How Does Virtuals Protocol Work? Turning AI Agents into Investable On-Chain Assets Through IAO

As AI becomes a new generation of productive capacity, traditional token models increasingly struggle to reflect the characteristics of AI that operates continuously and generates revenue autonomously. The emergence of IAO shifts asset issuance away from one-time fundraising toward the construction of long term economic networks. Through shared ownership, agent revenue sharing, and on-chain economic cycles, the value of AI can accumulate dynamically as usage and demand grow. This design redefines AI business models by turning users into investors and governance participants, and by positioning AI as a digital asset capable of generating sustainable cash flow.

This article reviews the evolution of Web3 issuance models from ICOs and IDOs to IAO, explains how IAO operates within Virtuals Protocol and how agent tokenization works, illustrates how shared ownership reshapes AI business models and economic cycles, compares IAO with NFT and GameFi issuance logic, and discusses potential risks and regulatory challenges. The goal is to help readers fully understand how IAO represents a new generation of asset issuance at the intersection of AI and Web3.

From ICO and IDO to IAO: The Next Step in Web3 Asset Issuance

The development history of Web3 is essentially a history of evolving asset issuance models. ICOs addressed early project funding needs. IDOs improved liquidity and price discovery. NFTs enabled creators and communities to form more direct economic relationships. As AI becomes a core productive force, existing models are increasingly insufficient.

The key difference between AI and traditional tokens lies in continuous operation and learning. AI is not a static asset. It evolves over time and can actively generate revenue. This requires a different issuance model. The emergence of IAO shifts asset issuance logic from project fundraising toward putting digital labor on-chain.

Within this framework:

- The AI agent itself is the core asset

- Communities invest in the future capabilities and revenue of AI

- The purpose of issuance shifts from fundraising to building economic networks

As a result, IAO functions more like an AI economy bootstrap mechanism rather than a conventional token launch. This also aligns with the ICV (Incentivized Contribution Value) concept proposed by Virtuals Protocol, where every contribution to AI development can be recorded on-chain, priced, and converted into economic rights that can be held.

How Virtuals Protocol Works: The IAO Mechanism

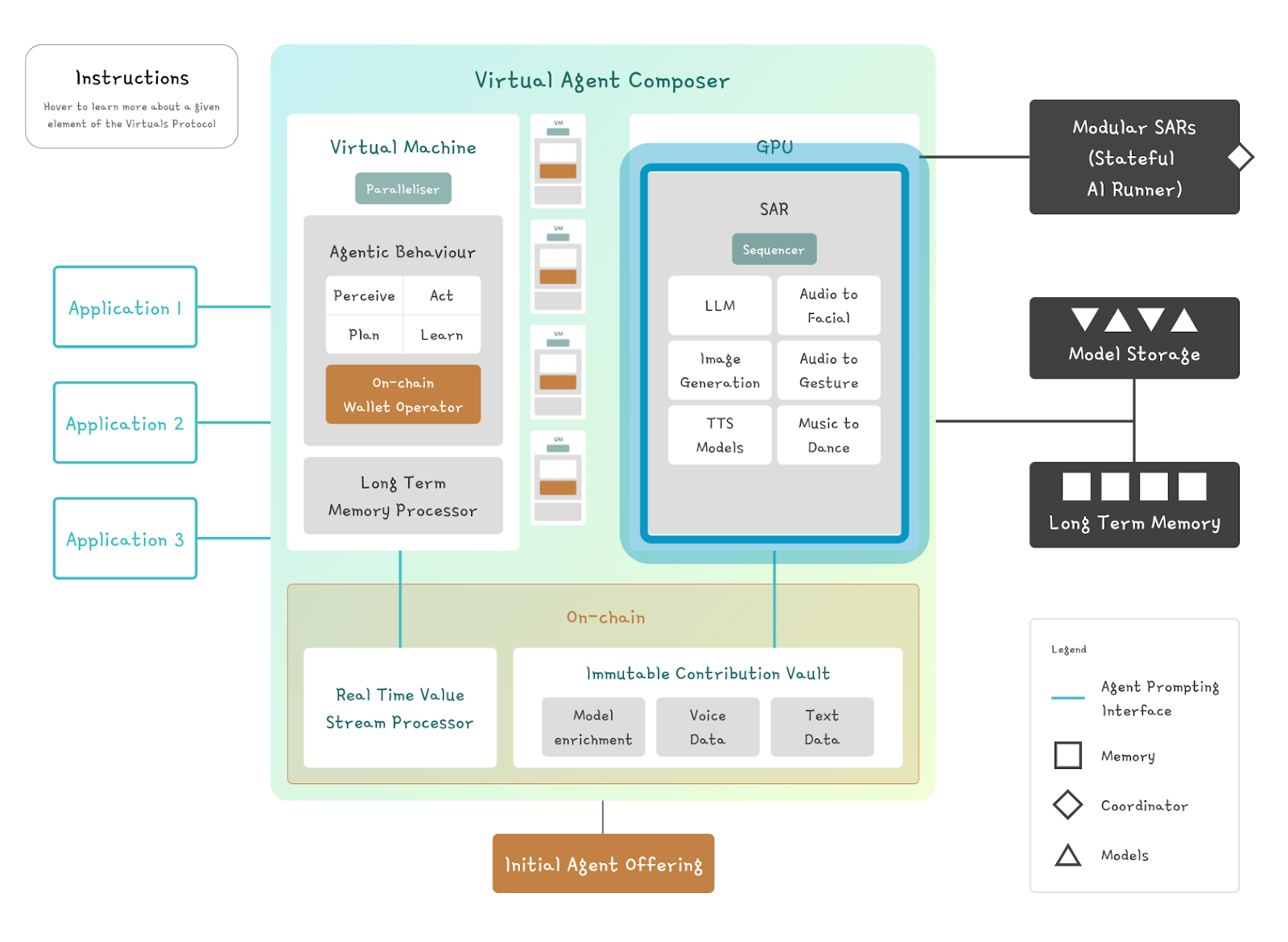

Virtuals Protocol is built on a decentralized AI agent network. Through multimodal cognition, voice, and vision cores, agents can execute tasks across multiple scenarios. With the Agent Prompt Interface, external applications are connected to agents, enabling two-way interaction between dapps and AI.

Within this architecture, IAO (Initial Agent Offering) serves as the key gateway for AI agents to enter the on-chain economy. Once an agent is deployed and capable of providing services, its functionality, revenue rights, and governance rights are tokenized and exposed to the market for value discovery.

The overall logic can be understood across several layers:

- Agent infrastructure: The protocol layer provides models and algorithms, while the dapp layer handles real world application and user interaction, forming a network for invoking AI capabilities.

- IAO tokenization process: After deployment, each AI agent issues a fixed supply of agent tokens that map functionality and revenue rights to on-chain assets.

- Automatic liquidity mechanism: When market capitalization reaches a defined threshold, a liquidity pool is created automatically, reducing manual intervention and market manipulation risk.

- Economic cycle design: Dapp revenue and protocol fees flow back into the ecosystem to incentivize contributors, validators, and ongoing agent operation.

- Value discovery logic: Fixed supply avoids unlimited dilution, and agent value reflects usage, demand, and participation through market mechanisms.

This design allows AI to move beyond being a tool and become an on-chain entity with its own independent economic model, where value forms dynamically and evolves over time.

(Source: whitepaper.virtuals)

How Shared Ownership Reshapes AI Business Models

The most fundamental change introduced by IAO is the transformation of AI from a corporate asset into a community asset. In traditional models, users are simply paying customers. Under the IAO model, users can simultaneously be investors, governors, and promoters.

This shared ownership structure creates a new economic loop. When communities hold AI tokens, they are incentivized to increase AI usage, since higher usage and revenue directly affect asset value. The results include aligned incentives between users and platforms, communities becoming organic growth engines for AI, and business models shifting from subscriptions to revenue sharing. AI is no longer just consumed, but jointly operated.

Agent Token Economic Cycles and Value Capture

Another core element of IAO is the establishment of a sustainable economic cycle. When AI provides services such as content generation, recommendations, or automated tasks, user payments flow directly into the agent’s on-chain wallet. Smart contracts then distribute revenue according to predefined rules.

This includes sharing revenue with token holders, buying back tokens, or allocating funds to ecosystem development, tightly linking token value to actual AI usage.

The value cycle can be summarized as:

Users pay for AI services → revenue accumulates in the agent wallet → distributed to token holders → partial buyback or burn supports token value.

Through this structure, AI tokens move beyond narrative assets and become digital assets with real cash flow and value capture mechanisms.

Differences Between IAO and NFT or GameFi Issuance Models

On the surface, IAO may resemble NFT or GameFi issuance models, but the core value sources are fundamentally different. NFTs typically represent static ownership, while GameFi assets are heavily dependent on game lifecycles. AI agents, by contrast, have the ability to evolve continuously.

Through data learning and user interaction, AI can increase its value over time. Its economic model is closer to that of a digital laborer, where asset value is tied to productivity. Growth potential depends on usage and learning, and in theory there is no fixed lifecycle endpoint. This makes IAO a genuinely new asset category rather than an extension of existing models.

Potential Risks and Regulatory Challenges of IAO

Despite its innovation, IAO introduces new risks. The most immediate challenges are regulatory, especially when AI generated revenue is treated as investment returns, which could place IAO under securities regulation. AI performance and ethical issues also affect asset value. Model failures, bias, or non compliant behavior can trigger legal liability.

Key risks include:

- Regulatory frameworks remain unclear

- Technical performance may be unstable

- Market speculation may become excessive

Both investors and developers must balance innovation with effective risk management.

Summary

IAO is not merely a new fundraising tool. It represents a transformation in AI economic structure. When AI can be jointly owned, generate ongoing revenue, and participate in governance, it becomes more than software. It becomes a new type of digital asset. The model proposed by Virtuals Protocol may represent one of the most distinctive economic experiments emerging from the convergence of AI and Web3.

FAQ

What is IAO, and how does it differ most from ICO and IDO?

IAO (Initial Agent Offering) is an issuance model centered on AI agents as core assets. Instead of issuing only project tokens, it issues AI entities with real functionality and revenue generation capability. Unlike ICOs and IDOs that primarily focus on fundraising, IAO puts digital labor on-chain and allows the market to invest in AI’s future productivity and cash flow.Why is IAO considered a shared ownership AI business model?

Because under the IAO framework, users are not just AI consumers. By holding agent tokens, they become co owners and revenue participants. As AI usage and revenue increase, token value grows, aligning the interests of users, investors, and AI development.How is the value of IAO tokens supported?

The value of IAO tokens comes from actual AI service revenue. Users pay for AI services, revenue flows into the agent wallet, is shared with token holders, and partially used for buybacks or burns. This creates an economic cycle directly linked to usage, transforming tokens from narrative assets into digital assets backed by cash flow.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?