What Is Being Built in the Monad Ecosystem? Emerging Opportunities and Key Developments

Traditional EVM chains such as Ethereum process roughly 10 transactions per second, while Monad targets more than 10,000 TPS with confirmation times of approximately 0.5 to 1 second. This performance profile positions it as a strong infrastructure layer for complex DeFi protocols, high frequency trading, NFT platforms, and on chain gaming applications.

This article focuses on the current stage of ecosystem development, its overall structure, key opportunities and challenges, and future growth directions. Whether you are a developer, investor, or everyday user, this guide will help you better understand the potential and risks within the Monad ecosystem.

Overview of Monad’s Current Ecosystem Development Stage

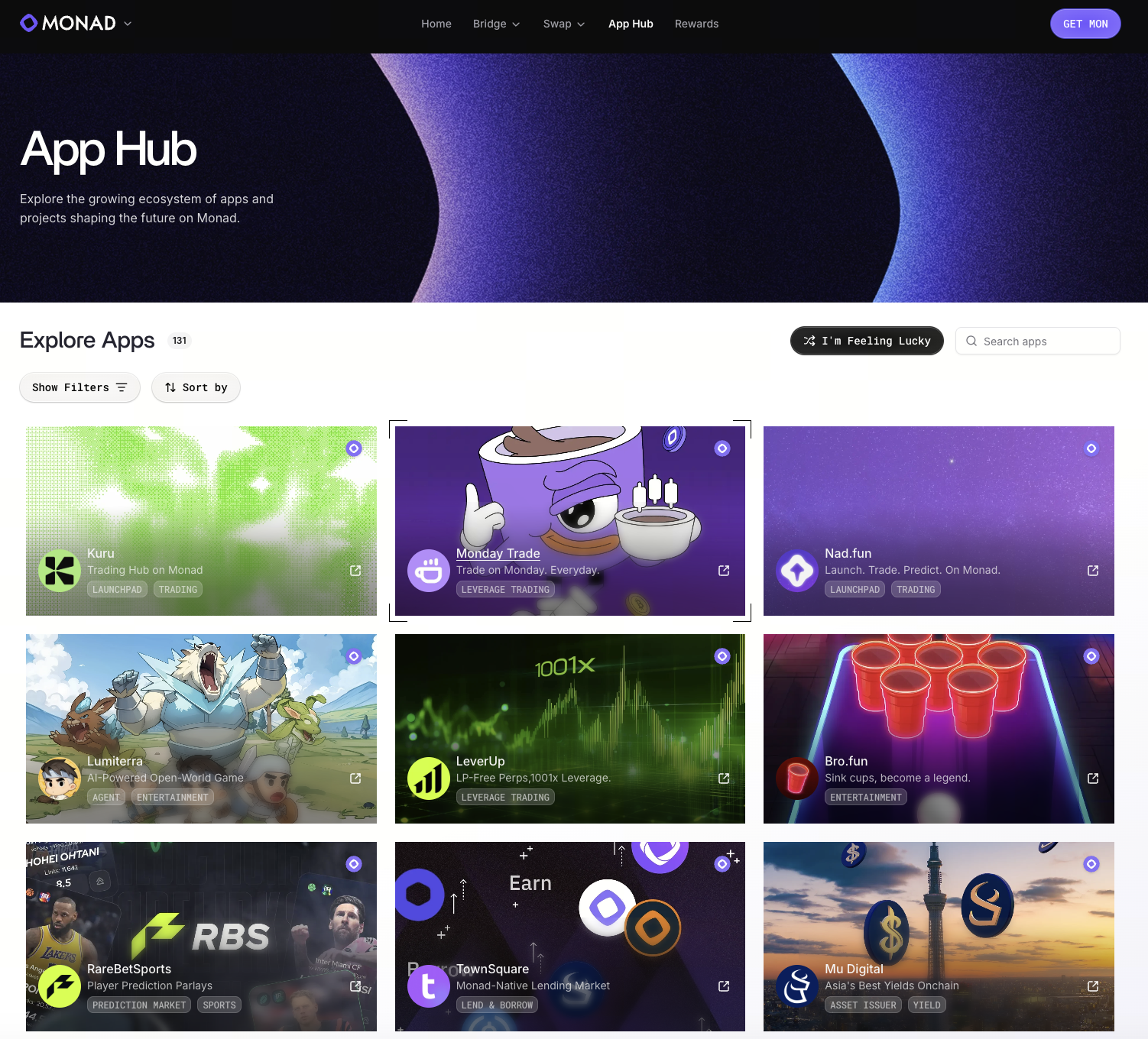

Image source: Monad official website

As of early 2026, the Monad mainnet is officially live and in active use, marking a clear transition from the research and development phase into a more mature ecosystem stage.

In terms of ecosystem growth, official listings and third party rankings show that Monad has attracted more than 200 applications across multiple categories, including DeFi, NFTs, gaming, and infrastructure.

Key Ecosystem Milestones

- During the public testnet phase, transaction activity reached significant levels, with contract deployments and real user interactions gradually expanding.

- The mainnet officially launched on November 24, 2025, introducing native token issuance and on-chain activity.

- The number of ecosystem projects has grown rapidly, from just a few dozen in the early days to well over one hundred today.

These milestones indicate steady progress from technical demonstrations toward real world application adoption.

What Types of Applications Are Entering the Monad Ecosystem

| Application Type | Core Functions | Representative Projects |

|---|---|---|

| Decentralized Finance, DeFi | Includes DEXs, lending, staking, yield optimization, and liquidity provision | Balancer, Atlantic, Azaar, PyeFinance, Kintsu, Puffer Finance, FastLane |

| NFT and Digital Collectibles | NFT creation, trading, collecting, exhibitions, and derivative use cases | Magic Eden, BlockNads, MonadName, ChogNFT, Purple Frens |

| Gaming, GameFi | Blockchain games, character interaction, and in game economic systems | Battlebound, DRKVRS, Mozi |

| Artificial Intelligence, AI Applications | Integration of AI and blockchain, decentralized agents and prediction systems | AiCraft.fun, Fortytwo Network, Gaib AI |

| Bridge and Cross Chain | Cross chain asset transfers and interoperability | Wormhole, Garden, Chainlink CCIP |

| Wallets and Infrastructure | Wallet support, RPC services, explorers, account abstraction | Binance Wallet, Bitget Wallet, Backpack Wallet, MonadScan |

| Oracles and Data Services | Provision of off chain data and price feeds | Chainlink Oracle, Band Protocol, migrated project |

| Social and Community Applications | Social interaction, content sharing, and SocialFi | Experimental social projects |

| Prediction Markets and Betting | Event based prediction and sports related markets | Prediction and betting applications |

| RWA and Enterprise Applications | Tokenization of real world assets and enterprise data solutions | Concept projects in supply chain and identity verification |

Projects in the Monad ecosystem span several major categories:

- DeFi protocols: These include decentralized exchanges, lending markets, liquidity aggregators, and yield optimizers. Examples include Nitro, Bean Exchange, aPriori, Timeswap, and Catalyst.

- Wallets and infrastructure: The number of wallets supporting Monad continues to grow, including Gate Wallet, alongside improvements in interaction tools, RPC services, and analytics infrastructure.

- NFT and metaverse projects: Covering digital collectibles, on chain domain names, and community driven cultural content. These projects often leverage Monad’s high performance and low fees to deliver smoother user experiences.

- Gaming, GameFi: NFT driven games and character collection titles such as Rug Rumble, Battlebound, and Anterris use the high speed network to support frequent on chain interactions.

- Cross chain and oracle services: Cross chain protocols such as LayerZero and Wormhole, along with oracle providers, are adapting to Monad to enhance interoperability and external data support.

This multi category expansion shows that the ecosystem is moving beyond experimentation and into broader, real world use cases.

Growth Opportunities for DeFi Protocols on Monad

DeFi protocols on Monad benefit from several clear advantages:

- High TPS and low latency: Strong throughput and fast confirmations allow decentralized exchanges to support real time order book trading and complex strategy execution. This is particularly important for algorithmic trading and flash loans.

- Low transaction fees: Reduced costs make small trades and on chain arbitrage more viable, which can help drive higher user participation.

- Ecosystem incentives: Grants and incentive programs support early stage DeFi projects, including liquidity mining initiatives and hackathon rewards.

- Composability and interoperability: Full EVM compatibility enables existing Ethereum DeFi protocols to migrate with minimal friction, while cross chain bridges facilitate asset connectivity with other networks.

Together, these factors create favorable conditions for DeFi activity to expand on Monad.

The Potential of Gaming and NFT Applications on a High Performance Chain

High performance infrastructure offers natural advantages for NFT and gaming applications:

- Large scale concurrent interactions: Games and NFT marketplaces often require frequent transactions and interactions. A high TPS network helps prevent user experience issues caused by network congestion.

- Lower fees encourage experimentation: Compared to Ethereum, lower transaction costs reduce the barrier to trying new games or trading NFTs, helping attract a broader user base.

- Emerging on chain economies: In game assets and NFTs can form fully on chain economies. Fast confirmations support efficient asset circulation and player incentive mechanisms.

For these reasons, gaming projects built on Monad are particularly well positioned to deliver rich interactivity and genuine on chain ownership experiences.

Why Developers Are Willing to Migrate or Deploy on Monad

- Full EVM compatibility is one of the strongest attractions. Smart contracts developed on Ethereum can be deployed on Monad with little to no modification.

- High performance and parallel execution support large scale applications. From decentralized exchanges to complex DeFi logic, projects can leverage network advantages to improve responsiveness.

- Ecosystem support includes technical documentation, SDKs, testnet incentives, and hackathons, all designed to reduce development costs and risks.

- Cross chain capabilities make it easier for projects to connect with external ecosystems, which is especially appealing for teams pursuing multi chain strategies.

How Users Can Participate Early in the Monad Ecosystem

Users can engage with the Monad ecosystem in several ways:

- Follow community campaigns and airdrop opportunities. Early participants often receive rewards through official or community programs, which may contribute to long term value accumulation.

- Use decentralized applications directly. Interacting with ecosystem DEXs, NFT marketplaces, and other applications is the most straightforward way to participate, while also gauging project activity levels.

As always, users should remain aware of the risks associated with crypto assets and avoid participating based solely on market hype.

Competitive Landscape and Challenges Facing the Monad Ecosystem

Despite rapid growth, Monad faces several key challenges:

- Competition from established chains: Other high performance EVM compatible chains and Layer2 networks are also competing for DeFi and NFT projects, making the landscape highly competitive.

- Performance validation and security: Theoretical performance must be proven through long term stable operation on the mainnet. Security audits and vulnerability mitigation remain critical.

- User and developer engagement: High performance alone does not guarantee strong user retention. Sustainable growth depends on delivering real value and building network effects.

How effectively these challenges are addressed will directly influence the ecosystem’s long term sustainability.

Future Expansion Directions and Growth Potential for Monad

Looking ahead, the Monad ecosystem may evolve along several paths:

- Expanded cross chain and multi chain collaboration: Strengthening asset interoperability with other Layer1 and Layer2 networks to enhance liquidity and user reach.

- More advanced DeFi products: The development of derivatives, options, and structured financial products could narrow the experience gap with centralized exchanges.

- Deeper integration with enterprise and real world assets, RWA: Supporting stablecoin payments, enterprise chains, and compliant assets may attract attention from mainstream financial institutions.

- Maturing DAO and on-chain governance mechanisms: More sophisticated decentralized governance can help guide long term ecosystem development and self sustainability.

These directions not only expand the scale of the ecosystem, but also increase its practical utility on chain.

Conclusion

As a high performance, EVM compatible Layer1 blockchain, Monad is steadily transitioning from a development phase into a more mature application ecosystem. Its core strengths, high TPS, low latency, low fees, and ease of deployment, have attracted projects across DeFi, NFTs, and gaming. Although it faces competitive pressure and the risks inherent in scaling new technology, the ecosystem demonstrates meaningful multi sector potential and clear growth pathways. Over the long term, cross chain collaboration, more sophisticated financial products, and robust on chain governance may become central pillars of its continued expansion.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?