The New Trend Favorite of 2026: Why More Traders Are Choosing Gate’s ETF Leveraged Tokens

Image: https://www.gate.com/leveraged-etf

As the crypto market heads into 2026, the ongoing uptrend is fueled by the approval of global crypto ETFs, increased institutional participation, and capital flowing back on-chain. For users seeking higher returns during these trends—without the high risk of futures contracts—ETF leveraged tokens are fast becoming the preferred trading instrument.

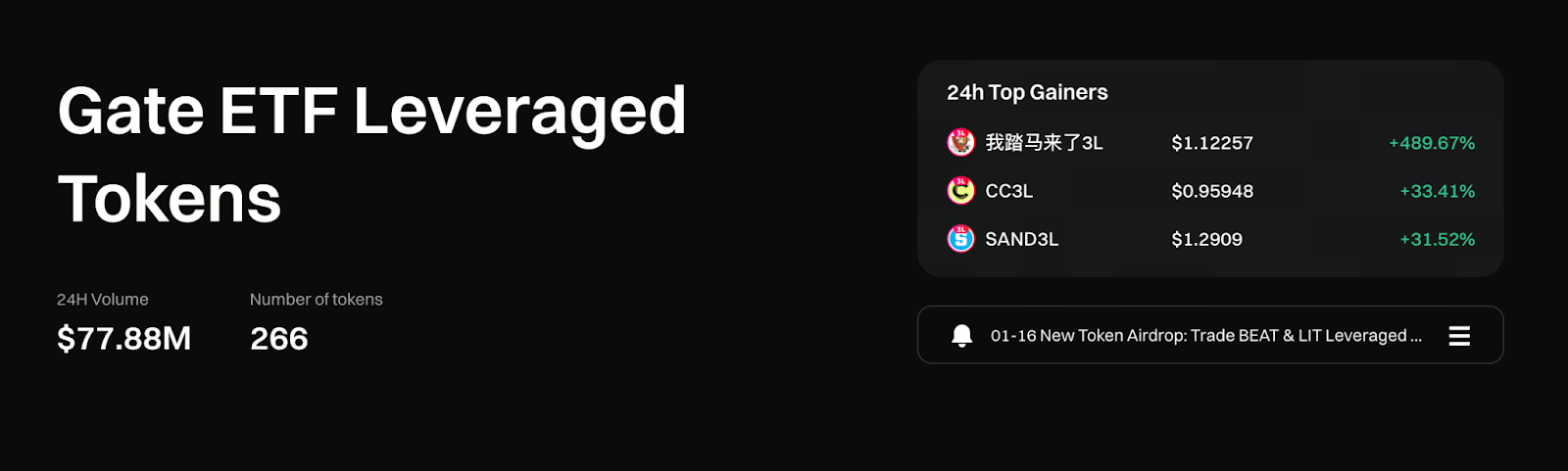

Among major trading platforms, Gate’s ETF leveraged tokens are gaining significant recognition for their deep liquidity, automated management mechanisms, and rapid inclusion of trending assets.

I. ETF Leveraged Tokens: The “Light Leverage” Solution for Trending Markets

ETF leveraged tokens are instruments with preset leverage ratios (such as 3x or 5x) that automatically manage positions.

Key features include:

- No additional margin required

- No liquidation threshold

- Trade like spot—one-click execution

- Automatic rebalancing to maintain stable leverage

This makes them a go-to “lightweight leverage” option for trend traders. In strong uptrends, they amplify gains; in choppy markets, they automatically manage risk.

II. Why Are Gate’s ETF Leveraged Tokens So Popular?

1. Spot-Like Trading Experience—Easy to Get Started

There’s no need to understand complex contract parameters or manage margin. Simply select:

- BTC3L: 3x long

- BTC3S: 3x short

- ETH5L: 5x long

and you’re ready to participate in trending markets instantly.

For users moving from spot trading, there’s virtually no learning curve.

2. Gate Offers the Broadest Coverage of Trending Assets

Gate rapidly lists tokens in high demand, such as:

- Mainstream coins: BTC, ETH, SOL, MATIC, TON

- Hot themes: Meme, AI, L1, L2

- New or short-term breakout projects

This broad asset selection lets users capture opportunities across evolving market narratives.

3. Automated Rebalancing Enhances “Trend Compounding”

The most attractive feature of Gate ETF leveraged tokens is automated rebalancing.

In uptrends, automatic rebalancing will:

- Increase effective position size

- Lock in swing gains

- Maintain stable leverage

- Create a “trend-based position scaling” effect

This is why in one-sided markets, BTC3L or ETH3L often outperform the market average.

4. Easier Risk Management—Ideal for Users Avoiding High-Stress Trading

Unlike futures contracts, ETF leveraged tokens:

- Cannot be liquidated

- Will not wipe out margin due to sudden volatility

- Do not require constant monitoring

- Are suitable for long-term trend followers

Especially in the 2026 environment—marked by sustained uptrends and sharp short-term swings—ETF leveraged tokens provide a more user-friendly risk management experience.

III. When Are Gate’s ETF Leveraged Tokens Most Effective?

1. Clear Uptrends (Most Ideal)

For example:

- BTC breaks through key price levels

- ETH rallies on positive ETF news

- The overall market enters a “liquidity return” phase

In these scenarios, 3L or 5L tokens are often among the top-performing products.

2. Short-Term Moves Driven by Major Positive Events

For example:

- Institutional accumulation news

- On-chain sector booms

- Regulatory tailwinds

- New ETF approvals

Short-term, event-driven moves are especially well-suited for leveraged token amplification.

3. High-Profile Thematic Cycles

When a sector rallies for several days, such as:

- AI narrative breakout

- Network-wide Meme surge

- Major ecosystem growth on a specific chain

Users can quickly position using Gate’s ETF leveraged tokens for the relevant assets.

IV. Three Key Considerations When Using Gate ETF Leveraged Tokens

While risk is more controlled, users should still keep in mind:

Possible Price Decay in Sideways Markets

Automated rebalancing cannot generate profits in range-bound markets, so ETF leveraged tokens are not suitable for long-term holding during repeated price swings.

Best for Short- or Medium-Term Trends, Not Long-Term Holding

They are not intended for regular investment plans.

Choose Highly Liquid, Popular Tokens

Such as BTC, ETH, SOL, etc., for more stable price tracking.

V. Gate: The Top Gateway for Trend Multiplication Tools

Gate’s edge in ETF leveraged tokens comes from:

- Strong focus on compliance and risk disclosure

- Fast listings that keep pace with market trends

- Deep liquidity and low slippage

- Professional courses and articles to help users understand the products

For users, this means a more efficient, secure, and flexible way to participate in trending markets.

VI. Summary: Why Are Gate ETF Leveraged Tokens Essential for Trend Trading in 2026?

They address the market’s most critical needs:

- Strong trends → users need return amplification tools

- High futures thresholds → users need lower-risk alternatives

- ETF adoption → users are more familiar with leveraged products

- Comprehensive Gate offerings → users are more likely to trade on the platform

All things considered, Gate’s ETF leveraged tokens are becoming the most popular “light leverage tool” for trend trading in 2026 and are set to play an even more important role in future markets.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B