Gold and Silver Hit Record Highs in January 2026: Rising Safe-Haven Demand Fuels Surge in Gate TradFi Precious Metals Futures Trading

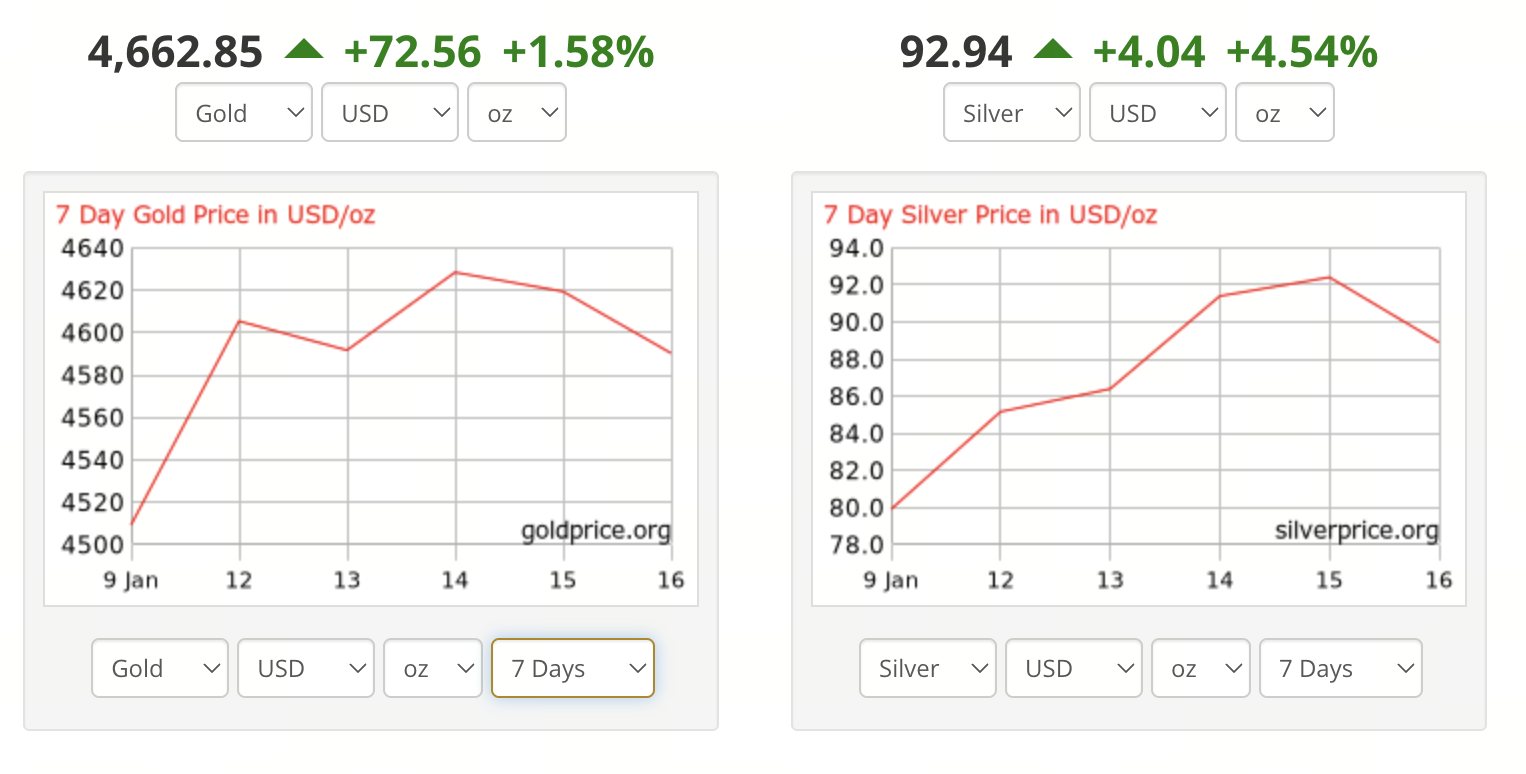

Image source: https://goldprice.org/

On January 19, the international precious metals market experienced a powerful breakout. Silver set a new all-time high at $93.69 per ounce, jumping more than 4% in a single day. Gold also surged, climbing 2% to $4,690 per ounce and establishing a fresh record high. This marks one of the most significant events in the precious metals market this year.

Global Safe-Haven Demand Fuels Precious Metals

Global markets have recently faced a wave of uncertainty—including renewed Middle East tensions, mixed U.S. economic data, and concerns over slowing global growth—driving a rise in safe-haven demand. As risk asset volatility intensifies, commodities, and especially precious metals, have become a focal point for capital reallocation.

Core Drivers Behind Silver’s Record Rally

Silver’s ascent has outpaced gold, fueled by higher expectations for industrial demand, including ongoing expansion in the new energy and photovoltaic sectors. Early positioning by some funds in silver ETFs has also supported spot price gains.

From a technical perspective, silver has broken through multiple key resistance levels. The combined influence of high-frequency trading and CTA strategies has accelerated the price surge.

Gold Nears $4,700: Market Logic and Institutional Outlook

Gold’s rally is primarily driven by traditional factors:

- Expectations that the Federal Reserve will cut rates multiple times this year

- Declining U.S. Treasury yields

- Rising geopolitical uncertainty

Many institutions see further upside for gold in the medium term, with some investment banks raising their price targets above $5,000 per ounce.

Macro Backdrop: Geopolitics, Rate-Cut Expectations, and Dollar Volatility

The surge in precious metals comes amid signals of a shift in global monetary policy. Even though the Federal Reserve has not fully committed to a rate-cut path, markets are already pricing in an easing cycle. As the Dollar Index retreats from its highs, both gold and silver are attracting increased capital inflows.

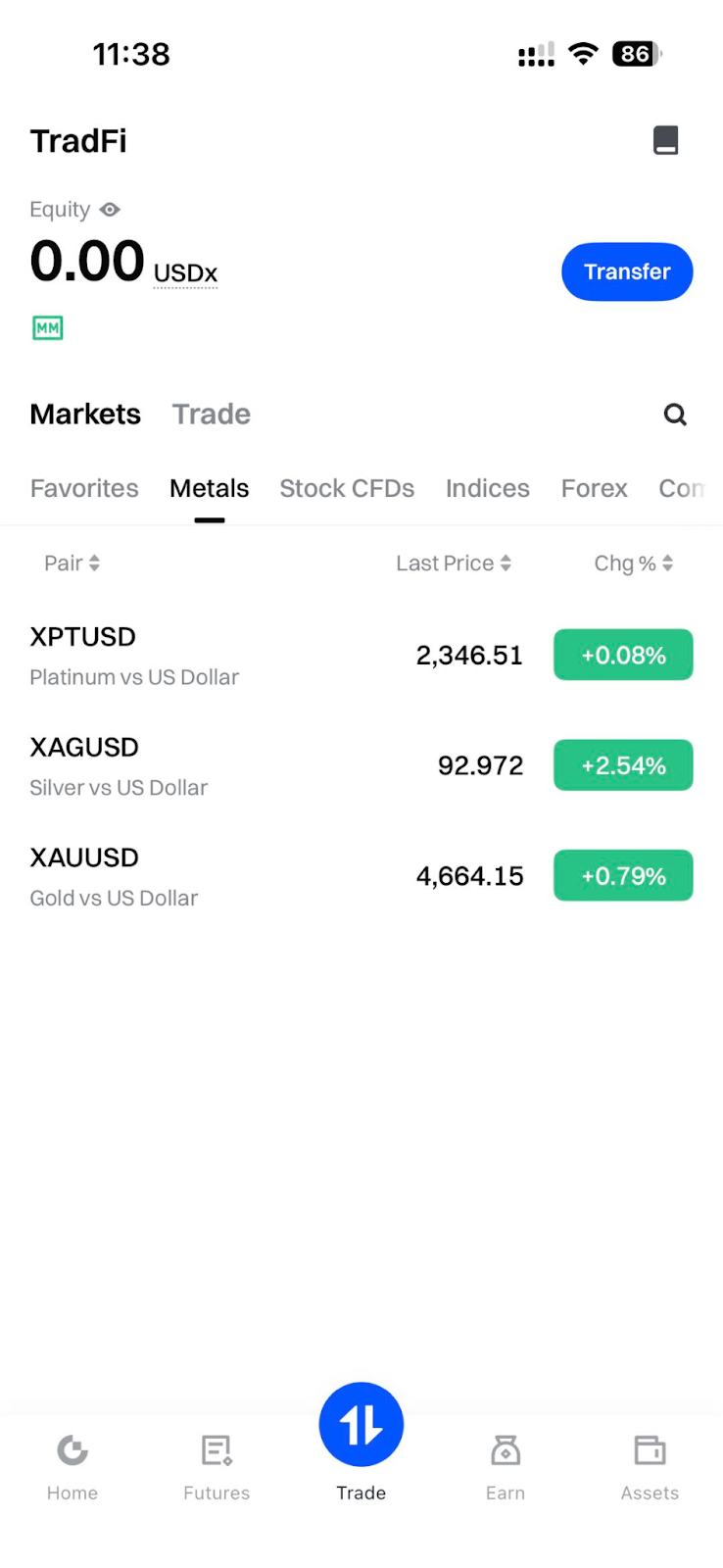

Gate TradFi: A Cross-Market Solution for Gold and Silver Contracts

As precious metals rally sharply, Gate TradFi has emerged as a key channel for investors to access gold and silver. Unlike the cumbersome procedures and long settlement cycles of traditional banks or brokerages, Gate TradFi allows global users to directly trade long and short gold (XAU/USDT) and silver (XAG/USDT) contracts through their crypto trading accounts.

This enables investors to profit from rising prices or hedge risk by shorting contracts if prices become overheated and poised for a correction. Key advantages include:

- Higher liquidity: Seamless integration with on-chain assets for flexible capital allocation

- 24/7 trading: No restrictions from traditional commodity market hours

- Lower entry barriers and faster execution: Orders filled in seconds, ideal for volatile markets

- Cross-market strategies: Manage gold/silver alongside BTC, ETH, and stablecoins

With gold and silver setting new records, Gate TradFi’s precious metals trading volume has also grown, making it a vital tool for both retail and professional traders to capture market volatility.

Investor Risks and Opportunities: Is There Further Upside for Precious Metals?

In the short term, silver’s rally appears somewhat overheated and may face a technical correction. Gold maintains a strong trend, but investors should keep an eye on U.S. economic data and inflation volatility.

Over the long term, precious metals are likely to remain in the spotlight, especially as the easing cycle approaches and geopolitical uncertainty increases.

Conclusion

The historic breakout in gold and silver not only highlights rising risk aversion but also signals a shift in global asset allocation. Looking ahead, multi-asset correlations will become more frequent, and the integration of TradFi and crypto finance will continue to deepen.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?