Optimism Proposes Using 50% of Superchain Revenue to Buy Back OP Tokens: A Deep Dive into a New Era of Value Capture

Proposal Background and Core Content: Optimism Proposes to Repurchase OP with 50% of Superchain Revenue

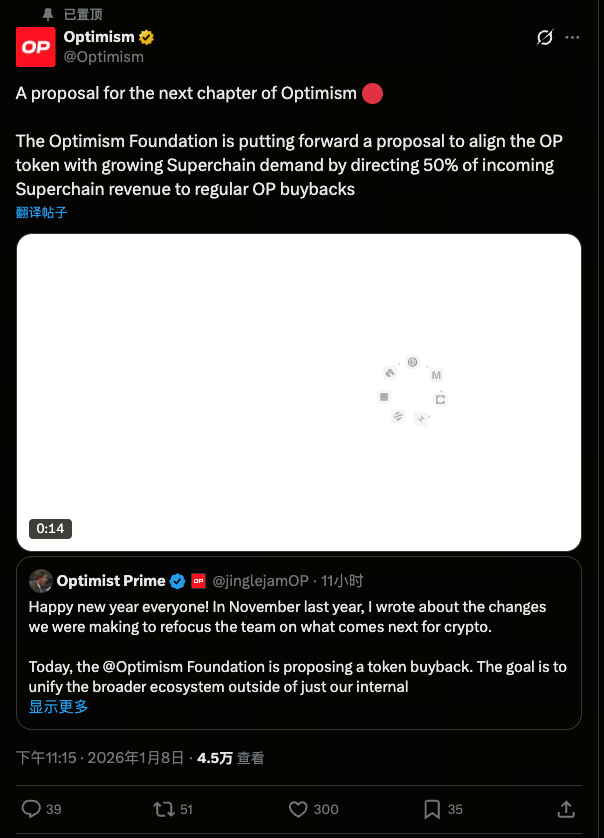

Image: https://x.com/Optimism/status/2009282745466503506

In January 2026, the Optimism Foundation formally submitted a milestone proposal to its governance community: to allocate 50% of Superchain network revenue for regular OP token buybacks.

The proposal’s core aim is to shift OP from a governance-centric utility token to a value asset directly tied to ecosystem economic growth.

As outlined in the proposal’s execution framework, if approved in the governance vote (scheduled for January 22):

- The buyback program will commence in February 2026

- The execution period will last 12 months

- Repurchased OP will be returned to the Collective Treasury

- The final use of these tokens will be determined by community governance, including: burning; staking rewards; ecosystem incentives; and public goods funding

This structure establishes a direct income anchor for OP’s value capture mechanism.

Superchain Ecosystem Revenue and Historical Data Overview

Superchain is an ecosystem of multiple Layer-2 networks built on the OP Stack. Key members currently include:

- OP Mainnet

- Base

- Unichain

- Ink

- World Chain

- Soneium, among others

Over the past 12 months, the Superchain ecosystem generated approximately 5,868 ETH in Sequencer (block ordering) revenue, amounting to tens of millions of dollars at current prices. All revenue is managed within a public treasury governed by the Optimism system.

From a market structure perspective:

- Superchain accounts for roughly 61.4% of Layer-2 transaction fee market share

- It processes approximately 13% of total crypto ecosystem trading volume

Data shows Superchain has progressed from the conceptual stage to scaled operations, with the capacity to generate sustainable cash flow.

Why 50% Buyback? How Does the Mechanism Work?

Buyback mechanisms are established tools for value capture and distribution in both traditional finance and crypto. Optimism’s choice to allocate 50% of Superchain revenue to OP buybacks is driven by several key factors:

Buyback Execution Logic

- Each month, 50% of actual Superchain revenue will be used to repurchase OP

- Buybacks will primarily occur via over-the-counter (OTC) transactions to minimize market disruption

- Acquired OP will be deposited into the treasury, not immediately burned

Value Pathways After Buyback

OP returned to the treasury can be allocated to various uses via governance:

- Burning to reduce circulating supply

- Distribution to long-term staking or governance participants

- Providing ecosystem incentives to developers and supporting public goods

This creates a clear positive feedback loop: ecosystem usage growth → increased revenue → larger buybacks → stronger support for OP value.

This approach transforms OP from representing only “governance rights” to being directly linked to Superchain’s real economic activity.

Potential Impact on OP Price and Market Sentiment

Image: https://www.gate.com/trade/OP_USDT

From a market perspective, OP’s price action has faced pressure in recent years. After reaching a historical high of about $4.69 in March 2024, the token saw a substantial correction, with current prices well below previous highs. This reflects a disconnect between network growth and token value.

If the buyback proposal is implemented, the following changes may occur:

- Strengthened market confidence: predictable buyback demand helps establish a price floor

- Improved capital efficiency: network-generated cash flow feeds directly into the token system

- Enhanced long-term expectations: combining buybacks with burning or lock-up mechanisms may ease circulation pressure

However, these effects depend on actual Superchain adoption and the formation of market consensus.

Community Feedback and Potential Risks

While some community members support the proposal, discussion has centered on several key risks:

1. Token Unlocks and Sustained Sell Pressure

OP has undergone multiple large-scale unlocks in the past. Whether continued supply releases will weaken the buyback effect remains a core issue in governance debates.

2. Governance Trade-Offs

Using 50% of revenue for buybacks reduces available funding for other uses (such as public goods or ecosystem subsidies). Governance must balance short-term value support against long-term ecosystem investment.

3. Long-Term Sustainability of the Mechanism

The current proposal is set for 12 months. Whether buybacks become a permanent policy or remain a temporary experiment will depend on future governance decisions.

Conclusion: A Key Step from Governance Token to Economic Asset

In summary, Optimism’s proposal to use 50% of Superchain revenue for OP buybacks is not merely a capital operation. It’s a systematic effort to define how decentralized ecosystems allocate economic returns and establish token value loops.

If implemented, this proposal could become a landmark example of value capture mechanism evolution in the Layer-2 space. Regardless of the final outcome, this initiative signals that the Layer-2 ecosystem is moving beyond mere scalability narratives toward mature economic system design.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About