What Is Gate Leveraged ETF? Rethinking Leverage Strategies in Crypto Trading

Leverage Is Breaking Out of the Contract Framework

In the cryptocurrency market, traders looking to amplify returns often think immediately of contract trading. But contracts bring more than just leverage—they require constant monitoring, real-time risk management, and can create significant emotional stress. These demands don’t suit every trader. As market rhythms accelerate, trading tools are evolving. Leverage is no longer confined to contract accounts; it’s now being integrated into more intuitive trading formats.

Leveraged ETFs: Packaging Complex Mechanisms into Tradable Tokens

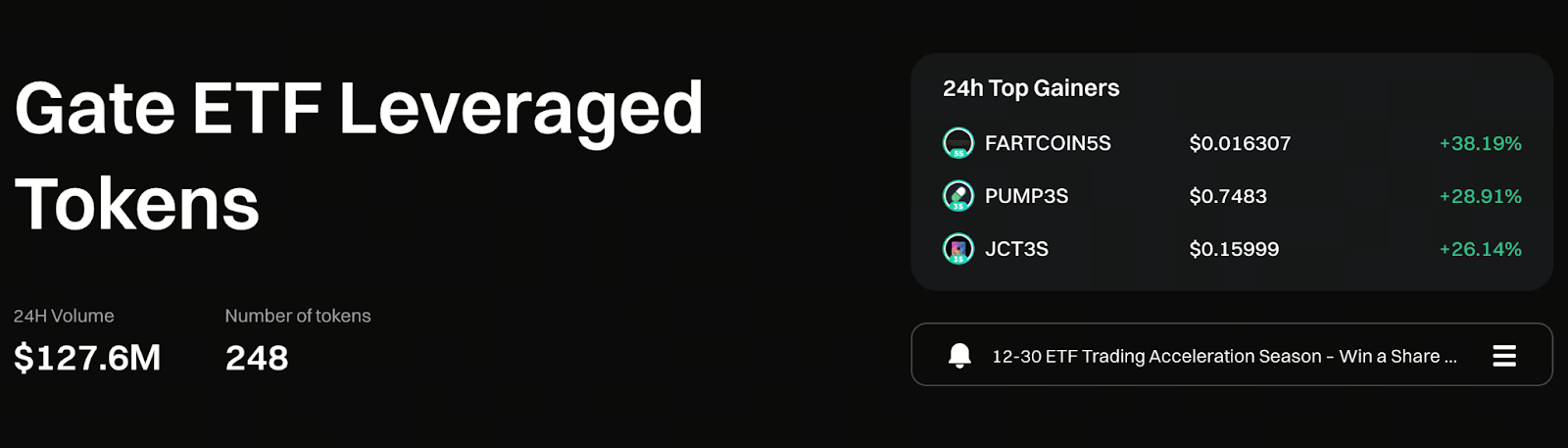

Gate Leveraged ETF tokens are not traditional fund products. Instead, they’re trading tokens you can buy and sell directly on the spot market. Their core design establishes leveraged positions via underlying perpetual contracts. The system then automatically adjusts those positions to maintain a preset leverage level—such as 3x or 5x.

For users, the trading experience feels much like spot trading. There’s no need to understand contract mechanics or deal with complex margin calculations.

Start trading Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

Achieve Leverage Through Spot Trading

The biggest difference with leveraged ETFs is that they bring amplified price exposure back to the trading process itself. Users simply trade on the spot market to participate in leveraged price movements—without the need for:

- Contract account management

- Maintenance margin and margin calls

- Immediate forced liquidation risk

The system handles risk management and position adjustments. This lets traders focus on market direction and strategy, not operational complexity.

How Is Fixed Leverage Maintained Over Time?

Each Gate Leveraged ETF is backed by an independent set of contract positions. When market volatility pushes actual leverage away from the target, the system automatically rebalances and adjusts position size to restore leverage to the set range.

The platform also schedules routine rebalancing at fixed intervals to reduce deviation risk during extreme market swings. For users, this means no manual position adjustments or constant strategy tweaks are necessary.

Why Do Trend Traders Prefer Leveraged ETFs?

Leveraged ETFs are tailored for short-term and trend trading. In clear directional markets, leverage accelerates capital deployment, making each decision have a more pronounced impact on price. Because there’s no instant forced liquidation, brief adverse moves won’t immediately close positions. This creates a smoother trading experience, which appeals to traders seeking to minimize market noise in their strategies.

Risks You Can’t Ignore

Even with lower entry barriers, leveraged ETFs remain high-volatility products. Before trading, users must clearly understand these features:

- Price swings are much greater than in regular spot trading

- In sideways or choppy markets, rebalancing may erode returns

- Actual returns will not precisely match the stated leverage multiple

- Management fees and hedging costs are gradually reflected in the token price

These factors mean leveraged ETFs are best used as strategic tools—not for long-term passive holding.

Why Management Fees Exist

Gate Leveraged ETFs charge a daily management fee of around 0.1%. This supports product operations, including perpetual contract trading costs, funding rates, liquidity management, and slippage or losses during rebalancing. Such fees are standard for leveraged ETFs and are essential to maintain fixed leverage and stable system performance.

How to Use Leveraged ETFs Effectively

Leveraged ETFs are not buy-and-hold investments. They’re strategic tools that require clear trend analysis, stop-loss planning, and capital allocation. Only by understanding how they work and their risk structure can leveraged ETFs enhance trading efficiency rather than add unnecessary risk.

Summary

Gate Leveraged ETFs offer a trading solution that bridges the gap between spot and contract markets. They lower the entry barrier but don’t hide the inherent risks of leverage. The process is simplified, yet strategic flexibility is preserved. In today’s highly volatile crypto markets, whether leveraged ETFs are suitable depends on a trader’s understanding of their purpose and ability to deploy them precisely in the right context.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B