Inside Polymarket’s Top 10 Whales: 27,000 Trades, the Illusion of “Smart Money,” and the Real Survival Rules

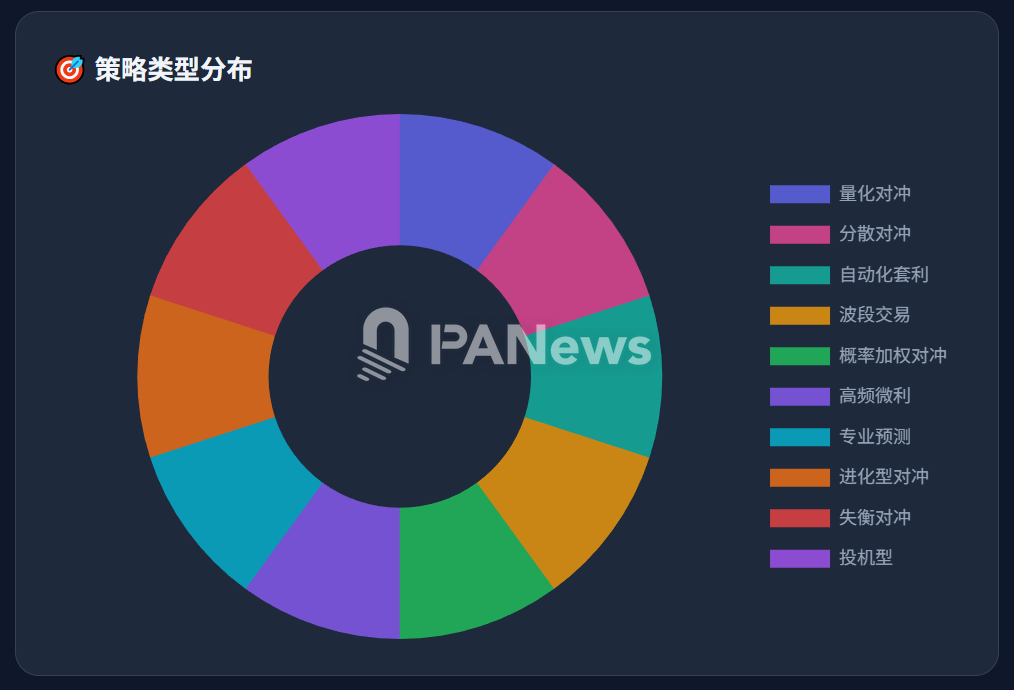

Recently, prediction markets have been heating up, especially as smart money arbitrage strategies become the benchmark for success. Many are now trying to emulate these tactics, sparking what looks like a fresh gold rush.

But beyond the buzz, how effective are these seemingly sophisticated strategies in real-world trading? How are they actually executed? PANews conducted an in-depth analysis of 27,000 trades made by the top 10 profit-making whales on Polymarket in December to uncover the truth behind their profits.

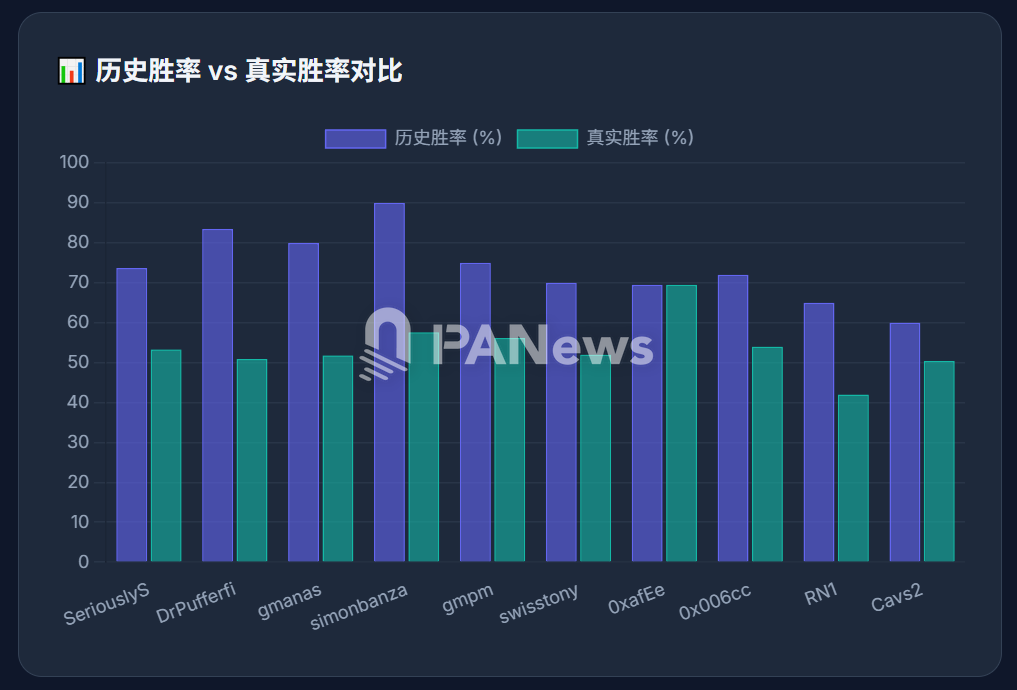

PANews found that while many so-called “smart money” traders do use hedging arbitrage, their actual strategies are far more complex than the simple hedging described on social media. Rather than just pairing “yes” and “no” positions, these traders leverage sports betting rules like “over/under” and “win/loss” to build intricate hedged portfolios. Another key insight: the extremely high historical win rates often seen are inflated by a large number of “zombie orders” that remain open, masking the true win rate, which is much lower.

PANews now breaks down the actual trading methods of these “smart money” whales through real-world examples.

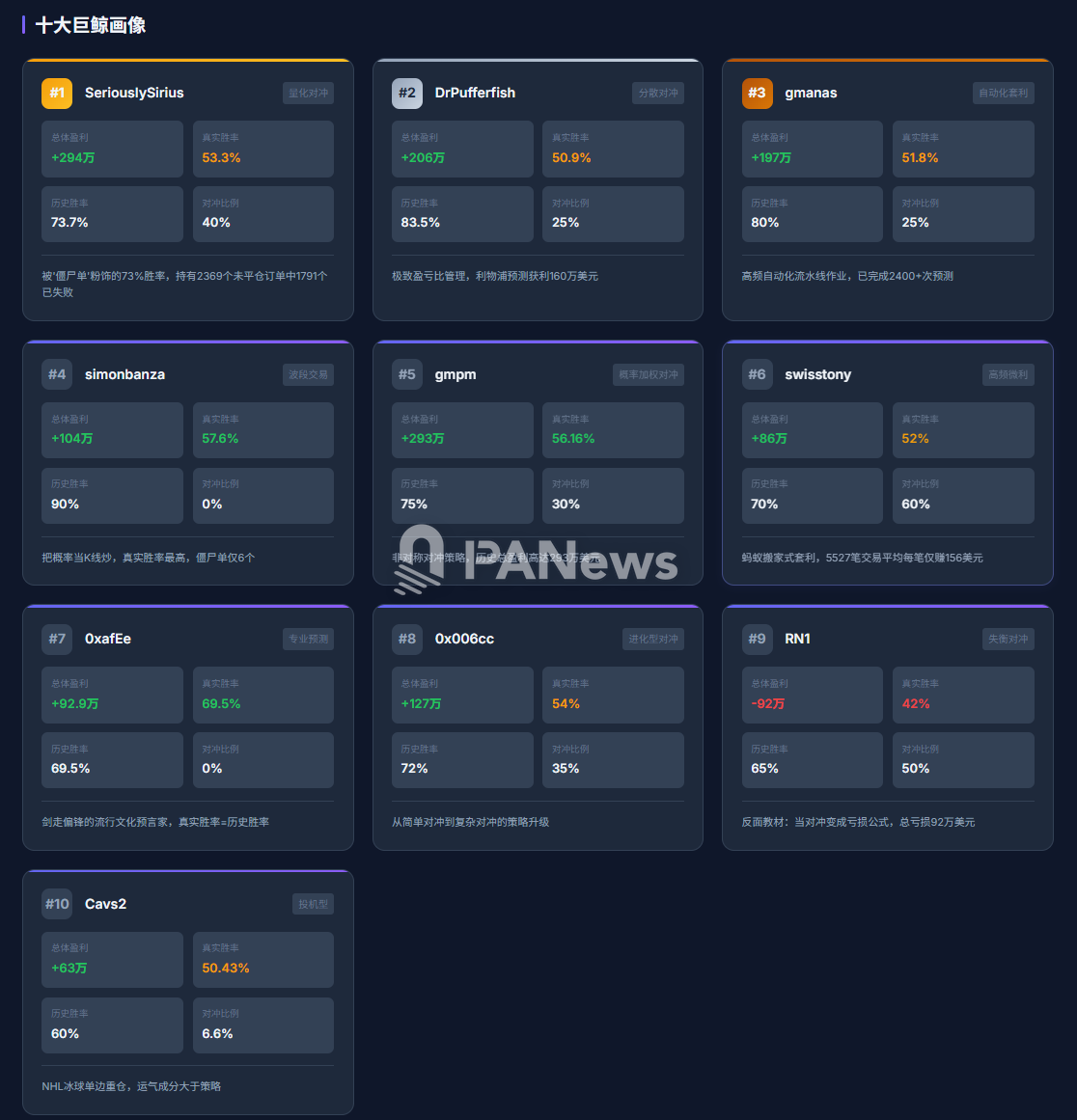

1. SeriouslySirius: A 73% Win Rate Masked by “Zombie Orders” and a Complex Quantitative Hedging Web

SeriouslySirius led December’s rankings, earning about $3.29 million that month and $2.94 million in total historical profit. Looking only at settled trades, his win rate hits 73.7%. However, this address currently has 2,369 open trades and 4,690 settled trades. Of the open positions, 1,791 are already total losses, but have not been closed out. This saves considerable effort and fees, and because he typically closes only profitable trades, the historical settled data shows an inflated win rate. When factoring in these unclosed “zombie orders,” the actual win rate drops to 53.3%—barely better than a coin toss.

About 40% of his trades are hedged bets on multiple outcomes in the same event. But this is not just “YES” + “NO” hedging. For example, in an NBA game between the 76ers and Mavericks, he bet on Under, Over, 76ers, Mavericks, and seven other outcomes—11 in total—earning $1,611. He used arbitrage where the combined probabilities were less than 100%. For instance, he bought the 76ers to win at 56.8% and the Mavericks at 39.37%, spending about 0.962 in total, guaranteeing a profit. In that game, he made $17,000.

Still, this approach doesn’t always win. In the Celtics vs. Kings game, he placed nine bets and lost $2,900.

There are also many cases where capital allocation is highly imbalanced—sometimes one side receives more than ten times the funds of the other. This likely results from limited market liquidity. It shows that while arbitrage looks attractive, liquidity can be the biggest obstacle, and you may not always achieve perfect hedges.

Because the execution is automated, such trades can easily turn into major losses if market conditions shift.

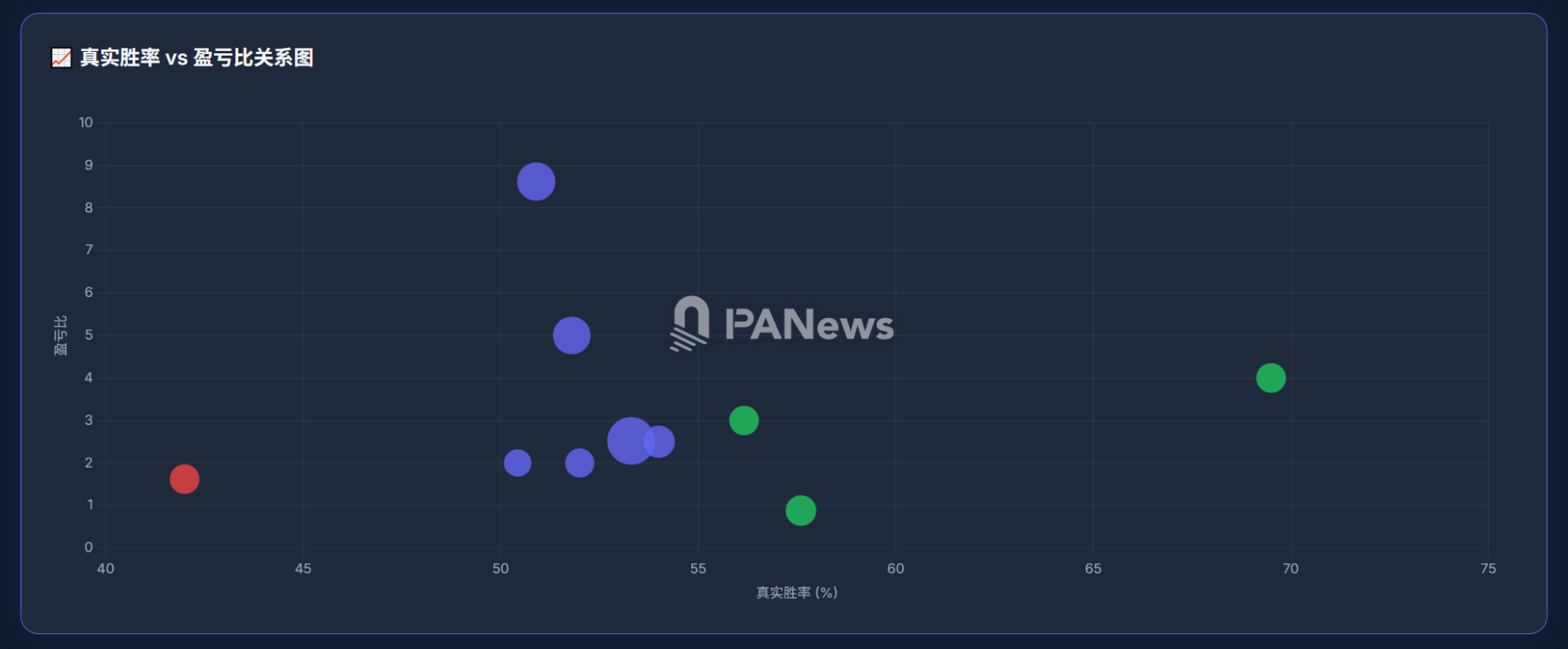

Ultimately, SeriouslySirius’s profitability comes down to disciplined position management, with a profit-loss ratio around 2.52. This allows him to remain profitable even with a modest true win rate.

This strategy wasn’t always a winner. Before December, this address was often below breakeven, with a maximum drawdown of $1.8 million. Whether the current approach will continue to deliver remains uncertain.

2. DrPufferfish: Turning Small Probabilities into Big Wins—The Art of Extreme Profit-Loss Ratio Management

DrPufferfish was December’s second most profitable trader, earning about $2.06 million that month with a historical win rate of 83.5%. But after accounting for many “zombie orders,” his true win rate is only 50.9%. His strategy is quite different from SeriouslySirius. Although about 25% of his trades are hedges, these are not opposing bets but rather diversified positions. For example, in the MLB championship market, he bought 27 low-probability teams, whose combined probability exceeded 54%. This turns a series of small-probability bets into a high-probability outcome.

His main edge is controlling the profit-loss ratio. Take Liverpool, his favorite English Premier League team: he predicted their results 123 times, earning about $1.6 million. His average profit on winning trades was about $37,200, while average losses were just $11,000. He often sells losing trades early to limit downside.

This approach yields a profit-loss ratio of 8.62 and a strong expectation of profitability. His strategy relies on professional analysis and strict risk management, not just simple arbitrage. Notably, most of his hedged trades are actually unprofitable, with total losses of $2.09 million, indicating these hedges serve mainly as insurance.

3. gmanas: High-Frequency Automated Trading

gmanas, ranked third, follows a style similar to DrPufferfish, earning $1.97 million in December. His true win rate is 51.8%, close to DrPufferfish’s, but he trades far more frequently, with over 2,400 completed predictions—clearly using automated strategies. His approach is similar to the previous address and needs no further elaboration.

4. Hunter simonbanza: Swing Trading Prediction Probabilities Like “Candlesticks”

simonbanza, ranked fourth, is a professional prediction market trader. Unlike others, he never hedges, yet has realized about $1.04 million in profits, with only $130,000 in “zombie order” losses. While his capital and volume are lower, his true win rate is the highest at 57.6%. His average profit on winning trades is about $32,000, while average losses are $36,500—a modest profit-loss ratio, but the high win rate yields strong returns.

This address has very few “zombie orders”—just six—because he typically closes out trades early, taking profits from probability swings rather than waiting for final outcomes.

This is a unique approach, treating probability changes like price swings in financial markets. His exact methods for achieving such a high win rate remain his secret.

5. Whale gmpm: Asymmetric Hedging—Using Large Positions for Certainty

gmpm, ranked fifth in December, actually has higher historical profits than those above, at $2.93 million, with a true win rate of 56.16%. His approach is similar to the fourth-ranked trader, but with a unique twist.

He often bets on both sides of a match, but rather than seeking arbitrage, he puts more capital on the higher-probability outcome and less on the lower-probability side. This way, when the likely outcome occurs, gains are substantial, while losses on unlikely events are limited.

This is a more advanced hedging strategy, combining event judgment with hedging to reduce losses rather than relying solely on mathematical arbitrage where “yes” + “no” is less than 1.

6. Workhorse swisstony: “Ant Moving” Style High-Frequency Arbitrage

swisstony, ranked sixth, is an ultra-high-frequency arbitrageur with 5,527 trades—the most of any address here. He has earned over $860,000, but average profit per trade is just $156. His “ant moving” strategy involves buying all possible outcomes in a match. For example, in the Jazz vs. Clippers game, he bought 23 different outcomes. Because his bets are small, capital allocation is relatively balanced, achieving some hedging.

However, this approach requires precise execution. For example, “yes” + “no” must be less than 1, but he often exceeds this, guaranteeing a loss. Still, with a reasonable profit-loss ratio and win rate, his overall returns remain positive.

7. Outlier 0xafEe: The “Pop Culture Prophet” Taking the Road Less Traveled

0xafEe, ranked seventh, is a low-frequency, high-win-rate trader, averaging just 0.4 trades per day and a true win rate of 69.5%.

He has earned about $929,000 with almost no “zombie orders”—just $8,800 in unrealized losses. He never hedges, focusing instead on predictions about Google search trends and pop culture, such as “Will Pope Leo XIV be the most searched person on Google this year?” or “Will Gemini 3.0 launch before October 31?” His unique analysis yields a remarkably high win rate. Among top whales, he’s the only one not focused on sports.

8. Manual Hedger 0x006cc: From Simple to Complex Hedging Strategies

0x006cc, ranked eighth, is similar to the complex hedgers above, with about $1.27 million in net profit and a true win rate of 54%. Unlike automated traders, he trades infrequently—just 0.7 trades per day. Early on, he likely used simple manual hedging strategies.

By December, he had upgraded to complex hedging. His history shows that as more traders learn about hedging, strategies in this market are evolving rapidly.

9. Cautionary Example RN1: When Hedging Becomes a Formula for Losses

RN1, ranked ninth, is the only address among the December top ten with a net loss. He realized about $1.76 million in profits but has $2.68 million in unrealized losses, for a net loss of $920,000. As a cautionary tale, there’s much to learn from his experience.

His true win rate is only 42%, the lowest here, and his profit-loss ratio is just 1.62—together, these mean negative expected returns.

Looking closer, he also pursues arbitrage, but often invests more in the low-probability side and less in the high-probability side, resulting in unbalanced positions. When the likely event occurs, he suffers real losses.

10. Gambler Cavs2: Heavy One-Sided Bets in Ice Hockey—Luck Over Strategy

Cavs2, ranked tenth, is another trader who prefers heavy, one-sided bets, mainly in NHL hockey. Overall, he’s earned about $630,000, with a true win rate of 50.43% and a low hedging ratio of 6.6%. These results are unremarkable, and luck played a larger role than strategy, as a few big wins drove his total profit. His approach offers little strategic value for others.

Five Harsh Truths After Demystifying “Smart Money”

After a deep dive into these “smart money” trades, PANews reveals the realities behind the prediction market “wealth stories.”

1. Hedging arbitrage strategies are not as simple as meeting probability conditions. In a competitive market with limited liquidity, they can easily turn into formulas for loss. Blind imitation is risky.

2. Copy trading doesn’t work well in prediction markets either. Rankings and win rates are based on settled profit data, which is often distorted. Most “smart money” isn’t as smart as it appears—win rates above 70% are rare, and most are close to coin flips. Market depth is limited, so arbitrage opportunities can only absorb small capital, and copy traders may get squeezed out.

3. Managing profit-loss and position ratios is more important than chasing win rates. The best performers excel at risk management—some, like gmpm and DrPufferfish, exit positions as probabilities shift to minimize losses and improve their ratios.

4. The real secret lies beyond mathematical formulas. Many social media “arbitrage formulas” seem logical, but in practice, real smart money’s edge comes from judgment and unique analytical models. These invisible decision algorithms are their true advantage. For those without them, prediction markets are a cold “dark forest.”

5. Prediction market profit potential is still limited. Even the top-earning address in December made only about $3 million. Compared to crypto derivatives, the ceiling here is clear. For those dreaming of overnight riches, this market is simply too small. Its niche, specialized nature means it’s unlikely to attract institutions anytime soon—perhaps the key reason prediction markets remain small.

In Polymarket’s prediction market, which looks golden on the surface, most so-called “legendary whales” are actually lucky survivors or relentless grinders. The real secrets to wealth aren’t found in inflated win rate leaderboards, but in the algorithms of a select few top players who put real capital on the line after filtering out the noise.

Statement:

- This article is reprinted from [PANews], with copyright belonging to the original author [Frank, PANews]. If you have any concerns about this reprint, please contact the Gate Learn team, and we will respond promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without referencing Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?