton, offering 24/7 digital asset trading, reinforcing confidence in the network’s institutional roadmap. (9)

WLFI climbed 5.1%, driven by its exposure to SpaceCoin. SpaceCoin’s announcement of the SPACE airdrop, phased unlock, and staking program directly benefits World Liberty Financial, as WLFI holders are eligible via the prior token swap and can earn staking yield, strengthening WLFI’s product appeal and user engagement. In addition, Binance launched a USD1 holding campaign with up to $40M in WLFI rewards, providing a strong near-term demand catalyst. (10) (11)

The Key Crypto Highlights

1. BitGo advances toward IPO as demand grows for regulated crypto custody and infrastructure

BitGo made its public market debut, valuing the crypto custodian at $2.59B and marking the first crypto IPO of 2026. Positioned as a regulated digital-asset infrastructure provider rather than a token-levered play, BitGo reported $35.3M net income in the first nine months of 2025. Regulatory momentum has also improved: last month, BitGo received approval from a top U.S. banking regulator to convert its state trust bank charter to a national charter, enabling nationwide operations. (12)

2. U.S. pauses CLARITY Act, reigniting DeFi governance and self-custody debate

U.S. lawmakers have paused the CLARITY Act, reopening debate over how DeFi should be regulated. Crypto firms including Paradigm and Variant warn the bill still leaves ambiguity around whether DeFi developers and infrastructure could be subject to KYC or centralized compliance rules. The delay followed public criticism from Brian Armstrong, as pressure mounts on regulators to better protect self-custody and avoid misclassifying decentralized activity. (13)

3. Nasdaq moves to lift position limits on BTC, ETH ETF options

Nasdaq has filed a rule change with the U.S. Securities and Exchange Commission to remove position limits on options tied to spot BTC and ETH ETFs, eliminating the current 25,000-contract cap. The SEC waived the standard 30-day waiting period, allowing the change to take effect immediately while retaining the right to suspend it within 60 days. Nasdaq argues the move aligns crypto ETF options with other commodity-based funds and removes unequal treatment without weakening investor protections. The proposal covers ETF options from issuers including BlackRock, Fidelity, Grayscale, ARK 21Shares, VanEck, and Bitwise. (14)

Key Ventures Deals

1. Superstate raises $82.5M Series B to expand onchain equity issuance infrastructure

Superstate completed an $82.5 million Series B funding round led by Bain Capital Crypto and Distributed Global, with participation from Galaxy Digital, Bullish, ParaFi, and others. The company plans to use the capital to expand beyond tokenized Treasury offerings into a broader issuance layer for SEC-registered equities on Ethereum and Solana. Superstate operates as an SEC-registered transfer agent through its Opening Bell platform, enabling public companies to issue and sell tokenized shares directly to investors via stablecoins. (15)

2. River secures $8M strategic investment from TRON to build cross-chain stablecoin infrastructure

River announced an $8 million strategic investment from Maelstrom Capital, The Spartan Group, and TRON to support deployment of chain-abstract stablecoin infrastructure. The funding will accelerate deep integration with DeFi protocols on TRON, enhancing the network’s stablecoin liquidity capacity and cross-chain capital introduction efficiency. River’s satUSD protocol allows users to deposit assets like wBTC, ETH, and BNB from EVM ecosystems and receive satUSD on TRON, providing smoother access to TRON’s native lending, trading, and yield opportunities. (16)

3. Bitway secures $4.444M seed round to build DeTraFi-native yield infrastructure

Bitway announced a $4.444 million seed round led by TRON DAO, with participation from HTX Ventures, building on an earlier lead investment by YZi Labs via EASY Residency, alongside strategic investors and angels. The funding will accelerate Bitway Earn’s rollout as a DeTraFi (Decentralized + Traditional Finance) yield gateway, combining institutional-grade risk management with on-chain transparency and start with market-neutral strategies executed on Binance. Natively integrated with Binance Wallet, Bitway Earn enables users to deposit stablecoins on BNB Chain, receive yield-bearing vault tokens (e.g., bwUSDT), and access diversified, risk-managed yields with flexible unstaking. (17)

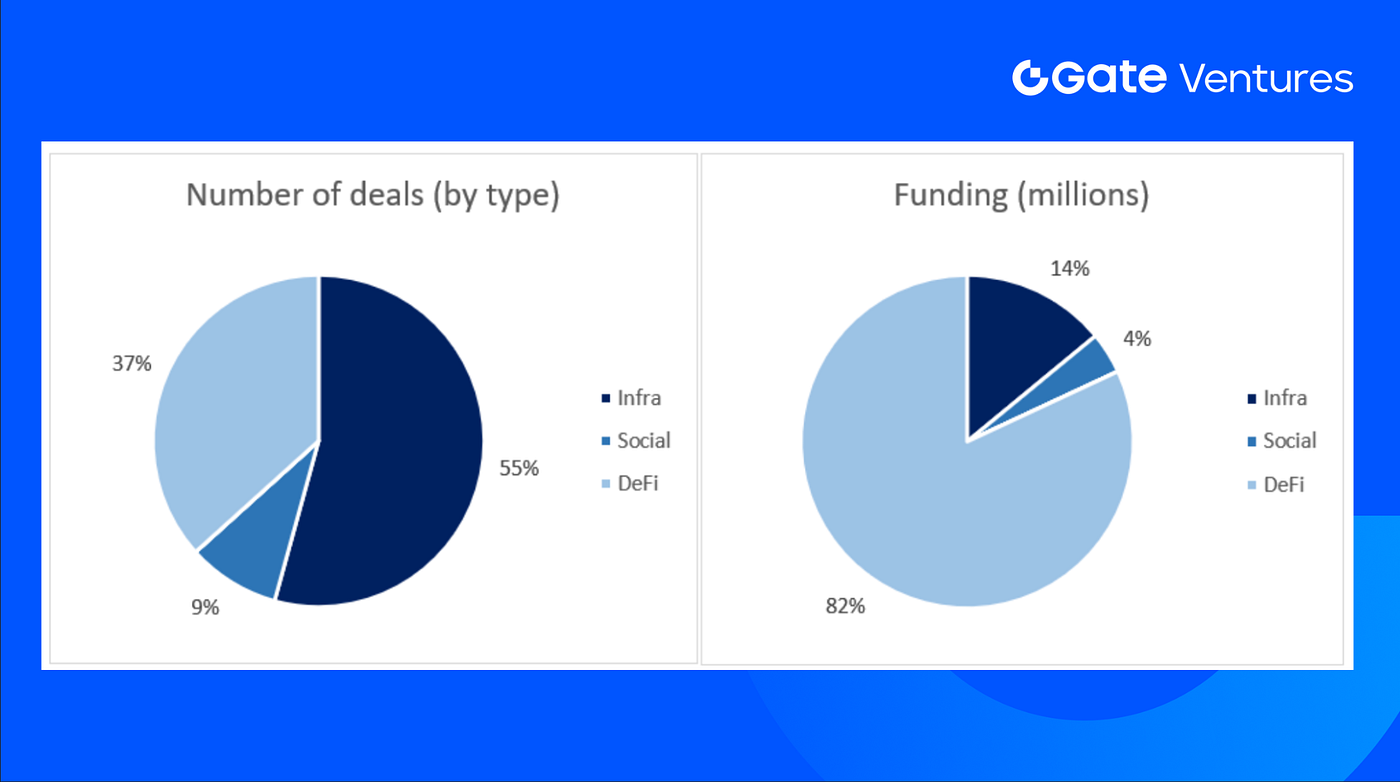

Ventures Market Metrics

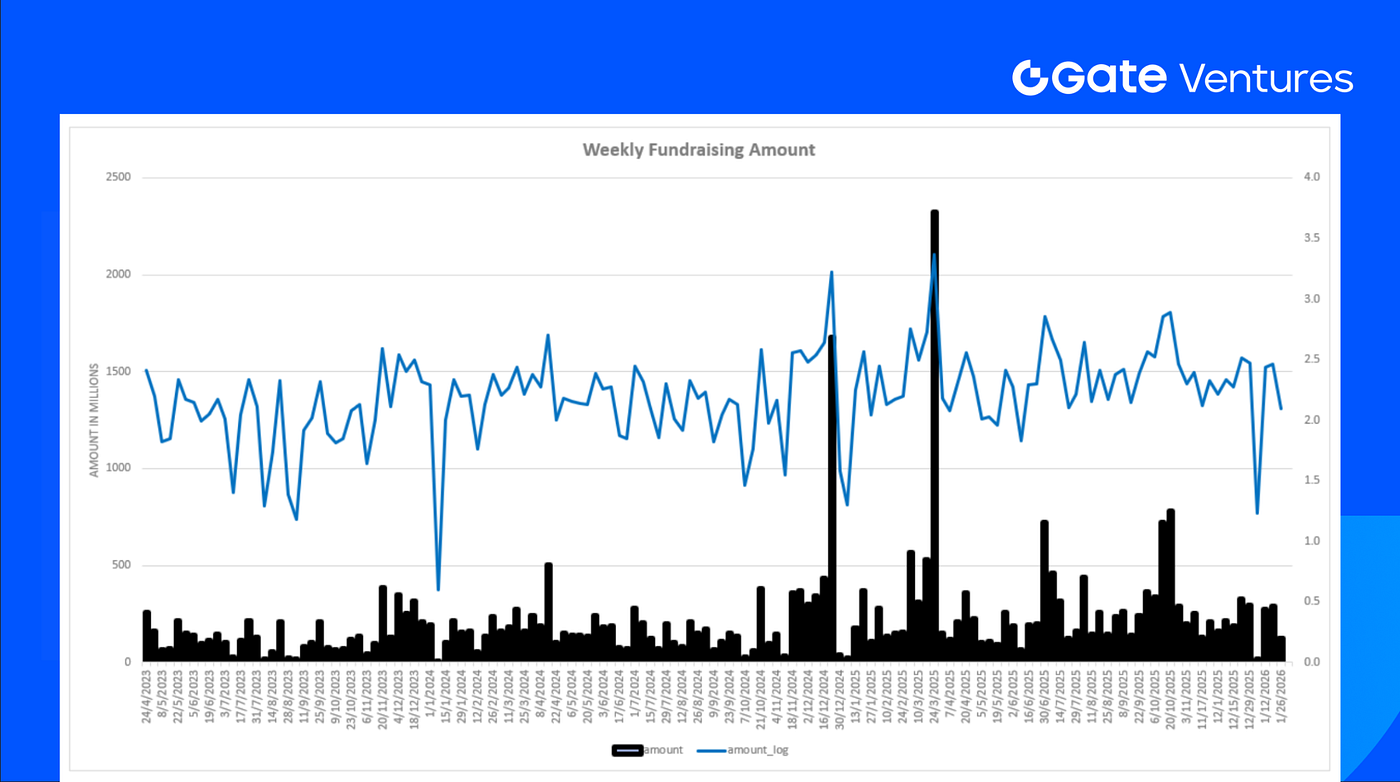

The number of deals closed in the previous week was 11, with Infra having 6 deals, representing 55% of the total number of deals. Meanwhile, DeFi had 4 deals (37%), and Social had 1 deal (9%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 26th Jan 2026

The total amount of disclosed funding raised in the previous week was $124.1M, 1 deal in the previous week didn’t announce the raised amount. The top funding came from the DeFi sector with $101.7M. Most funded deals: Superstate ($82.5M).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 26th Jan 2026

Total weekly fundraising declined to $124.1M for the 4th week of Jan-2026, a decrease of 57% compared to the week prior.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Week Ahead Economic Preview, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-19-january-2026.html

- Japan Interest Rate Decision, Investing.com, https://www.investing.com/economic-calendar/interest-rate-decision-165

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC ETF Holder Average Cost, https://www.coindesk.com/markets/2026/01/23/u-s-bitcoin-etf-outflows-largest-since-november-may-signal-imminent-price-rebound

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Canton Network Roadmap Update, https://coinmarketcap.com/community/articles/696fc360adbf5f01ae10f65e/

- WLFI Spacecoin Partnership, https://coinmarketcap.com/community/articles/697459887273cc310cf1f070/

- USD1 campaign on Binance, https://www.msn.com/en-us/money/other/hold-usd1-on-binance-to-earn-wlfi-rewards-from-40m-pool/ar-AA1USSkW?ocid=finance-verthp-feeds

- BitGo debuts with $2.59 billion valuation as crypto IPO window reopens https://www.reuters.com/business/crypto-custody-firm-bitgos-shares-jump-246-nyse-debut-2026-01-22/

- U.S. pauses CLARITY Act, reigniting DeFi governance and self-custody debatehttps://cointelegraph.com/news/defi-crypto-bill-delay-governance-self-custody-finance-redefined

- Nasdaq moves to lift position limits on Bitcoin, Ether ETF options https://cointelegraph.com/news/nasdaq-position-limits-bitcoin-ether-etf-options

- Superstate raises $82.5M to build blockchain-based IPO issuance platformhttps://cointelegraph.com/news/superstate-raises-82m-tokenized-capital-markets

- River secures $8M strategic investment from TRON to build cross-chain stablecoin infrastructure https://x.com/RiverdotInc/status/2014596762846253130?s=20

- Bitway secures $4.444M seed round to build DeTraFi-native yield infrastructure https://x.com/BitwayOfficial/status/2013463859089285447?s=20

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)