How Strategy Became The Largest Bitcoin Holdings Public Company

Rarely has a corporation achieved such a stunning leap as MicroStrategy (now Strategy), evolving from a legacy software provider into one of the world’s most significant Bitcoin asset repositories. Through the forward-looking roadmap of founder Michael Saylor, the firm transitioned Bitcoin from a simple inflation hedge into a central pillar of its business model.

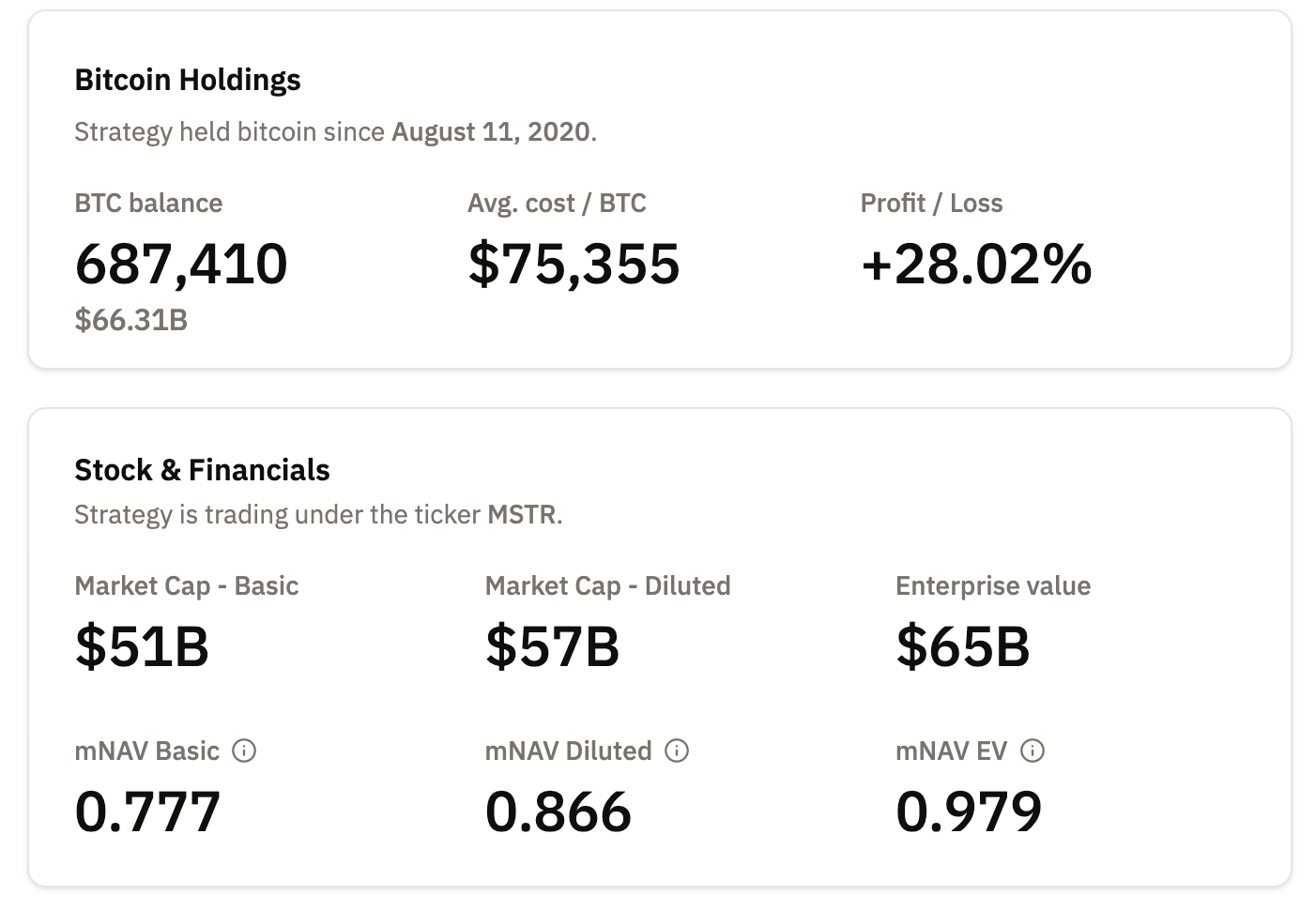

In January, Strategy once again reinforced its position by acquiring additional Bitcoin. As of now, Strategy’s Bitcoin holdings have officially surpassed 687,000 BTC. This achievement makes it not only the world’s largest publicly listed Bitcoin holder, but also secures its dominant role within the crypto asset landscape.

This article provides a comprehensive breakdown of Strategy’s current Bitcoin holdings and examines how the company leveraged financing to achieve this scale. We also compare the Bitcoin reserves of other industry giants—such as Tesla, Metaplanet, and MARA—and offer an in-depth analysis of how the “Bitcoin treasury model” is reshaping global financial markets.

Strategy’s Evolution and Bitcoin Transformation: From Software Giant to Digital Asset Pioneer

Founded in 1989 by MIT graduates Michael Saylor and Sanju Bansal, Strategy began as a business intelligence (BI) and analytics software provider. Despite stable cash flows and a strong technological foundation, its share price remained stagnant before 2020, and its cash reserves lost purchasing power due to fiat currency depreciation.

On August 11, 2020, Strategy announced the purchase of 21,454 BTC for $250 million—a move that stunned Wall Street and marked the start of its relentless Bitcoin accumulation.

Michael Saylor has since become Bitcoin’s most prominent spokesperson. He believes that consensus is building around Bitcoin as digital gold. In a recent CNBC interview, Saylor revealed that over the past six months, about half of major U.S. banks have begun offering Bitcoin-backed credit. Institutions including Charles Schwab and Citigroup plan to launch custody and related credit services in the first half of 2026. This growing support for custody, trading, and credit from the banking sector is poised to elevate Bitcoin to a new asset class.

Strategy Becomes the Public Company with the Largest Bitcoin Holdings

If 2020 was Strategy’s “trial year,” the aggressive expansion of the past two years marks its transformation into a Bitcoin-centric, financial powerhouse. Through a series of bold financing strategies, Strategy has solidified its dominance as the world’s largest publicly listed Bitcoin holder.

As of January 12, 2026, Strategy’s Bitcoin reserves reached a staggering 687,410 BTC—far surpassing the spot ETFs managed by leading institutions like BlackRock. Among public companies, its holdings are more than ten times those of the second-largest holder, MARA Holding.

Data source: Bitcoin Treasuries official website

List of Major Public Companies Holding Bitcoin

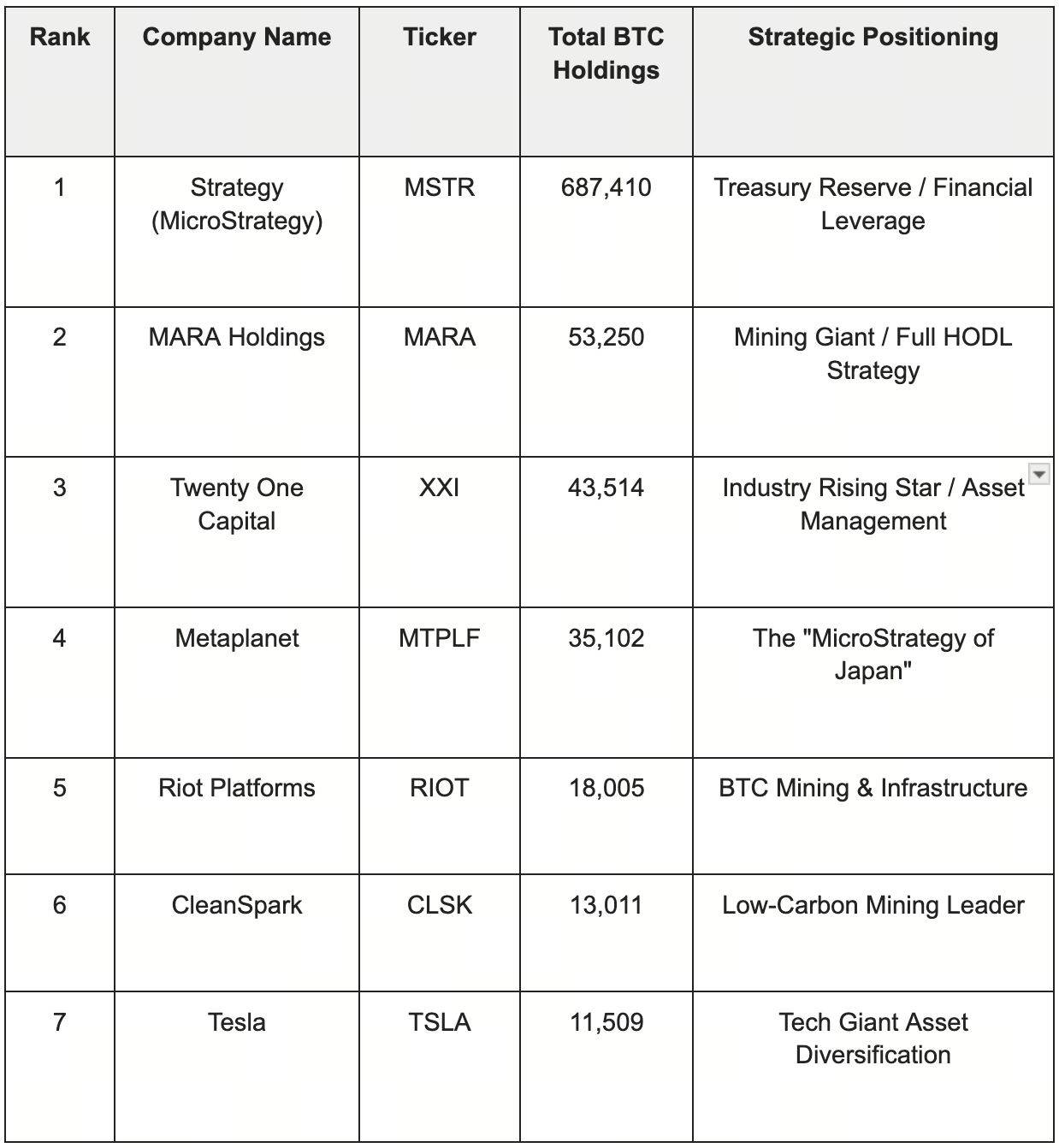

While Strategy stands out as the clear leader, it is far from alone. According to the latest data from BitcoinTreasuries.net, as of January 2026, more than 260 public companies worldwide have added Bitcoin to their balance sheets. Their combined holdings now exceed 1.2 million BTC, representing about 5.7% of all Bitcoin in circulation.

The surge in crypto-equity activity in 2025 prompted many public companies to emulate Strategy’s approach. For example, Metaplanet—often called the “Asian MicroStrategy”—has mirrored MSTR’s success, with its share price closely tracking BTC’s performance.

Below is a list of some of the top public companies by Bitcoin holdings as of January 2026:

Image source: Bitcoin Treasuries official website

The data illustrate Strategy’s overwhelming lead in both scale and market share:

- Scale comparison: Strategy’s holdings (687,000 BTC) are nearly 13 times those of second-place MARA Holdings (53,000 BTC).

- Market share: Among all publicly listed companies holding Bitcoin, Strategy alone commands about 60% of the total. This makes MSTR the definitive Bitcoin proxy in the equities market.

Conclusion

A close examination of Strategy’s trajectory reveals that it is no longer merely a software vendor—it has become a financial innovation lab powered by Bitcoin. However, high returns come with high risks, and Strategy’s path forward remains challenging.

One core metric for assessing Strategy’s investment value is mNAV (the ratio of enterprise market value to holding value). As of January 15, 2026, Strategy’s mNAV had dropped to 1.08. This suggests that market enthusiasm for paying premiums on Bitcoin-holding companies is at a low point. Compared to the high premiums of 2024–2025, the current market is more cautious, with investors less willing to pay high management fees or leverage premiums for corporate Bitcoin holdings.

Strategy has also faced the risk of exclusion from mainstream capital markets. In October of last year, global equity and ETF benchmark provider MSCI proposed removing Strategy from its benchmark indices, arguing that its asset structure more closely resembled an “investment fund” than an “operating company.” JPMorgan analysts warned that exclusion from MSCI and the Nasdaq 100 could trigger billions of dollars in passive outflows and severely impact the share price.

The good news is that on January 6, 2026, MSCI announced it would not remove Strategy from its index of Bitcoin treasury companies for now. This enables Strategy to retain its position in major global investment portfolios, providing a valuable strategic buffer.

Strategy’s transformation is both controversial and visionary. Despite challenges such as valuation pressures and regulatory scrutiny, as long as its unique “Bitcoin treasury” model continues to generate excess returns, it will remain a focal point for investors as a public company with a strategic Bitcoin allocation.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape