The Real Use Case of Gate ETF Leveraged Tokens: Not for Chasing Pumps, but for Improving Trading Efficiency

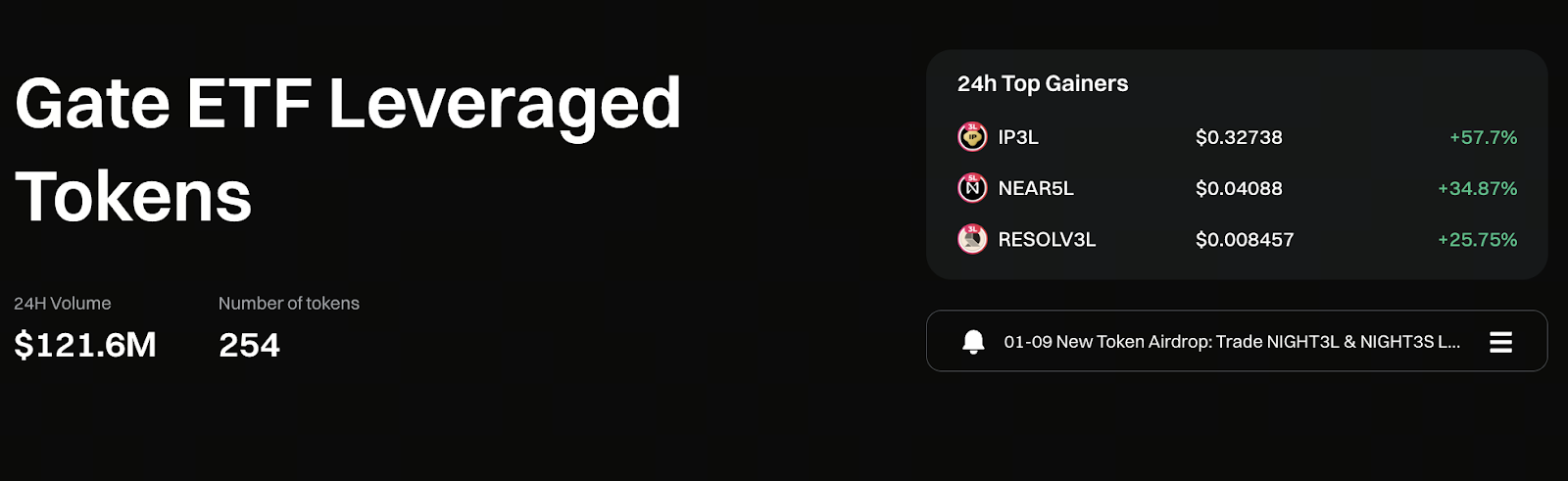

Image: https://www.gate.com/leveraged-etf

1. Many People Misunderstand the Purpose of Gate ETF Leveraged Tokens

The word “leverage” often brings to mind quick profits, chasing rallies, and aggressive short-term trading. However, Gate ETF leveraged tokens are not gambling tools. They are professional products designed to help trend traders optimize capital efficiency.

If you use them simply to chase market highs, you’ll be disappointed most of the time. But in the right scenarios, their benefits are far greater than you might expect.

2. The Real Value of ETF Leveraged Tokens: Boosting Return Efficiency in the Right Trend

ETF leveraged tokens offer distinct advantages:

- They continuously amplify returns when following a trend

- They eliminate the risk of forced liquidation

- They require no active position management

This makes them ideal after a trend is confirmed, not during uncertain or overheated market phases. In short, they’re not for starting trends—they’re for accelerating them. Once a trend is clearly established, ETF leveraged tokens are far more efficient than equivalent spot positions.

3. Three Classic Scenarios: When Are ETF Leveraged Tokens Most Effective?

Here are three scenarios that traders commonly encounter, illustrating the product’s logic.

Scenario 1: The Market Breaks a Key Level and You Confirm the Trend Is Accelerating

When the price breaks through long-term resistance, trading volume expands, and the trend structure becomes clear:

- Spot returns are limited

- Contract volatility is high, making it easy to get stopped out by pullbacks

- ETF leveraged tokens amplify returns in the early trend and resist pullbacks

This is the optimal time to use ETF leveraged tokens.

Scenario 2: You See a Clear Trend but Want to Avoid Liquidation Stress

For example:

- BTC or ETH enters a strong upward trend

- A leading sector starts to rally

- Market risk appetite increases

You want bigger returns but don’t want contract liquidation lines to dictate your emotions. Gate ETF leveraged tokens provide a more relaxed option. They boost your results without needing you to watch your margin every day.

Scenario 3: You Don’t Want to Endure Position Cuts or Margin Calls During Volatility

Many traders correctly predict the trend, but end up missing the move because of:

- Intermittent volatility

- Margin call pressure

- Emotional strain

- Forced liquidation of contract positions

Gate ETF leveraged tokens solve this: volatility won’t force you out, and as long as the trend remains, you can hold your position throughout the move.

4. Why Are ETF Leveraged Tokens Easier to Hold Than Spot?

Because:

Pullbacks Are Controllable

ETF leveraged tokens, unlike contracts, won’t be instantly forced out of the market.

You Know Your Maximum Risk

Entry price, target direction, and trend structure are all clear at a glance.

Much Lower Emotional Pressure

No margin monitoring, no fear of liquidation. Stable emotions mean you can execute your strategy systematically.

This is why many traders actually perform better with ETF leveraged tokens.

5. ETF Leveraged Tokens Are Not “Hold Forever” Tools

They have boundaries:

- Not suitable for sideways or range-bound markets

- Not suitable for extended periods without a trend

- Not suitable for value investing

- Not suitable for chasing highs during emotional peaks

ETF leveraged tokens are only for one thing: following the trend. If the market isn’t trending, they shouldn’t be used.

6. The Logic of Using ETF Leveraged Tokens: Don’t Guess—Wait

The right approach is always:

- Wait for direction

- Wait for structure

- Wait for confirmation

- Then use ETF leveraged tokens to boost return efficiency

This is discipline, not speculation.

Conclusion: Gate ETF Leveraged Tokens Are for Efficiency, Not Speculation

When you shift from “short-term betting on price swings” to “structured trend following,” you’ll see that Gate ETF leveraged tokens exist not for gambling, but to help you capture the right market moves deeper, steadier, and more efficiently. Trends give you direction; ETFs give you efficiency. Use the right tool in the right scenario, and your advantage will naturally grow.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B