What are DATs? A Comprehensive Guide to Digital Asset Treasury Companies: Types, Logic, and Investment Opportunities

Since 2025, “DATs” has emerged as a prominent theme in financial markets. Companies announcing plans to add Bitcoin, Ethereum, BNB, and SOL to their balance sheets have seen repeated share price surges. Crypto investors increasingly view these stock price movements as a leading indicator of broader market trends.

Growing numbers of publicly traded companies on US, Hong Kong, A-share, and Japanese exchanges have unveiled “crypto accumulation strategies,” redefining their valuation narratives. Firms once focused solely on on-chain crypto projects are now connecting with equity markets through reverse mergers and strategic holdings. This interdependence between crypto and equities has become a powerful, irreversible trend.

To clarify the concept of DATs, this article systematically addresses three key questions: What defines DATs? What are the main categories? How should individual investors understand the investment logic behind crypto-related stocks?

1. DATs vs. Traditional “Blockchain Concept Stocks”

To understand “DATs,” investors must distinguish them from traditional “blockchain concept stocks.” The latter typically focus on technology development and industry applications, including digital currency software, mining hardware, blockchain solutions, or related deployments. Valuations for these companies are usually based on technology patents, market share, or software revenue.

In contrast, “DATs” primarily refer to Digital Asset Treasury Companies and, more broadly, to firms deeply integrated with cryptocurrencies or on-chain ecosystems. The commercial evaluation of crypto stocks goes beyond business models or technology output, incorporating metrics such as the nominal or explicit addition of crypto assets (BTC, ETH, SOL, etc.) to their balance sheets.

The fundamental distinction is this: traditional concept stocks are “business-driven,” while crypto stocks are propelled by “asset management and capital operations.”

2. Three Core Features of DATs

To accurately identify a true “DATs,” assess the company across three dimensions:

High Correlation with Crypto Asset Prices or Ecosystem

Crypto stock valuations are no longer primarily based on traditional price-to-earnings ratios. Instead, they are closely tied to the prices of the crypto assets held and the depth of their ecosystem integration. For example, Strategy (MSTR, formerly MicroStrategy) maintains a market cap correlation with Bitcoin ranging from 0.7 to 0.9, reflecting strong positive linkage. Some evolving crypto stocks—such as DFDV and SBET—not only hold assets but also participate in public blockchain ecosystems through staking or validator node operations, generating endogenous, non-dilutive cash flow rewards.

Participation in Crypto Markets via Public Company Structure

Crypto stock companies often leverage their public listing status to create a compliant bridge between traditional capital markets and the crypto sector. They typically use two financial instruments—market-based stock issuance programs and convertible bonds—to expand leverage and stimulate market optimism.

Market-Based Stock Issuance Program (ATM): Allows companies to flexibly issue new shares in batches at market price, directly raising funds on the secondary market to purchase crypto. In July 2025, Strategy launched a $4.2 billion “at-market issuance” plan, offering 10% perpetual STRD preferred shares to fund Bitcoin acquisitions.

Convertible Bonds: Enable companies to issue low- or zero-interest bonds with an embedded option for holders to convert bonds into company shares under certain conditions. This allows firms to raise substantial capital at minimal interest cost, which is then used to purchase crypto assets. From January 5 to January 11, Strategy acquired 13,627 Bitcoins, bringing its total holdings to over 680,000 Bitcoins, valued at approximately $51.8 billion.

Dual Nature: Stocks and Crypto Assets

Crypto stocks act as leveraged proxies for crypto assets. The inherent volatility of cryptocurrencies directly impacts share price performance. When token prices rise by 1%, crypto stock prices may climb by 2% or more due to market sentiment.

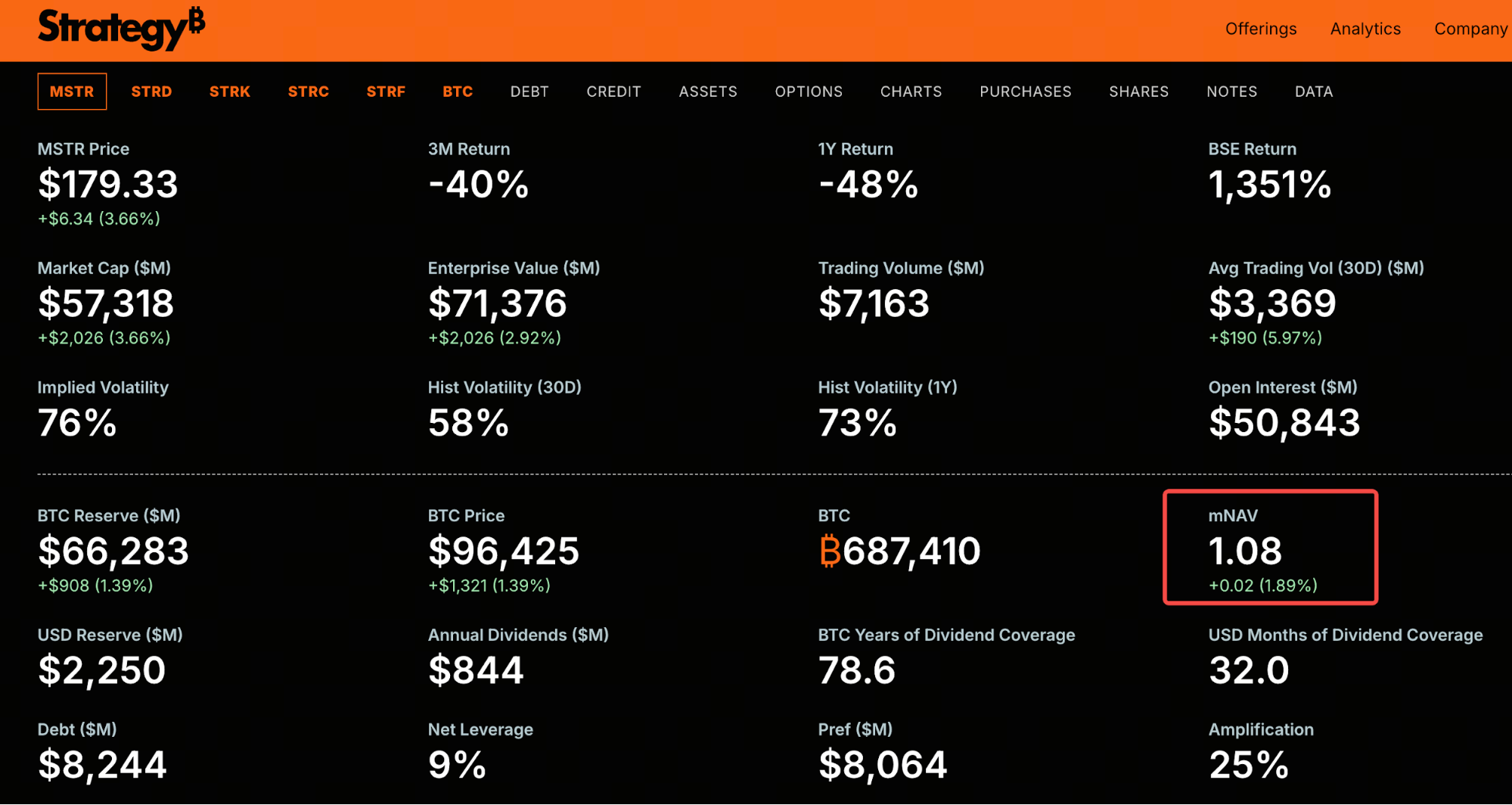

StrategyTracker data shows that as of January 15, Strategy’s mNAV (enterprise value to BTC holdings ratio) was 1.08, signaling weak market confidence in Strategy’s Bitcoin holdings and a general reluctance to pay a premium for MSTR. In November 2025, this metric briefly fell below 1.

Image source: StrategyTracker

3. Categories of DATs

Over the past year, nearly one hundred public companies worldwide—led by Strategy—have announced their entry into the crypto stock space. Based on their core attributes, these companies fall into three main categories.

Treasury-Type

The central strategy for treasury-type crypto stocks is allocating mainstream crypto assets (BTC, ETH, SOL, etc.) on the balance sheet. Notable examples include Strategy, GameStop, and Metaplanet for Bitcoin holdings; SharpLink Gaming for Ethereum; and Windtree Therapeutics for BNB.

Financial Services

These firms serve as gateways for retail and institutional investors to access crypto markets. Their core assets are user traffic and ecosystem reach. Representative examples include platforms offering crypto services, promoting the USD-pegged USDG stablecoin, and Robinhood, which acquired the crypto exchange Bitstamp for cash in June.

Infrastructure / Stablecoin Issuers

These companies focus on providing foundational support for the crypto ecosystem, with business models similar to traditional finance but enhanced by technological advantages. The main example is Circle, the principal issuer of USDC, whose value lies in building an efficient and transparent global payment and settlement network.

4. Opportunities and Risks of DATs

Most crypto stock targets are listed on major exchanges such as NYSE or Nasdaq, enabling substantial capital and investor participation through regulated channels and presenting significant upside potential.

However, many small- and mid-cap companies have entered the crypto stock arena. While this creates short-term speculative opportunities, the long-term sustainability depends on the health of their asset reserves, the appreciation of their crypto holdings, and their operational management capabilities. A clear example is Windtree Therapeutics (WINT), which announced a BNB strategic reserve in July 2025, sending its share price from $0.40 to $1.28. Just one month later, the company received an SEC notice due to persistent low share price and non-compliant stock splits, resulting in a forced delisting.

Despite historic setbacks in 2025, most crypto stock companies face major challenges. Yet the fusion of crypto assets with traditional finance is now irreversible. Crypto assets are becoming deeply integrated into the value engines of global public companies and have emerged as a key focus for investors.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?