Gold and Silver Hit Record Highs as Gate Precious Metals Perpetual Contracts Enter a Key Trading Window

1. Gold and Silver Hit New Highs as Trading Demand Shifts

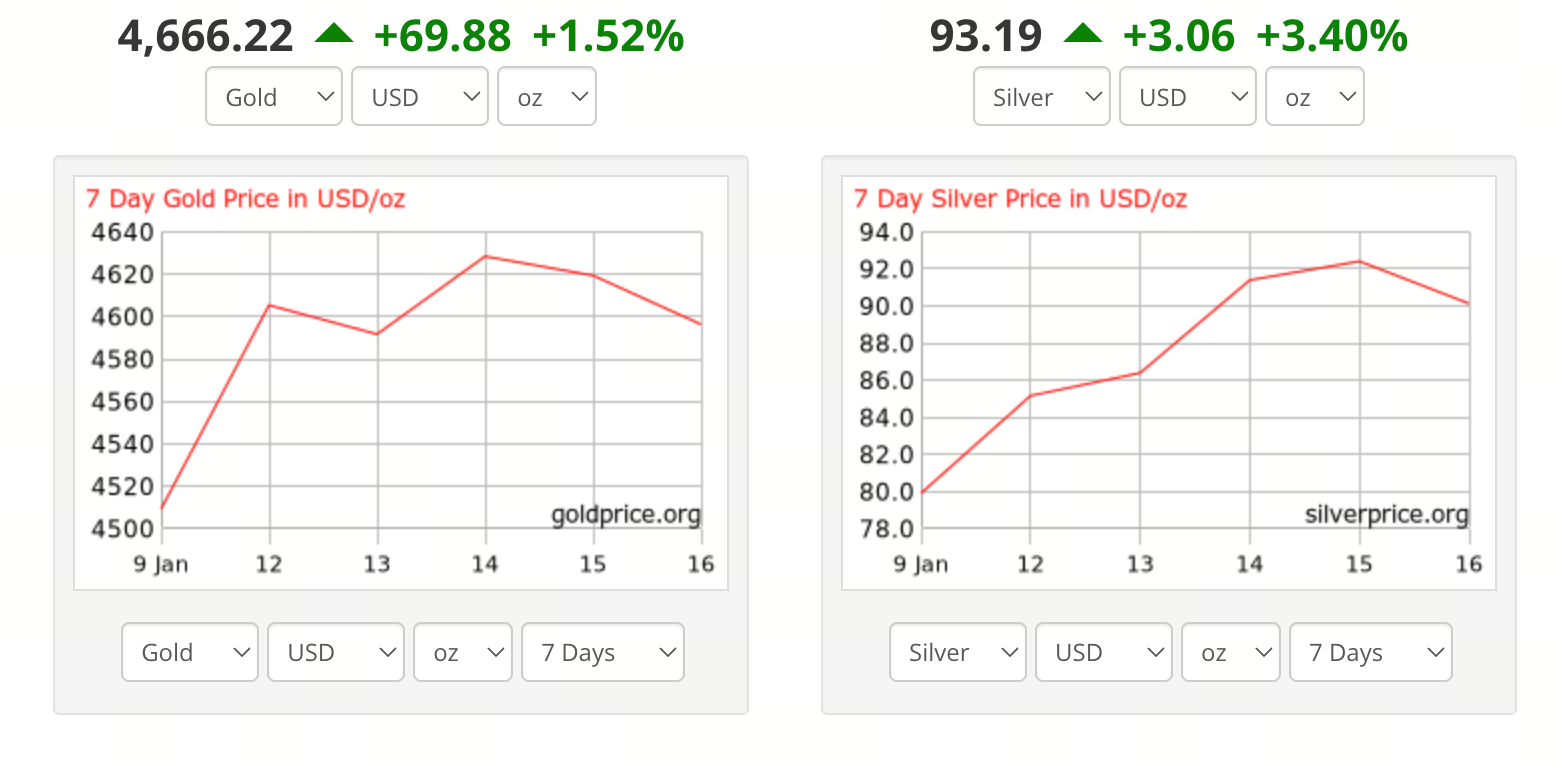

Source: https://goldprice.org/

Since 2026, gold and silver have maintained strong price momentum, both setting record highs in January. This rally stands apart from previous cycles by attracting not only traditional safe-haven capital but also drawing increased attention from crypto traders to precious metal assets.

When prices reach elevated levels, market demand shifts away from simple “long-term holding” toward swing trading, hedging, and risk management. This changing dynamic sets the stage for Gate’s launch of its dedicated perpetual contracts section for precious metals.

2. Why Gate Is Introducing Precious Metals Contracts at New Highs

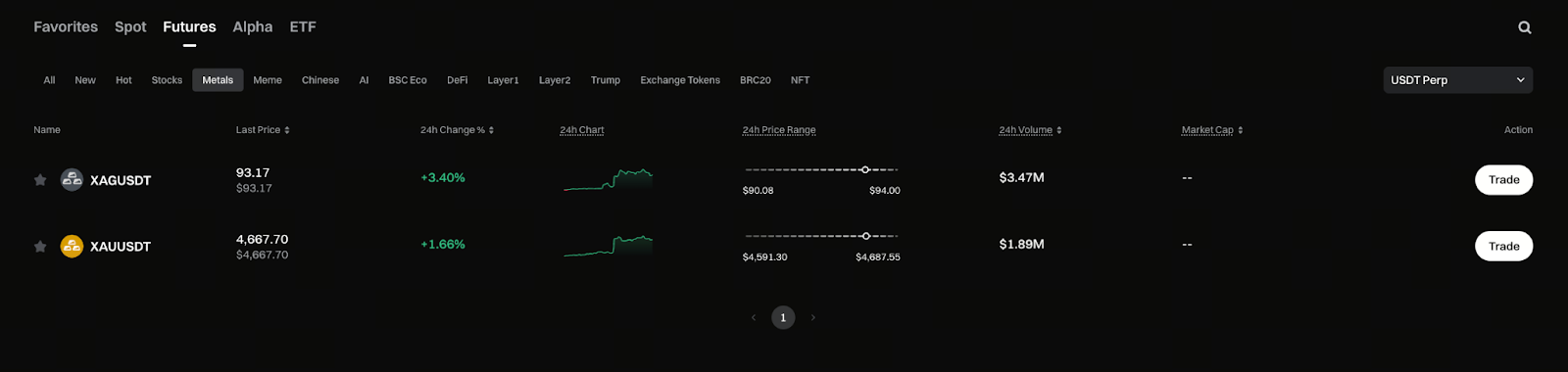

Source: https://www.gate.com/price/futures/category-metals/usdt

From a product logic perspective, periods of high volatility are when derivatives see peak demand. Gate’s decision to launch perpetual contracts for gold and silver during such active market phases is driven by three key goals:

- Deliver trading tools that respond to price swings, not just a single long-only approach

- Enable round-the-clock trading, overcoming traditional market hour limitations

- Apply Gate’s mature contract risk management framework to classic safe-haven assets

This is not a fleeting trend, but a strategic step in Gate’s ongoing expansion of its TradFi product portfolio.

3. How Gate’s Precious Metals Perpetual Contracts Solve Key Issues

Compared with traditional precious metal trading, Gate’s perpetual contracts offer a user experience designed for crypto traders.

- Contracts are settled in USDT, eliminating the need for physical delivery or foreign currency, which reduces operational complexity.

- Trading is available 24/7, allowing users to adjust positions instantly in response to macro events or sudden market moves.

- An index-based pricing mechanism helps mitigate the impact of single-market volatility on contract pricing, enhancing stability.

These innovations shift precious metals trading from “passive holding” to “active management.”

4. Who Benefits from Precious Metals Contracts on Gate

Gate’s precious metals perpetual contracts are designed for more than just traditional precious metal investors.

- Contract traders gain access to gold and silver—assets with low correlation to the crypto market

- Asset allocators can use them to hedge against sharp swings in crypto prices

- Short-term traders benefit from increased liquidity and volatility in highly watched markets

As gold and silver reach new highs, these needs will only intensify.

5. Gate’s Strategic Move in TradFi × Crypto Integration

The precious metals section marks a major milestone in Gate’s TradFi strategy, not its conclusion. By bringing gold and silver into a standardized perpetual contract format, Gate is building a unified derivatives trading ecosystem that spans both crypto and traditional assets.

For users, this means they can execute trades, hedges, and strategies within a single platform instead of switching between multiple services. For Gate, it’s a critical step toward becoming a comprehensive global trading infrastructure.

6. Conclusion: Tools Matter More Than Market Trends

Whether gold and silver continue to reach new highs will depend on macro conditions and market sentiment. What’s clear is that as prices and volatility remain elevated, the importance of effective trading tools is growing.

With perpetual contracts for precious metals, Gate equips users to navigate complex market environments and gives traditional safe-haven assets new relevance in the crypto space.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About