When Precious Metals Enter 24/7 Trading: The Market Implications of Gate Metal Perpetuals

Traditional Safe-Haven Assets Are Being Repurposed

With global economic uncertainty on the rise, gold and silver are once again attracting significant capital attention. Unlike previous cycles, the market now views these precious metals not just as defensive, long-term holdings, but is also exploring their potential for immediate responsiveness and rapid, flexible trading adjustments.

As the crypto derivatives market matures, precious metals are evolving from static safe-haven assets into dynamic trading vehicles. This shift is fundamentally changing how these assets are traded.

Gate Precious Metals Zone: Bringing Gold and Silver Into the Crypto Trading Rhythm

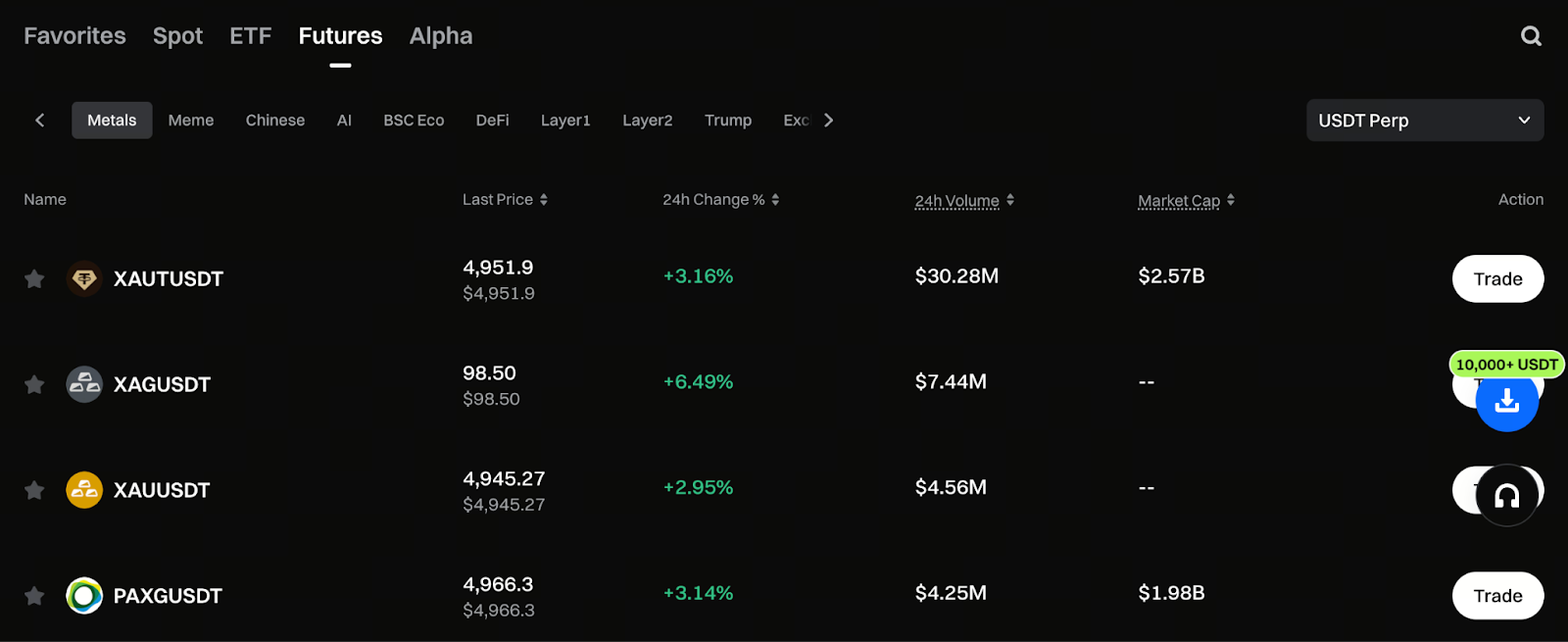

Gate’s new “Precious Metals Zone” integrates gold (XAU) and silver (XAG) into the platform as USDT-margined perpetual contracts, making these traditional assets part of the crypto market’s fast-paced trading environment for the first time.

With a contract-based approach, precious metals are no longer restricted by traditional market hours. They can be priced and traded continuously, 24/7, allowing prices and positions to adjust instantly as market events unfold.

Start trading now in the Gate Precious Metals Zone: https://www.gate.com/price/futures/category-metals/usdt

No System Migration Required—Trade Across Markets Seamlessly

Gate has directly incorporated precious metals perpetual contracts into its existing trading interface. Users can access these contracts via the Gate website or app without needing to open a separate account or learn a new workflow.

This seamless integration enables traders to operate in both crypto and precious metals markets using the same tools and risk controls, substantially reducing the barriers and costs of cross-market trading.

Precious Metals Market Rebounds, Attracting Fresh Capital

Since the start of 2026, risk aversion has intensified, and precious metals prices have strengthened:

- Spot gold is up nearly 7% this year, breaking above $4,600

- Silver has shown even greater flexibility, rising about 23% year-to-date with strong short-term momentum

In this context, XAU and XAG USDT perpetual contracts have become key channels connecting traditional safe-haven demand with the speed and efficiency of crypto trading, allowing capital to engage with precious metals price movements at higher frequency.

Index-Based Pricing for Transparent, Linked Markets

To prevent single-market prices from disproportionately influencing contract valuations, Gate’s precious metals perpetual contracts use an index based on prices from multiple markets. This structure helps stabilize prices in volatile conditions and enhances transparency and verifiability. For traders employing leverage, risk management, or high-frequency strategies, index-based pricing is essential for the long-term stability of these contracts.

A Strategic Bridge Between TradFi and Crypto

Strategically, precious metals perpetual contracts serve more than one type of trader:

- For traditional finance users, gold and silver are familiar, well-understood assets

- For crypto-native users, these contracts introduce assets with different risk profiles, helping diversify portfolios and reduce reliance on any single market

Whether for macro hedging, swing trading, cross-market arbitrage, or as a hedging tool in overall asset allocation, precious metals contracts act as a strategic bridge between TradFi and Crypto.

The Next Phase in Multi-Asset Contract Expansion

Gate’s long-term commitment to derivatives has resulted in robust systems for liquidity management and risk control. The launch of the Precious Metals Zone is more than just adding new products—it completes a critical piece in the integration of traditional assets into the crypto contract market. Gate also plans to continue evaluating contract-based offerings for more traditional assets within compliance and risk frameworks, progressively expanding into indices, commodities, and other derivatives.

Summary

With gold and silver now available in the 24/7 crypto contract market, the trading logic for safe-haven assets is being rewritten. Gate’s precious metals perpetual contracts transform traditional assets from passive allocations into active participants in global market shifts, offering greater flexibility for cross-market and multi-asset strategies. As crypto and traditional finance converge, these products are becoming essential components in professional traders’ asset allocation strategies.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About