What Is Gate GTETH? Redefining ETH Staking as a Liquid Asset Allocation

As Market Cycles Accelerate, ETH Staking Loses Its Edge

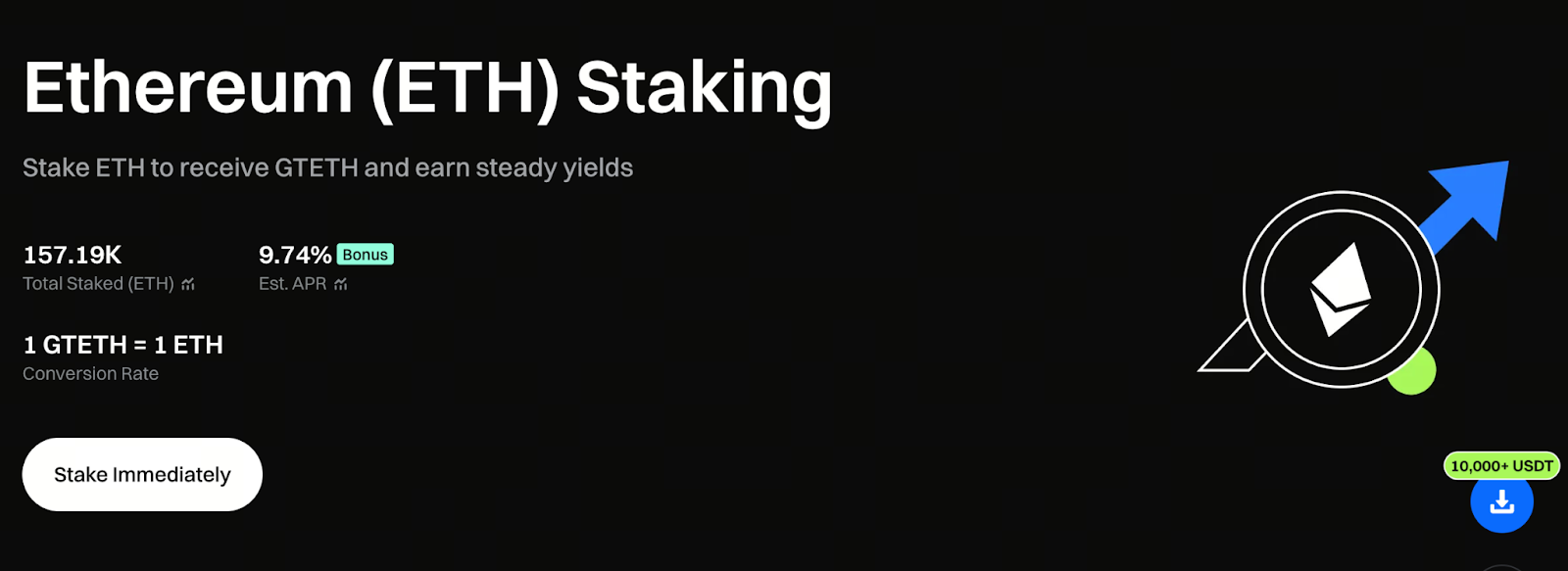

Following Ethereum’s transition to Proof of Stake (PoS), staking became a core allocation for ETH holders. Yet, as market volatility intensifies and capital rotation speeds up, the staking model—designed for long-term holding—now increasingly diverges from practical trading demands.

The challenge isn’t about whether staking generates returns. It’s whether locked ETH can remain part of active asset management when market conditions shift. If funds can’t respond instantly, staking returns become an implicit cost.

Traditional Staking Limitations

Most ETH stakers eventually encounter several real-world issues:

- Staked positions can’t be quickly rebalanced during market reversals

- Staking yields are difficult to assess alongside other asset performance

- Locked ETH is excluded from alternative strategies

Over time, staking shifts from a yield-generating tool to a passive, inflexible asset block.

GTETH: Transforming Staking’s Form, Not Just Its Process

GTETH’s design doesn’t simply add more steps to the existing staking framework—it fundamentally reimagines staking’s structure. By converting ETH to GTETH, staking becomes an intrinsic property of the asset itself, eliminating the need to wait for unlocking.

After conversion, GTETH functions as an ETH-based asset that can be held, traded, and incorporated into any portfolio strategy. Staking becomes seamlessly integrated with daily capital management, no longer siloed from broader asset allocation.

Returns Embedded in Asset Value—Holding Is Participating

GTETH features a yield-inclusive structure, with its value gradually reflecting two key sources of return:

- Base staking rewards from Ethereum PoS

- Additional GT incentives from Gate

Users don’t need to claim rewards or track multiple yield streams. Simply holding GTETH allows rewards to accumulate and be reflected in the asset’s value. All returns remain verifiable on-chain, ensuring full transparency and traceability.

Yield Without Sacrificing Liquidity

Unlike traditional ETH staking, GTETH does not require asset lock-up. Holders can redeem GTETH for ETH at any time or trade it directly in the market—no need to wait for fixed unlock periods. This structure allows yield and liquidity to coexist in a single asset, enabling staking to move in sync with market cycles.

From Passive Returns to Deployable ETH Units

Once liquidity restrictions are lifted, GTETH’s role evolves. It’s not just a staking alternative, but an ETH unit that can be actively managed within any portfolio. Whether reducing exposure during volatility or reallocating quickly when opportunities arise, GTETH enables dynamic adjustments while preserving staking yield potential—ETH is no longer forced to sit idle.

Transparent Yield Structure—Long-Term Efficiency Made Quantifiable

GTETH’s yield sources are straightforward, primarily comprising:

- Ethereum PoS staking rewards: approximately 2.74% APY

- Gate’s additional GT incentives: approximately 7% APY

All rewards are reflected upon final ETH redemption, making long-term holding efficiency easy to calculate, compare, and assess.

Join Gate ETH staking now to start earning on-chain mining rewards: https://www.gate.com/staking/ETH?ch=ann46659

VIP Tier Directly Impacts Long-Term Compounding

GTETH’s fee structure is tied to Gate VIP levels, starting with a base fee of 6%, and offering tiered discounts:

- VIP 5–7: 20% fee discount

- VIP 8–11: 40% fee discount

- VIP 12–14: 60% fee discount

While short-term differences may be modest, over time and with compounding, fee rates become a decisive factor in final returns.

A Distinct Approach from Mainstream LSTs

Most liquid staking tokens are still built around locked asset mapping, limiting strategic flexibility. GTETH is closer to a daily asset management tool, with value that naturally tracks yield and allows free market entry and exit. In this structure, staking is no longer a passive commitment, but a dynamic ETH management method that adjusts in real time with your strategy.

Summary

GTETH doesn’t add complexity to ETH staking—it redefines its place in portfolio management. By retaining PoS yield potential and removing liquidity constraints, staking can truly synchronize with the pace of modern Web3 operations. As market change becomes the norm, ETH staking need not be a rigid, long-term commitment, but can serve as a flexible solution balancing liquidity and yield.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks