What Is Raydium? A Comprehensive Guide to Solana’s Core DEX and Liquidity Protocol

As the Solana ecosystem continues to expand at a rapid pace, decentralized exchanges and liquidity protocols have become core infrastructure for the free circulation of on-chain assets and efficient capital allocation. As one of the most representative DEXs on Solana, Raydium has steadily attracted the attention of traders and liquidity providers thanks to its unique hybrid architecture and rich feature set.

This article offers a professional, systematic analysis of Raydium’s underlying mechanisms, product features, and its role and positioning within the broader DeFi ecosystem, helping readers gain a comprehensive understanding of this important protocol.

What Is Raydium? Project Background and Development Positioning

Raydium is a decentralized exchange (DEX) and automated market maker (AMM) protocol built on the Solana blockchain. It was first launched in 2021 by an anonymous team, with the goal of leveraging Solana’s high throughput and low transaction fees to provide infrastructure for DeFi activities such as crypto asset trading, liquidity provision, and yield farming. As a key component of the Solana ecosystem, Raydium combines the AMM model with an order book mechanism to improve trading efficiency and capital utilization, playing a critical role within the ecosystem.

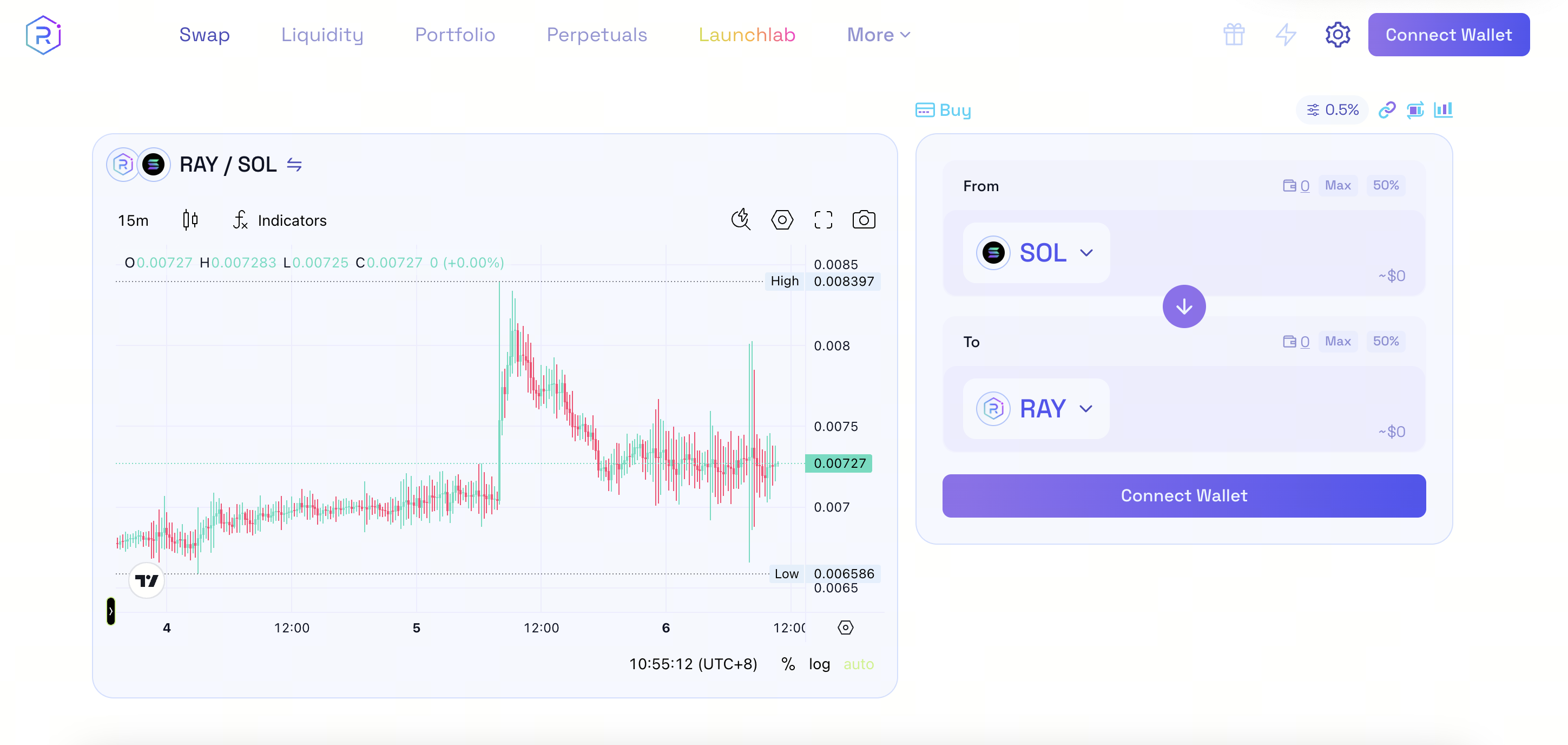

Source: Raydium

Over time, the protocol has continued to evolve and expand its product offerings. This includes the introduction of LaunchLab, optimization of liquidity pool types, and support for a wider range of trading pairs, further reinforcing its position as a liquidity hub on Solana. According to recent market data, Raydium accounts for a significant share of Solana DEX trading volume and is one of the deepest liquidity protocols in the ecosystem.

How Does Raydium Work? An Analysis of AMM and Order Book Mechanics on Solana

As a decentralized trading protocol built on the Solana blockchain, Raydium achieves efficient asset swaps and price discovery by deeply integrating automated market maker (AMM) mechanisms with on-chain order books. Benefiting from Solana’s high throughput, low latency, and low fees, Raydium is able to maintain decentralization and self custody while delivering trading speeds and liquidity depth comparable to centralized exchanges. This provides flexible participation options for different types of traders and liquidity providers.

Automated Market Maker (AMM)

One of Raydium’s core components is its AMM (Automated Market Maker) mechanism, which uses algorithmic formulas to automatically price assets and provide liquidity. Users deposit paired assets into liquidity pools, and the protocol adjusts prices based on supply and demand. This allows traders to execute swaps instantly without waiting for a traditional counterparty. The AMM model makes trading more efficient and eliminates the need for centralized order matching.

Order Book Mechanism

Unlike pure AMM platforms, Raydium incorporates an order book mechanism and is deeply integrated with order book DEXs in the Solana ecosystem, such as OpenBook and the Serum order book. This allows AMM liquidity to be shared with a broader order book liquidity pool. The hybrid architecture enables more advanced trading functions, such as limit orders, and improves price execution accuracy and overall market depth.

This combined AMM + order book model gives Raydium both the convenience of instant swaps and the flexibility of traditional limit order trading, offering an optimized experience for a wide range of users.

What Are Raydium’s Core Products and Trading Features?

Raydium’s ecosystem includes several key modules:

- Swap interface: an AMM-based instant swap tool supporting fast exchanges across a wide range of SPL tokens.

- Order book trading: advanced trading features through an integrated central limit order book, including market and limit orders.

- Liquidity pools and LP provision: users can supply assets to specific pools to earn a share of trading fees and participate in yield farming.

- Yield farming: liquidity providers can stake their LP tokens to earn additional rewards.

- LaunchLab/AcceleRaytor: a launch platform for new projects, enabling community participation in early token distribution and liquidity bootstrapping.

This diversified product lineup makes Raydium not only a trading venue, but also a comprehensive DeFi toolkit for capital growth.

Raydium’s Role and Partnership Network in the Solana DeFi Ecosystem

Raydium is one of the most influential DEXs on the Solana blockchain and has established partnerships with multiple key protocols and products within the ecosystem. Through connectivity with central limit order books and integrations with major wallets and aggregators such as Phantom, Solflare, and Jupiter, Raydium has become a crucial liquidity hub for the entire ecosystem.

Its deep liquidity, cross platform integrations, and support for new projects have also contributed to improvements in trading depth and asset issuance efficiency across Solana as a whole.

The Utility and Incentive Mechanisms of the RAY Token

RAY is Raydium’s native ecosystem token and serves several important functions:

- Governance: RAY holders can vote on key decisions such as protocol upgrades and fee adjustments.

- Staking and rewards: holders can stake RAY to earn a share of trading fees and other incentives.

- Yield farming rewards: RAY is commonly used as a reward token to incentivize liquidity providers.

- Fee discounts and LaunchLab privileges: enhanced fee discounts and priority access to project launches.

In addition, certain mechanisms include RAY buybacks and burns to support long term value capture.

How Does Raydium as a DEX Differ From Centralized Exchanges (CEXs)?

Compared with centralized exchanges:

- Decentralization: users always retain control of their private keys and assets, without relying on third parties.

- Transparency: all transactions occur on chain and can be publicly verified.

- No KYC requirements: trading generally does not require identity verification.

- Low fees: Solana’s underlying architecture enables transaction costs that are significantly lower than those of traditional CEXs.

| Contrast dimension | Raydium (DEX) | Centralized Exchange (CEX) |

|---|---|---|

| Asset custody method | Users self-custody their assets, with private keys fully controlled by the users themselves | Assets are custodied by the exchange, and users do not directly control private keys |

| Transaction execution method | Automatically executed through on-chain smart contracts | Matched and settled by the exchange’s internal systems |

| Whether KYC is required | Identity verification is usually not required | Most platforms require KYC and compliance verification |

| Transparency of transactions | All transaction records are publicly accessible and verifiable on-chain | Order matching and ledgers are centralized, with limited transparency |

| Transaction fee structure | Combination of on-chain fees and liquidity pool fees, generally low cost on Solana | Trading fees, withdrawal fees, and other charges are set uniformly by the platform |

| Transaction speed | Influenced by blockchain performance, with low latency on Solana | High-speed matching with extremely low latency |

| Supported transaction types | Spot trading, AMM swaps, and limited limit order functionality | A wider range including spot, futures, options, leverage, and more |

| Sources of liquidity | Community liquidity providers (LPs) | Platform market makers and user orders |

| Type of risk | Smart contract risks and impermanent loss | Platform failure, asset freezing, and regulatory compliance risks |

| Resistance to censorship | Strong, as the protocol operates at the protocol layer and is not easily shut down from a single point | Weak, as it is highly influenced by regulation and platform policies |

That said, CEXs typically offer stronger liquidity and more complex derivatives markets, while DEXs place greater emphasis on user sovereignty and openness.

How Is Raydium Different From Other Solana DEXs or Major DEXs?

Compared with other Solana based DEXs such as Orca, Raydium’s core advantage lies in its hybrid AMM + order book architecture, which tightly integrates AMM liquidity with central limit order books to improve price discovery and trading depth.

Compared with DEXs on other major chains, such as Uniswap on Ethereum, Raydium often offers a superior user experience and lower costs due to Solana’s high throughput and low fee characteristics.

What Risks Should You Be Aware of When Using Raydium?

- Smart contract risk: like all DeFi protocols, Raydium may face vulnerabilities or potential attacks.

- Impermanent loss: liquidity providers may suffer losses during periods of high price volatility.

- Market volatility: sharp token price movements can lead to asset losses.

- Regulatory risk: global regulatory uncertainty may affect future operations.

Conclusion: Raydium’s Potential Role in the Future of Solana DeFi

As one of the most mature DEXs in the Solana ecosystem, Raydium’s hybrid trading model, deep liquidity support, and diversified product suite make it a foundational pillar of DeFi infrastructure. As the Solana ecosystem continues to grow and more users participate in on-chain trading, Raydium is well positioned to maintain its core role and drive further adoption and innovation in decentralized finance.

FAQ

Q1: Is Raydium the largest DEX on Solana?

A: Raydium consistently ranks near the top among Solana DEXs in terms of trading volume and liquidity, and holds a prominent position due to its architectural advantages.

Q2: What is the RAY token used for?

A: It is used for governance, staking, earning revenue shares, and participating in new project launches.

Q3: Is Raydium safe?

A: The protocol has been audited and operates reliably, but DeFi inherently carries risks, so users should proceed with caution.

Q4: How do I start trading on Raydium?

A: Prepare a Solana wallet and funds, visit the official website, connect your wallet, and you can begin swapping tokens or providing liquidity.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks