How Gate ETF Leveraged Tokens Are Becoming an Efficient Return Amplifier in the 2026 Market Trend

Image: https://www.gate.com/leveraged-etf

As we enter 2026, trends in the crypto market are becoming increasingly pronounced. With global regulatory clarity improving and spot crypto ETFs gaining acceptance in more countries, BTC and ETH continue to lead the market higher. In these trending environments, traders are seeking greater return potential, making ETF leveraged tokens one of the most popular instruments.

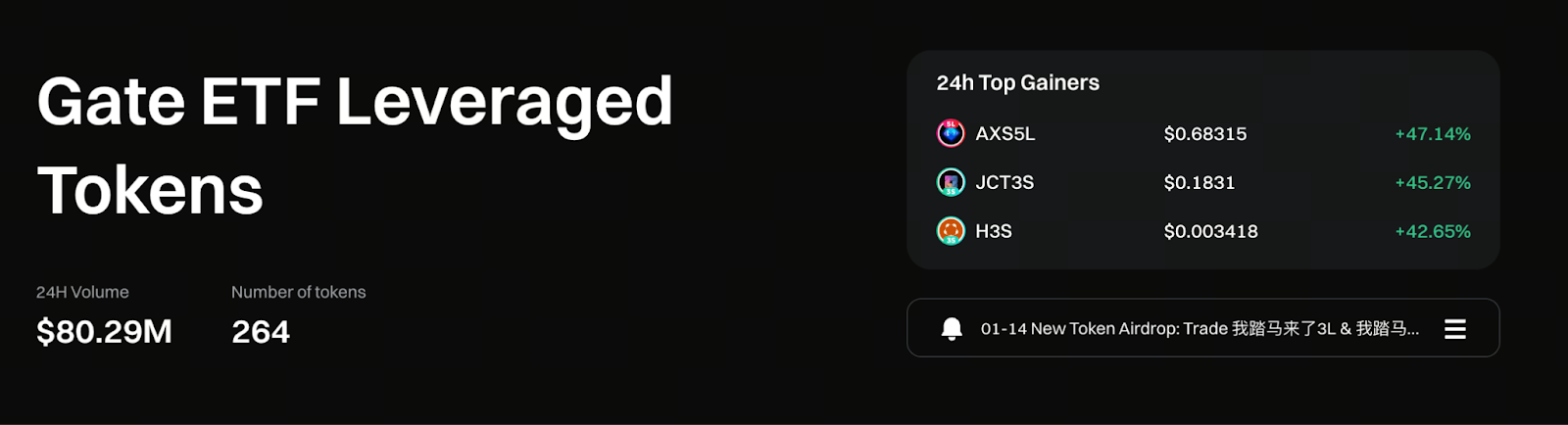

Among leading trading platforms, Gate’s ETF leveraged tokens stand out for their comprehensive coverage, robust liquidity, and stable auto-rebalancing. This offers countless traders a low-barrier way to magnify gains in market trends.

I. Why Are ETF Leveraged Tokens Exceptionally Strong in Trending Markets?

ETF leveraged tokens embed a fixed leverage multiple (such as 3x or 5x) directly into the token structure. Their key advantages include:

- Trade like spot assets—no need to open a contract account

- No margin calls or forced liquidation thresholds

- Automatic rebalancing keeps leverage stable

- Ideal for capturing high returns during strong trends

This means users avoid the psychological stress of contracts and eliminate the risk of forced liquidation from operational errors.

During uptrends, ETF leveraged tokens’ automatic rebalancing continually enhances the compounding effect, further amplifying upside potential.

II. What Makes Gate ETF Leveraged Tokens Better for Everyday Traders?

1. Spot-Like Trading: Minimal Learning Curve

On Gate, buying BTC3L feels just like buying BTC spot—no need to master complex risk parameters or monitor margin ratios.

For newcomers who want to boost returns without taking on high risk, ETF leveraged tokens are inherently user-friendly.

2. Auto-Rebalancing Delivers a Smoother Holding Experience

Gate’s ETF leveraged tokens automatically adjust positions daily based on market movements, keeping leverage close to the target multiple. This mechanism provides two main benefits:

- Enhances compounding during uptrends

- Buffers extreme risk during downturns

This makes them best suited for trend trading, not for sideways markets.

3. Broad Coverage: Major Coins, Trending Tokens, and Thematic Assets

Gate offers one of the industry’s broadest leveraged token lineups:

- BTC3L / BTC3S

- ETH5L, ETH3L

- SOL3L, DOGE3L, TON3L

- 3L / 3S / 5L versions for new trending tokens

- Thematic sector tokens (such as AI and Meme assets)

This enables users to quickly find leveraged tokens that track the latest market trends and narratives.

4. Stable Liquidity, Tight Spreads—Meets Both Short-Term and Trend Trading Needs

Gate’s mainstream leveraged tokens offer deep liquidity, allowing even moderate-volume traders to execute orders smoothly without significant slippage concerns.

III. When Are Gate ETF Leveraged Tokens Most Effective?

ETF leveraged tokens are not suitable for every market environment. They perform best under the following three conditions:

Clear, Sustained Uptrends

When BTC breaks above monthly highs or on-chain capital inflows surge, the amplified return potential of BTC3L or ETH3L becomes especially clear.

Short-Term Surges Triggered by Macro or Policy Catalysts

Examples include:

- Approval of new crypto ETFs

- Major institutions announcing new purchases

- Clear expectations for Federal Reserve rate cuts

These events often spark rapid rallies, and leveraged tokens are an efficient way to capture these moves.

Sector Breakouts and Narrative-Driven Phases

During hot cycles—such as in AI, the SOL ecosystem, or Meme tokens—leveraged tokens help users capture amplified Beta returns.

IV. What Risks Should You Be Aware of When Using Gate ETF Leveraged Tokens?

1. Range-Bound Markets Lead to “Decay”

When prices fluctuate sideways, auto-rebalancing erodes returns over time, so long-term holding may diverge from expectations.

2. Not Designed for Long-Term Holding

Leveraged tokens are intended for short-term trend trading—not for holding over several months or a year.

3. Avoid Heavy Positions When the Trend Is Unclear

When the market direction is uncertain, the cost of holding leveraged tokens is higher. Reduce your position size or exit temporarily in these scenarios.

Gate clearly highlights these risks in its educational content, so users are encouraged to review relevant materials before trading for greater safety.

V. Why Does Gate Lead the ETF Leveraged Token Sector?

Robust Educational System

Gate offers a complete learning path from foundational courses to advanced guides, helping beginners quickly grasp product logic.

Rapid Listings, Hot Topic Coverage

Gate’s ability to quickly list trending tokens ensures traders never miss a market opportunity.

Deep Liquidity and Trading Stability

Mainstream leveraged tokens on Gate offer strong depth and tight spreads, making them ideal for short-term, intraday, or trend trading strategies.

VI. Summary: Efficient, Low-Barrier Tools for Amplifying Returns in Trending Markets

As the crypto market enters a renewed bull phase in 2026, crypto ETFs are becoming a vital bridge for institutional participation. For everyday users, Gate ETF leveraged tokens are among the most accessible, convenient, and risk-controllable tools for amplifying returns.

They enable regular traders to:

- Access leveraged returns with spot-style trading

- Amplify Beta during market trends

- Avoid forced liquidation risk

- Quickly track market hot topics

- Participate in trends with lower barriers to entry

For investors aiming to maximize efficiency and returns in a bull market, Gate’s ETF leveraged tokens remain an essential option.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B