OP Introduces Superchain Buyback Mechanism, Allocating 50% of Revenue to Buybacks as OP Price and Tokenomics Reach a Major Turning Point

Overview of the New OP Proposal

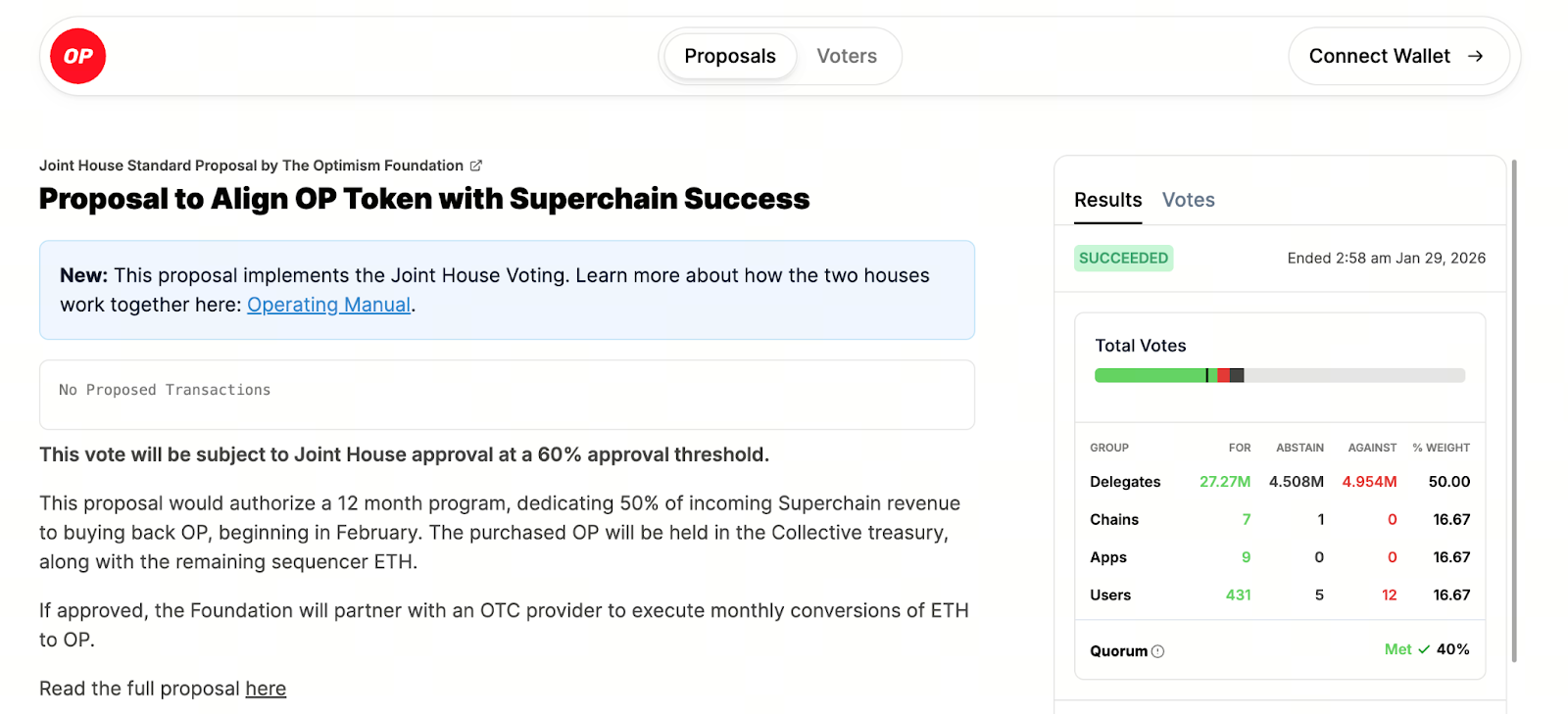

Recently, the governance body of the Ethereum Layer 2 network Optimism (OP) passed a pivotal proposal: over a 12-month pilot period, 50% of Superchain sequencer net revenue will be allocated to repurchasing OP tokens. With approximately 84.4% support, this proposal marks a substantial move toward value capture within the OP token economic model.

This mechanism centers on leveraging the network’s own revenue to establish consistent demand for OP tokens, thereby strengthening the link between token value and protocol operations—moving beyond OP’s previous role as primarily a governance token.

How the Buyback Mechanism Works

The proposal specifically outlines:

- Launching a one-year (12-month) buyback program starting in February;

- Allocating 50% of Superchain sequencer net revenue each month for regular OP token buybacks;

- Returning repurchased OP tokens directly to the Optimism Treasury, with future usage (burn or ecosystem incentives) to be determined by community governance.

Superchain is a suite of Layer 2 networks built on the OP Stack, including OP Mainnet, Base, Unichain, World Chain, Soneium, Ink, and others. As these networks expand, Superchain’s revenue base continues to grow, providing a reliable funding source for the buyback mechanism.

Short-Term Impact on OP Price

Image: https://www.gate.com/trade/OP_USDT

After the buyback mechanism was announced, expectations for the OP price showed significant volatility. Data indicate that, prior to the governance vote, OP briefly dropped to the $0.25 range. Following the proposal’s approval and improved market sentiment, the price saw a modest recovery but remained below its historical highs.

Typically, such buyback mechanisms create sustained demand for the token, which can help alleviate long-term supply pressure and bolster market confidence. However, the true impact will depend on market response once the buyback program is operational.

Ecosystem Growth and Long-Term Value Capture

Over the long term, channeling protocol revenue into OP token buybacks could deliver several key value propositions:

- Strengthened value capture: Allocating part of protocol revenue to buybacks closely ties the OP token’s economic model to Superchain usage growth, evolving from a governance token to a value-oriented token.

- Improved network economic health: The buyback mechanism may enhance OP’s market liquidity, optimize market structure, and help establish a more stable price floor.

- Enhanced incentive alignment: As protocol revenue increases, buyback intensity may rise accordingly, enabling ecosystem participants to share in the benefits.

Moreover, as Superchain’s presence in the Layer 2 sector expands—such as increased activity on Base and other chains—this buyback mechanism could provide even stronger support for token value going forward.

Potential Risks and Community Perspectives

While the buyback mechanism theoretically enhances value capture, its implementation faces several potential risks:

- Revenue volatility: Superchain income is highly sensitive to on-chain activity, so fluctuations could result in inconsistent buyback levels.

- Token supply and deflationary effects: If repurchased tokens are not burned, they may tie up treasury resources long-term, potentially impacting market supply-demand dynamics.

- Uncertainty in governance decisions: Future token usage will be determined by governance, which could trigger community debate over resource allocation.

Community views on the proposal are diverse. Supporters believe the buyback strengthens economic incentives, while critics are concerned about limited short-term effects and emphasize the need for ongoing observation.

Summary and Outlook

In summary, OP’s latest proposal to allocate 50% of Superchain revenue to an OP buyback mechanism represents a significant reform of its token economic model and signals a new phase in Optimism’s approach to value capture. As the pilot program rolls out and market feedback emerges, this mechanism could serve as an important reference model for value creation within Layer 2 ecosystems.

For investors, understanding this revenue-driven buyback framework is essential for a comprehensive assessment of the OP token’s medium- and long-term potential.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About