In-Depth Analysis of Gate ETF Leveraged Tokens: Understanding the Mechanism Matters More Than Chasing Returns

ETF Leveraged Tokens Are Not Just “Magnified Spot”

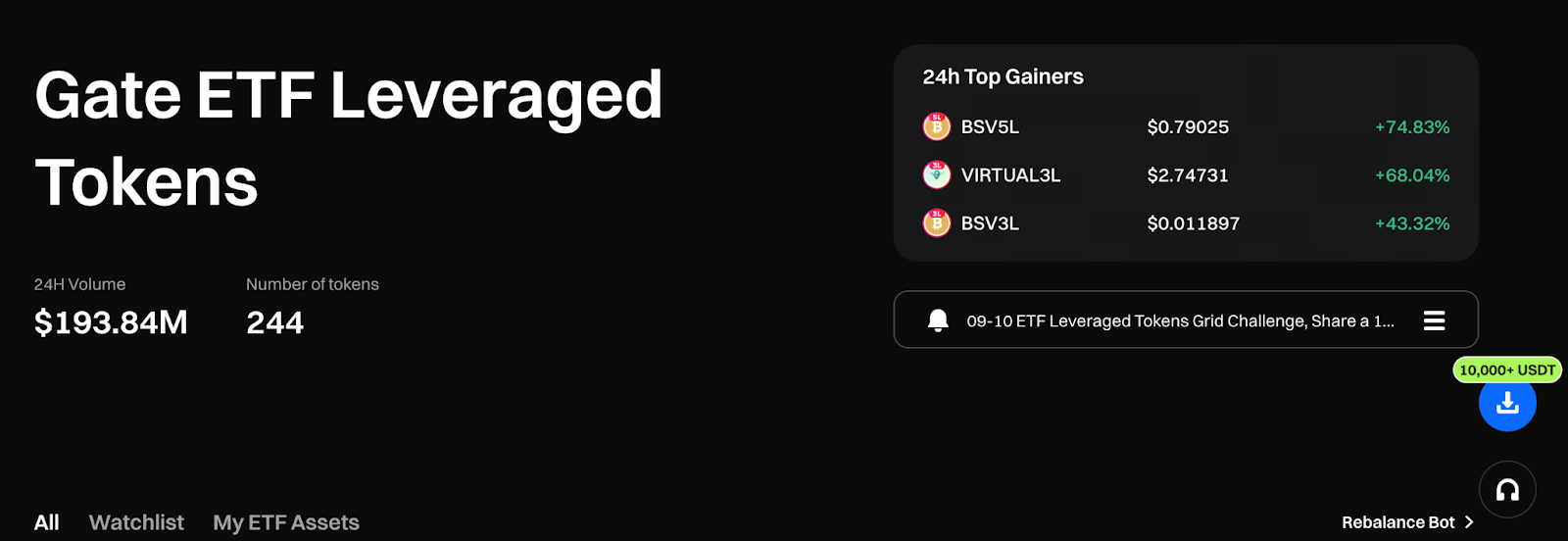

Image source: https://www.gate.com/leveraged-etf

Many traders, when first introduced to Gate ETF Leveraged Tokens, mistakenly believe these products simply multiply price movements. In fact, their underlying mechanisms are far more complex. The net asset value (NAV) of an ETF Leveraged Token is not derived by directly applying the leverage multiple to the underlying asset’s price change. Instead, the system achieves target leverage through dynamic management of underlying contract positions. As a result, the market’s path directly impacts the final returns.

Recognizing this distinction is the first step to avoiding misuse of these products.

How Does Gate ETF Leveraged Token Manage Risk Exposure?

The primary risk control for Gate ETF Leveraged Tokens is not forced liquidation, but automatic rebalancing to manage position risk.

When volatility causes leverage to drift outside the target range, the system proactively adjusts contract positions to reduce excessive risk. This approach enhances token stability during extreme market conditions and helps avoid the sudden liquidation risks common in traditional contracts.

However, rebalancing comes at a cost, which is a central trade-off when using ETF Leveraged Tokens.

Why Are Choppy Markets Challenging for ETF Leveraged Tokens?

In clear trending markets, the rebalancing mechanism of ETF Leveraged Tokens typically enhances returns. In contrast, during sideways or highly volatile markets, this mechanism can erode NAV.

When prices oscillate within a range, the token repeatedly rebalances its positions. This buy-high, sell-low effect can gradually diminish NAV. For this reason, ETF Leveraged Tokens are not ideal for prolonged sideways markets.

Therefore, identifying whether the market has a clear trend is more critical than selecting a specific leverage multiple.

What Trading Strategies Suit Gate ETF Leveraged Tokens?

Practically, Gate ETF Leveraged Tokens work best with the following trading approaches:

- Enter after the trend is confirmed, not before

- Favor short- or medium-term holding periods

- Exit promptly when the trend shows signs of ending

This approach emphasizes following the prevailing trend rather than repeatedly trading minor fluctuations. For traders who prefer frequent buy-high, sell-low strategies, ETF Leveraged Tokens may not be the optimal choice.

How Does the Mindset Differ Between Gate ETF Leveraged Tokens and Contract Trading?

With ETF Leveraged Tokens, the focus shifts from “position management” to “timing and direction management.”

In contract trading, traders primarily focus on leverage ratios, margin requirements, and liquidation prices.

For ETF Leveraged Tokens, the key questions are:

- Is there a clear trend?

- Has the market entered an acceleration phase?

- Is it the right time to exit?

This shift in perspective makes ETF Leveraged Tokens more of a “strategy execution tool.”

Risks and Costs of Long-Term Holding

Although Gate ETF Leveraged Tokens can exist indefinitely, they are not designed for long-term holding. Ongoing management fees and rebalancing losses in sideways markets can make passive, long-term holding without a clear strategy suboptimal.

For traders, the more prudent approach is to use these tokens during well-defined trends and close positions when the trend ends, rather than allocating them as a permanent part of an investment portfolio.

How to Set Proper Expectations for ETF Leveraged Tokens?

Setting realistic expectations is more important than any trading technique. ETF Leveraged Tokens are not designed to deliver stable returns, nor are they “automatic profit products” that eliminate the need for directional judgment.

They are specialized tools that perform best in specific market conditions, provided users understand the rules and are prepared to accept the risks of incorrect market calls.

Conclusion

The true value of Gate ETF Leveraged Tokens lies not in leverage itself, but in how they simplify trend trading execution. Once you grasp the interplay between rebalancing mechanisms, market conditions, and holding periods, you’ll see that using the right tool at the right time is more effective than simply seeking higher leverage. This is the core purpose of ETF Leveraged Tokens.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B