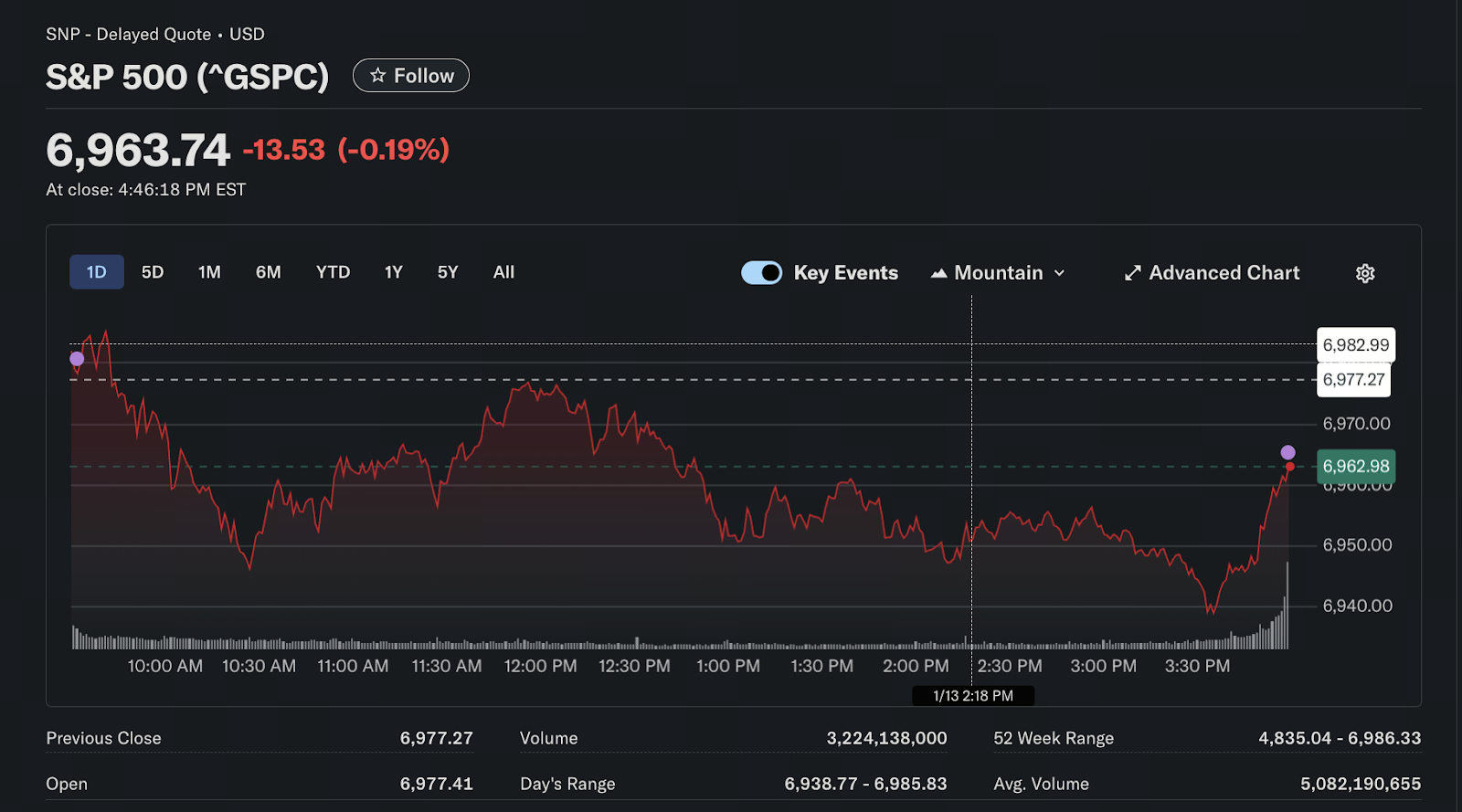

S&P 500 Breaks Above 6,975 Again, Setting a New All-Time High: Third Record in 2026 and Market Outlook

I. Index Hits New All-Time High: Market Context and Latest Developments

Chart: https://finance.yahoo.com/quote/%5EGSPC/

Early in 2026, US equities continued their robust upward trajectory. The S&P 500 Index closed above the historic 6,975-point mark for the third time, underscoring market resilience and ongoing capital inflows. Repeated record highs reflect investor confidence in corporate earnings and signal a stable macroeconomic environment alongside a resurgence in risk appetite.

Most market participants see this rally as driven by strengthening economic momentum, improved corporate fundamentals, and shifting monetary policy expectations—rather than short-term sentiment.

II. Core Drivers of Index Growth

Corporate earnings surpass forecasts: From late 2025 into early 2026, several major blue-chip firms posted results ahead of expectations, with technology and consumer discretionary sectors providing notable support for the index.

Solid macro data: Inflation readings came in slightly below expectations, strengthening forecasts for accommodative or neutral monetary policy. Employment and consumer spending have remained resilient, supporting ongoing economic growth.

Technology and industry trends: Long-term themes like artificial intelligence and cloud computing continue to play out, with large-cap tech stocks exerting structural influence on the index due to their significant weighting.

Additionally, a rebound in global risk appetite and renewed international capital flows into equities have provided external momentum for US stocks.

III. Impact of Consecutive Highs on Market Sentiment and Strategy

- Boosted confidence: New all-time highs are widely seen as signals of a continuing bull market, prompting both institutional and retail investors to increase allocations.

- Reduced volatility: During record-setting phases, implied volatility typically declines, favoring trend-following strategies and medium- to long-term portfolio positioning.

However, high valuations often accompany elevated market levels. Professional investors typically mitigate drawdown risk through diversification, dynamic position management, and strict stop-loss discipline.

IV. Risk Considerations: Valuation and Policy Uncertainty

While fundamentals support the ongoing rally, several risks warrant close attention:

- Elevated valuations: Following multiple record highs, some sectors now trade at historic valuation ranges, potentially limiting future returns.

- Policy changes: If inflation or employment data fluctuate, shifts in Federal Reserve policy could quickly alter market pricing.

- Economic lag effects: Stocks often lead the real economy; if macro data disappoints, volatility could increase substantially.

V. 2026 Outlook: Potential Scenarios and Investment Insights

In the coming months, further advances in the S&P 500 are possible, with the area above 7,000 points emerging as a key market focus. However, volatility may increase, depending on ongoing earnings performance and macro data confirmation.

Investors should closely monitor inflation trends, employment figures, corporate results, and global macro developments. As long as the upward trend persists, disciplined risk management and balanced portfolio allocation remain essential for US equities in 2026.

Conclusion: Near-term uncertainty remains, but from a medium- and long-term perspective, US equities continue to offer structural growth potential and fundamental appeal.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About