Gold breaks above the $5,200 threshold, and Gate Precious Metals introduces new trading opportunities for elevated market conditions.

Gold Price Surpasses $5,200 as Market Shifts to High-Level Speculation

As of January 28, 2026, spot gold trades near $5,266 per ounce, marking a new historical high. At these levels, market focus is moving from "Will prices rise?" to "How should we manage volatility?"

Markets at elevated levels typically feature:

- Wider price swings

- Intensified long-short disagreements

- Noticeably higher trading frequency

Such conditions demand greater flexibility in trading tools.

Traditional Trading Methods Show Their Limits in High-Level Precious Metals Markets

In conventional precious metals markets, investors often encounter:

- Limited trading hours, making it difficult to react quickly to sudden price moves

- A focus on holding positions, with less flexibility for short selling or hedging

- Complex workflows when switching across multiple markets

When gold trades above $5,200, these constraints can directly affect trading decisions and risk management.

Gate Precious Metals Zone: Core Value Proposition

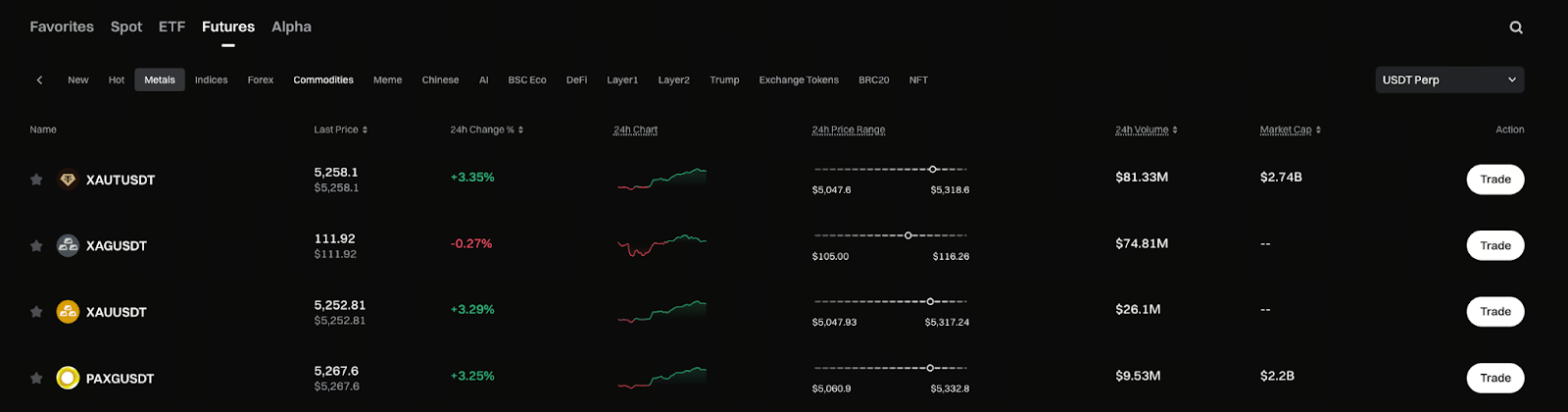

Image: https://www.gate.com/price/futures/category-metals/usdt

The Gate Precious Metals Zone is engineered to meet the needs of trading in highly volatile markets. With USDT-margined perpetual contracts for gold (XAU) and silver (XAG), Gate gives users more flexible ways to participate.

Key advantages include:

- 24/7 uninterrupted trading, free from traditional market hour restrictions

- USDT settlement for streamlined fund management

- Perpetual contract design, eliminating concerns over contract expiration

These features can dramatically improve trading efficiency when prices move rapidly at elevated levels.

How Gate Contracts Fit Trading Strategies in a $5,266 Gold Market

Gate's Precious Metals Zone offers gold and silver perpetual contracts for more than just one-way trades.

- Trend traders can take advantage of swing trading opportunities around key price levels

- Risk managers can use contracts to hedge existing positions

- Contract traders can diversify with assets that have low correlation to crypto markets

When gold reaches historic highs, flexible trading structures that allow both entry and exit become especially valuable.

Precious Metals Zone’s Role in Gate’s Overall Product Ecosystem

From a platform perspective, the Precious Metals Zone is not a temporary add-on—it’s a key component of Gate’s TradFi product strategy.

By integrating gold and silver into its contract suite, Gate achieves:

- Fusion of traditional safe-haven assets with crypto contract logic

- A unified interface for multi-asset trading

- Shared risk control and clearing mechanisms

This lets users manage trading and risk for different asset types all in one place.

Conclusion: High-Level Markets Require the Right Trading Tools

Gold’s climb above $5,200 marks a period of intense attention and volatility. In this environment, choosing the right trading tools often matters more than predicting market direction alone.

Gate’s Precious Metals Zone, with its perpetual contracts, offers users a new pathway to participate in gold and silver markets—making traditional safe-haven assets far more actionable on a crypto platform.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About