If you've had a terrible year, then take a look at NFT projects and players.

At present, the total circulating market capitalization of the crypto gaming sector is even lower than the aggregate amount invested by venture capital firms in this space. Meanwhile, 2025 has become a pivotal year as NFT projects collectively pivot and distance themselves from the “NFT” label.

The above is excerpted from The Block’s 2026 Digital Assets Outlook report.

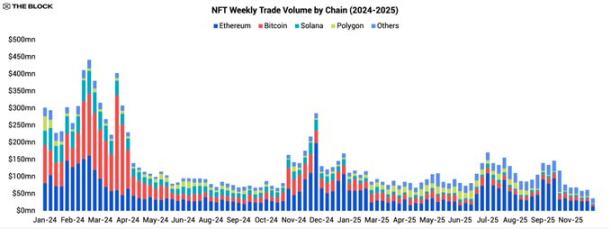

Entering 2025, the NFT market was already showing signs of weakness and failed to reverse its downward trajectory throughout the year. Transaction volumes on all chains contracted, with market activity increasingly concentrated among a few top IPs and select incentive programs. Most NFT series and niche segments saw little engagement. The data illustrates this contraction: total NFT trading volume for 2025 reached just $5.5 billion, significantly below 2024’s level, marking a sharp retreat from the market’s peak.

A Smaller, More Concentrated NFT Market

Within the remaining activity, Ethereum further consolidated its leadership. In 2025, approximately 45% of NFT trading volume took place on Ethereum’s mainnet. Bitcoin and Solana, which briefly drew attention in 2023–2024 due to the “Inscription” and SOL NFT booms, have since lost momentum. Bitcoin’s share of NFT trading volume fell to around 16%, less than half of last year’s, while Solana’s share dropped to single digits.

The takeaway is clear: the NFT trading market has become smaller and increasingly Ethereum-centric. Liquidity has thinned, secondary trading in most collections has nearly stalled, and blockchains that once benefited from market hype now struggle to maintain user mindshare.

Platform and Product Evolution

Despite the overall decline in trading volume, the product landscape in 2025 was far from static. Marketplaces and creators experimented with new foundational technologies and business models, often moving beyond NFTs as the sole on-chain asset type.

Zora’s Shift to Token Model

Zora exemplifies this transformation. Early in the year, Zora began phasing out NFT minting and commenting features in its app and, by late February 2025, rolled out a “token” upgrade. From then on, every new post on Zora is minted as a unique ERC-20 token with a fixed supply of 1 billion—no longer the singular, non-fungible NFT format.

This change essentially transforms creator posts into micro-tokens with greater liquidity and lower trading friction, rather than illiquid collectibles. The move signals a clear judgment: compared to single-use NFTs with poor liquidity and weak secondary market value, users favor lightweight, liquid tokens that are easy to accumulate, trade, and use in incentive programs.

Marketplaces Evolve Toward All-in-One Platforms

Zora is not the only player expanding its business boundaries. Major NFT marketplaces, especially OpenSea and Magic Eden, are actively positioning themselves as multi-asset platforms rather than pure NFT listing sites. Beyond their core marketplace, both have invested heavily in token swap functionality and broader trading tools to adapt to shifting liquidity and user interests.

OpenSea Reclaims Market Leadership

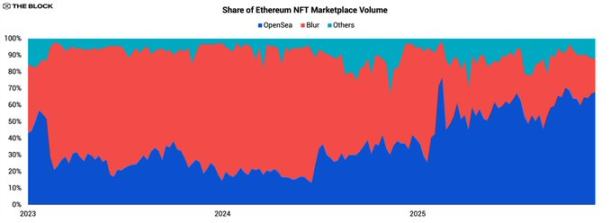

OpenSea’s most notable shift is the reversal of Ethereum NFT market share. After ceding the top spot to Blur for nearly three years, OpenSea retook first place in 2025 and significantly widened its lead.

At the start of 2025, OpenSea held about 36% of trading volume in the Ethereum/EVM NFT market, with Blur at 58%. By year-end, OpenSea’s share had surged past 67%, while Blur’s fell below 24%. Despite a shrinking industry-wide trading volume, OpenSea’s own NFT trading value grew by double digits year-over-year, exceeding $1.4 billion. In contrast, Blur’s annual trading volume dropped by more than 73%.

Major Events of the Year

Against the backdrop of cooling market activity, only a handful of events in 2025 genuinely shaped the NFT sector’s narrative. Most revolved around token distributions tied to NFT IP or experiments in verticals with clear utility.

Magic Eden Launches Platform Token

Magic Eden’s platform token launch and incentive programs were key catalysts for market activity during the year. The rollout followed three steps: the ME token airdrop in December 2024, expanded staking and trading mechanisms in April 2025, and the announcement of a retroactive rewards program in August.

Despite these efforts, Magic Eden’s marketplace trading volume remained in decline for most of the year. Occasional spikes in engagement did not fully offset the persistent weakness in overall NFT demand. This highlights a core reality of 2025: incentive programs may guide existing liquidity, but in a shrinking market, they rarely create new liquidity.

Top NFT IPs Issue Liquidity Tokens

Another key trend is the move by leading NFT series to issue fungible “ecosystem tokens,” creating liquid investment exposure to their brands. Notable examples include:

- Pudgy Penguins — PENGU

- Doodles — DOOD

- Azuki — ANIME

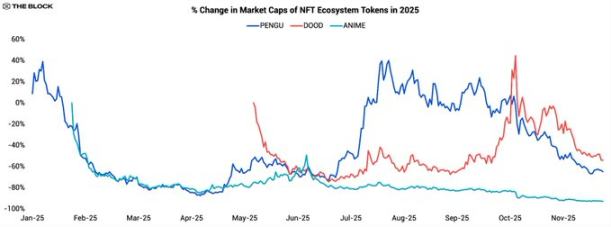

The common goal of these token launches is to expand originally limited, relatively static NFT series into larger token ecosystems, allowing supporters to trade, stake, or use them in future products. Yet, their price action highlights the challenge of sustaining “culture coin” momentum in 2025.

PENGU launched at the end of 2024, rallied nearly 40% in its first week, then crashed over 90% within three months. The second quarter saw a strong rebound, with valuations rising tenfold, but the latter half of the year brought renewed decline. As of this report, PENGU’s annual drop exceeds 60%.

This pattern is typical: initial hype driven by airdrop speculation and brand narrative (especially Pudgy’s strong offline presence and awareness) fades as early incentives are exhausted and organic demand proves insufficient. With few clear use cases or tangible utility—aside from trading and vague future reward promises—and a challenging macro environment for risk assets and “culture coins,” price weakness persists.

Doodles’ DOOD token followed a similar trajectory, though on a different timeline. It fell nearly 75% within two months of launch, then consolidated, and rebounded about 160% from September to October 2025. The rally did not last, and by year-end, DOOD had declined nearly 50% for the year.

Azuki’s ANIME token stands out for its lack of any meaningful rebound. After launching in late January 2025, it declined quickly and, unlike PENGU or DOOD, never saw a significant rally. Its price slid throughout the year, with a cumulative drop over 90%, making it the worst performer among the three major NFT ecosystem tokens. Market fatigue with “culture coins” has fully overtaken initial curiosity.

In sum, these three tokens delivered a combined annual return of about -67%, ranking among the worst-performing categories alongside meme coins and gaming sector indices (see Chapter 1 of this report).

The key takeaway is not that the ecosystem token model is flawed, but that 2025’s market lacks structural demand for “culture-driven tokens.” In an environment of tight liquidity and investors seeking clear cash flows or protocol utility, tokens that rely primarily on brand recognition struggle to maintain lasting appeal. Without robust burn mechanisms, revenue sharing, or meaningful governance rights, these assets resemble leveraged bets on short-lived hype, not long-term IP value vehicles.

Pudgy Penguins: Entering the Mainstream

Among NFT series that continued building in 2025’s weak market, Pudgy Penguins stands out. From a branding and promotional standpoint, the project had one of the busiest years in the sector:

- In January 2025, the team launched Abstract, a dedicated Layer-2 blockchain, on mainnet.

- Walmart and Target continued selling Pudgy toys and merchandise, reaching a broad non-crypto audience.

- The Pudgy brand’s animated series premiered on YouTube, further strengthening its IP presence in digital media.

- In August, the project gained sports exposure through a NASCAR Darlington race car livery partnership.

- Pudgy plush toys appeared in Season 2 of Apple TV’s “Platonic,” and a November teaser announced a collaboration with DreamWorks’ “Kung Fu Panda” IP.

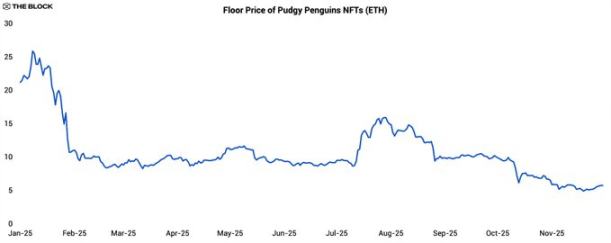

These developments show that even with weak on-chain metrics, NFT IPs can successfully penetrate mainstream culture. Yet, despite ongoing brand growth, Pudgy Penguins NFTs saw their floor price drop about 75% during the year.

Meanwhile, its ecosystem token PENGU also declined about 60% for the year, slightly outperforming the NFTs themselves. For investors seeking exposure to the Pudgy brand, the token may now be a more convenient, liquid investment tool, even if its economic model is not directly tied to product sales or media revenue.

Pudgy’s case highlights a structural challenge for NFT projects and IP: positive brand developments do not automatically translate into increased value for associated NFTs or tokens. Mainstream consumers engage with the brand through toys, shows, and collaborations, but may never interact with the blockchain assets that launched the brand.

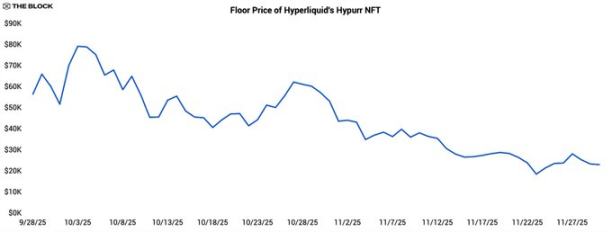

Hyperliquid’s Hypurr NFT

While many NFT projects have shifted to issuing fungible tokens, some native token communities have taken the opposite approach, launching NFTs as identity markers and participation credentials within existing ecosystems. Hyperliquid’s Hypurr NFT is a prime example.

Hypurr was distributed to Hyperliquid community members based on eligibility rules, rewarding users who actively traded on the platform before its native token launched in November 2024. On secondary markets, its initial floor price exceeded $55,000, with a historical peak near $79,000, before settling around $28,000.

Early strength was driven by several factors: a highly active and loyal trader community; the status symbol of owning a scarce NFT tied to a successful platform; and market expectations for future utility, such as exclusive access, rewards, or governance rights.

However, as time passed and functional utility remained limited, prices declined—reflecting a general tendency toward profit-taking and showing that not all collectors are willing to hold high-value NFTs as illiquid “identity badges” for the long term.

The Hypurr case demonstrates that building a “token-to-NFT” path atop a mature, product-market-fit community is viable. But it also underscores the need for clarity in the role of such NFTs—whether as access credentials, loyalty tools, or collectibles—if their value is to endure beyond initial hype.

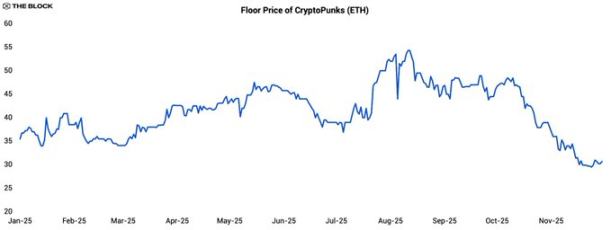

CryptoPunks’ Short-Lived Rebound

Even in a subdued year, CryptoPunks sparked a brief wave of attention. The floor price rose about 40% from July to August 2025, peaking near 54 ETH in mid-July, before halving to around 30 ETH by the time of this report.

Notable is not only the volatility, but also the changing correlation with Ethereum (ETH). From early 2025 until July’s rally, the Punk floor price had a correlation coefficient of about -0.28 with ETH, indicating a slight negative correlation.

During the three-week rebound, the coefficient rose to 0.24, still a weak relationship. This suggests the rally was driven by specific factors—possibly large holders—rather than broad market risk appetite. The major shift occurred after the price peak.

From the local high, Punk’s correlation with ETH surged to 0.87, meaning it resumed its role as a high-beta, high-volatility ETH proxy asset. This is typical after a bubble bursts: when series-specific catalysts fade, market participants again treat it as a leveraged bet on Ethereum price swings, rather than a fully independent investment vehicle.

NFT/GameFi: The Gap Between Funding and Value Realization

Since the Axie Infinity boom, the intersection of NFTs and gaming has been a major investment theme, but 2025 data shows the sector has yet to deliver on its massive funding.

While the pace has slowed, venture capital continues to invest in NFT and GameFi projects, but annual fundraising in 2025 was just $1 billion, down about 65% from 2024. Meanwhile, the total market value of NFT/gaming tokens declined more than 60% for the year, reflecting both price drops and underperformance by many launched projects.

Even more striking, the current total market value of NFT/gaming tokens is about $14 billion, lower than the sector’s cumulative historical funding of roughly $19 billion. In other words, at current prices, the entire circulating supply of tokens could theoretically be acquired for less than total historical funding. This “funding exceeds market cap” inversion reveals that many projects, despite significant capital, have struggled to achieve lasting user adoption.

NFT and Gaming Outlook for 2026

Looking ahead to 2026, data from 2025 points to a “K-shaped” trajectory for the NFT, NFT-related IP, and token industries: a small number of projects will keep building audiences and occasionally spark liquidity swings, while most series and ecosystems remain subdued in both attention and price.

In the base case, NFT trading volume will remain moderate, with market activity centered in the upper half of the “K”—for example, Pudgy Penguins, CryptoPunks, and specialized ecosystems like Pokémon trading cards, which have clear user bases, offline distribution, or mature monetization models. These justify continued investment in infrastructure and market support. The lower half includes the many NFT series launched between 2021 and 2024, which see thin trading, declining floor prices, and token experiments that produce only brief rallies.

One core lesson from 2025 is that positive brand developments do not automatically translate into value growth for associated NFTs or tokens. The ownership credentials (NFTs/tokens) that launched these brands are just one part of the overall value system, increasingly coexisting with mainstream channels—retail, streaming, social media—that drive major audiences and revenue.

For investors and builders, the wisest approach is highly selective optimism. The space is smaller, more concentrated, and more demanding than ever. Yet in these focused segments, projects that tightly integrate on-chain assets with real products, revenue, and community may still find room for growth, even as the era of broad NFT appreciation has ended.

Statement:

- This article is republished from [Foresight News]. Copyright belongs to the original author [@ somanyfigs]. If you have objections to this republication, please contact the Gate Learn team, which will process your request promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article unless Gate is referenced.

Related Articles

Top 10 NFT Data Platforms Overview

7 Analysis Tools for Understanding NFTs

What is NFTs Marketplace Aggregator?

What is Galxe (previously Project Galaxy)? All You Need to Know About GAL 2025