What Is Virtuals Protocol? Building a Shared Economy for Autonomous AI Agents

As generative AI and blockchain converge more rapidly, AI is shifting from an application layer tool into a digital role capable of commercial activity and economic exchange. Virtuals Protocol builds a new value relationship between AI and users through on-chain wallets, agent tokenization, and a shared ownership model, so that an agent’s interactions, content, and services can translate into distributable revenue. Through the IAO launch model and the Immutable Contribution Vault (ICV), the protocol also reshapes how AI is developed, coordinated, and rewarded, laying a more sustainable foundation for an agent driven economy.

This article introduces Virtuals Protocol from its core concept and background, explains its three layer operating structure and autonomous agent design, and describes the IAO launch mechanism, shared ownership model, and VIRTUAL tokenomics. It also explores key use cases in gaming, social media, and decentralized revenue sharing, and explains how the overall monetization model can form a positive economic cycle, helping readers understand how Virtuals Protocol is redefining the role and value of AI in the on-chain world.

What Is Virtuals Protocol?

(From: virtuals_io)

Virtuals Protocol is a blockchain protocol designed specifically for intelligent AI agents. Its central goal is to ensure AI is not limited to being a service tool inside a single platform, but can become a digital entity that operates across applications with autonomous behavior and economic value.

In the Virtuals architecture, every AI agent is an on-chain asset that can be deployed, traded, and jointly owned. Through decentralization, developers, creators, and users can all participate in building agents and sharing the revenue they generate. This approach addresses common limitations of traditional AI systems, including high deployment costs, concentrated ownership, and difficulty monetizing outcomes.

The Origins and Development of Virtuals Protocol

Virtuals Protocol originally grew out of PathDAO, a GameFi investment guild founded in 2021. As generative AI accelerated in 2023, the team identified the potential of combining AI and blockchain, transitioned into Virtuals Protocol, and deployed its core protocol on Base.

In 2024, Virtuals launched its first AI agent, Luna, which accumulated more than 500,000 followers on TikTok, demonstrating the commercial feasibility of AI virtual characters. Later that year, the $VIRTUAL token was listed on multiple exchanges, and the market value grew rapidly into the billions, bringing the project into broader market visibility. Toward the end of 2024, $VIRTUAL was listed on multiple major exchanges, and within a few months its market value rose from tens of millions of dollars to over $3 billion. This increased liquidity and visibility attracted more users and developers into the ecosystem, marking Virtuals Protocol’s entry into a mainstream phase.

As the ecosystem expanded, the number of AI agents created on Virtuals Protocol grew quickly and has now exceeded 1,000, covering a range of use cases such as virtual idols, intelligent customer support, and content creators, gradually forming a more diversified AI agent economy.

How Virtuals Protocol Works

Virtuals Protocol operates on a decentralized ecosystem that encourages the creation and use of AI agents (VIRTUAL). Each agent integrates multimodal modules such as a cognition core, voice and audio core, and vision core, enabling complex cross media interaction. Through the Agent Prompt Interface as an intermediary layer, Virtuals Protocol builds a two way communication bridge between external applications and AI agents. It also provides APIs and SDKs so developers can integrate AI capabilities into games, social platforms, or other dapps, allowing agents to receive data in real time, execute tasks, and respond to user behavior.

(From: Virtuals Protocol)

Overall, the architecture can be understood as having a protocol layer and a dapp layer. The protocol layer provides base models and algorithms, with contributors and validators jointly maintaining quality. The dapp layer focuses on real world application, allowing decentralized products to call AI functionality more seamlessly. Economically, the ecosystem uses the VIRTUAL token to incentivize contribution and validation, and uses revenue generated by dapps to buy back tokens, forming an internal economy that supports agent operations and value circulation.

Autonomous and Multimodal AI Agents

Virtuals AI agents have a high degree of autonomy and can complete tasks without human intervention, including exploring environments, interacting with users, and even executing on-chain transactions.

These agents support multimodal interaction methods such as text chat, voice communication, and 3D animated character behavior. In gaming scenarios, an AI agent can move and talk like a real character, remember player choices, and develop personality and memory over repeated interactions, forming longer term relationships.

Initial Agent Offering (IAO) and Shared Ownership

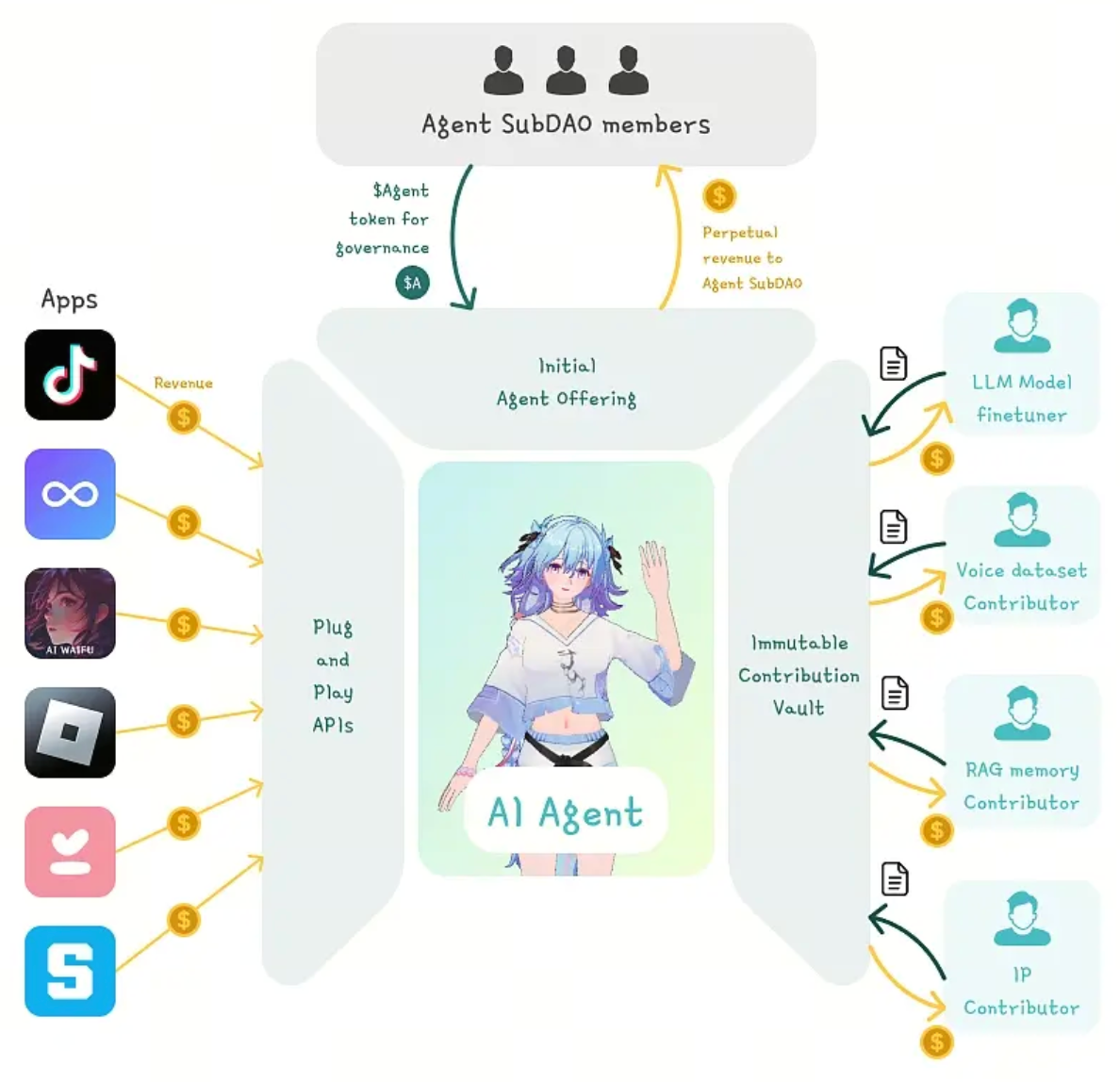

Virtuals Protocol introduces the Initial Agent Offering (IAO) mechanism, allowing each AI agent to be tokenized and opened to market participation.

The core IAO design includes:

- Each AI agent mints 1 billion dedicated tokens

- No pre mine and no internal allocation, using a fair launch approach

- When market capitalization reaches $420,000, a liquidity pool is automatically created and locked for 10 years

- Each transaction charges 1% as a protocol operating fee

Through this model, users are not only using AI. They become co-owners who can participate in the agent’s development, governance, and revenue sharing.

Immutable Contribution Vault (ICV)

To strengthen fairness in the development process, Virtuals created the Immutable Contribution Vault (ICV).

Key functions of the ICV include:

- Recording all contributions on-chain

- Tracking each developer’s model and data inputs

- Serving as the basis for revenue distribution

- Ensuring contribution records cannot be tampered with

Each AI agent exists in the form of an NFT, while contribution content is minted as service NFTs. This makes collaborative development measurable, traceable, and revenue shareable.

VIRTUAL Tokenomics

VIRTUAL is the core platform token of Virtuals Protocol. It is issued on Base and has a total supply of 1 billion tokens.

Key use cases of VIRTUAL include:

- Serving as the liquidity base for all AI agent tokens

- Being used to buying and trading AI agents

- Paying for AI inference and interaction fees

- Participating in protocol governance and ecosystem decisions

When new agent tokens are created, a certain amount of VIRTUAL is locked into the liquidity pool. As usage demand increases, the effective circulating amount declines, creating a form of structural deflation.

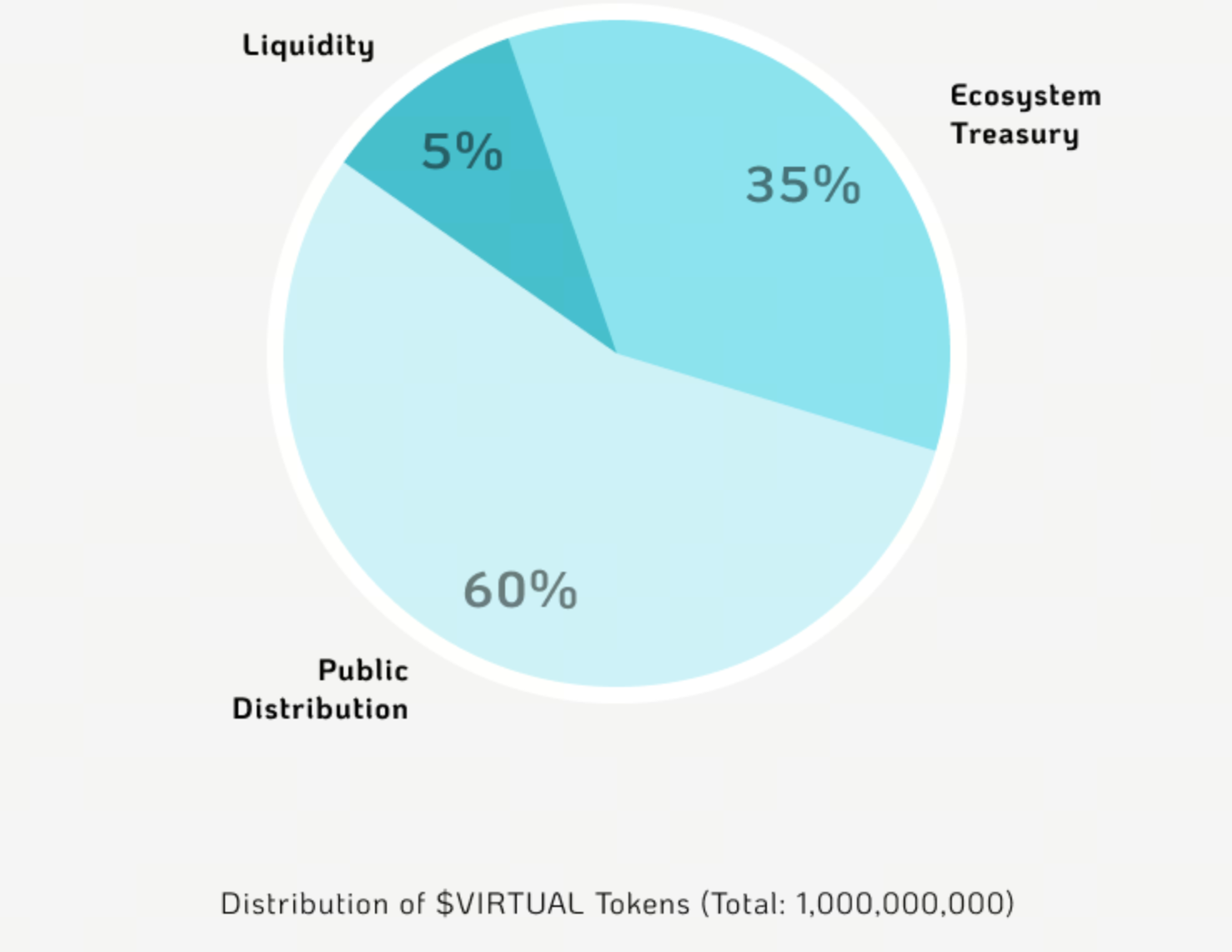

The token distribution structure is as follows:

- 60% public distribution

- 5% liquidity pool

- 35% ecosystem treasury, governed by the DAO

(From: whitepaper.virtuals)

Core Use Cases of Virtuals Protocol

Gaming and interactive storytelling

AI agents can act as intelligent NPCs, remember player choices, and adjust narrative direction to create more personalized gameplay experiences.Social media and virtual characters

AI agents can function as virtual influencers on platforms such as TikTok and Telegram, maintaining cross platform memory and consistent personas while building emotional connections with followers.Decentralized revenue sharing

Users who hold AI agent tokens can share interaction revenue generated by the agent, and benefit from buyback and burn mechanisms that support token value.

The Revenue Model of Virtuals Protocol

Virtuals uses an on-chain pay per interaction model. Each conversation, command, or service between a user and an AI agent generates an inference fee that is paid directly to the agent’s wallet.

The revenue distribution logic is:

Interaction revenue → AI agent wallet → shared with token holders → partial buyback and burn of the agent token → forming a positive value cycle. As the number of applications grows, the ecosystem’s cash flow and token demand can expand together.

Summary

Virtuals Protocol is not presenting a simple AI platform, but a new digital asset paradigm. In this structure, AI agents have autonomy, economic value, and shared ownership, moving from a tool role into an on-chain entity that can be invested in, governed, and participated in. When AI has a wallet, can generate revenue, and can be jointly owned by a community, Virtuals Protocol is exploring a future where AI also becomes an economic participant, rather than an economic system that only humans take part in.

FAQ

What is the biggest differenceison between Virtuals Protocol and typical AI platforms?

The biggest difference is that Virtuals treats AI agents as on-chain assets rather than platform limited service features. Each AI has its own wallet and token, can be traded, jointly owned, and can generate revenue directly, turning AI from a tool into a digital entity with economic value and an ownership structure.What is an IAO (Initial Agent Offering) and how can regular users participate?

An IAO is a mechanism that allows an AI agent to issue a dedicated token similar to a project launch. Users can buy the agent token in the market, become a co owner of that agent, and share interaction revenue and potential future growth benefits rather than only using the AI service.What role does the VIRTUAL token play in the ecosystem?

VIRTUAL is the base asset of the Virtuals ecosystem. It supports liquidity for all AI agent tokens and is also the core token used to buy agents, pay interaction fees, and participate in governance. As AI applications and usage increase, demand for VIRTUAL can rise as well.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?