Left hand to right hand? Unveiling the financial leverage cycle behind the AI boom and Wall Street's ultimate gamble.

Key Takeaways

The AI boom is pervasive, but much of it is superficial. Capital is circulating among a small number of unprofitable companies. If this is a bubble and it bursts, the impact could be widespread, with significant consequences for all.

Many experts warn that if AI turns out to be a bubble and it bursts, the consequences could deeply affect the entire economy. Bloomberg Originals investigates the cycle of investment deals among AI companies and how these transactions have become the so-called “ultimate gamble.”

Highlights and Insights

Circular Investment Chains

- Nvidia plans to invest up to $100 billion in OpenAI, which is also a major customer for Nvidia chips

- OpenAI leases computing services from Oracle, which is itself a Nvidia customer—capital circulates in a closed loop among a few companies

Profitability Challenges

- Leading AI projects like OpenAI and Anthropic are not yet profitable; OpenAI may lose money each time a user interacts with ChatGPT

- Sam Altman has stated the company expects to break even between 2029 and 2030

Infrastructure Race

- Morgan Stanley estimates that total corporate investment in AI data centers could reach $3 trillion

- A 1-million-square-foot textile factory was converted into a data center; retrofitting existing facilities can take 6 months, while building from scratch takes 2 years

Lessons from the Dot-com Bubble

- The 2000 dot-com bubble burst wiped out roughly $5 trillion worldwide

- Amazon’s stock took 8 years to recover to pre-bubble levels, while Cisco took 25 years

“Too Big to Fail” Concerns

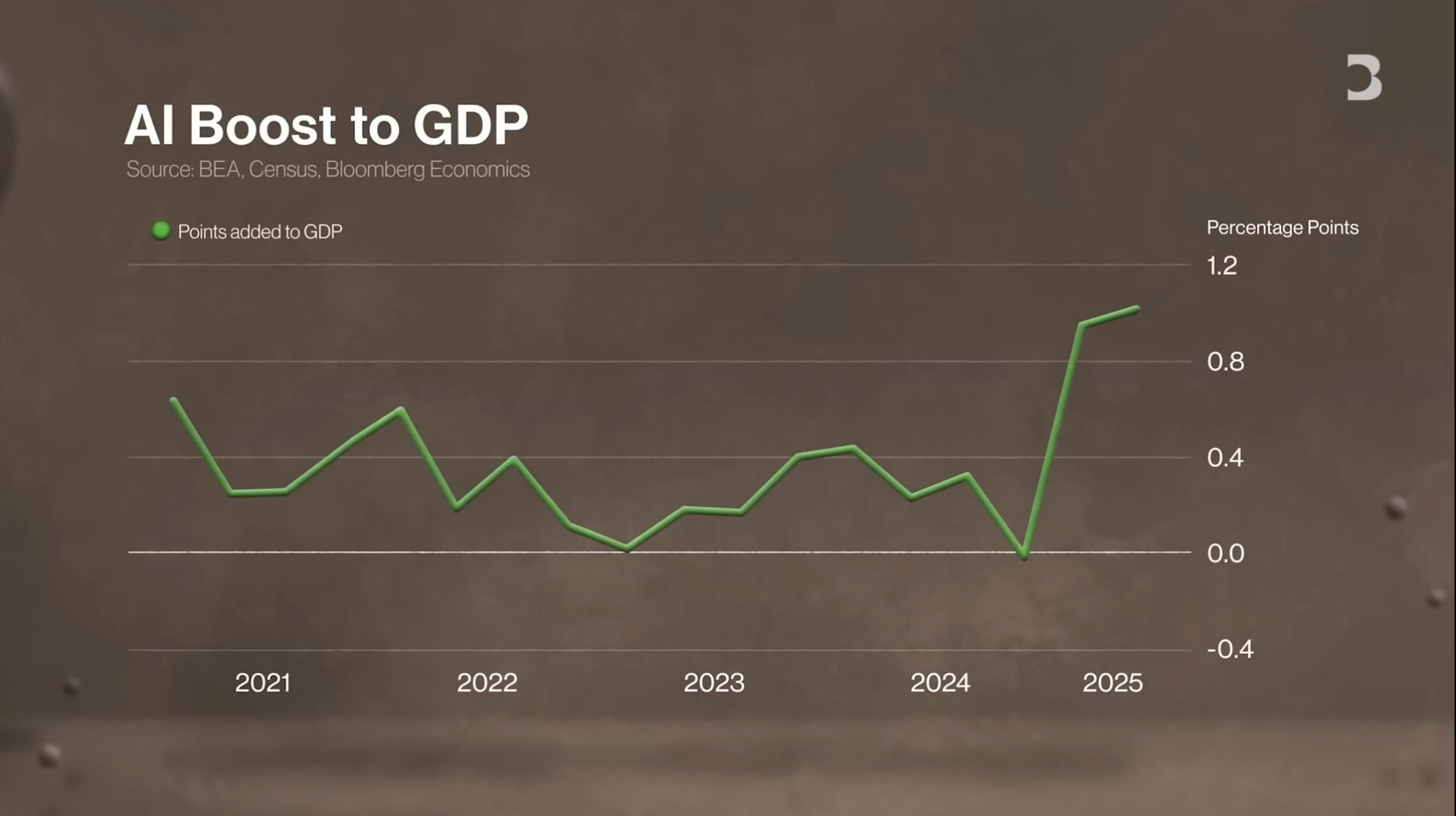

- The AI investment boom is now a major driver of GDP growth

- Ordinary Americans’ retirement accounts indirectly hold shares in these tech giants, making risk exposure broader than many realize

- Some fear this could play out like the 2008 financial crisis—large institutions may require massive capital to prevent a systemic collapse

- AI represents the biggest gamble in Wall Street’s history, and Wall Street is known for its appetite for risk—this is the “ultimate gamble.”

AI Boom and Circular Investment

Artificial Intelligence (AI) is expanding from Wall Street to rural America, becoming a central engine of economic growth. The market is brimming with confidence in AI’s potential, viewing it as a miracle that cannot fail. Investors have exceedingly high expectations for AI’s growth, with tech giants like Microsoft, Meta, and Alphabet already investing tens of billions of dollars in related capital expenditures and planning even more aggressive investments in the future.

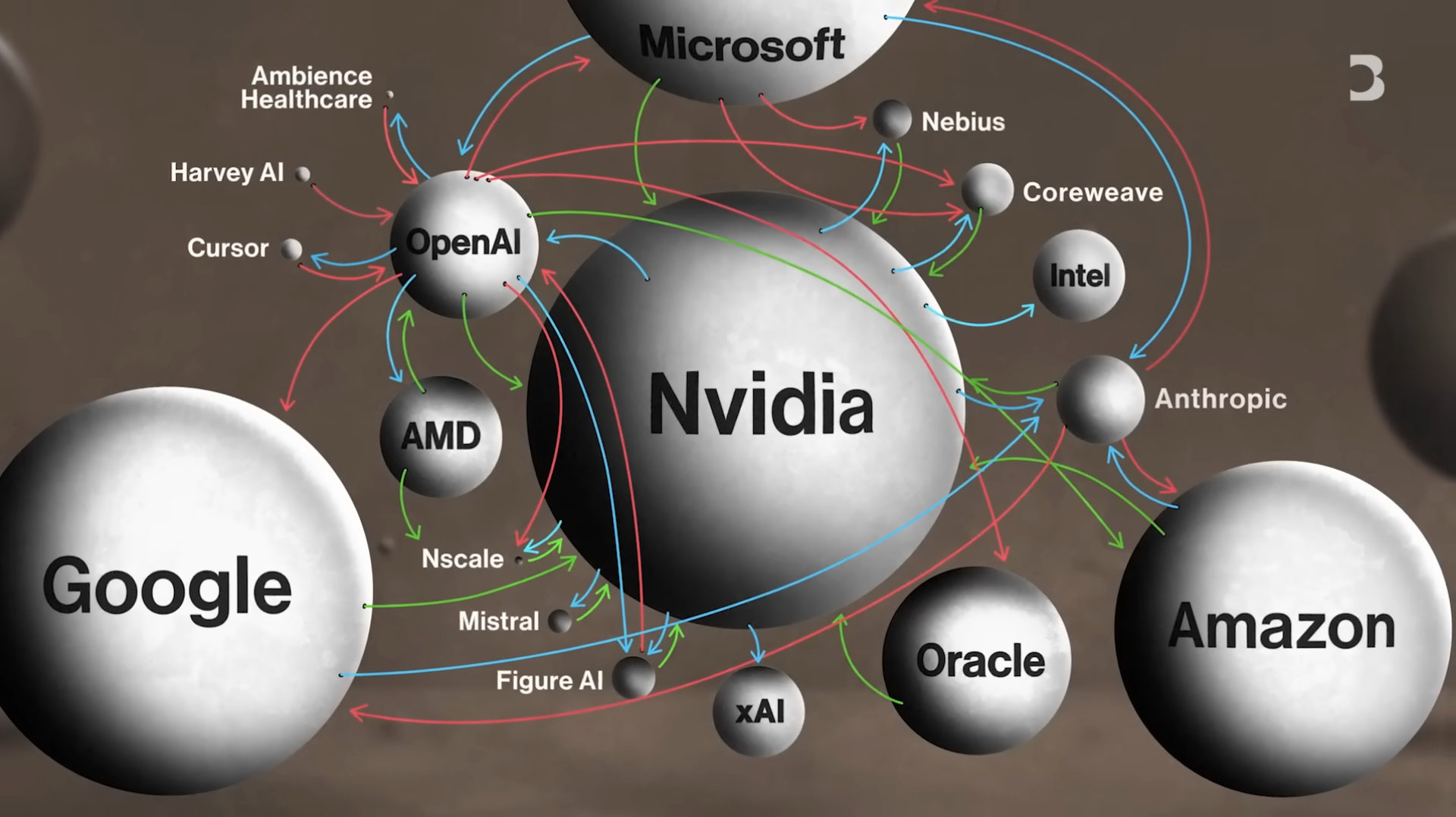

The AI boom extends well beyond software development, fueling a surge in infrastructure construction. Supporting AI’s growth requires new data centers and reliable supplies of energy and water. Yet this rapidly evolving sector also poses certain risks, especially in capital flows. A new investment strategy has emerged—tens of billions of dollars in circular investments. For example, Nvidia plans to invest up to $100 billion in OpenAI, with these enormous sums circulating among tech giants and forming a carousel-like chain of capital.

Still, AI’s potential remains immense. Around 80% of US businesses have already adopted AI, signaling a structural revolution on par with electricity or the internet.

Bubble Concerns and Complex Capital Flows

AI possesses tremendous potential, but its profitability has yet to be fully proven. Today, the most pressing question in San Francisco’s tech scene is whether we are in an AI investment bubble. If so, how big is it, and what would happen if it bursts? This is a crucial question. We may be entering a new era of AI-driven growth—or facing an unprecedented investment bubble.

So-called “circular investment” refers to capital, products, and services flowing among companies. For instance, Nvidia plans to invest up to $100 billion in OpenAI, while OpenAI is also a major customer for Nvidia chips. This capital flow further involves intermediaries like Oracle. OpenAI sometimes leases computing services from Oracle, which is also a Nvidia customer. This complex web of capital flows has made the industry into an intricate network involving many major players.

Industry Interdependence and the Infrastructure Race

Capital flows frequently among these companies. While this model is not inherently problematic, excessive deal sizes could drive overexpansion. The current worry is whether this symbiotic relationship could make the entire system fragile. If one company underperforms or encounters trouble, could it destabilize the whole industry?

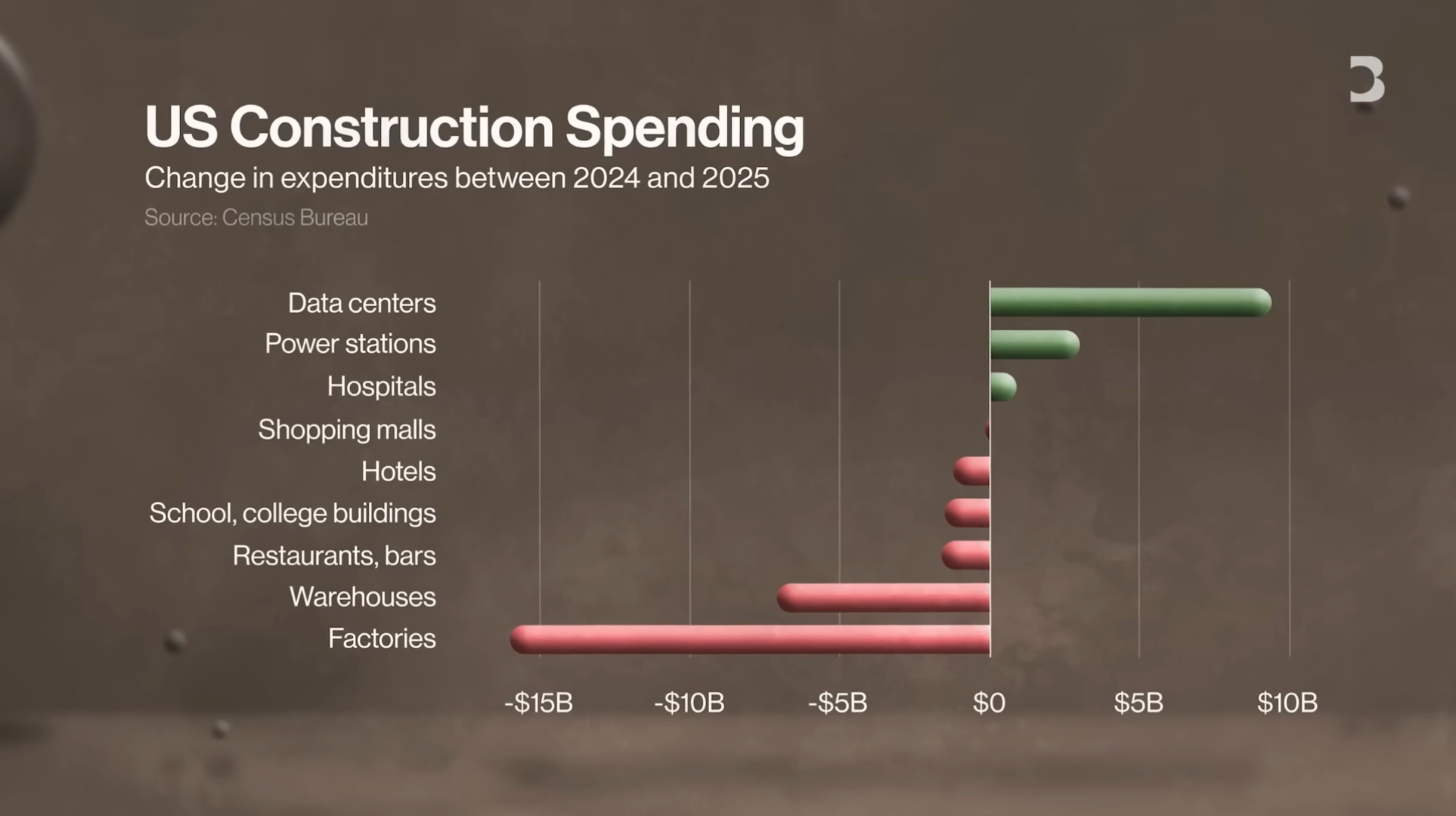

At the same time, massive investment is pouring into data center construction, fueling a nationwide infrastructure boom. We are witnessing an “arms race” in infrastructure. For example, while construction spending in most sectors is expected to decline in 2025, data center and power plant spending is rising. Many firms now serve as “builders” for the AI industry, aggressively investing in these projects. According to Morgan Stanley’s latest estimates, total corporate investment in AI data centers is projected to reach $3 trillion.

Data Center Construction Boom: The “Picks and Shovels” of Infrastructure

Data center construction is now in a period of explosive growth. If your business provides infrastructure or services for data centers, you are in a highly advantageous position. Market demand far outpaces supply, funding is abundant, and the outlook is strong. For example, the facility we’re in was once a 1-million-square-foot textile plant, later converted into a data center.

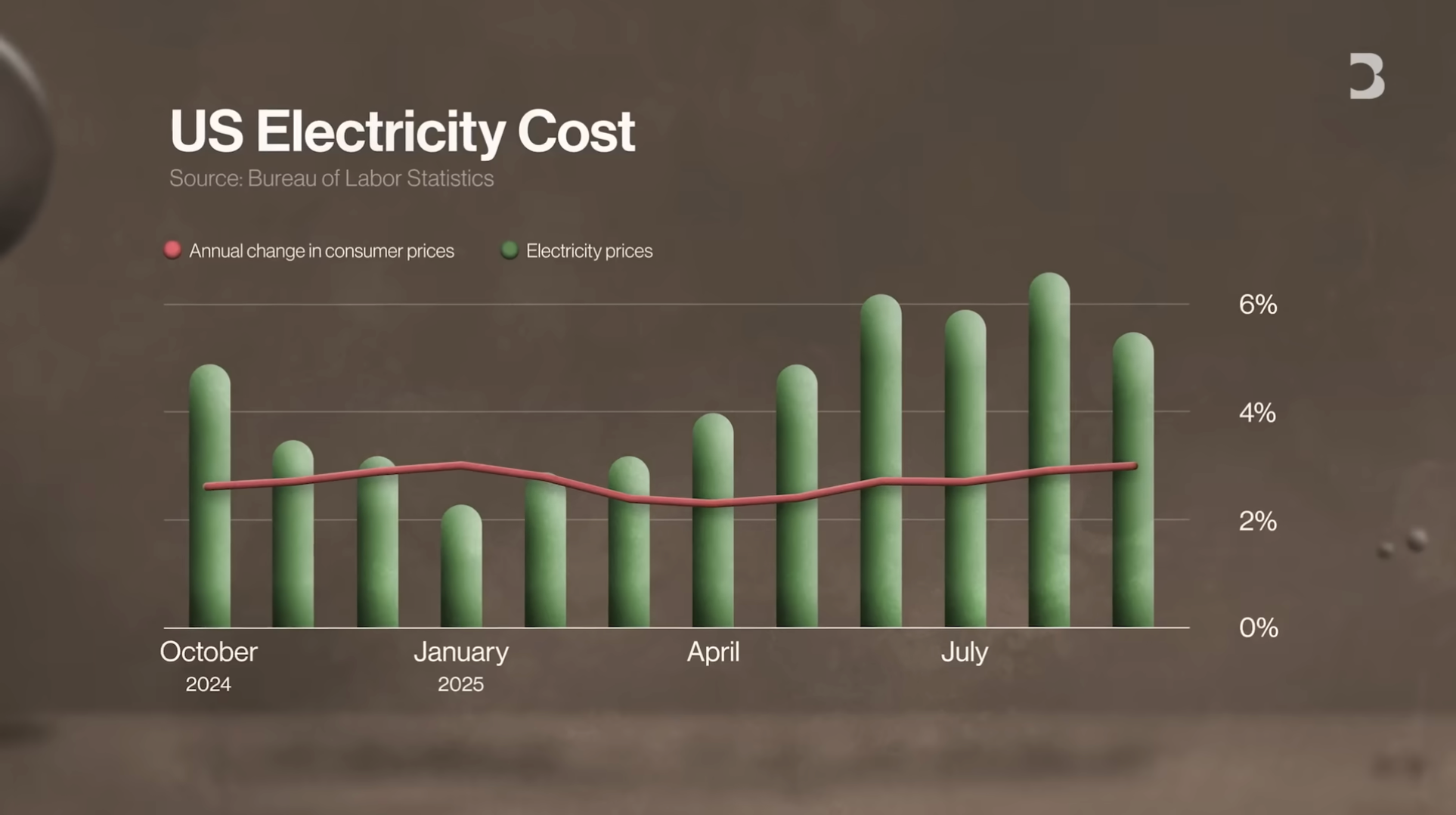

Demand for data centers is nearly limitless, spanning electricity supply, infrastructure, and specialized technical support. These needs are unlikely to slow in the near term. For the AI sector, time is critical. If you can retrofit an existing facility and be operational in 6 months rather than spend 2 years building from scratch, that’s the clear choice. Meanwhile, data centers’ demand for electricity is driving utility costs up faster than inflation. Utility companies and construction firms specializing in data center energy supply are especially strong performers.

Profitability Puzzle: Challenges and Risks for AI Projects

Yet rapid data center construction does not guarantee profits. Data centers require ongoing investment to keep technology current, or they will quickly lose customers. So far, major AI projects remain unprofitable. For example, OpenAI may lose money every time a user accesses ChatGPT, and companies like OpenAI and Anthropic have yet to achieve profitability.

OpenAI CEO Sam Altman has said the company expects to break even between 2029 and 2030. But given the current rate of cash burn and the need for further investment in data centers and computing resources, this goal is highly challenging. There are concerns about whether these AI startups can bear such high costs, especially as they commit to massive data center investments. Data center companies may serve as “early warning signals” for shifts in industry demand. If demand for AI products suddenly weakens, the entire sector could be affected. While all companies currently report strong demand for AI products, any downturn will quickly expose vulnerabilities.

Historical Parallels: Comparing the Dot-com Bubble and the AI Boom

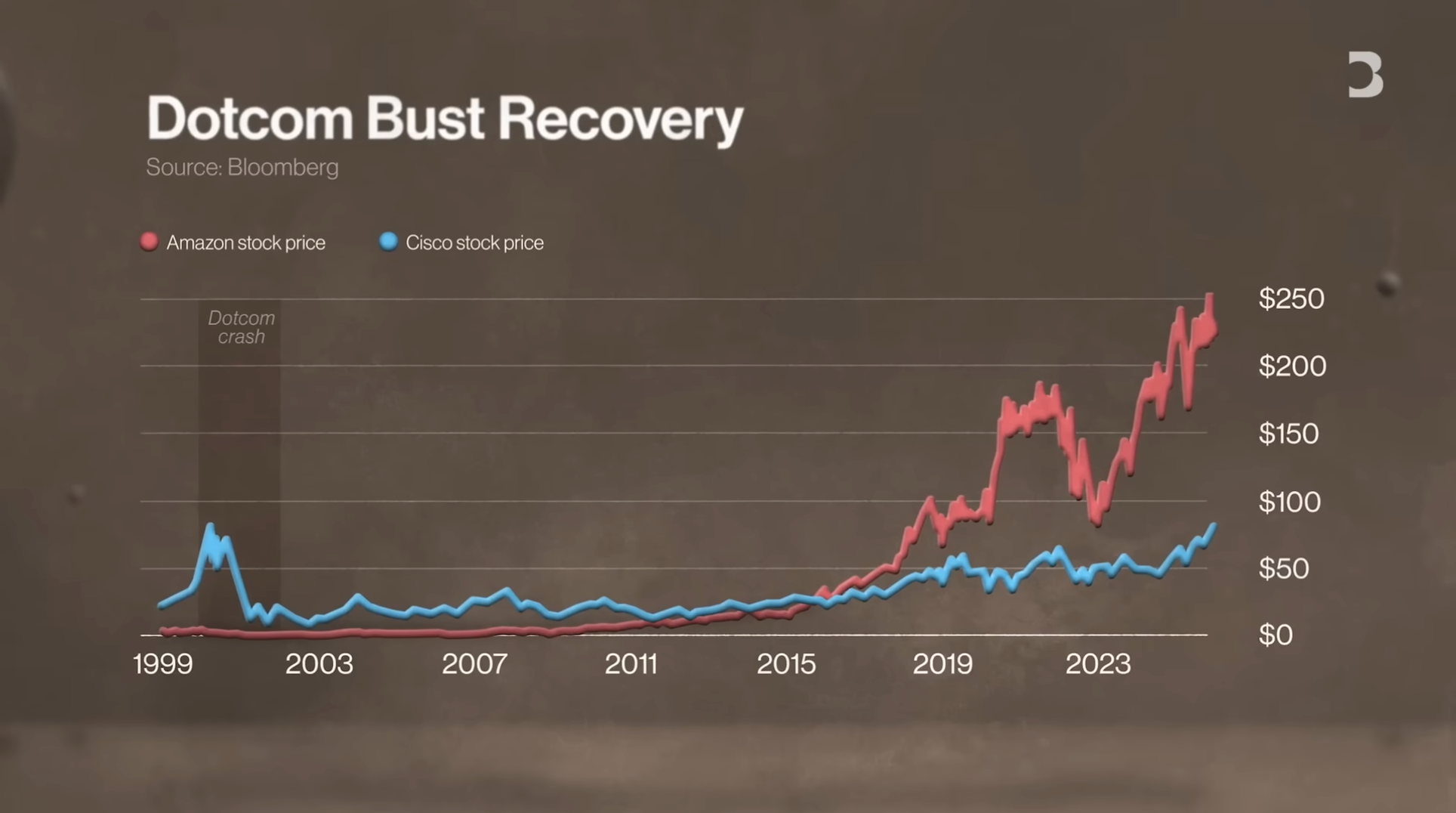

To grasp the potential risks of today’s AI boom, look back at the 2000 dot-com bubble. Then, internet companies promised a new era of hope, but ultimately caused massive losses. Savings were wiped out, office parks emptied, and about $5 trillion in value vanished globally. Tech stocks suffered the most, including many internet companies. Even the strongest firms took years to recover. Amazon, a famous survivor, took 8 years to regain its pre-bubble stock price, while Cisco as an infrastructure provider took 25 years to recover.

There are clear parallels between these two booms, including the phenomenon of circular investment. The question is whether the AI boom will go beyond the tech sector’s usual cycles and have a more profound impact on the broader economy.

Economic Impact and “Too Big to Fail” Worries

The dot-com bubble hit the economy hard, but if the AI boom collapses, the effects could be even more far-reaching. AI investment is now a major force behind GDP growth, helping to bolster the US economy amid tariffs and inflation. However, this also means ordinary Americans are exposed to risk, as many retirement and investment accounts hold shares in the tech giants leading the AI charge.

Does this mean the AI boom is already “too big to fail”? The current concern is whether these companies have become so large and interconnected that their failure would trigger not only economic turmoil but broader systemic risks. Some worry this could play out like the 2008 global financial crisis, when major institutions required massive bailouts to prevent total collapse. If the AI boom does collapse, the challenges for the US economy could be even greater.

Long-Term Outlook: AI’s Future Remains Bright

Despite the risks of the AI boom, many remain optimistic about the future as the technology keeps advancing. During the dot-com era, companies invested heavily in fiber optic cables, which seemed excessive at the time but ultimately became the backbone of internet broadband. Unused fiber laid in the 1990s later proved essential for internet growth. Similarly, today’s data center construction, even if it results in temporary overcapacity, may be fully utilized in the future.

Of course, AI’s development may take longer than expected. Some strong companies may survive this process, though their valuations may fluctuate significantly. However, AI technology itself is unlikely to suddenly implode like a bubble. While some companies may not withstand market pressures, the AI sector is not an illusion. It has already produced tangible products and demonstrated immense potential. AI represents the largest gamble in Wall Street’s history, and Wall Street is famous for its appetite for risk—this is the “ultimate gamble.”

Statement:

- This article is reprinted from [TechFlow], with copyright held by the original author [TechFlow]. If you have concerns regarding this reprint, please contact the Gate Learn team, who will handle the matter promptly according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article in any manner not referencing Gate.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

What is AIXBT by Virtuals? All You Need to Know About AIXBT

AI Agents in DeFi: Redefining Crypto as We Know It

Understanding Sentient AGI: The Community-built Open AGI