New Year, New Opportunities: What to Watch on Berachain

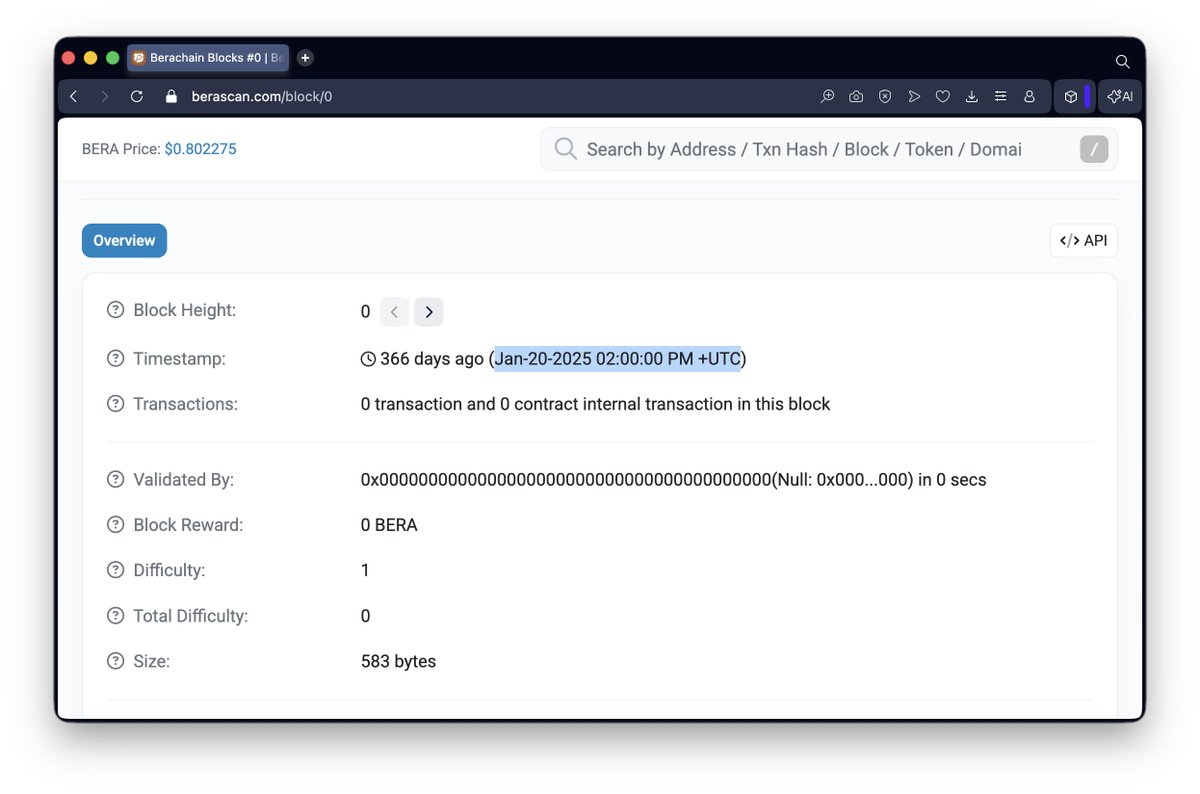

Since Berachain’s mainnet launch in January 2025, the network has completed a full annual cycle. Over the past year, its innovative PoL mechanism has evolved from early proof-of-concept to large-scale deployment, demonstrating increasing maturity as a foundational economic coordination layer.

From an operational standpoint, PoL now enjoys a stable and growing user base. Over 25 million BERA are currently staked in PoL, marking a new all-time high. With this foundation, ecosystem TVL supported by PoL has surpassed $250 million. The protocol’s supply structure has stabilized, and liquidity has shifted from relying on short-term incentives to entering a phase of sustainable operation. This transition signals that PoL is no longer just an incentive mechanism—it is becoming the operational core of the Berachain ecosystem for the long term.

In parallel, the total supply of on-chain stablecoins has exceeded $100 million. USDT issued on BERA is now listed on major exchanges, including Kraken, Bybit, and OKX. Stablecoins are moving beyond their role as “liquidity tools” and are emerging as foundational, reusable assets within the ecosystem, serving as a unified value anchor for trading, lending, and derivatives.

Building on this, the Berachain ecosystem is experiencing rapid and diverse growth across applications.

Infrared Finance (IR) is now listed on major CEXs such as Binance, Bitget, and HTX. Dolomite (DOLO) is available on Binance, Coinbase, and Bybit, and has become the primary lending venue for USD1 within the WLFi framework. Kodiak (KDK) attracted approximately $150 million in demand for a $1 million allocation during its IDO on Gate; its DEX has surpassed $5 billion in cumulative spot volume and $1 billion in perpetuals. Meanwhile, projects like CrediFi, Foreverlong, and LiquidRoyaltyX have all completed funding rounds, creating a more clearly structured and layered ecosystem.

Reviewing this period, PoL’s greatest achievement is fostering a replicable, scalable model for ecosystem growth—where incentives, liquidity, and applications form a closed loop rather than depleting each other. Entering 2026, Berachain’s ecosystem is poised for a new cycle, presenting users with a range of ongoing opportunities to watch.

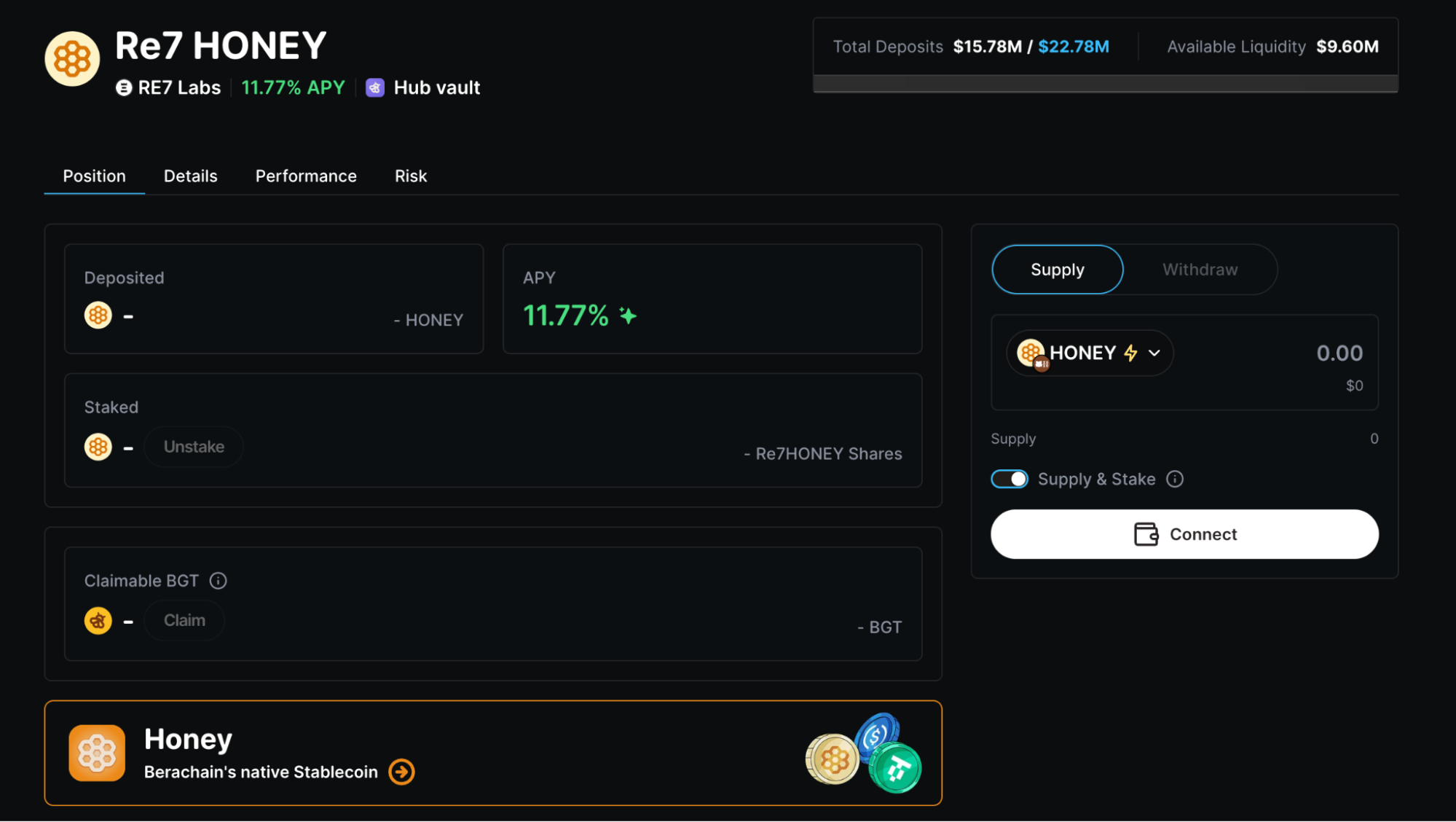

HONEY Stablecoin Staking: Approximate 12% Annual Yield

Honey is Berachain’s native on-chain stablecoin and a core asset under the PoL mechanism. As the mainnet enters a stable phase, Honey’s circulating supply has surpassed $100 million, signifying its entry into the scalable stablecoin category. Currently, Honey supports staking at https://bend.berachain.com/lend with annual yields around 12%. For HONEY holders or those seeking low-risk, stable returns on Berachain, this is an attractive option.

A key advantage of Honey staking is its direct, on-chain yield path that does not rely on complex structures. Users can deposit and withdraw at any time, with no lock-up period or cap. This approach positions Honey as a “yield-bearing stable asset” available on demand, rather than a short-term product requiring precise timing or quota competition.

In the current stablecoin yield market, HONEY stands out for both its returns and convenience. For comparison, yields on major centralized exchanges have dropped sharply: OKX now offers less than 2% annualized returns on standard stablecoins; Binance and Bitget provide somewhat higher rates, but only up to 300 USDT earns about 5% APY, with any excess earning much less. These yields act more as promotional tools than as sustainable allocation strategies.

From a Berachain ecosystem perspective, Honey’s real significance is in establishing a long-term, on-chain stablecoin use case. Stablecoins are no longer just for liquidity rotation or as trading intermediaries—they can now serve as long-term parked assets actively participating in the ecosystem. High liquidity and low-friction yield paths encourage users to keep funds on-chain, supporting lending, trading, derivatives, and the PoL system with steady, predictable liquidity.

This structure creates an endogenous capital retention mechanism for Berachain, allowing funds to accumulate naturally through use and forming a stable foundation for the protocol’s operation. This is a critical enabler for PoL’s continued expansion and provides sufficient safety margins and liquidity depth for future, more complex financial applications.

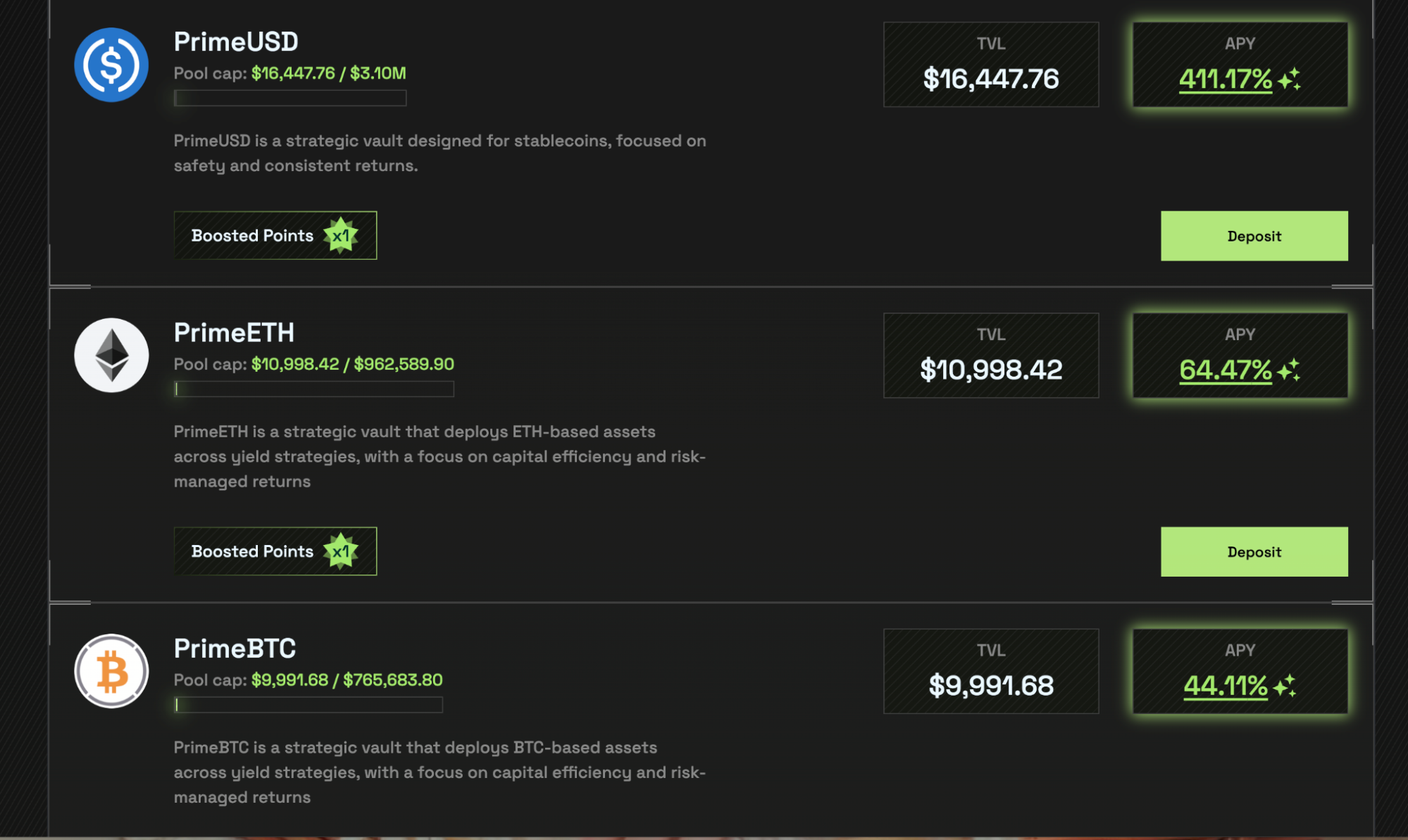

Prime Vaults Deposit Program Launch: First-Phase Strategy Deployed on Berachain

Prime Vaults has launched its first pre-deposit phase, with initial strategies deployed in Berachain’s high-yield PoL environment. Users can participate in these strategies through Vaults without managing underlying DeFi operations. Current stablecoin pool yields exceed 400%.

Early users can join before pools reach capacity, as each Vault has a clear cap. The main features of this phase are straightforward: no principal lock-up, yields are claimable at any time, and this is a classic early-stage, high-efficiency allocation window.

According to the protocol’s front-end data, core Vaults are currently yielding as follows (overall TVL is still in its infancy):

- PrimeUSD (Stablecoin Pool)

TVL: approx. $16,447.76 / Cap $3.10M

Current APY: approx. 411.17% - PrimeETH (ETH Pool)

TVL: approx. $10,998.42 / Cap $962,589.90

Current APY: approx. 64.47% - PrimeBTC (BTC Pool)

TVL: approx. $9,991.68 / Cap $765,683.80

Current APY: approx. 44.11%

Currently, Vault utilization rates are very low, and yields remain at levels not yet diluted by broader participation. The stablecoin pool offers returns far above market norms in this early stage, while ETH and BTC pools also outperform typical rates for similar assets on mainstream lending protocols and centralized platforms.

Prime Vaults is designed for asset holders seeking sustainable yield with principal security. The protocol pools returns from lending, liquidity mining, AMM, and other strategies, reducing the impact of single-strategy volatility. Principal and yield are separated—yields can be withdrawn anytime while principal continues to accrue, balancing liquidity with cash flow flexibility.

Prime Vaults has set a clear long-term benchmark: yields will not fall below the Aave V3 Core supply rate, and users can benefit from additional upside when strategies perform well. The focus on Berachain’s high-yield environment in this opening phase is a key driver of the elevated APY during the pre-deposit stage.

If you are a long-term holder of ETH, BTC, or stablecoins seeking to earn yield in Berachain’s ecosystem without changing your asset structure or facing lock-up constraints, Prime Vaults’ first phase remains an early participation window worth your attention.

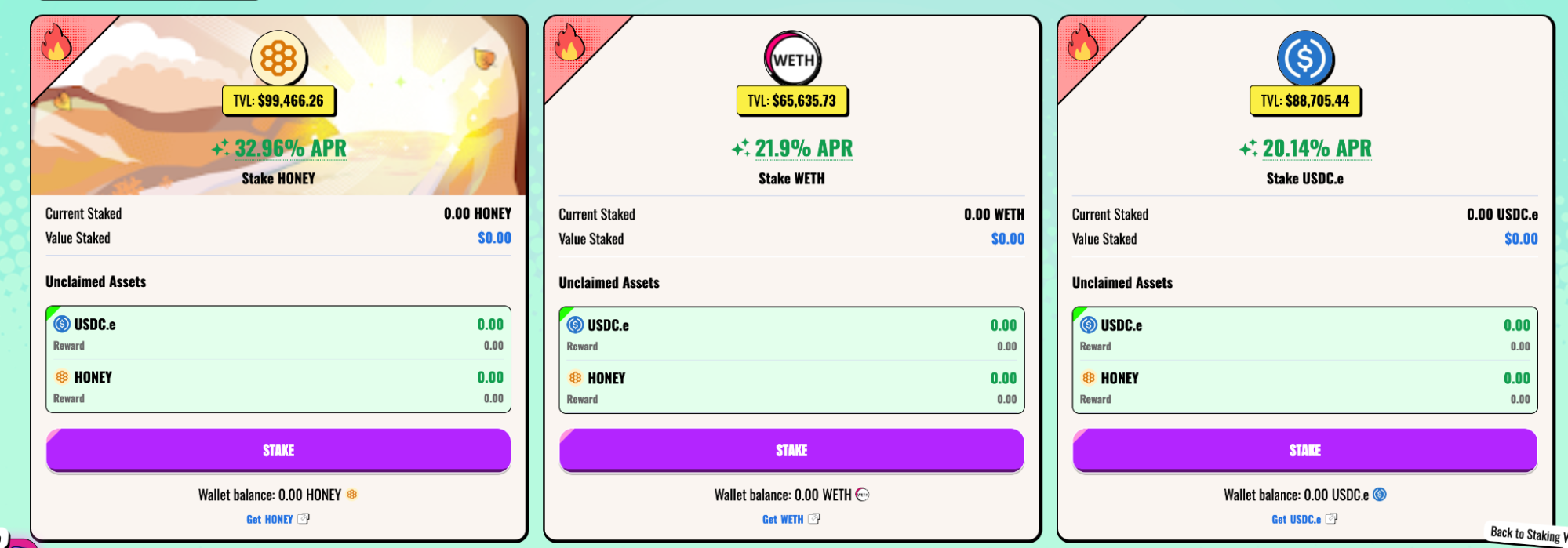

Jiko Finance Launches Limited-Time Boost Yield Event for HONEY

As a stablecoin yield protocol within Berachain, Jiko Finance has introduced a limited-time Boost yield event for HONEY. The event runs for 14 days and offers participants a minimum of 30%+ annualized returns—a well-defined, time-sensitive allocation opportunity.

This Boost event combines two components: a base yield from the protocol itself, currently around 20.12% APY, and an additional incentive yield of about 10.07% APY, totaling over 30% annualized. The yield structure is transparent and effective throughout the event period.

Jiko Finance focuses on simple, low-barrier yield products for stablecoins and HONEY. This limited-time Boost event adds a temporary incentive to its existing model, directing liquidity into HONEY pools.

Amid generally declining stablecoin yields, such clearly structured, time-limited events offer a relatively predictable short-term yield opportunity. Given the short window, these are best suited for tactical allocation or increasing HONEY position efficiency—not for long-term lock-up strategies.

For users seeking to enhance short-term returns on stablecoins or HONEY without complex operations or additional structural risk, Jiko Finance’s Boost event is a rare high-yield, low-barrier opportunity.

$BGT Annual Inflation Rate Lowered from 8% to 5%

It is also notable that Berachain, through governance, is reducing the $BGT annual inflation rate from 8% to 5%. This adjustment is already showing positive effects in practice. By lowering inflation without diminishing PoL’s incentive function, the protocol is optimizing token supply—shifting incentives from pure expansion to a mechanism that balances long-term value and ecosystem stability. This strengthens expectations for $BGT’s long-term scarcity and incentive power, boosting confidence in Berachain’s sustainable development.

As new yield opportunities emerge and the inflation model tightens, Berachain is entering a new stage defined by structural optimization and long-term stability. For the Berachain ecosystem, 2026 will remain a prime landscape for long-term value creation.

Disclaimer:

- This article is republished from [TechFlow], copyright by the original author [黑色马里奥]. If you have concerns about this republication, please contact the Gate Learn team, who will promptly address the matter according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article if Gate is not referenced.

Related Articles

Top 10 NFT Data Platforms Overview

7 Analysis Tools for Understanding NFTs

What Is Technical Analysis?

What is Tronscan and How Can You Use it in 2025?

Top 20 Crypto Airdrops in 2025