OWL High-Yield Savings Launch: Gate Simple Earn Opens Limited 30-Day Fixed Term with Up to 200% APY

Gate Simple Earn Introduces New High-APY Fixed-Term Savings Event

Image: https://www.gate.com/simple-earn?asset=OWL&product_id=318&product_type_tag=1

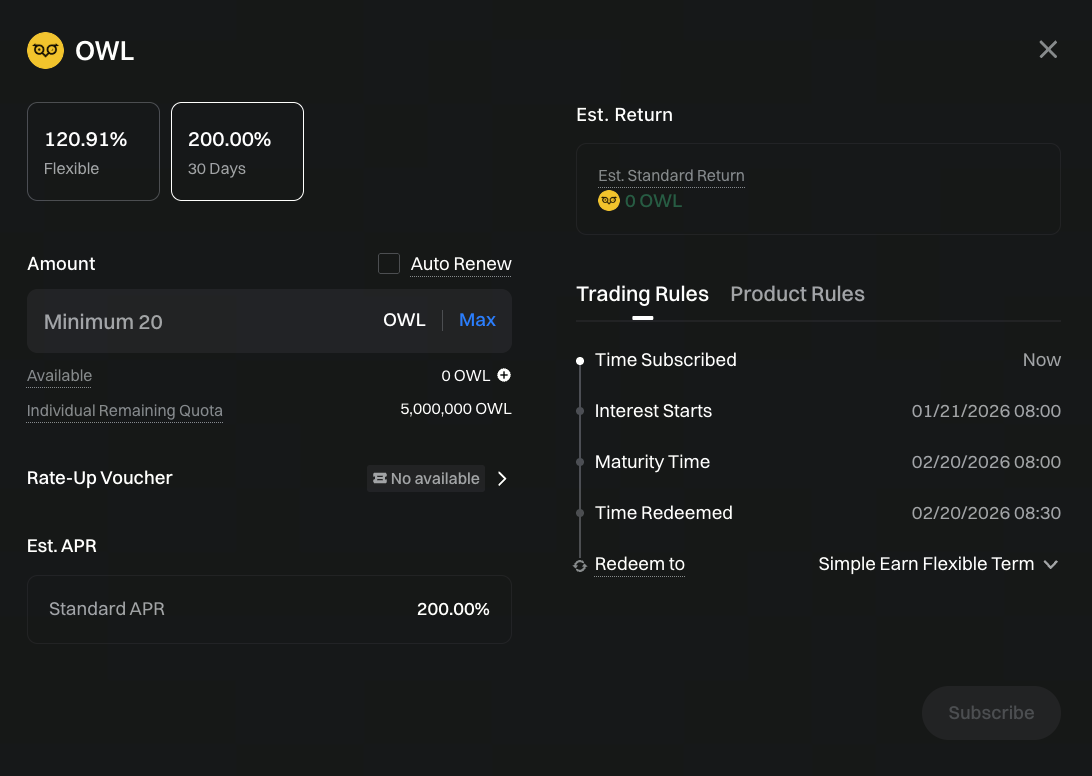

As Gate continues to diversify its savings products, Simple Earn has recently launched a 30-day fixed-term savings program for OWL, attracting strong market interest. This offering centers on “limited time + high APY,” delivering up to 200% annualized returns over a set term and expanding choices for users seeking yield-driven allocations.

Compared to standard flexible savings, the OWL fixed-term product delivers significantly higher returns but requires stricter liquidity management.

Key Rules for the OWL 30-Day Fixed-Term Savings

Gate Simple Earn’s OWL fixed-term savings follows clear, standardized rules for user clarity and easy participation:

- Fixed savings term of 30 days

- Annualized yield up to 200%

- Interest paid in OWL tokens

- Limited quota; available while supplies last

After purchase, funds enter a lock-up period. Principal and interest are settled together at maturity.

Who Benefits Most from High-APY Fixed-Term Savings?

From an asset allocation perspective, high-APY fixed-term savings may not suit every user, but they offer clear value in specific scenarios:

- Maximizing returns on assets not needed in the short term

- Mid-term investors confident in the OWL ecosystem’s growth

- Users seeking to optimize capital efficiency over a defined period

In periods of increased market volatility, fixed-term savings provide a more predictable return path for certain users.

Why OWL Was Selected as the Savings Asset

OWL is the native token of the Owlto Finance ecosystem, a project focused on AI-powered cross-chain interoperability protocols designed to solve asset transfer and execution efficiency across multiple blockchains.

Currently, Owlto Finance has achieved:

- Coverage in over 200 countries and regions

- More than 3 million total users

- Over 13 million on-chain transactions

- Strategic investment from multiple institutions

This foundation supports OWL’s integration into the Gate Simple Earn savings system.

Gate Simple Earn Savings Product Positioning

Gate Simple Earn divides savings products into two main categories: flexible and fixed-term:

- Flexible savings prioritize liquidity

- Fixed-term savings focus on stable returns and yield

The OWL 30-day fixed-term savings is positioned as a yield-focused product, offering differentiated choices through its limited-time high APY structure.

Risk Awareness Before Participating in OWL Fixed-Term Savings

Although the OWL fixed-term savings offers high annualized yields, users should note the following before participating:

- Fixed-term savings involve a capital lock-up period

- Returns are paid in tokens; price volatility should be considered

- Annualized yield is a calculated indicator and not equivalent to actual return multiples

- Product rules are subject to the subscription page

Understanding the yield model rationally is essential before engaging in high-APY savings.

Summary: Limited-Time OWL Savings Offers New Yield Options on Gate Simple Earn

Overall, Gate Simple Earn’s launch of the OWL 30-day fixed-term savings stands out for its attractive yields and product design. For users willing to commit to a fixed term and pursue efficient returns, this product presents new asset allocation strategies.

In today’s market environment, carefully assessing your liquidity needs and risk tolerance remains a crucial step before participating in any savings product.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About