When Leverage Moves Beyond Futures: Understanding Gate Leveraged ETF

Leverage Trading Is Taking a New Shape

In the past, most people associated leverage with contract trading. While contracts can amplify returns, they also increase complexity and psychological pressure. Real-time margin calculations, forced liquidation risks, and constant monitoring make it hard for traders to confidently stick to their strategies—even when their market predictions are correct.

As markets move faster, trading tools are being redefined. Leverage is no longer just a feature of contract accounts; it’s now being integrated into more intuitive product structures that resemble spot trading. Gate’s Leveraged ETF was created in response to this trend.

What Is a Leveraged ETF Token?

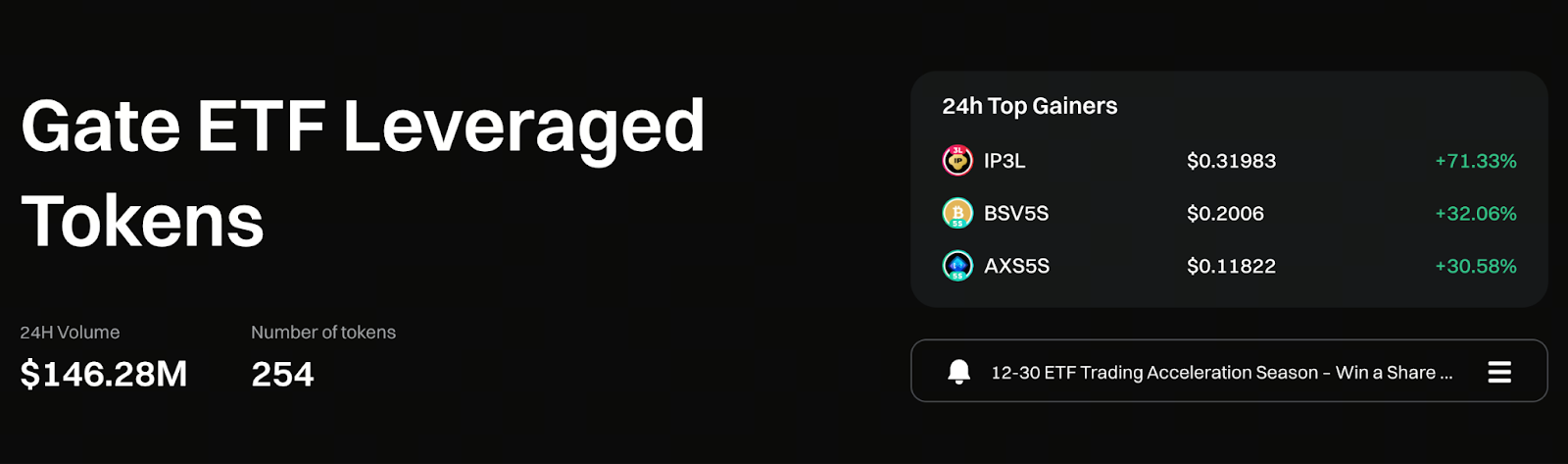

Gate Leveraged ETF tokens aren’t traditional funds. Instead, they’re tokenized products that can be traded directly on the spot market. Their leverage is created through perpetual contracts and automatically maintained at preset levels, such as 3x or 5x.

For users, these tokens are straightforward trading instruments that can be bought or sold directly. The system manages the creation and adjustment of leveraged positions behind the scenes, so users don’t need to intervene.

Trade Gate ETF leveraged tokens now: https://www.gate.com/leveraged-etf

Achieve Leveraged Exposure with Spot Trading

The core value of leveraged ETFs is that they bring “amplifying market moves” back to the logic of spot trading. Users simply place orders in the spot market to participate in leveraged price swings, without having to deal with:

- Contract account setup and fund transfers

- Margin ratio and maintenance calculations

- Interruption risks from instant forced liquidations

The system handles risk control and position management, so traders can focus on analyzing trends and allocating capital—not on operational details.

How Is Fixed Leverage Maintained?

Each Gate Leveraged ETF is backed by its own independent contract positions. If market movements cause actual leverage to drift from its target, the system automatically rebalances positions to keep leverage within the intended range.

The platform also performs routine rebalancing at set times to further reduce the risk of deviation during extreme market conditions. This means users don’t have to manually adjust positions or constantly monitor and update their strategies.

Why Do Trend Traders Focus on Leveraged ETFs?

Compared to contracts, leveraged ETFs better match the pace of trend trading. When the market direction is clear, leverage accelerates capital response, making price movements more pronounced. And since there’s no instant forced liquidation, short-term countertrend moves won’t immediately close out positions. This results in smoother trading and appeals to those who want to minimize market noise and interruptions.

Leveraged ETFs Are Still High-Risk Tools

Even though they’re easier to use, leveraged ETFs are fundamentally volatile products. Before trading, it’s essential to understand these features:

- Price swings are much greater than regular spot assets

- Rebalancing during sideways or choppy markets can lead to losses

- Returns won’t precisely match the stated leverage multiple

- Management fees and hedging costs gradually impact prices

These factors make leveraged ETFs better suited for strategic use, not for long-term passive holding.

Why Management Fees Are Charged

Gate Leveraged ETFs charge a daily management fee of about 0.1%. This covers perpetual contract trading costs, funding rate expenses, liquidity management, and any slippage or losses from rebalancing. This type of fee structure is standard for leveraged ETFs and is necessary to maintain fixed leverage and stable system operations.

How Should You Use Leveraged ETFs?

Leveraged ETFs aren’t buy-and-hold products. They’re strategic tools that require clear trend analysis, stop-loss planning, and disciplined capital management. Only by understanding how they work and the risks involved can you use them to improve efficiency—rather than add extra risk.

Summary

Gate Leveraged ETFs offer a trading solution that bridges spot and contract products. They streamline the process without hiding the risks of leverage, lower the entry barrier, and maintain strategic flexibility. In today’s highly volatile crypto market, whether leveraged ETFs are right for you depends on your understanding of their purpose and your ability to apply them precisely in the right market environment.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B