Prediction Market Bets Surge: BlackRock Executive Could Become the Next Federal Reserve Chair Under a Trump Administration

Prediction Markets Surge: BlackRock’s Rick Rieder Emerges as Top Fed Chair Contender

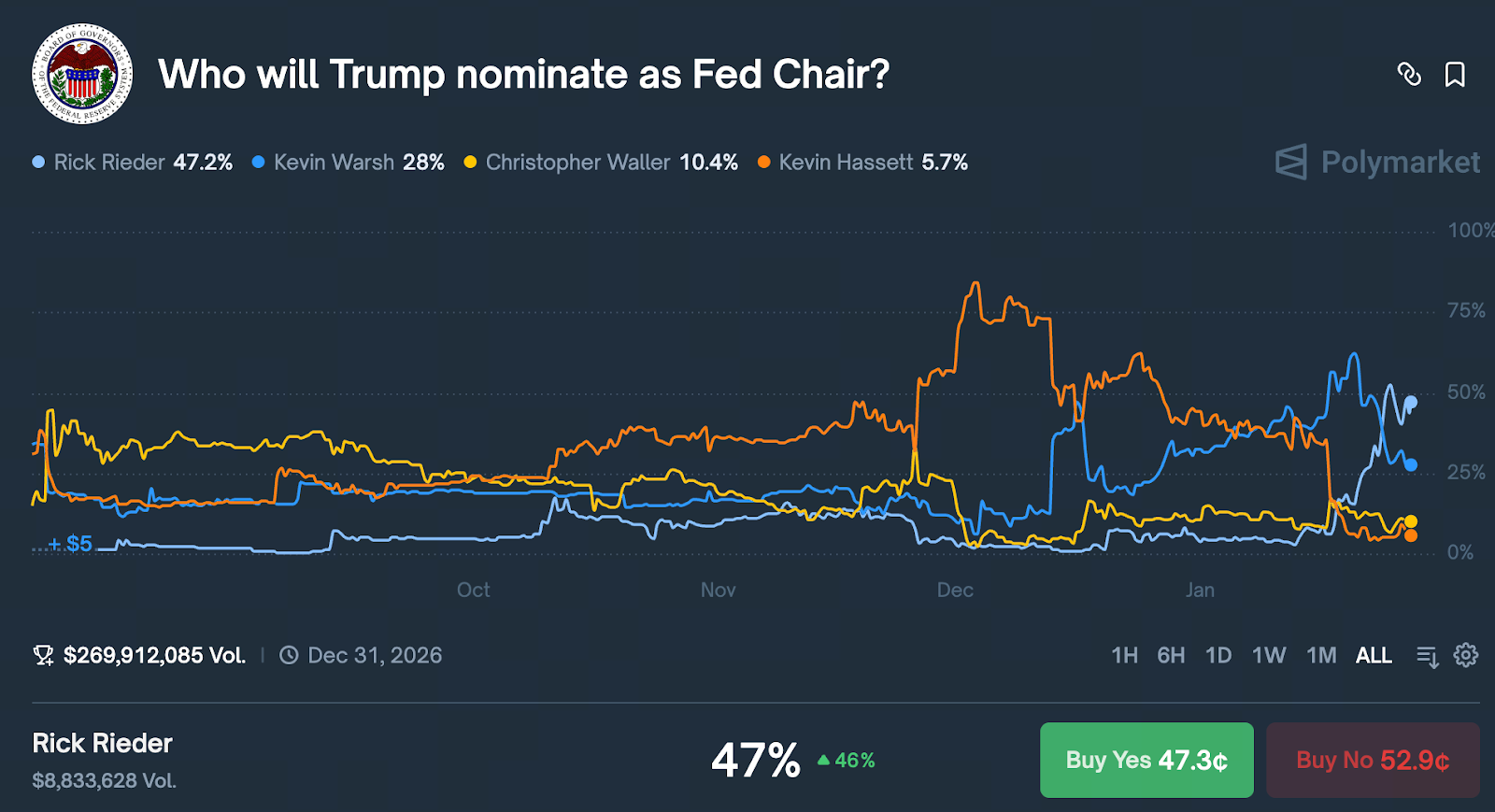

With the new US administration set to announce its core financial and economic leadership, prediction markets have shown significant shifts. Rick Rieder, Global Head of Fixed Income at BlackRock—one of the world’s largest asset managers—has seen his odds of being nominated as Federal Reserve Chair surge across multiple prediction platforms, making him a focal point for market participants.

This uptick in betting reflects not only changing political expectations but is also beginning to influence the dollar, US Treasury yields, and equity market risk appetite at the margins, positioning it as a key topic in current macro trading strategies.

Why Are Prediction Markets Rapidly Backing BlackRock Leadership?

Source: https://polymarket.com/event/who-will-trump-nominate-as-fed-chair

Prediction markets use real capital and are seen as more responsive to real-time sentiment shifts than traditional polling. Over the past week, Rick Rieder’s implied probability has jumped from single digits to the 30%–50% range, driven primarily by the following factors:

1. Trump Team Deepens Engagement with Wall Street

Multiple media sources indicate that the new administration is prioritizing candidates with frontline market experience for its financial regulatory and economic leadership roles, aiming to navigate the complex landscape of high interest rates, debt pressures, and the need for financial stability.

2. Macro Environment Favors “Market-Oriented” Policymakers

With inflation easing but fiscal and debt challenges persisting, markets are increasingly seeking policymakers who understand liquidity, risk transmission, and asset pricing. Rieder’s experience aligns squarely with these demands.

Rick Rieder: Background and Market Perception

As BlackRock’s Global Head of Fixed Income, Rick Rieder has managed hundreds of billions of dollars in bond assets and is recognized as one of the most influential figures in the global bond market.

Market participants generally view his policy orientation as:

- Moderate and neutral, with pragmatic emphasis

- Strong focus on market liquidity and financial stability

- Less reliance on macroeconomic models, with greater attention to price signals and risk feedback

As a result, many investors believe that if Rieder becomes Fed Chair, monetary policy could become more predictable and stable, reducing policy uncertainty and providing medium-term support for both equities and bonds.

However, there are also clear reservations in the market:

- His Wall Street background may raise concerns about the Fed’s independence

- BlackRock’s scale could present potential conflicts of interest

Therefore, while prediction market bets have surged, there is still significant uncertainty regarding his nomination.

Initial Asset Price Reactions: Macro Pricing Adjusts

With Rieder viewed as a relatively “dovish/moderate” candidate, related assets have already seen marginal repricing:

1. US Dollar Index (DXY) Softens Short-Term

The market has modestly increased the probability of medium-term rate cuts, weighing on the dollar.

2. Treasury Prices Climb, Yields Fall

Yields on 10-year Treasuries have declined as traders reassess the likely path of future policy rates.

3. Sentiment Improves for Tech and Growth Stocks

If future rate pressures ease, high-valuation assets stand to benefit directly, with risk appetite for the Nasdaq clearly recovering.

If Rick Rieder Becomes Chair, What Policy Direction Is Likely?

Current market pricing reflects several anticipated scenarios:

Policy pace will likely be steady, avoiding extremes: Rieder’s background emphasizes stability, making aggressive rate moves or rapid pivots less likely.

Policy communication will center on market feedback: His longstanding engagement with institutional investors gives him strong expectation management and communication skills.

Greater focus on financial market stability: Especially bond market liquidity, which could become a key factor in policy decisions.

Uncertainty and Potential Risks Remain

While prediction markets show positive signals, several risk factors remain:

- The Trump team’s internal candidate selection is not yet final

- The Fed Chair nomination requires Senate confirmation

- Prediction markets are subject to emotional swings and herd behavior

- Sudden changes in macro data or financial conditions could alter the candidate list at any time

As such, prediction market probabilities serve better as sentiment and directional indicators than as definitive conclusions.

Conclusion

Prediction market shifts have certainly made Rick Rieder one of the most closely watched Fed Chair candidates, but the final outcome still depends on official appointment. For investors, it is more important at this stage to monitor structural changes among the dollar, Treasuries, and risk assets, rather than overtrading based on a single nomination.

Until an official policy decision is made, market pricing remains driven by “expectations.”

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About