Harvard Leads Institutional Surge into Bitcoin ETFs as Global Capital Accelerates Allocation

Harvard Takes the Lead in Expanding Bitcoin ETF Holdings

Top global academic institutions are steadily shifting their capital allocations. According to the latest public filings, Harvard University significantly increased its position in the spot Bitcoin ETF (IBIT) during the third quarter, becoming one of the most prominent institutional buyers in the market. This move marks a rare large-scale ETF allocation for the Harvard endowment. It also highlights Bitcoin’s emergence as a key asset for traditional institutional capital.

IBIT Surges to Become Largest Public Holding

13F filings show Harvard’s stake in BlackRock’s IBIT (iShares Bitcoin Trust) soared in Q3 to:

6,813,612 shares—an increase of 257% from 1,906,000 shares at the end of June. IBIT has now surpassed Microsoft, Amazon, and SPDR Gold, making it Harvard’s largest publicly disclosed position.

Valuation Overview:

- Approximately $443 million at the time of filing

- Currently around $364 million due to market correction

Although this represents only a small share of Harvard’s nearly $57 billion endowment, the symbolic impact is significant.

Bloomberg ETF analyst Eric Balchunas said, “For top endowments, allocating to an ETF is unprecedented. Harvard’s increased commitment stands as one of the most significant endorsements for a Bitcoin ETF to date.”

(Source: theblock)

Market Volatility Intensifies

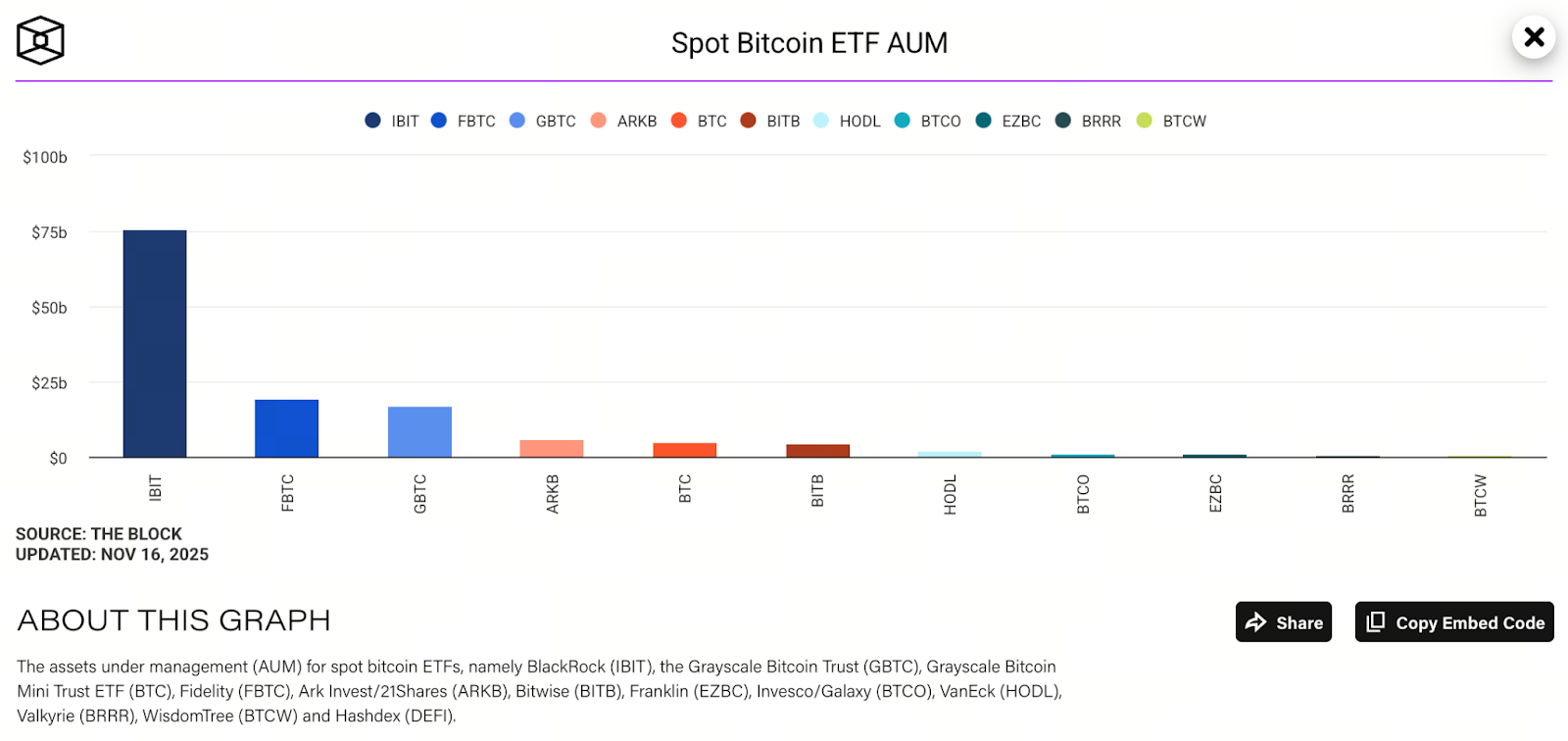

Although IBIT currently holds the largest AUM among global spot Bitcoin ETFs, it recorded net outflows exceeding $532 million in the past week. The primary driver was Bitcoin’s drop below $100,000, which triggered short-term panic. As of press time, Bitcoin traded at approximately $95,130. Meanwhile, long-term investors—such as universities and sovereign wealth funds—increased their holdings during the correction, which contrasts sharply with retail investor behavior.

Middle Eastern Sovereign Wealth Funds Make Major Purchases

US universities are not the only institutional buyers. Recent 13F filings reveal that Al Warda Investments, a major Middle Eastern sovereign fund under the Abu Dhabi Investment Council (ADIC), also increased its holdings:

- Holding 7,963,393 shares of IBIT

- Valued at approximately $517.6 million

This represents a 230% increase since June, signaling that sovereign funds have now officially made Bitcoin ETFs a core portfolio allocation. Mubadala, previously known for investments in energy, technology, and infrastructure, has now formally entered the era of institutional Bitcoin investment.

To explore more Web3 content, register here: https://www.gate.com/

Summary

From Harvard’s dramatic increase in holdings to the parallel moves by Emory and Abu Dhabi sovereign funds, it’s clear that Bitcoin ETFs are transitioning from being considered emerging asset classes to mainstream financial instruments. While short-term volatility continues to affect the market, major institutions are expanding their positions during downturns, viewing Bitcoin as a long-term asset rather than a speculative short-term investment. Looking ahead, more endowments, sovereign funds, and even corporate treasury teams may join this trend, further solidifying Bitcoin’s role in global capital markets.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B